Фальшивые новости о «пустых портах, пустых полках» страдают от взрыва

Это было около месяца назад, когда акции упали, экономисты поспешили догнать скользящий рынок, делая то, что они делают лучше всего: гоняясь за ценами (в данном случае ниже), сокращая свои экономические прогнозы (в первую очередь Goldman Sachs), ход, который мы высмеивали в то время, и правильно предсказывали, что это будет примерно за месяц до того, как эти же экономисты сделают следующий шаг.нерецессия" Их базовый случай, когда акции восстановились.

Будет немного неловко, когда все банки, которые сделали рецессию своим базовым делом на этой неделе, сделают нерецессию своим базовым делом через 1 месяц.

— zerohedge (@zerohedge) 8 апреля 2025 г.

Прошло меньше месяца, чтобы этот прогноз сбылся, и теперь, когда акции стерли все свои потери после Дня освобождения, один из самых пристально отслеживаемых людей на Уолл-стрит, главный экономист Goldman Ян Хатциус, сказал на CNBC 2 мая - всего через несколько недель после объявления, что рецессия была его базовым случаем в течение 90 минут - что "" Самая последняя информация, безусловно, согласуется с тем, что экономика сейчас не переживает рецессии".

Конечно, одновременный всплеск в отслеживании ВВП ФРС Атланты в режиме реального времени с -3% (что было абсолютно неверно в отношении того, где на самом деле печатался ВВП Q1) до +2,4% во 2 квартале; Только закрепил нерецессионную базу...

Обновление по отслеживанию ВВП регионального ФРС pic.twitter.com/02r2VVLoXX

— zerohedge (@zerohedge) 30 апреля 2025 г.

Поскольку техническое определение рецессии - два последовательных отрицательных квартала - означало, что с ВВП Q2, который будет хорошо печататься в зеленом цвете, самое раннее, что США могут быть объявлены в официальной рецессии, было некоторое время в начале 2026 года, когда выйдет показатель ВВП Q4 2025.

Это было разрушительно для либерального крыла экономической профессии, не говоря уже о средствах массовой информации, все из которых решили, что рецессия Трампа неизбежна, и поэтому им пришлось обратиться к чему-то другому, что вызвало бы ежедневный кризис. обреченность и мрак повествование.

Что-то вроде гипотезы о том, что торговая война между США и Китаем бушует, это только вопрос времени, когда порты западного побережья будут пустыми, так как в США не придут китайские контейнеровозы, и результатом будет паника, подобная ковиду, для продуктов (помните легендарные туалетные бумаги) на фоне исторического заточения запасов.

Это было так, как если бы СМИ включили ни копейки, и с нарративом «надвигающейся рецессии», внезапно оставленным в пыли, он был заменен историей за историей о надвигающемся портовом кризисе, который, вздохнув, приведет к пустым полкам по всей Америке!

«Тарифы Трампа ударили по самому оживленному порту на Западе — трафик снизился почти на треть», — сообщает Sky News. «Почему порты США освобождаются до того, как тарифы ударят сильнее», — риторически спросил журнал Inc. «Пустые полки магазинов могут появиться раньше, чем вы думаете», — кричали безошибочно либеральные говорящие головы Bloomberg и Reuters, никогда не упускайте возможность усилить антитрамповскую нарративную линию, независимо от того, насколько заслуживающей доверия, повторил «Объем перевозок упадет на 35% на следующей неделе». "

Ты получишь фотографию.

Но это было только начало, потому что либеральные СМИ только начинали свою кампанию по запугиванию, чтобы заставить американцев паниковать и спешить и снова начать накапливать туалетную бумагу. Другими словами, «независимая пресса» надеялась привести к катастрофическому исходу, о котором она «предупреждала».

Нигде это не было более очевидным, чем на MSNBC, где якорь и бывший продавец облигаций Deutsche Bank Стефани Руле, больше не эксперт, близко знакомый с Under Armor (и особенно с ее генеральным директором), но теперь полномасштабный торговый гуру, заявил, что он не может позволить себе ничего подобного.Дональду Трампу было сказано посмотреть, как грузовые суда, прибывающие в Сиэтл, порт Лос-Анджелеса, выбирают порт. Эти порты получают все меньше и меньше судов с все меньшим количеством грузов.. И если он не перевернет все это через три недели, вы зайдете в магазин, и у нас будет кризис цепочки поставок, похожий на ковид, и Трамп ищет выход. "

"" Если он не перевернет это, через три недели вы зайдете в магазин, и у нас будет кризис цепочки поставок, похожий на ковид, и Трамп ищет выход, — вот комментарий @SRuhle, который вызвал расплавление Trump Truth Social pic.twitter.com / hzmP9uGTqu

— Aaron Rupar (@atrupar) 9 мая 2025 г.

Но, как это всегда бывает, именно CNN, наконец, довело это повествование о «сломанном телефоне» до абсурдного завершения, когда СМИ, ставшие опорой всех пропагандистских шуток, заявили, что это не так. «Нулевые» суда из Китая отправляются в порты Калифорнии. Чиновники не видели этого со времен пандемии."

Статья, написанная корреспондентом CNN по бизнесу и политике Ванессой Юркевич, которая, как и Руле из MSNBC, теперь является полномасштабным экспертом по морской торговле и логистике, как показывает быстрое сканирование ее последних статей.

До этого момента мы держались в стороне от этой идиотской дискуссии, которая лишь продемонстрировала, как мало понимания у так называемых экспертов нюансированной и сложной темы, как торговля и глобальная торговля.

Однако идиотизм CNN стал последней каплей.

Но прежде чем мы пойдем туда, быстро взглянем на то, что действительно происходит.

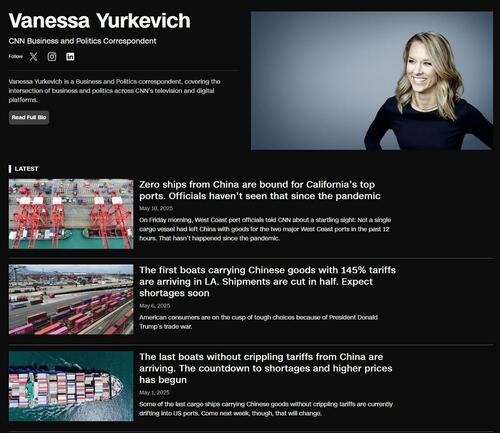

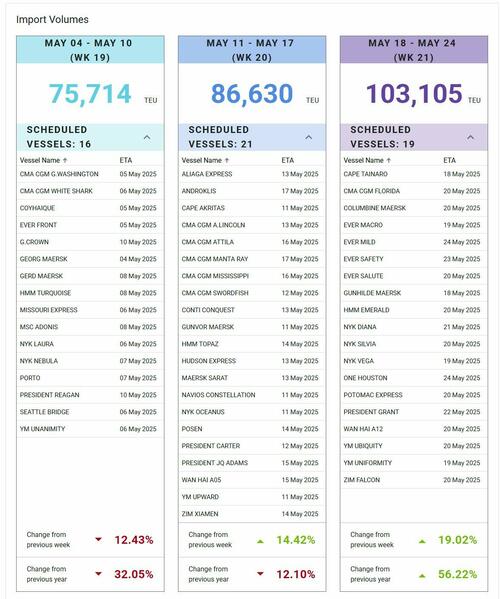

Во-первых, в связи с утверждением о том, что в портах западного побережья наблюдается резкое падение входящего трафика, в феврале и марте, безусловно, наблюдалось небольшое снижение входящего трафика, но снижение по сравнению с почти рекордной печатью в январе, что, в свою очередь, было результатом пополнения запасов, опередив то, что большинство ритейлеров знали о торговой войне. В конце концов, около года назад Трамп ясно дал понять, что у него есть все намерения возобновить торговую войну с миром, и особенно с Китаем, и только кто-то, кто смотрит CNN, будет удивлен недавним резким скачком тарифов, шаг, который, кстати, никогда не должен был быть постоянным, но был стратегией, предназначенной для того, чтобы причинить максимальную боль и заставить торговых партнеров сесть за стол переговоров. В любом случае, общий входящий трафик в калифорнийские порты, показанный ниже, вряд ли является апокалипсисом, о котором говорят либеральные СМИ (и даже Reuters обсуждает это в «почти рекордной полосе импорта контейнеров в США, ожидаемой в мае из-за тарифов»).

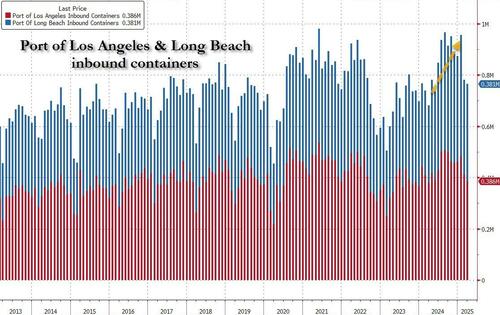

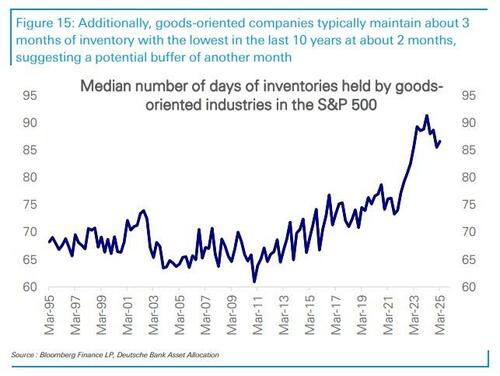

Затем, обращаясь к теме неизбежного дефицита продуктов, это было еще одно ложное повествование новостей, призванное вызвать панику и хаос, и в результате СМИ были «предупреждены». Потому что, если это навредит Трампу, это отлично для MSNBC и CNN. И, конечно же, Китай, который задает вопрос: сколько «рекламных долларов» и / или спонсорства эти СМИ получили от Пекина и китайских компаний в последние месяцы. Как ясно показывают следующие графики Deutsche Bank, то, что происходило в последние месяцы, и почему мы сейчас видим обратное, - это рекордные предварительные закупки и избыточный импорт.

... что, по мнению Deutsche Bank, привело к прямо противоположному результату, чем тот, который взорвали MSNBC и CNN: в канале поставок есть избыточные запасы, которых достаточно для того, чтобы длиться недели, если не месяцы, предполагая полномасштабный коллапс в мировой торговле, который, конечно, никогда не произойдет без какого-либо шока.

Кроме того, если и когда ритейлеры в конечном итоге ликвидируют эти миллиарды избыточных запасов, которые они накопили только для этой непредвиденной ситуации, результат будет дико дефляционным, и вряд ли инфляционный шок, который предсказывают многие «эксперты».

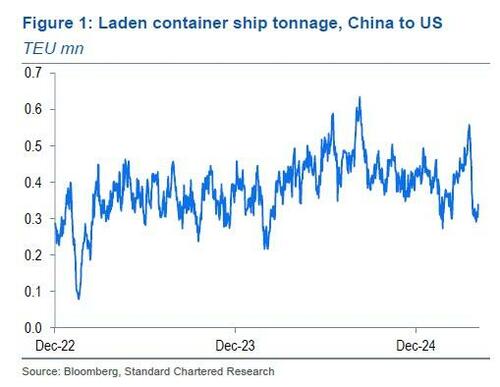

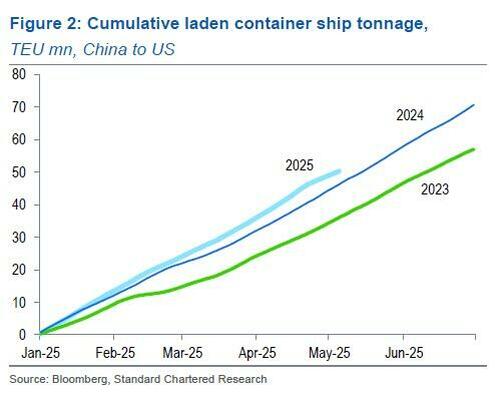

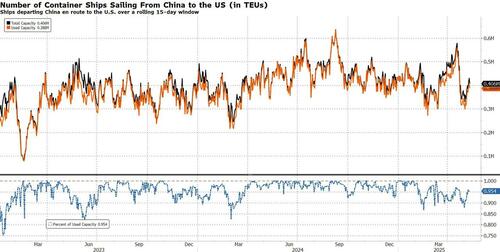

Возвращаясь к любимой теме СМИ о сбрасывании грузов из Китая, не только мы противопоставили популярному повествованию: так же поступил Стив Англиандер из Standard Chartered, который написал на прошлой неделе, чтоСтранные заголовки о падении грузов из Китая могут ввести в заблуждение. " Это связано с тем, что, как мы отмечали выше, объем грузоперевозок из Китая в США сократился почти на 50% по сравнению с серединой апреля 2025 года. Уровень середины апреля был очень высоким., И хотя вы никогда не услышите этого на CNN, Текущий уровень примерно на одном уровне с большей частью 2023 года.. На самом деле, Англикан сказал, что «текущий темп как низкий уровень нормы за последние пару лет». Опять же, вряд ли апокалипсис любимого медиа-тела Кевина Планка (мы используем этот термин свободно) изображает это.

Есть еще одна вещь, которую вы никогда не услышите на MSNBC или CNN. Если темпы доставки в начале мая в США сохранятся до конца июня, совокупная сумма, отправленная в H1-2025, будет на 18% выше, чем в H1-2023, и только на 5% ниже, чем в H1-2024. До сих пор в этом году тоннаж, отправленный в США, на 40% выше, чем в 2023 году, и на 9% выше, чем в 2024 году. Действительно, как отмечалось выше, и как отмечает Англичанин,Американские импортеры могут иметь буфер запасов до тех пор, пока тарифы не будут согласованы. "

Сделав шаг назад, если бы только в интересах наших читателей CNN и MSNBC, общая картина такова, что даже если США потеряют весь китайский импорт - результат, который никто не ожидает, поскольку это разрушит экономику Китая, как признало агентство Reuters на прошлой неделе - результат для США вряд ли будет разрушительным. Да, цены будут расти, но в целом США смогут справиться с этим. Вот, опять же, Англичанин объясняет, почему:

Импорт США из Китая составляет около 1,6% ВВП США в стоимостном выражении. Если входящий груз останется на уровне начала мая, то импорт H2-2025 составит 85% от уровней 2023 года (в натуральном выражении) и 67% от уровней 2024 года. Таким образом, шок объема импорта составит 0,25% ВВП по отношению к 2023 году и 0,5% по отношению к 2024 году. И помните, что Может быть замена из других источников. Могут быть временные задержки, поскольку импортеры США выясняют практические возможности решения новых тарифов, а отгрузка может временно снизиться, потому что импортеры запаслись до введения тарифов.

Существует мало прецедентов для такого рода тарифного шока. Но мы считаем, что американская экономика справится с этим. Мы согласны с тем, что возможны сбои в тарифах и что любые выгоды неопределенны. Но мы не думаем, что экономика США упадет с обрыва из-за шока такого масштаба.

Примечательно, что ни один из так называемых экспертов, предсказывающих гибель и мрак в последние дни, не потратил ни минуты, чтобы рассмотреть эту возможность. Именно поэтому попытка левых вызвать широкую панику, сосредоточившись на китайском импорте, была в значительной степени неудачной. И почему это заставило СМИ обострить свои претензии на все более смехотворные пропорции, пока мы не получили историю CNN о том, что было много нелепых заявлений.Ноль кораблей из Китая направляется в порты Калифорнии. "

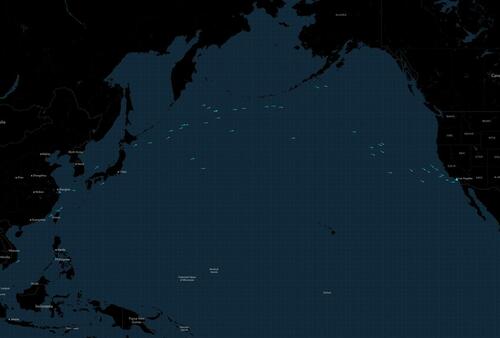

И вот здесь мы нарисовали линию, потому что требуется около 10 секунд поиска в Google на любом из сайтов морского отслеживания, таких как Marine Traffic. полная чушь. И тот факт, что CNN даже не считал, что не все его читатели являются абсолютными идиотами, которые приняли бы его ложь с нулевым отпором, является самым замечательным.

Ниже приведена диаграмма Bloomberg, показывающая все сухогрузные / контейнерные суда, которые недавно покинули Китай и в настоящее время находятся в воде.

Источник: Bloomberg, IMO

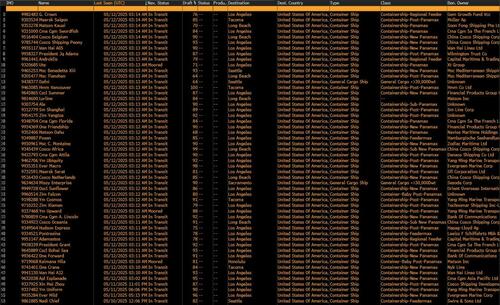

Источник: Bloomberg, IMOПо данным Bloomberg, в настоящее время из Китая в Калифорнию и на Западное побережье курсируют не менее 52 грузовых судов, полный список которых приведен ниже.

Источник: Bloomberg, IMO

Источник: Bloomberg, IMOНе секрет, что 52 отличается от Ноль кораблей, направляющихся в США, Как утверждает CNN, и если рассматривать это число в контексте, то среднее количество судов, следующих из Китая в США, было в 2025 году:

- 59 января корабли

- 56 февраля

- 55 марта

- 55 апреля

А теперь Май 52. Таким образом, это падение - с 55 до 52 - должно быть надвигающимся. похожий на ковид апокалипсис СМИ призывают американцев бежать в местный Walmart и запастись туалетной бумагой на несколько лет?

Но для CNN ситуация ухудшается, потому что, хотя мы можем понять, не имеют ли они доступа к Bloomberg или даже Google в результате недавних сокращений финансирования USAID, они могли бы просто зайти на веб-сайт Порт-Лос-Анджелеса, чтобы посмотреть на общедоступные данные Port Optimizer, которые показывают, что вопреки фальшивым рассказам о коллапсе мировой торговли, Объемы импорта за неделю с 18 по 24 мая выросли на 19% по сравнению с предыдущей неделей и на целых 56% по сравнению с прошлым годом.

И еще один способ показать это: вот общее количество контейнеровозов, следующих из Китая в США. Число 11 мая выше, чем было в 2024 году и такое же, как и в мае 2023 года. Но вы не услышите ничего подобного на CNN.

Вместо этого, это то, что вы будет Об этом сообщает CNN:

"" В пятницу утром представители порта Западного побережья рассказали CNN о поразительном зрелище: За последние 12 часов ни одно грузовое судно не покинуло Китай с грузами для двух крупных портов Западного побережья. Этого не было со времен пандемии. "

Только эта попытка разжечь панику (вызывая при этом пандемию ковидов по понятным причинам) также является Мертвая ошибка: В настоящее время 52 судна проходят транзитом через Тихий океан из Китая в SoCal в соответствии с историческими цифрами: поездка занимает 20 дней, что означает 2,6 судна, плавающих каждый день или один корабль каждые 9-10 часов. Таким образом, 12-часовой период не является чем-то необычным. И, как отмечает Сэл Меркольяно, хотя в пятницу ни один корабль не отплыл в Калифорнию, беглый взгляд на морское движение показывает, что три судна находятся в море. Cosco Africa, Ever Safety и Ever Mild Все они уезжают из Китая в SoCal. Так много для этого "Потрясающее зрелище". "

6/В истории говорится, что 41 корабль должен был отплыть, но в пятницу он был равен нулю. Но это не значит, что 41-й не плывет. Быстрый взгляд @MarineTraffic показывает, что COSCO AFRICA, EVER SAFETY и EVER MILD уходят в SoCal в эти выходные. pic.twitter.com/t35J2I8XgL

— Sal Mercogliano (WGOW Shipping) (@mercoglianos) 10 мая 2025 г.

Мы могли бы продолжить, но вы, в отличие от CNN, получите картину: транстихоокеанская торговля, возможно, замедлилась, но она нигде не находится рядом с полной остановкой, наблюдаемой в течение нескольких недель.

Между тем, вся дискуссия о пустых портах и пустых полках полностью спорна, потому что, как сообщило агентство Reuters еще до того, как стало известно о прорыве в торговых переговорах между США и Китаем в эти выходные.Китайские транспортные агенты возобновили покупку контейнерных площадей для товаров, направляющихся в Соединенные Штаты после серии отмены тарифов, вызванных США. Пекин и Вашингтон ведут торговые переговоры в Швейцарии. "

И вот Reuters подтверждает то, что мы сказали несколько дней назад:Однако с конца апреля трейдеры активизировали покупку судоходных мощностей, заблокировав пространство с середины мая, по словам двух руководителей китайских экспедиторских фирм. "

Именно то, что мы сказали Неделю назад.

Корабли, плавающие из Китая в США, достигают максимума за 2 недели. Но Лонг-Бич должен был стать портом-призраком pic.twitter.com/T2Jdi8eJx1

— zerohedge (@zerohedge) 7 мая 2025 г.

И удивительно, и вопреки всему, что вы можете услышать на CNN или MSNBC, Доставка из Китая в США на самом деле готовится к очередному всплеску! По словам Доминика Демараиса, директора по решениям в Liya Solutions, которая связывает малые и средние компании с поставщиками в Китае, производящими все, от мебели до титановых изделий. Цены могут вырасти на $500 за контейнер после 15 мая, когда судоходная деятельность восстановится.

Так много для фейковых новостей CNN.

Мы оставим читателям еще одну, гораздо более важную тему для обсуждения, а именно, приведут ли тарифы к инфляции, о чем мы будем больше говорить в ближайшие дни, поскольку это стало центром многих экономических дебатов в последние месяцы, не только на политической арене, но и внутри ФРС.

И хотя председатель ФРС Пауэлл, похоже, снова очень «запутался», утверждая, что тарифы являются инфляционными. ошибочное убеждение Ранее он утверждал, чтоИнфляция была преходящей. Вместо этого мы укажем вам на недавнюю работу Хавьера Бьянки, старшего экономиста-исследователя из Федерального резервного банка Миннеаполиса, который считает, что тарифы — это не просто негативный шок предложения. Но и негативный шок спроса, и утверждает, что оптимальный ответ денежно-кредитной политики на тарифы, которые приводят не к инфляции, а угрожают рецессии, Это сокращение ставок. Подробнее об этом важном вопросе читайте далее "" В условиях жесткого тарифа стимулирование экономики имеет приоритет перед инфляцией для центрального банка. Мы на 100% уверены, что ни CNN, ни MSNBC никогда этого не сделают.

Тайлер Дерден

Мон, 05/12/2025 - 00:16