Корпоративные акции - влияют ли они на рынки?

Автор Лэнс Робертс через RealInvestmentAdvice.com,

Фишер Инвестментс недавно написал интересную статью, в которой задается вопрос о том, влияют ли выкуп корпоративных акций на рынки. Вот их заключение:

"Да и нет? Акции движутся по спросу и предложению. Выкуп акций, когда компания покупает и выводит акции с рынка, теоретически снижает предложение. Они также могут увеличить прибыль на акцию, тем самым вознаграждая акционеров. Итак, все остальное равно, и на бумаге выкуп акций бычий. Но реальность, как всегда, сложнее. Выкуп — это только один фактор, влияющий на предложение. Есть и другие, и спрос тоже. Они не могут сократить предложение, если они просто компенсируют вторичные выпуски, такие как вознаграждения сотрудников за акции. Часто выкупы просто «стерилизуют» новую эмиссию. Другие негативные (или менее бычьи) фундаментальные факторы могут иметь большее значение в ценообразовании, снижая спрос, даже когда предложение сокращается. Таким образом, обратный выкуп является фактором, но не фактором."

Хотя заявление в основном верно, я не уверен, что они рассмотрели фактическое влияние выкупа корпоративных акций на рынок. Мы обсудили эту тему и прошлые искажения выкупа корпоративных акций. Вот список для большего фона.

- Они не являются возвратом капитала акционерам. Дивиденды есть.

- Выкуп корпоративных акций Это худшее использование наличных денег.

- Это преимущество, которое почти Все преимущества корпоративного инсайдераС.

Но, не перефразируя многие проблемы выкупа корпоративных акций, давайте сосредоточимся на влиянии этих транзакций на общий рынок.

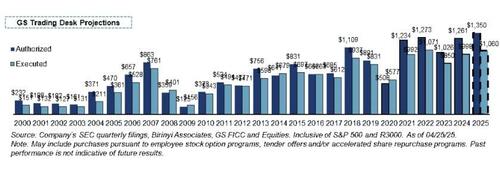

По состоянию на май 2025 года корпоративные разрешения на выкуп акций в этом году превзойдут 1,35 триллиона долларов, причем более 1 триллиона долларов будут исполнены. Это будет превышать любой другой год на рынке с начала века. Неудивительно, что Apple (AAPL) объявила о дополнительных 100 миллиардах долларов, а Google добавил еще 70 миллиардов долларов в свои программы (на эти две программы будет приходиться 12% от общего объема продаж). В полном одиночестве.

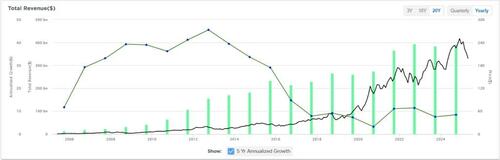

Данные должны привести к вопросу, почему корпоративные выкупы акций неуклонно росли с начала века. Это особенно актуально, когда чрезмерная зависимость от выкупа по неаккреционным оценкам для повышения цен на акции стала обычным явлением. Такое заявление подрывает ошибочность того, что выкуп корпоративных акций является исключительно возвращением капитала акционерам. Например, План Apple выкупить $110 млрд в 2024 году Некоторые инвесторы задаются вопросом о том, является ли компания Слишком много внимания уделяется немедленному росту цен на акции, а не инвестициям, которые могут привести к долгосрочной стоимости. Это заявление не следует упускать из виду, учитывая, что 5-летний годовой рост доходов был неизменным с 2018 года. (Чарт любезно предоставлен SimpleVisor.com)

Если выкуп корпоративных акций не является существенным фактором роста цен на акции, почему компании так активно этим занимаются? Почему бы просто не позволить динамике рынка нести нагрузку? Причина упрощена для понимания.

«Корпоративные руководители приводят несколько причин для выкупа акций, но ни одна из них не имеет близкой к объяснительной силе этой простой истины: Фондовые инструменты составляют большую часть их заработной платы, а краткосрочные выкупы приводят к росту цен на акции. " - Financial Times.

Итак, сколько фактора выкупа?

Являются ли выкупы важным фактором

Довольно легко увидеть, влияют ли корпоративные выкупы акций на цены акций. Как мы писали в прошлом году, влияние выкупа распространяется за пределы отдельных компаний. С 2000 года чистый корпоративный выкуп составил 100% покупок чистых активов на фондовом рынке- отражение уменьшения участия в пенсионном обеспечении, паевых инвестиционных фондов и индивидуальных инвесторов:

- Чистый поток: + $5,2 трлн

- Пенсии и взаимные Фонды: $2,7 трлн.

- Домохозяйства и иностранные Инвесторы: + $2,4 трлн

- Корпорации (Buyback): +$5,5 трлн.

Другими словами, без выкупа корпоративных акций фондовый рынок сегодня был бы примерно на 30% ниже.

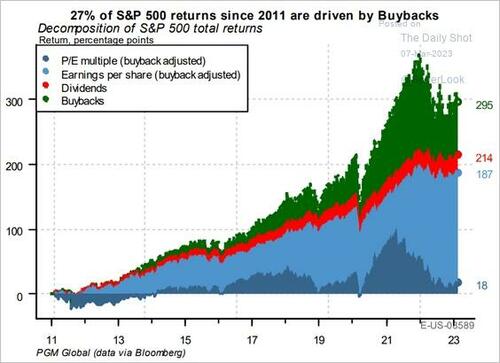

На приведенной ниже диаграмме через Павильон глобальных рынков показано влияние выкупа акций на рынок за последнее десятилетие. Разложение доходности для S&P 500 разбивается следующим образом:"

- 6,1% от множественных расширений (21% на пике),

- 57,3% от прибыли (31,4% на пике),

- 9,1% от дивидендов (7,1% на пике) и

- 27% от выкупа акций (40,5% на пике)

Да, выкупы так важны.

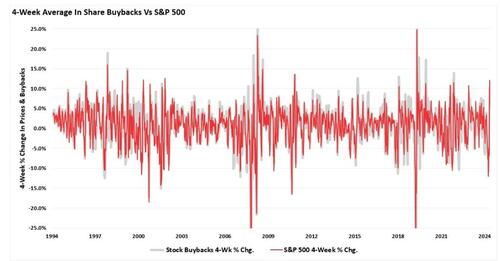

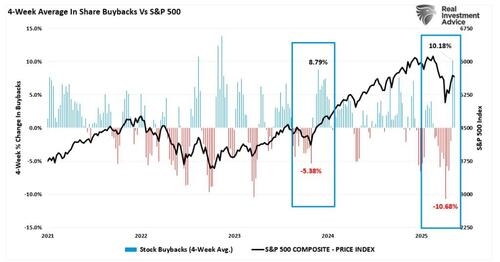

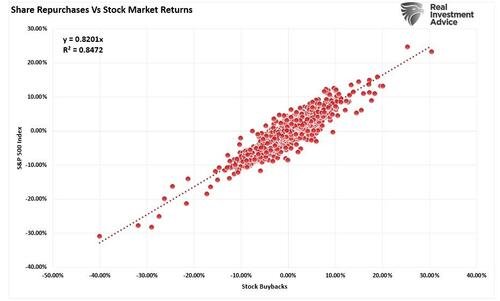

Однако, прямо к вопросу Фишера, существует нечто большее, чем просто небольшая корреляция между выкупом корпоративных акций и рынком. Диаграмма ниже накладывает 4-недельное изменение выкупа акций по сравнению с 4-недельным изменением индекса S&P 500. Стоит отметить, что до 1982 года SEC считала выкуп акций незаконной формой манипулирования рынком. (В 1982 году Комиссия по ценным бумагам и биржам приняла правило 10b-18, которое предусматривало «безопасную гавань» от «ответственности манипулирования рынком». Другими словами, SEC признает, что выкуп манипулирует финансовыми рынками, но обеспечивает «щит» для корпораций.

График выше сложен из-за большого количества данных. График ниже с 2021 года по настоящее время, где изменения в выкупе (увеличение или уменьшение) существенно влияют на изменения цен на акции. Стоит отметить, что снижение почти на 20% в апреле усугубилось резким разворотом активности выкупа и наоборот.

Хотя Фишер предполагает, что выкупы имеют мало общего с рыночными движениями, существует высокая корреляция между 4-недельным процентным изменением выкупов и фондовым рынком. Что еще более важно, поскольку акт выкупа акций обеспечивает покупателя для этих акций, корреляция .85 между ними предполагает, что это больше, чем просто случайные отношения.

Но да, Фишер прав, другие факторы поддерживают более высокие цены на активы.

Покупки влияют больше, чем просто цены

В 2023 году Джейсон Цвейг написал статью для WSJ, в которой говорилось:

"За последние пять лет, согласно индексам S&P Dow Jones, Крупные американские компании потратили $3,9 трлн на выкуп собственных акций.Покупки не являются ни плохими, ни хорошими. Они просто инструмент. Так же, как вы можете использовать молоток, чтобы построить дом или сбить его, выкупы полезны в правильных корпоративных руках и опасны в неправильных." - Джейсон Цвейг, WSJ

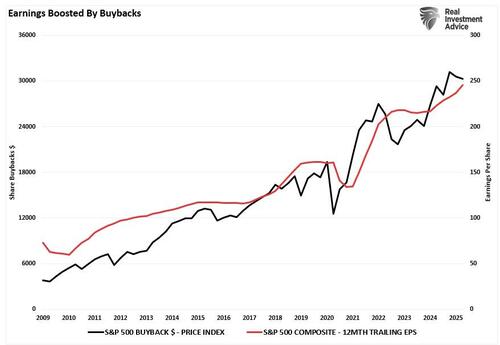

Это справедливое заявление. Влияние выкупа акций имеет жизненно важное значение для роста производственных доходов, поскольку мы измеряем прибыль на акцию. Другими словами, если вы уменьшите количество акций в обращении, корпоративная прибыль «На акцию» улучшить, как показано ниже.

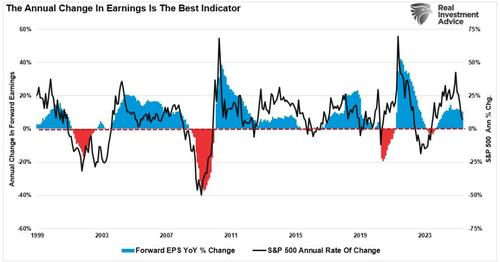

Как обсуждалось ранее, годовой темп изменения роста прибыли является одним из лучших предикторов доходности фондового рынка.

Тем не менее, инвесторы должны быть осторожны в понимании влияния выкупа на прибыль при инвестировании в компании. Как отметил Уоррен Баффет:

Наконец, важное предупреждение: Даже показатель операционной прибыли, который мы предпочитаемМенеджерами легко манипулировать. которые хотят это сделать. Такое вмешательство часто считается изощренным руководителями, директорами и их советниками.Репортеры и аналитики также признают его существование. Победа над «ожиданиями» объявлена управленческим триумфом. Эта деятельность отвратительна. Для манипулирования числами не требуется талант: Требуется только глубокое желание обмануть. «Смелый, творческий учет», как однажды сказал мне генеральный директор, Это стало одним из позоров капитализма."

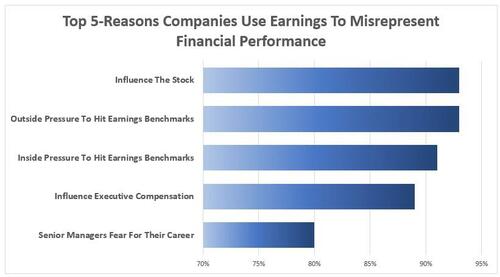

Почему руководители хотят манипулировать доходами? Неудивительно, что опрос WSJ финансовых директоров показал, что 93% указали на то, что «Влияние на цену акций» и «Внешнее давление» Причины манипулирования цифрами доходов.

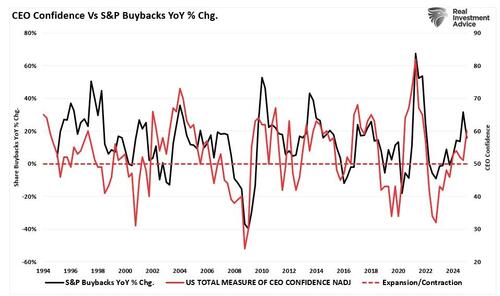

Конечно, одним из заблуждений является то, что корпоративные руководители выполняют выкупы, когда они считают, что акции недооценены. Однако реальность совершенно противоположна, и они, как правило, осуществляют выкуп акций, когда их текущий оптимизм повышен. Когда цены на акции снижаются, а обратный выкуп может осуществляться по аккреционным ценам, стимулов для этого мало.

Заключение

Доказательства очевидны: корпоративные выкупы акций не являются маргинальной силой на рынках.Они занимают центральное место в механике ценовой инфляции.. Когда на выкуп приходится весь чистый спрос на акции за последние два десятилетия, трудно утверждать, что это просто так. "а" фактор. Они не просто сокращают предложение на бумаге — это спрос. Без них стоимость акций выглядела бы совсем иначе.

Но что более важно, так это почему. Несмотря на популярный рассказ о том, что выкуп возвращает капитал акционерам, данные и поведение корпоративного управления рассказывают другую историю. Выкупы в подавляющем большинстве раздувают прибыль на акцию и повышают краткосрочные цены на акции, которые напрямую связаны с компенсацией исполнительной власти. Этот стимул искажает сроки и намерения программ выкупа от долгосрочного создания стоимости к краткосрочной финансовой инженерии.

К чести Фишера, рынки сложны. Спрос, настроения, процентные ставки и макроэкономические факторы имеют значение. Однако отказ от выкупа акций как одной из переменных среди многих игнорирует то, насколько они доминируют в потоках акций. Их влияние измеряется, усиливается финансовыми стимулами корпоративного руководства.

Вопрос для инвесторов заключается не в том, имеют ли значение выкупы - они имеют. Вопрос в том, используются ли они для создания реальной ценности или маскируют ее отсутствие.

Тайлер Дерден

Фри, 05/16/2025 - 09:50