Фунт упал после того, как Банк Англии снизил ставки, предупреждая о нарастании стагфляции; два чиновника проголосовали за более значительное сокращение

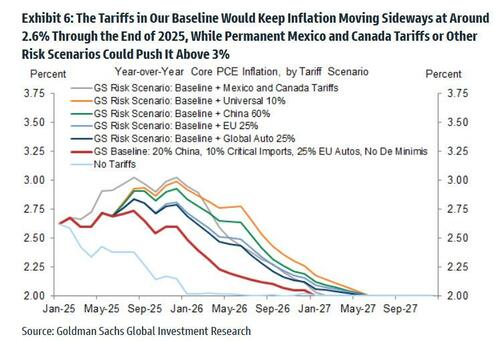

В то время как ФРС задается вопросом о том, насколько тарифы Трампа повысят инфляцию, и, по словам Голдмана, ответ на этот вопрос — колоссальные 0,5% до 2,6% (с 2,1% при отсутствии тарифов).

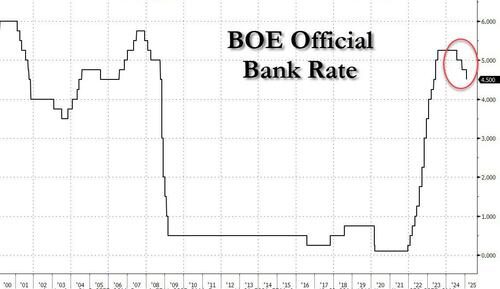

... Остальной мир продолжает тихо стимулировать свою экономику, вводя больше инвестиций. рефляционный ликвидность в системе, и сегодня утром Банк Англии был последним, кто сделал это, когда он не только снизил ставки по кредитам. третий раз подряд на 0,25% до 19-месячного минимума в 4,5%, как и ожидалось...

Но, к удивлению рынка, Два из девяти членов MPC проголосовали за более значительное снижение ставки на 50 б/с. Это, в свою очередь, побудило рынки повысить ставки на более мягкое игнорирование собственной формулировки Банка Англии.

Комитет по денежно-кредитной политике большинством голосов 7-2 проголосовал за снижение ставки до 4,5%.

Узнайте больше в нашем #MonetaryPolicyReport https://t.co/alETrQ281L pic.twitter.com/Vuo5G6m1H8

— Bank of England (@bankofengland) 6 февраля 2025 г.

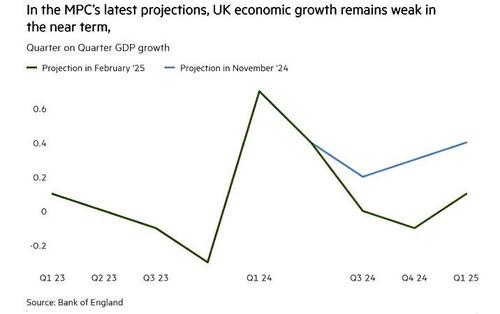

Был еще один поворот: в ударе по канцлеру Великобритании Рэйчел Ривз Банк Англии сократил свой прогноз роста, заявив, что теперь он ожидает, что экономика вырастет только на 0,75% в этом году, что составляет половину его ВВП. Ноябрьский прогноз в 1,5%, который, по крайней мере, оправдал бы снижение ставки.

Но и сам Боэ тоже повысил свой прогноз инфляции, Сейчас она достигает максимума в 3,7% из-за более высоких цен на энергоносители и выше по сравнению с предыдущим прогнозом в 2,8%. Другими словами, Великобритания сейчас находится в стагфляционной ловушке, но в мире, где больше нельзя терпеть боль, очевидная реакция центрального банка заключалась в том, чтобы больше снижать ставки.

Перспективы банка являются мрачным фоном для Ривза, который председательствовал на крахе роста с тех пор, как лейбористы выиграли всеобщие выборы в июле прошлого года. Банк Англии считает, что экономика сократилась на 0,1% за три месяца до декабря, квартал, который включал бюджет Ривза по сбору налогов 30 октября, и вырастет всего на 0,1% в первом квартале 2025 года.

Прогноз роста в этом году сократился вдвое до 0,75%, но в 2026 и 2027 годах он вырастет до 1,5% по сравнению с предыдущим прогнозом в 1,25% в оба года. Банк заявил, что его прогноз «не зависит от каких-либо изменений в глобальных тарифах», но торговая война может снизить рост Великобритании, «задерживая инвестиционные расходы и решения о найме». "

На фоне этой какафонии закрученных перспектив неудивительно, что MPC сигнализировал о «постепенном и тщательном подходе» к будущему снижению ставок, предупреждая о неопределенности из-за тарифов Трампа и предлагая в своих прогнозах. Чтобы вернуть инфляцию к целевому показателю в 2%, потребовалось еще два сокращения.

Добавление слова «осторожно» к основному руководству банка по будущему смягчению отразило вопросы о мировой экономике. «Мы живем в неопределенном мире, и дорога впереди будет иметь проблемы», — сказал он.

«Некоторые внутренние инфляционные давления остаются и, возможно, ослабли немного медленнее, чем мы ожидали в прошлом году», - сказал Бейли журналистам после решения. «И это подтверждает важность постепенного подхода к снятию ограничительных мер денежно-кредитной политики. "

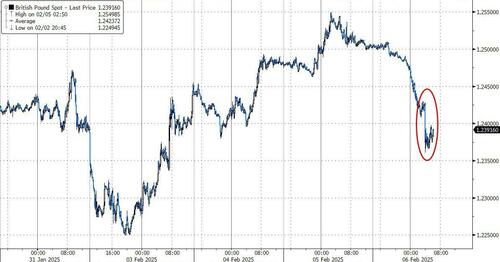

Несмотря на осторожные формулировки Бейли, трейдеры сосредоточились на призывах двух политиков к более резкому сокращению, добавив ставки на будущее снижение процентных ставок. Денежные рынки в настоящее время выступают за еще три сокращения на 25 базисных пунктов в этом году.

Это повредило фунту, который продолжил снижение по сравнению с долларом, упавшим на 1,2% до 1,2361 доллара. Это был худший показатель среди основных валют в четверг. Доходность позолоты за два года упала на целых семь базисов до 4,07%.

В ответ на снижение ставки стратег JP Morgan Private Bank Мэтью Лэндон сказал, что «на пределе». Мы интерпретируем это как зеленый свет для рынка, чтобы оценить более низкую ставку терминала." Он добавил, что Сегодняшнее сокращение от Банка Англии было широко ожидаемым, хотя сопровождающее заявление содержало некоторые смешанные сигналы. "

Решение MPC снизить ставку до самого низкого уровня с июня 2023 года представляет собой отсрочку для более чем полумиллиона домовладельцев, которые в этом году заключили пятилетние ипотечные соглашения. Ривз назвал это решение «приветственной новостью», но выразил разочарование более широкими перспективами, предоставленными банком.До сих пор не удовлетворены темпами роста. "

Роб Вуд, главный британский экономист Pantheon Macroeconomics, сказал, что он придал «больше веса» ястребиным прогнозам инфляции банка, относительно сильному обзору расчетов по заработной плате и его общему руководству, чем голоса двух выбывших. "

Бейли, похоже, поддержал эту точку зрения в комментариях журналистам после решения: «Я бы не стал переосмысливать любые другие движения в моделях голосования», - сказал он, добавив, что «важно, чтобы взгляд на будущий путь процентных ставок основывался на экономических основах». "

Кроме того, за этим изменением последовало понижение оценки банка относительно потенциала роста в Великобритании, что делает более быстрый рост инфляционным. В этом году он сократил свою оценку вдвое до 0,75%, но ожидает, что потенциальный рост вернется к 1,5% с 2026 года. Банк обвинил понижение в постоянно слабой производительности и предположил, что увеличение расходов лейбористов на Национальную службу здравоохранения может ухудшить положение.

Не было никаких существенных изменений в прогнозах банка после недавно объявленных планов Ривза по стимулированию роста за счет ослабления регулирования и реализации инфраструктурных проектов.

«Трудно видеть, что Банк Англии существенно увеличивает темпы смягчения, пока не увидит, как рост национального страхования переваривается экономикой весной», - сказал Люк Бартоломью, заместитель главного экономиста Abrdn. «Тем не менее, сегодняшние сигналы Банка свидетельствуют о том, что в этом году есть возможности для еще нескольких снижений ставок, учитывая слабые перспективы роста, и мы продолжаем видеть ставки ниже 3% в течение следующих двух лет. "

Тайлер Дерден

Ту, 02/06/2025 - 09:15

![Sąd: Jak liczyć zachowek od mieszkania [Wyrok w sprawie wydziedziczonego synka i trójki wnuków]](https://g.infor.pl/p/_files/38265000/podwyzki-38264590.jpg)

![W Goworowie debatowali o bezpieczeństwie. "Dziękujemy wszystkim mieszkańcom" [ZDJĘCIA]](https://www.eostroleka.pl/luba/dane/pliki/zdjecia/2025/275-227256.jpg)