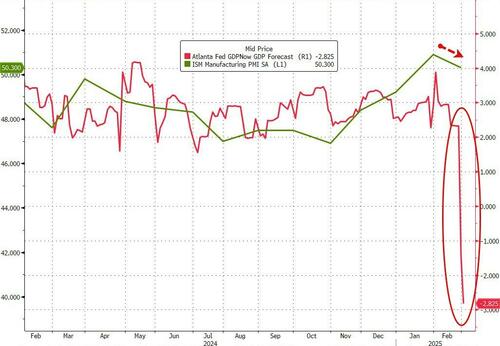

ФРС Атланты снова сократила прогноз ВВП после небольшого падения в исследовании производства ISM

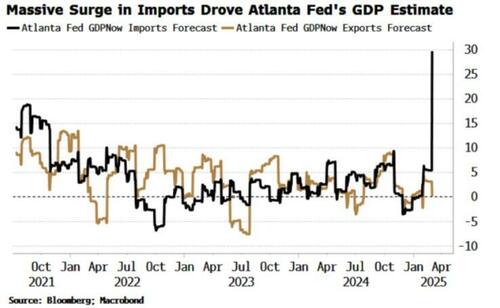

В мирное время двух рабочих дней прогноз ВВП ФРБ Атланты на 1 квартал 2025 года рухнул с +2,33% до -2,825% - ошеломляющий 510-бит/с в ожиданиях роста.

Сегодняшнее падение до сокращения на 2,825% - это Худший прогноз по ВВП со времен блокировки COVID в 2020 году...

Источник: Bloomberg

В пятничном падении был виноват торговый дефицит, как мы подробно описали ранее:

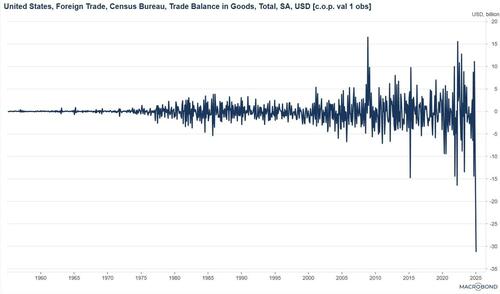

Дефицит торгового баланса товаров в январе упал до рекордных 153 млрд долларов против ожиданий в 116 млрд долларов.

Более того, как мы разделяем ниже, благодаря MacroBond, ежемесячное снижение на 31 миллиард долларов более чем в два раза больше, чем в любом другом случае с 1955 года. Импорт вырос на 12%, а экспорт увеличился на 2%. Резкое снижение торгового дефицита в первую очередь связано с тарифами американских компаний.. Примерно 22 миллиарда долларов из 31 миллиарда долларов, или около двух третей снижения, поступили от промышленных поставок. Потребительские товары (4 миллиарда долларов), продукты питания и напитки (2 миллиарда долларов) и другие товары (2,3 миллиарда долларов) составляют основную часть остальной части изменения. Аналогичный крупный торговый дефицит, скорее всего, будет зафиксирован в феврале.

Резкое снижение, в основном из-за тарифов, скорее всего, нормализуется в ближайшие месяцы.. Спрос на импорт будет меньше, чем обычно, так как запасы для конкретных продуктов в настоящее время раздуты для тех, кто хочет импортировать. опережая тарифы.

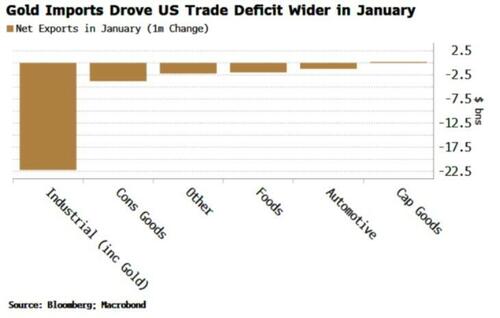

Однако, как мы подробно описали здесь, Большая часть увеличения торгового дефицита в январе была вызвана ростом импорта золота.

Ранее мы уже обсуждали динамику на рынке золота, которая привела к росту цен на золото. Скачок количества металла покидает Европу и направляется в США.

Это, вероятно, связано с постоянным сжатием физического металла в хранилищах в Лондоне. и Швейцария, движимая несколькими годами накопления средств в центральном банке ЕМ - Это не связано с циклическим экономическим ростом в США.

Сегодняшнее падение с -1,5% до -2,8% было вызвано снижением уровня ISM этим утром. Обследование производства:

После утренних выпусков Бюро переписи населения США и Института управления поставками в первом квартале рост реальных расходов на личное потребление и реальных частных инвестиций в основной капитал снизился с 1,3% и 3,5% соответственно до 0,0 и 0,1 процента.

Теперь, чтобы помочь людям прояснить, что здесь происходит, опрос ISM Manufacturing (мягкая точка обзора, используемая для прогнозирования экономического роста твердых данных) упал с 50,9 до 50,3 (все еще расширение).

Итак, чтобы уточнить - снижение на 0,6 п. п. в шумном ISM Обрабатывающей промышленности (которая продолжает расширяться) было достаточно, чтобы привести прогноз ФРС Атланты по экономическому росту к самому рецессионному со времен блокировок COVID?

Конечно, как ранее утверждал министр финансов Бессент, слишком удобная история заключается в том, что во всем виноват Трамп (и Маск).

На самом деле, как объясняет Бессент Мы видим похмелье от избыточных расходов в Байдене 4 года. Через 6-12 месяцев он станет экономикой Трампа. "

Министра финансов Скотта Бессента только что допросили, находимся ли мы в рецессии.

"" Мы видим похмелье от избыточных расходов в Байдене 4 года. Через 6-12 месяцев он станет экономикой Трампа. "

Перевод: Они хотят краха рынка в ближайшее время. https://t.co/NfSOVRpQV0 pic.twitter.com/QzryPJT1IO

— Financelot (@FinanceLancelot) 28 февраля 2025 г.

Как мы и прогнозировали, это произойдет в полном объеме в июле.

Тайлер Дерден

Мон, 03/03/2025 - 11:47