Уродливый Tailing 3Y Auction видит рекордные показатели по снижению спроса

В связи с тем, что долгие облигации взрываются по всему миру, в том числе, оправданные опасения надвигающегося всплеска предложения, несколько минут назад США Казначейство продало 58 миллиардов долларов в 3Y банкнотах. И хотя аукцион состоял из бумаги относительно низкой продолжительности, можно было почувствовать скромные трещины, востребованные на всем пути к передней части кривой.

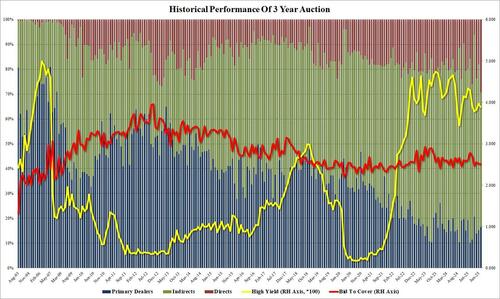

Вот что произошло: аукционные цены при высокой доходности 3,891%, это было примерно на 9 б/с ниже по сравнению с 3,972% в прошлом месяце, но он отошел от Когда Выпустил 3,887% на 0,4 б/с, тот же самый хвост, что и в июне, и 4-й хвост в последних 5 аукционах.

Заявка на покрытие также была ниже 2,51, по сравнению с 2,52 в прошлом месяце, и самой низкой с апреля, а также ниже среднего показателя в 2,61.

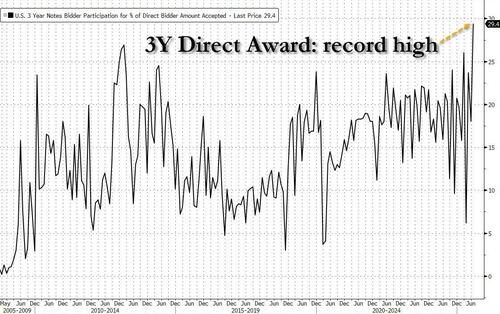

Тем не менее, наиболее заметными были внутренние органы, при этом Indirects получила 54,1%, что является самым низким показателем с декабря 2023 года, а дилеры получили 16,5%, что соответствует недавнему среднему показателю в 15,1%, у Directs осталось колоссальные 29,4%, что является самым высоким показателем за всю историю аукциона.

В целом, это был уродливый, продолжающийся аукцион 3Y, на котором наблюдался спад иностранного спроса, и только рекордный всплеск Directs смог избежать того, что было бы очень уродливым результатом для краткосрочной кривой доходности в день, когда долгосрочная перспектива уже взрывается.

Неудивительно, что доходность 10Y торгуется вблизи максимумов сессии, а новости об уродливом аукционе не помогают.

Тайлер Дерден

Туэ, 07/08/2025 - 13:47