Принятие национального государства для стимулирования роста биткоина; Fidelity Digital видит «новую эру» для криптовалют в 2025 году

В своем прогнозе по цифровым активам и биткоину Fidelity Digital Активы называют 2025 год «ключевым». Когда они должны начать оказывать более широкое влияние на отрасли и экономики.

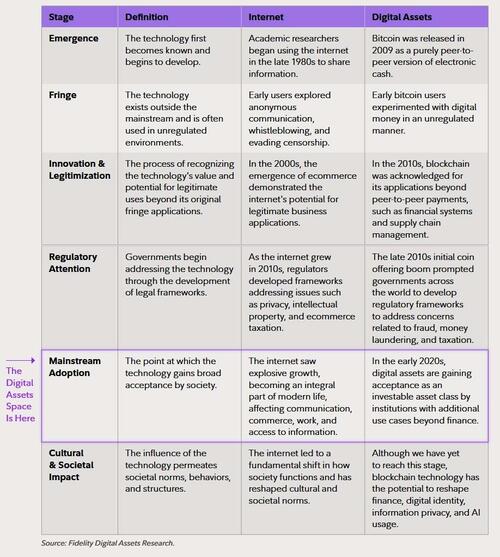

Ссылаясь на исследования экономиста Карлоты Перес, исследователи Fidelity заявили, что технологические революции, такие как железные дороги или Интернет, например, Как правило, разрушают несколько отраслей и полей и реконструируют целые экономики.

«Биткойн и цифровые активы могут соответствовать этой теории», — пишет исследователь Fidelity Digital Assets Крис Койпер.

«Потенциально мы прошли то, что Перес называет ранним спекулятивным периодом, сопровождающимся финансовым бумом и спадами, и сейчас, возможно, вступаем в фазу дальнейшего принятия. "

Об этом сообщает Fidelity Paper. Мы находимся на ранних стадиях массового распространения и внедрения цифровых активов в процессе, который будет развиваться в течение десятилетий.

«2025 год может стать годом, который рассматривается как ключевое время, когда «пропасть была преодолена», поскольку цифровые активы начинают приживаться и внедряться в различные области и отрасли», — сказал Койпер.

Например, в прошлом году мы уже наблюдали дискуссии вокруг принятия национальных государств и увеличения принятия корпоративных балансов. "

Таким образом, хотя биткоин процветал в 2024 году, он все еще находится в начале этой новой эры устойчивого принятия, распространения и интеграции. Койпер сказал.

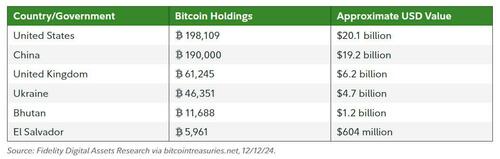

Мы ожидаем, что все больше национальных государств, центральных банков, суверенных фондов благосостояния и государственных казначейских облигаций будут стремиться установить стратегические позиции в биткойне. Об этом заявил аналитик Fidelity Digital Assets Мэтт Хоган в своей статье от 7 января под названием «2025 Look Ahead». "

Мартин из CoinTelegraph Молодой человек сообщает, что, по мнению Хогана, большее число организаций могут обратить внимание на учебную программу, используемую Бутаном и Сальвадором, и на существенную отдачу, которую они смогли получить от таких должностей за относительно короткий промежуток времени. "

Он сказал, что отказ от выделения биткойнов может стать большим риском для стран, чем создание такого из-за таких проблем, как изнурительная инфляция, обесценивание валюты и все более сокрушительный бюджетный дефицит.

Если США продолжат свои стратегические планы по резервированию биткоинов, Вполне вероятно, что национальные государства начнут накапливаться в тайне. Хоган сказал. «Ни одна страна не имеет стимула объявлять об этих планах, поскольку это может повлиять на большее число покупателей и повысить цену. "

Крупнейшие национальные государства, держащие биткойны. Источник: FDA

Хоган также предсказал, что продукты, структурированные и управляемые цифровыми активами, «станут популярными» в 2025 году, добавив, что «трудно переоценить успех» спотовых биткойнов и эфиров. Эт$3 237,85 биржевых фондов.

С первоначальным успехом этих продуктов было бы неразумно ожидать, что к 2025 году в мире TradFi появятся более структурированные пассивные и активно управляемые продукты с цифровыми активами.

Хоган также предсказал, что токенизация станет «приложением-убийцей» 2025 года, а стоимость ончейна удвоится с 14 до 30 миллиардов долларов к концу года.

«Токенизация часто рассматривается как модное слово в мире технологии блокчейн, но ее потенциал в финансовых услугах и за его пределами только начинает реализовываться», — сказал он.

Исследователи Fidelity заявили, что инвесторы должны «готовиться к ускорению» с «повышенным принятием, развитием, интересом и спросом на цифровые активы». "

Они добавили, что «инвесторы еще не поздно присоединиться к движению цифровых активов». «Возможно, мы вступаем в новую эру цифровых активов, которая продлится несколько лет, если не десятилетий. "

Тайлер Дерден

Ту, 01/09/2025 - 15:05

![Ustawka kiboli przy autostradzie A1. Policja musiała interweniować [FILM]](https://storage.googleapis.com/patrykslezak-pbem/tulodz/articles/image/8609d6f7-729f-4dc8-bc35-d73b1e8f9e01)