Опросы сектора услуг США упали в январе из-за роста цен и падения заказов

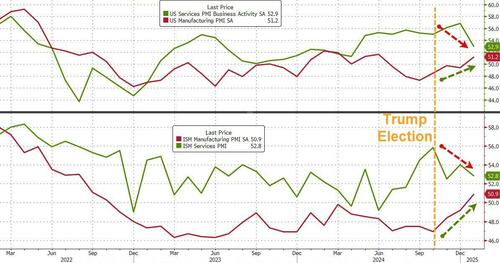

После неожиданного всплеска опросов PMI в США (эффект Трампа?), несмотря на замедление заводских заказов и сокращение рабочих мест в обрабатывающей промышленности (ADP), ожидания для сектора американских услуг были значительно слабее.

Несмотря на то, что в январе в США вновь появились «жесткие» макроэкономические данные, S&P Global US Services PMI обвалился до 52,9 в январе с 56,8 в декабре (немного лучше, чем 52,8 флэш-печати в январе)

Индекс ISM Services также упал с 54,0 до 52,8 (54,0 exp).

Источник: Bloomberg

Под капотом индекса ISM Services новые заказы резко ослабли, инфляция снизилась, но остается горячей, но занятость незначительно улучшилась.

Источник: Bloomberg

Интересная модель появилась с тех пор, как Трамп выиграл выборы.

Источник: Bloomberg

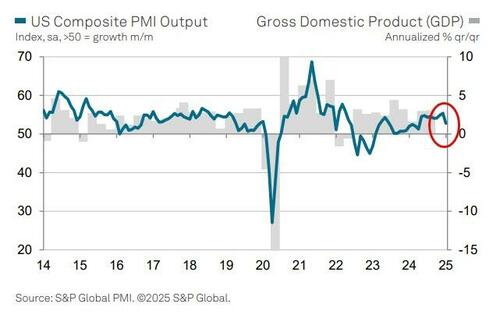

Индекс S&P Global US Composite PMI Output Index в январе составил 52,7, по сравнению с 55,4 в декабре. Но все еще сигнализирует о стабильном ежемесячном росте деловой активности. Экономика США остается самой сильной по сравнению с остальными крупными компаниями, но ее лидерство быстро угасает.

Источник: Bloomberg

Обновленный рост производства совпал с более медленным ростом активности в сфере услуг.

Темпы расширения нового бизнеса также снизились в январе, но темпы создания рабочих мест ускорились и стали самыми сильными с июня 2022 года. Между тем, Как затраты на ввод, так и цены на продукцию росли более быстрыми темпами.

Крис Уильямсон, главный экономист S&P Global Market Intelligence, сказал:

""Компании сферы услуг сообщили о замедлении в начале 2025 года. при этом уровень активности растет с меньшими темпами по сравнению с устойчивым ростом, наблюдавшимся в конце прошлого года. Рассматривая производственные и сервисные исследования PMI вместе, 1,6% годовых темпов роста ВВП ожидается в январе. Это сопоставимо с сигналом роста на 2,4% в четвертом квартале 2024 года, для которого официальные данные в настоящее время оценивают прирост ВВП на 2,3%.

Заметный рост найма дополнительно поддерживает мнение о том, что устойчивый рост должен возобновиться. Производство также продемонстрировало долгожданное возвращение к росту в течение месяца. которые, в случае их сохранения, должны обеспечиваться соответствующими услугами, такими как транспорт и логистика.

Но у них всегда есть оправдание слабости - и на этот раз это погода (холодные штормы зимой???!!!) Кто бы мог это предвидеть?

"Однако, по крайней мере, часть этого охлаждения, по-видимому, связана с нарушения, вызванные необычно неблагоприятной погодой, Это говорит о том, что рост в секторе услуг может возобновиться в феврале.

Но были некоторые явные признаки создания точек давления.

"Тем не менее, в ходе обследования были также зарегистрированы признаки более мягких условий спросаВ частности, там, где спрос сильно зависит от изменения ожиданий процентных ставок, таких как финансовые услуги. Бизнес-оптимизм также немного остыл. Это вряд ли повлияло на погоду, что отражает некоторый откат в бурном послевыборном оптимизме, наблюдаемом в декабре. Поэтому будет интересно посмотреть данные за предстоящий месяц, чтобы увидеть, начал ли медовый месяц после выборов улучшать оптимизм и возрождаться спрос.

"Тем временем, Надежды на большее снижение ставок будут еще больше уменьшаться за счет сочетания увеличения найма, сообщений о трудностях с предложением рабочей силы и повышения ценового давления."

Проблеск надежды для голубей? Нет, если цены продолжат расти так!

Тайлер Дерден

Свадьба, 02/05/2025 - 10:05

![Sąd: Jak liczyć zachowek od mieszkania [Wyrok w sprawie wydziedziczonego synka i trójki wnuków]](https://g.infor.pl/p/_files/38265000/podwyzki-38264590.jpg)

![W Goworowie debatowali o bezpieczeństwie. "Dziękujemy wszystkim mieszkańcom" [ZDJĘCIA]](https://www.eostroleka.pl/luba/dane/pliki/zdjecia/2025/275-227256.jpg)