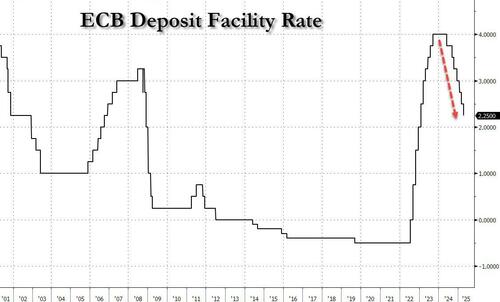

ЕЦБ снизил ставки в 7-й раз, прогноз окупается на фоне «исключительной неопределенности»

Как и ожидалось, ЕЦБ 7-й раз подряд снизил три основные ставки на 25 б/с (депозитный объект, основные операции рефинансирования и маржинальный кредитный объект будут снижены до 2,25%, 2,40% и 2,65% соответственно). Примечательно, что впервые в этом цикле смягчения центральный банк убрал из заявления слово «ограничение». Агентство Reuters сообщило, что решение о снижении ставок было единодушным, поскольку даже некоторые из более ястребиных игроков согласились с тем, что мировая торговля значительно изменила прогноз.

ЕЦБ также представил голубиный прогноз, учитывая «исключительную» неопределенность. Снижение было основано на «обновленной оценке прогноза инфляции, динамики базовой инфляции и силы передачи денежно-кредитной политики», говорится в заявлении Совета управляющих.

ЕЦБ заявил, что процесс дезинфляции идет полным ходом, но добавил, что перспективы роста ухудшились из-за растущей торговой напряженности. Повышенная неопределенность «может еще больше повлиять на экономические перспективы еврозоны». Кроме того, ЕЦБ отказался от слова «ограничительный» в отношении денежно-кредитной политики, что стало предметом дискуссий среди политиков в последние недели.

Сравнивая заявление, вот основные моменты

Торговля:

- Неблагоприятная и нестабильная реакция рынка на торговую напряженность, вероятно, окажет ужесточающееся влияние на условия финансирования.

- Эти факторы могут еще больше повлиять на экономические перспективы еврозоны.

- Повышенная неопределенность, вероятно, снизит доверие между домашними хозяйствами и фирмами, а неблагоприятные и нестабильные рыночные реакции на торговую напряженность, вероятно, окажут ужесточающееся влияние на условия финансирования.

Инфляция:

- Инфляция продолжает расти, как и ожидалось

- Совет управляющих намерен обеспечить устойчивую стабилизацию инфляции на уровне 2% в среднесрочной перспективе.

Осадки:

- Рост заработной платы сдерживается

Смотри:

- Экономика еврозоны наращивает устойчивость к глобальным потрясениям, но перспективы роста ухудшились из-за растущей торговой напряженности.

- Будет следовать подходу, зависящему от данных и заседаний, для определения соответствующей позиции денежно-кредитной политики.

По коленопреклонной реакции EURUSD упал с 1,1361 до 1,334, что является новым минимумом сессии, за 2 минуты, поскольку рынок рассматривал заявление более голубоватым, чем ожидалось (к чести Трампа, который назвал растущую бифуркацию между ЕЦБ и ФРС в качестве основы для своего гнева). В соответствии с голубиным ответом, будущее 24 января выросло со 130,95 до 131,17, в то время как Stoxx 50 показал скромный рост.

В целом, решения были в значительной степени, как и ожидалось, с устранением ограничений, учитывая, что сегодняшнее снижение на 25 б/с выводит ЕЦБ на верхний уровень его оценки нейтральной ставки 1,75-2,25%. Интересно, что Линия ограничения была удалена и не была заменена ссылкой на эту нейтральную полосу или аналогичную.; не обязательно сигнал или аналогичный, но все же точка, чтобы отметить. В других местах прогноз был неожиданно необязательным, хотя в заявлении подчеркивается повышенная неопределенность и связанное с этим влияние доверия, которое, вероятно, окажет ужесточение влияния на условия финансирования. Учитывая это, мы теперь ищем любой намек на компенсирующий политический ответ (т.е. голубиные действия), чтобы противостоять «вероятному» ужесточению условий финансирования - пункт, который, возможно, привел к слегка отложенной голубиной реакции.

Ранее:

Предварительный просмотр

ОБЗОР: Ожидается, что ЕЦБ снизит ставку по депозитам на 25 б/с до 2,25%. Несмотря на позитивные импульсы от немецкого пакета фискальных реформ и рекордно высокого уровня евро на основе взвешенной торговли, ожидаемый негативный шок роста от глобальной торговой войны приведет к тому, что политики смягчат денежно-кредитную политику до вершины предполагаемого нейтрального диапазона. Основное внимание будет уделено тому, как ЕЦБ в настоящее время моделирует влияние торговой войны на экономику еврозоны и как она может сформировать денежно-кредитную политику в ближайшие месяцы.. Тем не менее, ЕЦБ, вероятно, примет необязательный тон из-за неопределенности, связанной с торговой практикой администрации Трампа.

Предварительная встреча: Как и ожидалось, ЕЦБ нажал на спусковой крючок при снижении ставки по депозитам на 25 б/с. Больше внимания уделялось решению Совета управляющих изменить свое заявление о политике таким образом, чтобы оно гласило, что «денежная политика становится значительно менее ограничительной» (до этого «денежная политика остается ограничительной»).

В другом месте Банк решил повторить свой подход, зависящий от данных и заседаний, заявив при этом, что он не будет заранее придерживаться определенного политического пути. Для сопроводительных макропрогнозов прогноз инфляции на 2025 год был повышен до 2,3% с 2,1%, 2026 год держался на уровне 1,9%, а 2027 год сократился до 2,0% с 2,1%. На фронте роста политики сократили свои прогнозы роста на 2025 и 2026 годы, удерживая 2027 год на уровне 1,3%. На последующей пресс-конференции президент Лагард отметила, что изменение формулировки заявления не является безобидным изменением, а изменение слов имеет смысл. Она добавила, что ЕЦБ сейчас движется к более "эволюционному подходу". Что касается политического решения, все политики, за исключением австрийского Хольцмана (который воздержался), поддержали объявление. Лагард предположила, что ГК может снова сократить или приостановить свой цикл резки в зависимости от данных. Тот факт, что Лагард классифицировала обсуждение политики как «живое» и «интенсивное», предполагает, что предстоящие решения станут более спорными.

ЭКОНОМИЧЕСКИЕ РАЗВИТИЯ: Мартовский отчет HICP показал, что инфляция Y / Y снизилась до 2,4% с 2,6%, сверхосновное снижение до 2,4% с 2,6%, а инфляция услуг упала до 3,4% с 3,7%. Февральские потребительские ожидания ЕЦБ Опрос показал, что 12-месячный и 3-летний прогнозы остаются стабильными на уровне 2,6% и 2,4% соответственно. С точки зрения рыночных показателей, инфляция 5y5y снизилась примерно до 2,07% с 2,22%, наблюдавшихся на момент мартовского заседания. На фронте роста данные по ВВП 01 не публикуются до 30 апреля. Тем не менее, более своевременные данные опроса от S & P Global показали, что в масштабах всей EZ производственный печатный тик вырос до 48,7 с 47,6, услуги выросли до 51,0 с 50,6, оставив композит на 50,9 против 50,2. На рынке труда уровень безработицы в еврозоне остается на историческом минимуме в 6,1%. Стоит также отметить, что взвешенный в торговле евро в настоящее время находится на рекордно высоком уровне.

РЕЦЕНТНЫЕ КОММУНИКАЦИИ: Учитывая текучесть торговой ситуации, большая часть замечаний, высказанных после предыдущего совещания, была сочтена несколько устаревшими. Однако на последних сессиях. Президент Лагард (11 апреля) отметила, что банк готов использовать инструменты, необходимые для обеспечения ценовой стабильности. Французский Вильерой (10 апреля) заявил, что решение президента США Трампа о паузе было менее плохим, но элементы плохих новостей остаются. Он также отметил (9 апреля), что торговая война снизит рост EZ на 0,25 п.п. в 2025 году; шок не будет незначительным, но не будет рецессией. Австриец Хольцманн (9 апреля) заявил, что пока не видит причины для снижения ставки, добавив, что ожидание является лучшей стратегией, когда неопределенность настолько высока. Он добавил, что рассмотрение негабаритного разреза на 50 б/с является «нелепым». В другом месте на ястребином конце спектра Нидерландский узел (9 апреля) считает, что влияние торговой войны, вероятно, будет инфляционным в долгосрочной перспективе. Финская Rehn (9 апреля) заявила, что доводы в пользу продолжения снижения ставок на апрельском заседании поддерживаются материализующимися рисками снижения. Стурнарас из Греции (8 апреля) признал, что потенциальное увеличение инфляции может задержать нормализацию денежно-кредитной политики.

Ставки: Ожидается, что ЕЦБ снизит ставку по депозитам на 25 б/с до 2,25%, согласно опросу 61/71 экономистов Reuters (примечание, некоторые из этих прогнозов могут считаться устаревшими, учитывая текучесть торговой войны). Финансовые рынки более убеждены в снижении ставки на 25 б/с, а цена такого результата составляет 99%. На фоне встречи доминировала торговая повестка дня президента США Трампа. На момент написания статьи президент США Трамп объявил о 90-дневной паузе в тарифных действиях и сократил взаимность до 10% для стран, которые просили о переговорах. В ответ ЕС отложил свои контрмеры (задолженные 15 апреля) США. В целом перспективы торговли улучшились за последние несколько сессий, однако они остаются крайне неопределенными и поэтому продолжают сдерживать перспективы роста для региона. Соответственно, политики намерены принять меры по дальнейшему ослаблению денежно-кредитной политики. Отметим, что резкий рост на 50 б/с маловероятен, поскольку Симкус из ЕЦБ заявил, что не видит необходимости говорить о таком увеличении. Рынки также будут следить за тем, воздержится ли Холцман (или кто-либо другой) от этого решения. Учитывая ожидания сокращения, ЕЦБ также придется изменить свою коммуникацию. Вместо того, чтобы «монетарная политика становится значительно менее ограничительной», ЕЦБ, скорее всего, отметит, что при 2,25% ставка по депозитам теперь будет в пределах нейтральных процентных ставок». Остается выяснить, будет ли банк вставлять какие-либо дополнительные формулировки вместо продолжающейся торговой войны. Помимо предстоящей встречи, рыночные цены были особенно неустойчивыми, учитывая волатильность на рынках. Тем не менее, следующее снижение на 25 б/с полностью оценено к июлю с 80 б/с смягчением, подразумеваемым к концу года.

Тайлер Дерден

Thu, 04/17/2025 - 08:30