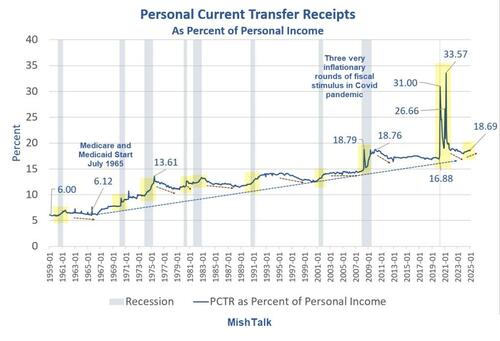

Визуализация растущей зависимости американцев от правительственных раздач с течением времени

Автор Майк Шедлок через MishTalk.com,

Потребители США все больше зависят от Medicare, Medicaid, SNAP и социального обеспечения.

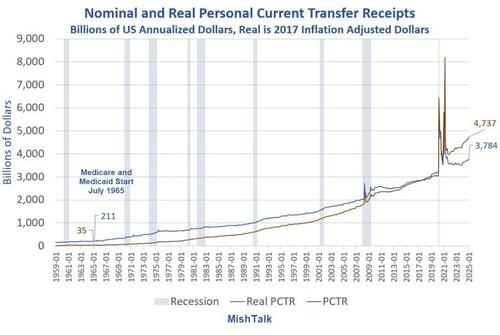

Персональные текущие трансферные квитанции (PCTR) и данные о доходах от BEA, диаграмма Mish.

В: Что такое личные текущие трансферные квитанции?

Бюро экономического анализа (BEA) объясняет, что PCTR состоит из выплат дохода лицам, для которых не выполняются текущие услуги. Это сумма государственных социальных пособий и чистых текущих трансфертных поступлений от бизнеса.

Medicare, Medicaid, SNAP (пищевые талоны), жилищные субсидии и социальное обеспечение являются примерами.

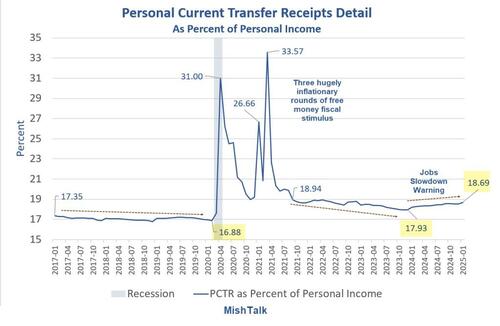

PCTR Процентная деталь

Персональные текущие трансферные квитанции (PCTR) и данные о доходах от BEA, диаграмма Mish.

PCTR Замечания

- PCTR, как правило, поднимается в рецессии, отставая от некоторых, но не до предыдущего уровня.

- Это имеет смысл из-за сокращения рабочих мест во время рецессии, за которым следует увеличение рабочих мест после рецессии.

- Когда снижение PCTR после рецессии превращается в увеличение, у вас есть предупреждение о рецессии, но с переменным временным лагом.

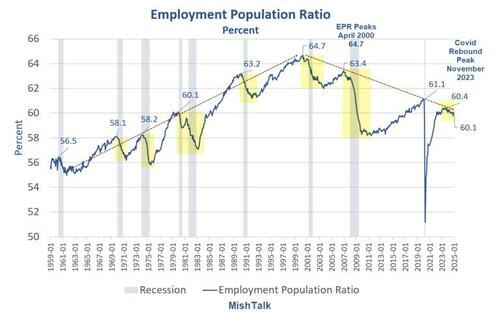

Бумерская демография и иммиграция

Демография, особенно стареющие бэби-бумеры, увеличивают зависимость от Medicare и социального обеспечения.

Иммиграция играет роль в программе Medicaid для детей. Но Трамп отключил все льготы для нелегальных иммигрантов.

Социальное обеспечение и медицинская помощь являются основными проблемами. Меньшее число работников поддерживает растущую потребность иждивенцев.

Коэффициент занятости населения

Коэффициент занятости населения от BLS, диаграмма Миша.

Каков коэффициент занятости населения?

Коэффициент занятости населения является статистической мерой, которая представляет процент трудоспособного населения страны, которое в настоящее время занято.

Это показывает долю людей в населении, которые активно работают.

ЭПР рассчитывается путем деления числа занятых на общее гражданское неинституциональное население в возрасте 16 лет и старше.

Как в этом играет инфляция?

Персональные текущие трансферные квитанции (PCTR) и данные по инфляции из BEA, диаграмма Миша.

Реальный и номинальный PCTR

- Годовой показатель PCTR составил $4,74 трлн в январе 2025 года. Это сопоставимо с 35 миллиардами долларов в июле 1965 года.

- Годовой показатель Real PCTR в январе 2025 года составил $3,78 трлн. Это сопоставимо с 211 миллиардами долларов в июле 1965 года.

В январе 2025 года люди получили 4,74 триллиона долларов, но это было 3,78 триллиона долларов.

С потребительской точки зрения, PCTR был завышен на $953 млрд, 25,4%. Тем не менее, влияние на федеральный дефицит составило $4,74 трлн.

Спасибо Федрезерву и Конгрессу

ФРС не виновата в трех раундах финансового стимулирования свободных денег, которые подпитывали массовую инфляцию после кризиса.

Тем не менее, ФРС на 100% виновата в своем ответе на инфляцию, который создал пузыри активов и буквально уничтожил рынок жилья.

Инфляционные и дефляционные силы

Свободные деньги и растущий дефицит по своей сути являются инфляционными.

В результате рост стоимости активов является инфляционным.

Демография бумеров и выход на пенсию являются дефляционными, но компенсируются ростом цен на активы и пузырями.

Инфляция наказывает тех, кто не владеет активами и нуждается в PCTR для покупки продуктов питания и оплаты аренды. Это дефляционно.

Если цены на активы упадут, вся смесь станет дефляционной.

Синопсис правительственной зависимости

Со временем мы все больше зависим от государственной помощи. Проблема усугубляется ростом уровня пособий, инфляции и демографии.

Ни одна из сторон этого не исправит. Ни одна из партий ничего не исправит, потому что Конгресс коррумпирован.

Нет никаких фискальных консерваторов.

DOGE — это сайд-шоу, которое оценивается в 4,74 триллиона долларов в рамках PCTR и всего бюджета.

Трамп хочет больше денег для обороны и получит их, предлагая что-то демократам взамен.

ФРС тоже ничего не исправит, потому что фискальная политика будет играть все большую роль, а ФРС даже не понимает, что такое инфляция.

Понимание инфляции

ФРС, Конгресс и Белый дом создали экономику двух государств, которая снова и снова спасает банки, владельцев активов и богатых.

ФРС не признает результат как инфляцию. Между тем, обе стороны поддерживают увеличение расходов на это в обмен на увеличение расходов на разжигание различных пузырей.

Пузыри активов по определению являются инфляционными. Мало кто понимает это, потому что ФРС и экономисты в целом рекламируют инфляцию как ИПЦ или PCE. ФРС неоднократно заявляла, что «инфляционные ожидания хорошо подкреплены».

Так что? Пожалуйста, подумайте. Феддум! ФРС некомпетентна по дизайну и не может быть исправлена

Меры потребительской инфляции являются очень плохим показателем общей инфляции. Не понимая этого простого момента, ФРС спонсировала многочисленные пузыри увеличивающейся амплитуды с течением времени.

Между тем, требуется все больше и больше PCTR, чтобы держать неимущих от бунта.

Когда пузырьки лопнут, результат будет очень дефляционным. Тарифы могут быть пресловутой соломой.

Тайлер Дерден

Мон, 03/03/2025 - 14:40