S&P 500: вес в течение нескольких десятилетий

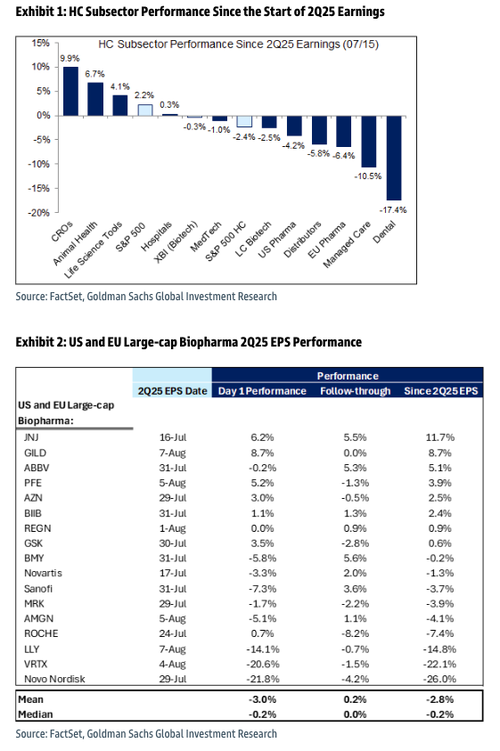

Сезон прибыли закончился для акций биофармы большой капитализации, с резкими распродажами по многим названиям. Вес сектора здравоохранения в S&P 500 упал до многолетнего минимума. Пессимизм растет во всем секторе на фоне предложения администрации Трампа о ценообразовании на Medicaid и перспективе фармацевтических тарифов.

Команда Goldman Sachs во главе с Асадом Хайдером сообщила клиентам в пятницу, что акции здравоохранения сталкиваются со слабыми показателями сектора и растущим пессимизмом, поскольку сезон доходов завершился на прошлой неделе.

Вот некоторые из основных моментов заметки под названием «Глобальное здравоохранение: фармацевтика: пятничный корм: более тонкое позиционирование в августовском затишье»:

Сезон заработка закончился крупными распродажами в двух ключевых названиях роста: Vertex Pharmaceuticals (-20,6% 4 августа, неудача в программе боли) и Eli Lilly And Co. сократили больше всего с эпохи DotCom после неутешительных пероральных данных о таблетках GLP-1.

Это последовало за более ранним снижением доходов на 10-20% в других крупных медицинских «качественных» названиях (Novo Nordisk, McKesson Corp, UnitedHealth Group, Intuitive Surgical).

Акции здравоохранения в этом сезоне переместились в среднем на ą6% от прибыли ... некоторые из самых высоких показателей волатильности в истории.

Индекс S&P 500 в здравоохранении сейчас находится на многолетних минимумах.

Что вызывает уныние и гибель в акциях здравоохранения?

Ну, это политика перевешивает:

Инвесторы по-прежнему сосредоточены на предложении администрации Трампа о ценообразовании MFN для Medicaid и возможных фармацевтических тарифах из продолжающегося расследования Раздела 232 (потенциально в середине августа).

100-процентный тариф администрации на чипы освобождает производство в США, поскольку фармацевтические компании увеличивают внутреннее производство.

Сначала Pfizer внедряет сценарии MFN в руководство; LLY открыта для постепенной перебалансировки цен в США и ЕС, начиная с новых продуктов.

Победители Themes & Stock-Level Notes

Победители

Johnson & Johnson: самая сильная послепродажная деятельность в американской фармацевтике; остается лучшим исполнителем YTD.

Гилеадские науки: +6% WTD, +30% YTD; мощный импульс франшизы ВИЧ и запуск Yeztugo.

Проигравшие

- Торговля ожирением: Предупреждение о прибыли Novo и слабые данные LLY о пероральном ожирении привели к потере рыночной капитализации LLY в размере 100 миллиардов долларов; аналитики Уолл-стрит сократили прогнозы ожирения и PT.

Топ-чарты

График, который мы смотрим...

Вот аналитик Goldman Большой взгляд Сальвина Ричера на здравоохранение:

Большая фотография: Хотя сектор биотехнологий восстановился с более широким рынком с апрельских минимумов (XBI / NBI / S & P 500 выросли примерно на 1/3 / 2% за последний месяц), мы видим потенциал для дальнейшей волатильности в 2H + по мере развития динамики политики (например, тарифы / налоговая политика, цены на лекарства / сокращение медикаментов, FDA / HHS и т. Д.). Мы продолжаем следить за предложением администрации включить ценообразование MFN в Medicaid и ожидаем вероятного объявления о фармацевтических тарифах после завершения текущих расследований Раздела 232 (потенциально к середине августа, по нашим американским экономистам, хотя возможны задержки), отмечая, что фармацевтические препараты были исключены из недавно объявленной торговой сделки между США и ЕС (установление базовой тарифной ставки 15% для большинства импорта ЕС) до завершения расследования Раздела 232.

Pro Subs может прочитать всю заметку в обычном месте.

Тайлер Дерден

Солнце, 08/10/2025 - 16:55