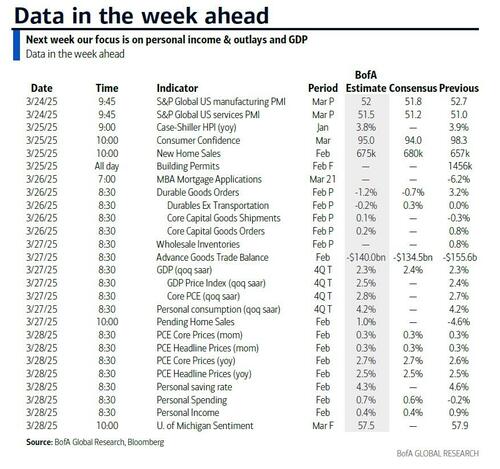

Ключевые события На этой неделе: переговоры по тарифам, основной PCE, доверие и глобальный индекс потребительских цен

Это последняя полная неделя перед объявлением тарифов 2 апреля в США. Ожидайте много заголовков на эту тему. Действительно, фьючерсы на акции США сегодня утром выше, чем в пятничной статье Bloomberg, что тарифы будут более целенаправленными, чем самые худшие опасения. Вне торговли Джим Рид из DB отмечает, что Инфляция займет центральное место с важнейшим ядром США PCE в пятницу. До этого инфляция в Великобритании и Австралии вышла в среду с внезапным французским и испанским ИПЦ в пятницу, наряду с токийским ИПЦ.

С точки зрения других моментов, сегодняшние глобальные флэш-PMI будут интересными. США и Европа подскочили в прошлом месяце, но с тех пор тарифная риторика агрессивно усилилась, но, с другой стороны, Германия отменила десятилетия фискального консерватизма. Таким образом, будет интересно посмотреть, как опросы реагируют на эти события.

Другие важные экономические показатели США включают Индекс потребительской уверенности Conference Board завтра после падения показателей Мичиганского университета на прошлой неделе (Окончательное чтение в пятницу). Говоря о доверии, завтра мы увидим последний немецкий IFO, так что у нас будет еще один шанс увидеть, изменил ли финансовый пакет прогноз или доминирует угроза тарифов. IFO - это только десятичные числа от недавних минимумов, которые были только слабее на высоте GFC и ненадолго в начале Covid. Затем в среду мы увидим Долговечные товары США и последнее весеннее заявление Великобритании о том, что бюджетные финансы неустойчиво сбалансированы, учитывая самонавязанные фискальные правила. Смотрите предварительный обзор наших экономистов здесь. В четверг будут опубликованы окончательные данные по ВВП США за 4 квартал и последние данные по торговле, которые повлияют на показатели ВВП за 1 квартал. Торговые данные могут увидеть рост импорта в преддверии вероятного повышения тарифов. Также следует отметить последний отчет о федеральном долге и установленных законом лимитах, а также долгосрочный прогноз бюджета (до 2055 года) в среду и четверг соответственно.

Что касается центральных банков, основные моменты включают краткое изложение мнений на мартовском заседании Банка Японии в четверг. В Европе ЕЦБ опубликует свой опрос потребительских ожиданий в пятницу, в тот же день, когда центральный банк Норвегии примет решение о ставках. В Китае основные моменты включают фиксацию ставок MLF на 1 год завтра, а также промышленную прибыль за февраль в четверг. В центре внимания также будет ежегодный Форум развития Китая, который завершится сегодня в Пекине. Присутствуют многие руководители американских и европейских корпораций.

Полная дневная неделя впереди, как обычно, заканчивается, но давайте в пятницу посмотрим на основной PCE США. Личный доход (+0,2% против +0,9%) и потребление (+0,3% против -0,2%) должны нормализоваться в противоположных направлениях, но основной дефлятор PCE (+0,37% против +0,28%), вероятно, увеличится, и это должно подтолкнуть ставку YoY вверх на десятую до 2,8%. Недавние более сильные, чем ожидалось, показатели инфляции заставили экономистов DB отметить свои прогнозы инфляции на 2025 год. В настоящее время они видят базовую инфляцию Q4/Q4 CPI и базовую инфляцию PCE на уровне 3,0% и 2,7% соответственно.

В других местах в выходные новостной поток усилился в Тюркье с ключевым лидером оппозиции и мэром Стамбула Экремом Имамоглу, заключенным в тюрьму по обвинению в коррупции после задержания полицией на прошлой неделе. Тот факт, что ему не было предъявлено обвинение в терроризме, означает, что новость не настолько экстремальна, как могла бы быть, поскольку такой шаг привел бы к назначению попечителя в муниципалитет Стамбула, рискуя вызвать больше протестов и беспорядков. Индекс акций Bloomberg TRL на прошлой неделе упал на -17,59%, а центральный банк повысил ставки по кредитам на ночь на 200 б/с до 46%. Вчера вечером регулятор расширил запрет на короткие продажи акций и ослабил правила выкупа акций компании, чтобы попытаться стабилизировать рынки. Итак, один, чтобы посмотреть сегодня утром.

Издательство DB, вот ежедневный календарь событий

понедельник 24 марта

- Данные: США, Великобритания, Япония, Германия, Франция и Еврозона флеш мартовские PMI, США февраль Чикаго Индекс национальной активности ФРС

- Центральные банки: Bostic и Barr ФРС говорят, BoJ протокол январской встречи, Holzmann ЕЦБ говорит, губернатор BoE Бейли говорит

- Заработок: Бид

Вторник 25 марта

- Данные: US March Conference Board Consumer Trust Index, Richmond Fed Manufacturing Index, Business Conditions, Philadelphia Fed Non-Manufacturing Activities, January FHFA House Price Index, February New Home Sales, China 1-yr MLF rate, Japan February PPI Services, Germany March Ifo survey, EU27 February New Car Registrations

- Центральные банки: Вильямс и Куглер ФРС говорят, Казимир ЕЦБ, Нагель, Хольцман и Вуйчич говорят

- Аукционы: US 2-yr Notes ($69 млрд)

Среда 26 марта

- Данные: США февральские заказы на товары длительного пользования, Великобритания февральский ИПЦ, ИПЦ, январский индекс цен на жилье, Франция мартовское доверие потребителей, Австралия февральский ИПЦ

- Центральные банки: Мусалем и Кашкари из ФРС, Виллеруа и Циполлоне из ЕЦБ, резюме обсуждений на мартовском заседании

- Заработок: Долларовое дерево, RENK

- Аукционы: US 2-yr FRN (открытие, $28 млрд), US 5-yr Notes ($70 млрд)

- Другие: US CBO Federal Debt and the Statutory Limit report, Великобритания

четверг 27 марта

- Данные: Февраль в США в ожидании продаж жилья, торгового баланса, оптовых запасов, производственной деятельности ФРС в Канзас-Сити, первоначальных претензий по безработице, промышленных прибылей в Китае в феврале, ИПЦ Японии в Токио в марте, Еврозона в феврале M3

- Центральные банки: Баркин Федрезерва говорит, краткое изложение мнений БоДжей с мартовского заседания, Гуиндос ЕЦБ, Виллерой, Вунш, Эскрива и Шнабель говорят, Дхингра BoE говорит, решение Norges Bank

- Заработок: H&M, Лулулемон

- Аукционы: 7-летние банкноты США ($44 млрд)

- Другие: Долгосрочный прогноз бюджета США: 2025-2055 годы

Пятница 28 марта

- ДанныеСША Февраль PCE, личные доходы, личные расходы, Март Канзас-Сити Федрезерв услуг, Великобритания Февраль розничные продажи, январь торговый баланс, Q4 баланс текущего счета, Германия Апрель GfK доверие потребителей, мартовский уровень требований к безработице, Франция Мартовский ИПЦ, ИПЦ, февральские потребительские расходы, Италия Мартовский индекс доверия потребителей, доверие к производству, экономические настроения, январь промышленные продажи, февральский ИПЦ, Еврозона Мартовское экономическое доверие, Канада Январь ВВП

- Центральные банки: Барр и Бостик из ФРС говорят, ЕЦБ Февральский опрос потребителей

Наконец, глядя только на США, основные экономические данные на этой неделе Базовая инфляция PCE и отчет Мичиганского университета в пятницу. На этой неделе чиновники ФРС провели несколько выступлений, в том числе мероприятие с губернатором Барром в понедельник.

понедельник, 24 марта

- 09:45 утра S&P Global US manufacturing PMI, March preliminary (консенсус 51.8, last 52.7); S&P Global US Services PMI, March preliminary (консенсус 51,2, last 51,0)

- 01:45 PM Президент ФРБ Атланты Бостик (FOMC non-voter) говорит: Президент ФРБ Атланты Рафаэль Бостик даст интервью Bloomberg Television.

- 03:10 PM Федеральный губернатор Барр говорит: Губернатор ФРС Майкл Барр выступит в умеренной дискуссии на мероприятии, организованном Институтом Аспена.

Вторник, 25 марта

- 09:00 утра S&P Case-Shiller 20-городской индекс цен на жилье, январь (GS +0,6%, консенсус +0,4%, +0,5%)

- 09:00 утра Индекс цен на жилье FHFA, январь (консенсус +0,3%, последний +0,4%)

- 09:05 утра Президент ФРБ Нью-Йорка Уильямс (избиратель FOMC) говорит: Президент ФРС Нью-Йорка Джон Уильямс выступит с вступительным словом на конференции в ФРС Нью-Йорка. Ожидается речевой текст. 4 марта Уильямс сказал: Я думаю, что нынешняя политическая позиция хороша. Я не вижу необходимости менять его сразу». «Экономика США начинается в очень хорошем месте — безработица составляет 4%, рынок труда стабилизировался, инфляция составляет 2,5% и постепенно снижается к нашей цели в 2%», — сказал он. "

- 10:00 Новые продажи жилья, февраль (GS +2,2%, консенсус +3,5%, последние -10,5%)

- 10:00 Доверие потребителей Conference Board, март (GS 93.0, консенсус 93.6, последние 98.3)

Среда, 26 марта

- 08:30 утра Заказы на товары длительного пользования, февраль предварительный (GS -2,0%, консенсус -1,0%, последний +3,2%); Заказы на товары длительного пользования экс-транспорт, февраль предварительный (GS -0,2%, консенсус +0,2%, последний фиксированный); Основные заказы на капитальные товары, февраль предварительный (GS -0,2%, консенсус плоский, последний +0,8%); Основные поставки капитальных товаров, февраль предварительный (GS +0,4%, консенсус +0,2%, последний -0,3%): По нашим оценкам, заказы на товары длительного пользования снизились на 2,0% в предварительном февральском отчете (месяц за месяцем, с учетом сезонной корректировки), что отражает снижение заказов на коммерческие самолеты. Мы прогнозируем снижение заказов на основные капитальные товары на 0,2%, что отражает резкое снижение новых заказов в феврале и увеличение поставок основных капитальных товаров на 0,4%, что отражает рост основных заказов в последние месяцы.

- 10:00 Президент ФРБ Миннеаполиса Кашкари (FOMC non-voter) говорит: Президент ФРС Миннеаполиса Нил Кашкари проведет мероприятие Fed Listens в Детройт-Лейкс, штат Мичиган. Ожидается Q&A.

- 01:10 PM Президент ФРБ Сент-Луиса Мусалем (избиратель FOMC) говорит: Президент ФРБ Сент-Луиса Альберто Мусалем выступит с речью об экономике и денежно-кредитной политике США, за которой последует умеренный разговор. Ожидается речевой текст. 3 марта Мусалем сказал: Я верю, что терпеливый подход теперь поможет нам, поскольку мы стремимся к максимальной занятости, ценовой стабильности и прочной экономической экспансии. "

Четверг, 27 марта

- 08:30 ВВП AM, третий выпуск Q4 (GS +2,3%, консенсус +2,4%, последний +2,3%); личное потребление, третий выпуск Q4 (GS +4,2%, консенсус +4,2%, последний +3,7%); базовая инфляция PCE, третий выпуск Q4 (GS +2,65%, консенсус +2,7%, последний +2,7%): Мы оцениваем отсутствие пересмотра чистого роста ВВП к 4 кварталу на уровне +2,3% (в годовом исчислении за квартал), что отражает пересмотр в сторону снижения инвестиций в основной капитал для бизнеса и жилых помещений, компенсированный пересмотром в сторону повышения роста экспорта.

- 08:30 утра Предварительный торговый баланс товаров, февраль (GS - $140,0 млрд, консенсус - $134,5 млрд, последний - $155,6 млрд): Мы оцениваем, что дефицит торговли товарами сократился на 15,6 млрд долларов до 140,0 млрд долларов в февральском предварительном отчете, что отражает снижение импорта золота на 10 млрд долларов и увеличение общего импорта на 8 млрд долларов от основных азиатских торговых партнеров.

- 08:30 утра Первоначальные заявления о безработице, неделя закончилась 22 марта (GS 220k, консенсус 225k, последние 223k): Неделя, закончившаяся 15 марта (консенсус 1879k, последние 1892k)

- 10:00 Оптовые запасы, февраль предварительный (консенсус +1,0%, последний +0,8%)

- 10:00 До продажи жилья, февраль (GS -2,0%, консенсус +1,0%, последний -4,6%)

- 04:30 вечера Президент ФРС Ричмонда Баркин (FOMC non-voter) говорит: Президент ФРС Ричмонда Том Баркин прочитает лекцию в Университете Вашингтона и Ли. Ожидается речевой текст и Q&A. 25 февраля Баркин сказал: Вся эта неопределенность требует осторожности, поскольку мы стремимся завершить борьбу с инфляцией. Если встречные ветры сохранятся, нам, возможно, придется использовать политику, чтобы опереться на этот ветер. "

Пятница, 28 марта

- 08:30 утра Личный доход, февраль (GS +0,3%, консенсус +0,4%, последний +0,9%); Личные расходы, февраль (GS +0,5%, консенсус +0,5%, последний -0,2%); Индекс цен Core PCE, февраль (GS +0,34%, консенсус +0,3%, последний +0,2%); Индекс цен Core PCE (YoY), февраль (GS +2,75%, консенсус +2,7%, последний +2,6%); Индекс цен PCE, февраль (GS +0,30%, консенсус +0,3%, последний +0,3%); Индекс цен PCE (YoY), февраль (GS +2,50%, консенсус +2,5%, последний +2,5%): По нашим оценкам, в феврале доходы и личные расходы выросли на 0,3% и 0,5% соответственно. По нашим оценкам, базовый индекс цен PCE в феврале вырос на 0,34%, что соответствует годовому уровню в 2,75%. Кроме того, мы ожидаем, что индекс цен PCE вырос на 0,3% по сравнению с предыдущим месяцем, что соответствует годовому уровню в 2,50%. Наш прогноз согласуется с увеличением на 0,20% нашего показателя PCE (против 0,18% в январе).

- 10:00 Потребительские настроения Мичиганского университета, март предварительный (GS 57.9, консенсус 57.9, последний 57.9): Мичиганский университет 5-10-летние инфляционные ожидания, март предварительный (GS 3,8%, последние 3,9%)

- 03:30 вечера Президент ФРБ Атланты Бостик (FOMC non-voter) говорит: Президент ФРС Атланты Рафаэль Бостик будет модерировать панель по политике финансирования жилищного строительства США на мероприятии в ФРС Атланты.

Источник: DB, Goldman

Тайлер Дерден

Мон, 03/24/2025 - 09:30