Бум дата-центров может превратиться в долгосрочный риск глюта, предупреждает Goldman

В записке для клиентов в начале этой недели аналитик Goldman Виней Висванатан представил обновленную информацию о том, что происходит в мире. Рынок секьюритизации дата-центров США для своих клиентов. Он отметил, что рынок, движимый массовыми инвестициями в объекты, оснащенные тысячами графических процессоров, которые питают большие языковые модели. На пути к рекорду в этом году. Тем не менее, аналитики предупреждают, что они по-прежнему остаются незамеченными.Осторожность в отношении долгосрочного баланса спроса и предложенияНесмотря на то, что «краткосрочные зеленые побеги для сектора центров обработки данных"

Висванатан отметил, что «Ближайший импульс рынка» на рынке секьюритизации Для активов ЦОД из-за трех основных факторов:

Облачный Capex SurgeКрупные гипермасштаберы (AWS, Microsoft, Google, Meta, Oracle) увеличили прогноз капитальных расходов в 1 квартале 2025 года, сигнализируя о сильном спросе на облачные сервисы ИИ.

Жесткая поставкаПервичная вакансия в центрах обработки данных в Северной Америке достигла рекордно низкого уровня (1,9% в конце 2024 года), причем 72% новых мощностей уже были предварительно выпущены.

Поддержка политики: Инициатива администрации Трампа «Звездные врата» сигнализирует о генеративной инфраструктуре ИИ в качестве федерального приоритета, что еще больше стимулирует инвестиции частного сектора.

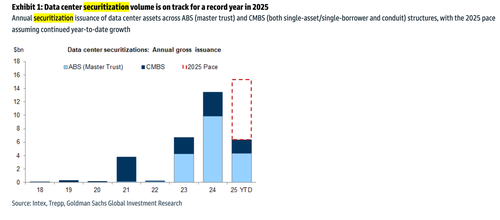

«Секьюритизация стала стабильным и масштабируемым источником финансирования для капиталоемкого сектора цифровой инфраструктуры», — сказал аналитик. Он отметил, что размер рынка секьюритизации ЦОД имеет Взрыв составил от 5 до 30 миллиардов долларов через структуры ABS (ценные бумаги, обеспеченные активами) и CMBS (коммерческие ценные бумаги, обеспеченные ипотекой).

В начале года рост в Рынок секьюритизации для центров обработки данных застопорился из-за опасений по поводу спроса на центры обработки данных в связи с повышением эффективности ИИ (напомним момент «глубокого поиска») и нарастанием тарифной неопределенности..

Однако, Цены и выпуск резко вырослиВернуть секьюритизацию центров обработки данных на пути к достижению новых максимумов к концу года, потенциально.

Трубопровод агрессивных построений гипермасштаберами.

С этим Транспортный трубопровод ускоряется Из-за мега-проектов, таких как Stargate, Висванатан предупредил:

Несмотря на краткосрочные зеленые побеги для сектора центров обработки данных, Мы сохраняем осторожность в отношении долгосрочного баланса спроса и предложения.. Наши коллеги по исследованиям справедливости ожидают, что рынок центров обработки данных достичь пика занятости к середине следующего годапостепенно ослабевает в ближайшие годы.

Два ключевых гонщика оправдывают точку зрения Висванатана:

ПервыйРастущий трубопровод запланированных центров обработки данных приведет к неуклонному увеличению количества завершенных работ, а проект «Звездные врата» будет способствовать еще большему увеличению поставок в будущем.

ВторойЭтот уровень роста предложения поставит высокую планку для роста спроса на рабочую нагрузку ИИ, чтобы сохранить заполняемость в течение следующих двух лет.

Аналитик добавил:

Если вторая производная спроса на ИИ окажется отрицательнойЭто может повлиять на рост арендной платы и ставки продления аренды. Это было бы особенно вредно для успеха переиздания сильно настроенных активов центров обработки данных, которые, естественно, имеют повышенный риск устаревания.

Ясно, что появились зеленые побеги, и строительство инфраструктуры ИИ в настоящее время полностью продолжается, вероятно, будет продолжаться в течение многих лет.

По словам аналитика UBS Стивена Фишера, ожидается, что структурные попутные ветры, стимулирующие расширение центра обработки данных, начнут проникать в реальную экономику во втором квартале 2026 года.

Как говорит Висванатан, Бум дата-центров не будет длиться вечно. Рано или поздно маятник перейдет от дефицита к профициту, и тогда партия закончится. До тех пор продолжайте веселиться. Не забывайте: каждая вечеринка заканчивается.

Тайлер Дерден

Thu, 06/12/2025 - 18:30

![Кремлевская пропаганда, пребывая в ступоре после разворота Трампа, использует «двойников» Путина [GOWORIT MOSKWA]](https://cdn.oko.press/cdn-cgi/image/trim=35;0;43;0,width=1200,quality=75/https://cdn.oko.press/2025/07/Goworit-Moskwa-Trump.jpg)