DeepSeek вытащил коврик на Nvidia и ASML

Сегодня утром в умах трейдеров есть только одна тема, которая угрожает перевернуть многолетнюю бычью тенденцию ИИ, приводящую акции чипов к рекордным максимумам: Китайский DeepSeek Реакция на ChatGPT OpenAI, как отмечено в статье под названием Голдман спрашивает, является ли китайский DeepSeek моментом спутника ИИ. "

Марк Кадмор из Bloomberg ранее сказал, что появление DeepSeek является потрясающей новостью для глобального роста и производительности. Однако он предупредил, что новая модель с открытым исходным кодом для большого языка подрывает огромную премию, выплачиваемую за исследования и разработки ИИ Американские акции с мегакапсулой предупреждают, что это может послужить катализатором для прекращения 15-летней исключительности фондового рынка США.

Возможно, Пин, который лопает пузырь акций AI в США. Если да, то смотрите ниже...

Deepseek лучше не быть настоящей сделкой pic.twitter.com/qv6vtINl2d

— zerohedge (@zerohedge) 26 января 2025 г.

Обсуждение DeepSeek Задаваемые вопросы О десятках миллиардов денег, которые крупные технологические фирмы потратили на модели ИИ и центры обработки данных, а также на более широкие тенденции модернизации стареющих электросетей.

В результате дизайнер чипов Nvidia падает 12% на предпродажных торгах в Нью-Йорке, в то время как нидерландские компании по производству чипов ASML и ASM International обвалились 10% и 15% соответственно. В Азии японские акции, связанные с чипами, торговались ниже.

Биткойн был забит ниже.

Для аналитиков Уолл-стрит развитие событий вызывает серьезные вопросы. Повышенная оценка акций, связанных с ИИ Бизнес-модель Силиконовой долины для масштабных исследований.

""Это ставит много внимания на уровне оценок.Бенедикт Лоу, стратег по деривативам на BNP Paribas Markets 360, сказал: Мы довольно позитивно относимся к технологическому сектору США. Но это ставит Давление на перспективы Это поворотный момент для компаний на данном этапе цикла. "

Аналитики Jefferies рассказали клиентам:Сразу же появились опасения что это может быть а Разрушитель текущей бизнес-модели ИИкоторый опирается на высокопроизводительные чипы и обширная вычислительная мощность и, следовательно, энергия"

Джереми из Goldman Элстер предложил свой взгляд на DeepSeek и реакцию рынка:

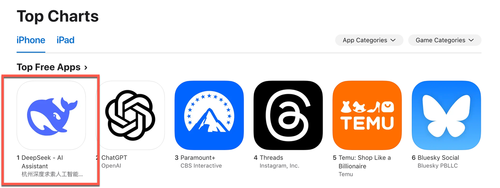

Только одна тема, чтобы начать неделю, угрожая подорвать большую часть повествования, приводящего к промышленному производству и ограничению товаров. DeepSeek.. Сегодня утром я отложусь на задний план Приво: то, что делает DeepSeek важным, не обязательно связано с тем, что он китайский или быстро поднялся до одной из самых популярных загрузок в Apple App Store. фундаментальный прогресс в эффективности технологии ИИ. По многим сложным причинам это в основном огромное повышение эффективности вывода. Некоторые Измерения в 40-50 раз эффективнее других моделей. Если вы можете Делать больше с меньшими затратами, естественно, приводит к вопросу о том, нужно ли вам столько возможностей....(примечание) => В промышленных товарах / изделиях с колпачком реакции сегодня утром в основном относятся к разновидностям «стрелять первым» по отношению к капексу, а силовое оборудование играет в соответствующих и смежных вертикалях. GSXEACDC -6%, что неудивительно, наиболее подвержено влиянию (наиболее подвержено воздействию SU в центре обработки данных, см. полный список экспозиций в пятнице здесь: ссылка). Также наблюдается заражение в полушарии (Atlas Copco, VAT Group).

В отдельной заметке Goldman аналитик Франсуа Тейс изложил реакцию DeepSeek Азиатская экосистема ИИ в режиме полной прибыли (GS Japan AI -3,08%, GS Asia Power Grid -3,3%) и Nasdaq значительно снизились до рынка. "

Тейс указал на одно ключевое значение развития DeepSeek:Прежде всего, речь идет о возврате инвестиций и эффективности Capex (и, следовательно, о бенефициарах в цепочке поставок и энергетических потребностях). "

Вопросы и ответы о DeepSeek (документ Bloomberg):

Как DeepSeek R1 сравнивается с OpenAI или Meta AI?

Стоимость обучения и разработки моделей DeepSeek, по-видимому, составляет лишь часть того, что требуется для лучших продуктов OpenAI или Meta Platforms Inc. Гораздо более высокая эффективность модели ставит под сомнение необходимость огромных затрат капитала на приобретение новейших и самых мощных ускорителей ИИ от таких компаний, как Nvidia Corp. Это также усиливает внимание к экспортным ограничениям США таких передовых полупроводников в Китай, которые были предназначены для предотвращения прорыва, который, по-видимому, представляет DeepSeek. DeepSeek говорит, что R1 близка или лучше, чем конкурирующие модели в нескольких ведущих тестах, таких как AIME 2024 для математических задач, MMLU для общих знаний и AlpacaEval 2.0 для производительности вопросов и ответов. Он также входит в число лучших исполнителей в доске лидеров UC Berkeley под названием Chatbot Arena.

Что вызывает тревогу в США?

Вашингтон запретил экспорт в Китай высококачественных технологий, таких как полупроводники GPU, в попытке затормозить достижения страны в области искусственного интеллекта, ключевого рубежа в американо-китайском конкурсе на технологическое превосходство. Но прогресс DeepSeek предполагает Китайские инженеры по искусственному интеллекту работали над ограничениями, сосредоточившись на большей эффективности с ограниченными ресурсами. Хотя остается неясным, насколько передовое оборудование для обучения ИИ DeepSeek имело доступ к нему, компания продемонстрировала достаточно, чтобы предположить, что торговые ограничения не были полностью эффективными в сдерживании прогресса Китая.

Еще одна причина для беспокойства.

Срини Паджджури, аналитик по полупроводникам в Raymond James, сказал клиентам: DeepSeek явно не имеет доступа к такому количеству вычислений, как американские гипермасштаберы. Как-то удалось разработать модель, которая выглядит высококонкурентной."

Вот наш последний отчет о DeepSeek:

Китайский DeepSeek AI перенес столицу технологий из Пало-Альто в Ханчжоу

Китайская бомба DeepSeek раскачивает AI Boondoggle за 500 миллиардов долларов

Goldman спросил, является ли DeepSeek в Китае моментом Sputnik

Вся глобальная экосистема ИИ будет в режиме получения прибыли в понедельник утром.

Тайлер Дерден

Мон, 01/27/2025 - 07:20