Фьючерсы восстановились на оптимизме торговых сделок, золото достигло еще одного рекорда

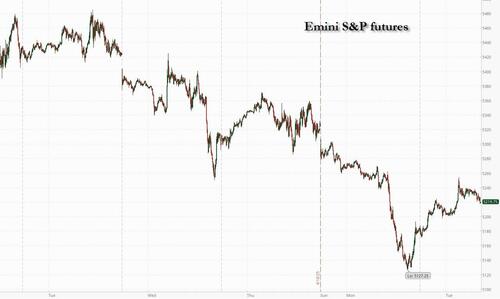

Фьючерсы на акции США выше, пытаясь смягчить некоторые из резких потерь от предыдущей сессии в понедельник и продлить вчерашнюю покупку, где S&P нашла поддержку на уровне 5100. Существует некоторый оптимизм в отношении торговой сделки с Японией или Индией, и сделка является вероятной вехой для того, чтобы акции наконец достигли дна.. По состоянию на 8:00 ET, фьючерсы S & P и Nasdaq выросли на 0,8%, максимумы сеанса - на 1,3%, а Mag 7 и Semis - все выше с прибылью TSLA после закрытия. На этой неделе 25% отчетов S&P Подразумеваются тома среди самых высоких со времен пика-COVID. Китайские технологические компании, как сообщается, рассматривают листинги в США, несмотря на «рыночные проблемы», сообщает Bloomberg со ссылкой на источники; Walnut Coding, CloudSky, Zaihui & Zhonghe заявили, что рассматривают возможность IPO в США. Кривая доходности становится все более плоской, и доллар США видит ставку после 4 дней потерь. Товарное пространство в основном выше во главе с Энергией, но золото остается главной историей, поскольку оно установило новый ATH, поднявшийся выше 3500 долларов, прежде чем ослабнуть. Макроданные сосредоточены на региональных показателях активности ФРС (Philly non-mfg и Richmond Fed в 8:30 утра / 10:00 утра по восточному времени), но более эффективными данными являются завтрашние печати Flash PMI. Мы также получаем множество спикеров ФРС (см. ниже) наряду с многочисленными доходами в тяжелом весе, включая Tesla.

В дорыночной торговле акции Magnificent 7 растут (Tesla +0,7%, Alphabet +0,7%, Nvidia +0,92%, Amazon +0,99%, Apple +0,82%, Microsoft +0,7%, Meta +0,6%). Запасы солнечной энергии растут после того, как США установили новые пошлины в размере 3,521% на импорт солнечной энергии из четырех стран Юго-Восточной Азии (First Solar +5,8%, Sunnova Energy +1,2%, SolarEdge Technologies +3%, Array Technologies +1,9%, Enphase Energy +2,3%). 3M (MMM) поднимается на 3% после того, как компания поддержала свое годовое финансовое руководство, признавая новые риски от разворачивающейся торговой войны. Вот некоторые другие известные премаркеты:

- Аппиан (APPN) вырос на 2% после найма Срджана Танджги в качестве финансового директора. Танджа покидает MongoDB, чтобы взяться за работу.

- Calix (CALX) взлетел на 14% после того, как компания, предоставляющая компьютерные услуги, сообщила о квартальных результатах, которые превзошли ожидания, и предоставила прогноз, который выше консенсусной оценки аналитика.

- CoreWeave (CRWV) растет на 2%, поскольку Jefferies и Barclays инициируют компанию по разработке программного обеспечения с избыточным весом, ссылаясь на надежность вычислений ИИ и преимущество первого двигателя.

- Danaher (DHR) поднялся на 3% после того, как компания Life-sciences сообщила о квартальной прибыли, которая превзошла оценки.

- Halliburton (HAL) упал на 4% после того, как компания, предоставляющая энергетические и инженерные услуги, сообщила о скорректированной прибыли на акцию и выручке за первый квартал, которая упала год к году.

- Kimberly-Clark (KMB) упала на 2% после того, как компания сообщила о квартальных органических продажах, которые разочаровали, и заявила, что компания столкнется с дополнительными расходами в размере около 300 миллионов долларов в 2025 году из-за тарифов.

- Northrop Grumman (NOC) упал на 8% после того, как оборонный подрядчик сократил скорректированную прибыль на акцию за весь год.

- StoneCo (STNE) растет на 3%, поскольку Citi модернизирует финтех, чтобы купить его на пути к тому, чтобы стать небольшим банком от платежной фирмы.

- Synchrony Financial (SYF) выросла на 3% после того, как компания подтвердила свой прогноз чистой прибыли на весь год.

- Verizon Communications Inc. (VZ) снизилась на 3% после публикации более крупного, чем ожидалось, снижения числа абонентов мобильных телефонов в первом квартале, что стало результатом сильной конкуренции и меньших расходов государственных учреждений.

- Zions Bancorp (ZION) упал на 3,8% после того, как прибыль в первом квартале не попала в среднюю оценку аналитиков. Аналитики отмечают, что текущая экономическая неопределенность влияет на перспективы компании.

В то время как фьючерсы на S&P привели к увеличению контрактов на 0,9%, разговор на Уолл-стрит по-прежнему сосредоточен на последствиях любых усилий Белого дома по замене Пауэлла. Опасения, что Трамп, возможно, готовится уволить Пауэлла, добавили беспокойства для трейдеров, уже борющихся с беспорядками, вызванными тарифным натиском президента. Политика Трампа и его сторонники против ФРС заставили переоценить доллар и казначейские облигации как убежища во времена стресса, хотя коллапс доллара был таким же большим, как и когда ФРС запустила QE, поэтому, если Пауэлл не ослабнет, Трамп получит удар по доллару другими способами.

«Учитывая растущую риторику со стороны администрации, призывающей ФРС снизить ставки, и рынки, вызывающие активные дискуссии о возможности замены председателя ФРС, мы не ожидаем спешки на рынок из-за рубежа», - сказал Джон Велис, стратег Bank of New York Mellon. «Статус убежища таких активов все больше ставится под сомнение. "

Внимание во вторник переключится на Tesla, которая сообщает о доходах в первом квартале после закрытия рынка; ее акции упали примерно на 44% в этом году, поскольку массовое ралли после элецитона полностью распалось. Роль Илона Маска в федеральном правительстве способствовала глобальному спаду продаж.

В Европе индекс Stoxx 600 упал, когда трейдеры вернулись с пасхального перерыва. Novo Nordisk A/S упала почти на 10% из-за опасений, что она столкнется с более жесткой конкуренцией со стороны экспериментальной таблетки для похудения Eli Lilly & Co. А вот и самые популярные во вторник:

- Драгоценные металлы и запасы полезных ископаемых растут, поскольку опасения по поводу экономики США и критика президента Дональда Трампа Федеральной резервной системы отправили золото на рекордную сумму выше 3500 долларов за унцию.

- Акции L’Oreal выросли на 2,6% после того, как рост продаж превзошел ожидания. Аналитики указали на высокие показатели на китайском рынке косметической компании

- Акции Pernod Ricard выросли на 3% после обновления Barclays, и аналитики утверждают, что риск растет, особенно на ключевом китайском рынке роста компании.

- ОВХ Акции Groupe выросли на 11%, достигнув самого высокого уровня за последние два года после обновления аналитиками Stifel, которые утверждают, что компания облачных вычислений не сталкивается с четкими встречными ветрами.

- Прирост биотажа составил 58% после того, как частная инвестиционная компания KKRa сделала частное предложение для шведской группы по наукам о жизни на 11,6 млрд крон ($1,2 млрд), что на 60% больше, чем на прошлой неделе.

- Акции Novo Nordisk упали на 9,8% в первый день торгов со среды после публикации сильных данных от конкурирующей таблетки от ожирения, разработанной американским коллегой Эли Лилли.

- Orsted упал на 9,6% после понижения до неэффективных показателей в Bank of America. Брокер ссылается на всплеск регуляторной неопределенности США в отношении оффшорных проектов датской ветроэнергетической компании.

- Акции Equinor упали на 3,1% после того, как РБК понизил акции до неэффективных, а норвежская энергетическая группа приостановила строительство своей оффшорной ветряной электростанции Empire Wind в США.

- Акции DCC упали на 1,5%, отказавшись от первоначальной прибыли после того, как согласились продать свое подразделение здравоохранения фондам, рекомендованным Investindustrial Advisors, на сумму 1,05 млрд фунтов стерлингов.

- Во вторник Aryzta упала на 4,9%, достигнув шести прямых ежедневных приростов, которые на прошлой неделе привели к тому, что акции достигли самого высокого уровня с октября 2018 года, после отчетности о результатах первого квартала.

Ранее на сессии азиатские акции были стабильными, поскольку трейдеры ожидают результатов тарифных переговоров США с ключевыми торговыми партнерами, в то время как новые опасения по поводу независимости ФРС также сдерживали настроения. Индекс MSCI Asia Pacific Index колебался в узком диапазоне. Рейтинг Тайваня упал более чем на 1%, в то время как Индонезия и Сингапур лидировали. Ключевые показатели в Гонконге выросли, в то время как в Австралии мало что изменилось, поскольку торговля возобновилась после четырехдневных выходных. Азиатские акции в целом хорошо сохранились по сравнению с большими потерями в Нью-Йорке, и наблюдатели рынка все чаще обсуждают ослабление доминирования торговли США.

В валютах индекс Bloomberg Dollar Spot мало изменился. Иена является самой эффективной валютой G-10, увеличившись на 0,3% по отношению к доллару США, хотя и не смогла выдержать более ранний перерыв после 140. «Волатильность рынка, хотя и приводит к некоторому притоку гавани в иену», - сказал Шоки Омори, главный стратег стола в Mizuho Securities Co. в Токио. «Доклады Банка Японии показывают, что нет необходимости менять свою позицию в отношении повышения ставок, что также способствует настроениям в валюте, в то же время ослабляя доллар. "

В ставках казначейские облигации смешиваются с низкими показателями, наблюдаемыми в более короткие сроки погашения, что повышает доходность США за два года до 3,79%, в то время как теноры с длинными датами имеют узкие диапазоны, сглаживая кривую 2s10s почти на 4bp, 5s30s более чем на 2bp. Немецкая доходность падает поперек кривой с двухлетними затратами по займам, достигающими самого низкого уровня с 2022 года. Кривая позолоты закручивается с расширением 2s10 почти на 5bps. Аукционный цикл Казначейства начинается с $69 млрд в 2 года в 1 вечера по нью-йоркскому времени и включает в себя $70 млрд в 5 лет и $44 млрд в 7 лет продаж в среду и четверг. Доходность WI за 2 года около 3,78% примерно на 11 л.с. богаче, чем мартовский аукцион, который остановился на 0,3 л.с.

В сырьевых товарах цены на нефть выросли, а WTI выросла на 1,4% до $64 за баррель. Биткоин вырос на 1,3% и выше $88,000. Спотовое золото ранее впервые достигло 3500 долларов, прежде чем сравнять прибыль с 3460 долларами.

Глядя на сегодняшний календарь, мы получаем апрельский индекс непроизводственной активности ФРС Филадельфии (8:30 утра) и индекс производства ФРС Ричмонда (10 утра). В список спикеров ФРС входят Джефферсон (9 утра), Харкер (9:30 утра), Кашкари (1:40 вечера), Баркин (2:30 вечера) и Куглер (6 вечера).

Рыночный снимок

- S&P 500 mini +1%

- Nasdaq 100 mini +1%

- Russell 2000 mini +1%

- Stoxx Europe 600 - 0,3%

- DAX -0,2%

- CAC 40 -0,4%

- 10-летний Доходность казначейства +1 базисный пункт 4,42%

- VIX-1,7 баллов в 32,17

- Индекс доллара Bloomberg незначительно изменился на 1216,69

- евро -0,1%, $1,1498

- Сырая нефть WTI +1,5% при $64,05/баррель

- Лучшие ночные новости

- Администрация Трампа намерена оказать давление на Индию, чтобы предоставить онлайн-ритейлерам, таким как Amazon и Walmart, полный доступ к своему рынку электронной коммерции стоимостью 125 миллиардов долларов в рамках торговой сделки, которая обсуждается под угрозой повышения тарифов. FT

- Переговоры между США и Таиландом по поводу тарифных планов администрации Трампа были отложены после того, как Вашингтон попросил страну Юго-Восточной Азии решить «вопросы», связанные с торговлей. BBG

- Тимираос из WSJ пишет: «Трамп закладывает основу, чтобы обвинить Пауэлла в любом спаде» и сигнализирует, что он обвинит ФРС в любой экономической слабости, вызванной его торговой войной, если она не снизит ставки в ближайшее время.

- Комиссия по ценным бумагам и биржам США объявила, что Пол Аткинс приведен к присяге в качестве председателя

- Старший республиканец Палаты представителей Фрэнк Лукас защищает Пауэлла и независимость ФРС на фоне атак Трампа. Аксиос

- Данные показали, что китайская торговля удерживалась в апреле, несмотря на тарифы Трампа, поскольку Трамп пощадил многие электронные устройства и приостановил сборы против большинства стран. BBG

- По данным таможенных служб, ограничения Китая на поставки критических металлов в США уже оказывают заметное влияние, при этом экспорт полезных ископаемых падает, а поставки нескольких критических предметов полностью прекращаются в марте. SCMP

- Японская делегация на этой неделе доставит письмо премьер-министра Сигеру Исиба Си Цзиньпину, поскольку Токио стремится избежать перекрестного огня между Китаем и США. BBG

- Когда министр финансов Японии Кацунобу Като встретится со своим американским коллегой Скоттом Бессентом в Вашингтоне на этой неделе, иена станет главной темой обсуждения, хотя источники говорят, что Токио будет сопротивляться любой просьбе о повышении своей валюты. РТС

- Меган Грин из Банка Англии заявила, что тарифы США могут быть скорее дезинфляционным риском для Великобритании, чем инфляционным. BBG

- Премьер-министр Индии Нарендра Моди и вице-президент США Джей Ди Вэнс в понедельник приветствовали «значительный» прогресс, достигнутый в торговых переговорах между двумя сторонами во время визита Вэнса в Индию. CNBC

Тарифы/торговля

- Министерство торговли США утвердило демпинговые пошлины в размере от 6,1% до 271,28% на солнечные батареи, импортируемые из Камбоджи, Малайзии, Таиланда и Вьетнама.

- Заявление торгового представителя США подтвердило, что USTR Greer и Министерство торговли и промышленности Индии завершили разработку «дорожной карты» для переговоров по взаимной торговле и заявили, что конструктивное взаимодействие Индии до сих пор приветствуется.

- Исполняющий обязанности президента Южной Кореи Хан сказал, что ожидает, что торговые переговоры между Южной Кореей и США на этой неделе проложат путь к взаимовыгодному решению.

- Reuters сообщает, что «Япония видит мало возможностей для грандиозной сделки по иене в переговорах с США» на встрече министров финансов в Вашингтоне на этой неделе. Источники сообщают, что Япония будет сопротивляться любой просьбе о повышении своей валюты. Япония, как сообщается, видит мало возможностей для прямых действий, т.е. валютного вмешательства или немедленного повышения BoJ. Встреча, скорее всего, будет сосредоточена на получении дальнейшего понимания намерений Вашингтона.

Более подробный взгляд на мировые рынки любезно предоставлен Newquawk

Акции APAC торговались в сочетании с большинством индексов, несмотря на распродажу на Уолл-Стрит, где акции и доллар находились под давлением после того, как президент Трамп возобновил свою критику в адрес председателя ФРС Пауэлла. ASX 200 мало изменился, поскольку рост запасов и производителей золота был компенсирован потерями в технологиях, энергетике и здравоохранении, в то время как ценовым действиям также мешало отсутствие каких-либо ключевых данных. Nikkei 225 боролся за направление и колебался между прибылью и убытками в относительно сдержанных параметрах на фоне неповоротливой валюты и немного более высокой японской доходности. Hang Seng и Shanghai Comp соответствовали смешанной картине с бенчмарком Гонконга, на который незначительно оказывалось давление по возвращении с пасхальных выходных, в то время как материк оставался на плаву на фоне доходов и положительных обновлений, связанных с электромобилями.

Лучшие азиатские новости

- Министр финансов Японии Като заявил, что финансовые власти должны попросить банки помочь поддержать финансирование небольших компаний, пострадавших от тарифов США, в то время как он организует встречу с министром финансов США Бессентом и планирует обсудить вопросы форекс.

- Глава Японской федерации бизнеса Кейданрен Токура говорит, что хочет, чтобы FX стабилизировалась как можно больше; быстрые колебания валютных курсов нежелательны для экономики, в ответ на вопрос о движении USD / JPY ниже 140,00.

Европейские биржи (STOXX 600 -0,6%) открылись в основном и незначительно ниже и торговались боком в течение всего утра. Настроения в Европе сегодня довольно мрачные, играя в догонялки к огромным потерям, наблюдаемым в США в понедельник (напоминание: Европа была закрыта из-за Пасхального понедельника). Европейские секторы придерживаются негативного уклона, вписываясь в тон риска. Недвижимость занимает первое место, получая выгоду от относительно низкой доходности (в Европе). Страхование следует за ними, и Helvetia и Baloise подскочили примерно на 4% после того, как пара объявила о слиянии равных, чтобы сформировать ведущую европейскую страховую группу. Здравоохранение было отягощено сегодня значительным давлением в Ново Нордиске (-8%), пострадавшем, поскольку трейдеры переваривают последние обновления таблеток от ожирения от конкурента Эли Лилли.

Лучшие европейские новости

- Грин из BoE говорит, что рыночные цены на снижение ставок BoE сильно изменились, но не все это связано с Великобританией. Осознайте рост инфляционных ожиданий, но риски для обеих сторон. Тарифы США представляют собой скорее дезинфляционный риск, чем инфляционный для Великобритании. Рост заработной платы остается «довольно высоким», исследование рабочей силы было нестабильным и имело свои собственные проблемы сбора.

- ЕЦБ Опрос профессиональных прогнозистов; прогнозы инфляции на 2025 и 2026 годы выросли, рост снизился.

- Правительство Германии снизило прогнозы роста до 0,0% на 2025 год и ~1% на 2026 год (Включая базовый тариф США в десять процентов, а также на сталь, алюминий и автомобили), по словам Олка из Handelsblatt.

Форекс

- DXY плоский с долларом США, показывающим различную производительность против сверстников (более сильный против EUR и CHF, более слабый против JPY). Понедельник был знаменательным днем для доллара США после очередного всплеска со стороны президента США Трампа, пытающегося укрепить позиции председателя ФРС Пауэлла в снижении ставок и спекуляциях по поводу того, будет ли он пытаться удалить его до истечения срока его полномочий в следующем году. Сегодняшний календарь не содержит данных по США, но в динамиках с Джефферсоном, Харкером, Кашкари, Куглером и Баркином все должно быть на палубе.

- EUR/USD Это немного ниже, но держится выше 1,15 после того, как ранняя покупка доллара сбила пару с ее ночного пика на 1,1547. Это произошло после того, как пара достигла многолетнего максимума в понедельник на уровне 1,1574. Что касается торговли, то с тех пор, как на прошлой неделе сообщалось, что ЕС ожидает, что тарифы останутся, учитывая отсутствие прогресса в торговых дискуссиях. Несмотря на сегодняшнюю отсрочку для доллара, Евро остается ликвидной альтернативой США, если инвесторы будут продолжать избегать американских активов.

- JPY является лидером G10 в качестве валюты США/JPY ненадолго опустились ниже отметки 140 в начале сессии впервые с сентября 2024 года. JPY также поддерживается надеждами на предстоящие переговоры между администрациями США и Японии.. При этом источник Reuters отметил, что Япония будет сопротивляться любому запросу на повышение своей валюты. Это вызвало небольшой подъем в USD/JPY После неспособности выдержать движение ниже 140. С точки зрения политики в Японии, источники предполагают, что Банк Японии, вероятно, сохранит свой сигнал о повышении ставок на своей встрече на следующей неделе, несмотря на тарифные риски Трампа.

- GBP равна доллару США с новостным потоком в Великобритании на светлой стороне. В интервью Bloomberg TV член MPC Грин отметил, что главный вопрос торговой войны заключается в том, будет ли основное влияние на спрос или сторону предложения; будут ли основные факторы на стороне спроса или стороне предложения. Грин добавил, что рост заработной платы остается «довольно высоким», однако исследование рабочей силы было нестабильным и имеет свои собственные проблемы. Вечеринка BoE’s Breeden выйдет позже.

- Антиподы теперь стабильны по отношению к доллару США После первоначального запуска сеанса на передней ноге. Upside был обрезан вместе с подбором в долларах США в тихом новостном потоке. Ночью AUD / USD достиг нового пика YTD на уровне 0,6439, прежде чем вернуться в диапазон 0,6369-0,6437 в понедельник.

- PBoC установил среднюю точку USD/CNY на уровне 7.2074 против exp. 7.2925 (Prev. 7.2055).

Фиксированный доход

- UST по-прежнему переваривают замечания Трампа по поводу председателя ФРС Пауэлла и процентных ставок. Комментарии, которые вызвали заметное повышение в понедельник, поскольку краткосрочная доходность была взвешена перспективой сокращений, в то время как долгосрочная перспектива подхватила перспективу того, что это вызовет больше инфляции. В настоящее время кривая немного ослабляет это действие и немного льстит сегодня, но все еще находится в непосредственной близости от самых крутых точек, наблюдаемых в понедельник, то есть 2s10s около 63bps против диапазона 55-66bps в понедельник. UST более мягкие на сессии, в нижней части диапазона от 110-18 до 110-27+. 2-летний аукцион должен состояться позже, с акцентом на множество спикеров ФРС.

- Скромное двустороннее действие в Бундсе сегодня, с катализаторами света до сих пор. Никакой реакции на последний SPF ЕЦБ, который показал увеличение инфляции и сокращение взглядов респондентов на рост; точка, которая вполне может быть отражена в прогнозах МВФ сегодня днем. Проведение в топ-энде группы 131,46-83 по возвращении с длинных выходных и в то время как Bunds превосходят UST, это только скромно с немецким бенчмарком, по сути, неизменным. Впереди также запланирован аукцион 2027 Schatz с выступлениями Лагард и Узла ЕЦБ.

- Потолки открылись чуть ниже на 30 клещей, прежде чем сравнять по существу весь ход, чтобы напечатать 92,40 максимума, всего пять клещей, стесняющихся закрытия пятницы. Тем не менее, это оказалось недолгим, поскольку эталон находился под постепенным, но заметным давлением и появился на базе 92,02. Грин подчеркнула двусторонние риски для инфляции, хотя некоторое скромное давление в Gilts, до 91,96 прогиба, произошло, поскольку она подчеркнула, что рост заработной платы остается «довольно высоким», и она следит за ростом инфляционных ожиданий.

Жестокий

- Фьючерсы на сырую нефть распространяются на отскок от предыдущего дня, несмотря на европейский отскок в долларах и общий спокойный поток новостей до сих пор. Рабочие места связывают недавние потери в комплексе с неопределенностью тарифов США, неприятием риска от давления Трампа на председателя ФРС и телеграфным прогрессом в отношении ядерных переговоров между США и Ираном. WTI находится в диапазоне $ 62,72-63,43/bbl. Brent аналог в $ 66,54-67,25/bbl параметр.

- Спотовое золото продолжило свое ралли и напечатало новый рекордный максимум в 3500 долларов США за унцию на момент написания статьи, с ростом в желтом металле, чему способствовало недавнее падение доллара в сочетании с продолжающейся неопределенностью в отношении тарифной политики США и геополитики. Добавьте к этому вопрос независимости центрального банка США после того, как президент США Трамп усилил давление на председателя ФРС Пауэлла, чтобы облегчить денежно-кредитную политику. Спотовое золото в настоящее время находится в диапазоне $3,3412.34-3,500.20 / унция.

- В основном более устойчивая торговля базовыми металлами на фоне недавнего падения доллара и устойчивости крупнейшего покупателя красного металла. 3М LME медь находится в $ 9,254.03-9,333.05/т.

Геополитика

- Пресс-секретарь Кремля Песков заявил в понедельник, что комментарии президента России Путина о том, что можно обсудить вопрос не нанесения ударов по гражданским объектам, в том числе на двусторонней основе, он имел в виду переговоры и дискуссии с украинской стороной.

- Министр иностранных дел Ирана посетит Китай 23 апреля, сообщает МИД Китая.

Календарь событий США

- 10:00: Apr Richmond Fed Manufact. Индекс, est. -6.5, prior -4

Центральные банки

- 9:00: Джефферсон из ФРС выступает на саммите по экономической мобильности

- 9:30: Харкер из ФРС выступает на саммите по экономической мобильности

- 1:40 вечера: Кашкари говорит в умеренном обсуждении

- 2:30 вечера: Баркин Федрезерва говорит в Fireside Chat

- 6:00: Куглер из ФРС говорит о передаче денежно-кредитной политики

Джим Рид из DB завершил ночную обертку

Добро пожаловать в Европу, которая наслаждалась долгими пасхальными выходными. В то время как большинство европейских рынков были закрыты в понедельник, основной темой рынка было возобновление давления на активы США, при этом S&P 500 упал на -2,36%, 30 лет назад. Доходность казначейских облигаций выросла на +10,4 б.п. до 4,90%, а доллар упал до нового 3-летнего минимума, в то время как золото увеличило свой прирост YTD более чем на +30%.

Широкая распродажа была вызвана растущими опасениями по поводу независимости ФРС, поскольку президент Трамп стал все более критически относиться к председателю ФРС Пауэллу. Риторика Белого дома первоначально обострилась после ястребиной речи Пауэлла, которая усугубила распродажу рынка в прошлую среду. Но в то время как рынки переварили первоначальный пост президента Трампа о том, что «увольнение Пауэлла не может произойти достаточно быстро» в прошлый четверг относительно хорошо, продолжающаяся критика привела к возобновлению давления на активы США в понедельник. В своем вчерашнем посте президент Трамп предположил, что пришло время для «упреждающих сокращений», утверждая, что «практически нет инфляции» и что экономика рискует замедлиться, если Пауэлл, которого президент Трамп назвал «слишком поздно», не снизит процентные ставки. Этот пост последовал за тем, как директор Национального экономического совета Кевин Хассетт заявил в пятницу, что команда Трампа изучает, может ли он удалить Пауэлла.

В то время как потенциальные риски для независимости ФРС уже вызвали заголовки в последние недели, вчерашние рыночные движения были явным признаком беспокойства инвесторов по этой теме. Пауэлл, срок полномочий которого истекает в мае 2026 года, повторил на прошлой неделе, что независимость ФРС «является вопросом закона», и что «мы не снимаем, кроме как по причине». Другие чиновники ФРС также предостерегли от ограничения независимости центрального банка, в том числе вчерашний президент ФРС Чикаго Гулсби. Обратите внимание, что, хотя председатель ФРС имеет значительное влияние на FOMC, меры денежно-кредитной политики принимаются большинством голосов, поэтому удаление Пауэлла может привести к усилению отпора со стороны других членов против давления на ФРС, чтобы обеспечить более легкую политику. И с последним повышением доходности, обусловленным в основном реальными ставками, а не безубыточными ставками, реакция рынка, возможно, больше связана с более широкими опасениями инвесторов о том, что менее заслуживающая доверия политика США может подорвать непомерную привилегию, которая позволила США иметь высокий двойной дефицит, чем с конкретным риском политического влияния на политику ставок ФРС.

Тарифы также остались в заголовках, а президент Трамп вчера сказал, что «тарифы идут хорошо, все хотят вести переговоры», но с окончательным прогрессом мало. Некоторые позитивные заголовки появились после визита вице-президента США Вэнса в Индию, когда Белый дом рекламировал «значительный прогресс в переговорах». Премьер-министр Японии Исиба сказал: «Если Япония все признает, мы не сможем обеспечить наши национальные интересы» в преддверии ожидаемого второго раунда переговоров с США. Президент Мексики Шейнбаум заявил, что пока нет соглашения с США, и переговоры продолжаются до крайнего срока 3 мая для тарифов на автозапчасти. А ранее в понедельник Министерство торговли Китая предупредило другие страны на переговорах с США о том, что они не будут «достигать соглашения в ущерб интересам Китая», не имея пока никаких признаков существенного взаимодействия между США и Китаем.

На этом фоне индекс S&P 500 (-2,36%) продемонстрировал широкое снижение в понедельник, когда все 24 отраслевые группы снизились в этот день, а взвешенная версия индекса снизилась на -2,04%. Циклические акции отставали, а Mag-7 снизился на -3,23%, что привело к снижению Tesla на -5,75% в преддверии выпуска отчета о прибылях. А снижение на -2,55% для NASDAQ привело к возвращению на территорию медвежьего рынка, при этом индекс снизился на -21% по сравнению с недавним пиком. Индекс волатильности VIX вырос +4.17pts до 33.82, и другие рискованные активы также боролись, с кредитными спредами US HY +14bps шире на 412bps.

В структуре облигаций, являющихся все более плохим хеджированием для акций, долгосрочные Казначейства увидели новую распродажу. Доходность 10yr выросла на +8,6bps до 4,41%, а доходность 30yr выросла на +10,4bps до 4,90%, что является самым высоким показателем с января. Этот рост был обусловлен реальной доходностью, при этом реальная доходность за 10 лет выросла +9,4 б/с до 2,18%. Напротив, доходность 2yr упала -3,5 б/с до 3,765%, поскольку сумма снижения ставки ФРС по цене к декабрю выросла +6,1 б/с до 93 б/с. Эти шаги привели к резкому закручиванию кривой доходности, когда склоны 2s10s и 2s30s достигли своих самых крутых уровней с января 2022 года, незадолго до того, как ФРС начала свой цикл после Covid.

Индекс доллара (-0,96%) вчера закрылся на самом низком уровне за последние три года. Индекс доллара снизился на 5,69% с начала апреля и в течение самого слабого месяца с 2009 года. Доллар потерял позиции по отношению ко всем валютам G10 в понедельник, причем евро вырос до 1,1515, что является самым высоким уровнем с ноября 2021 года, в то время как швейцарский франк (+ 1,08%) был самой сильной валютой G10. Полет в предполагаемые безопасные гавани также показал, что золото (+2,92%) заняло 22-е место с начала года, увеличив свой прогресс YTD до +30,46%. За ночь цены на золото выросли еще на 0,81% до $3 452 за унцию.

В энергетическом пространстве настроения риска, опасения по поводу торговой войны между США и Китаем и конструктивные заголовки в выходные на косвенных переговорах между США и Ираном оказывают новое понижательное давление на цены на нефть. Нефть марки Brent упала на -2,50% до $66,26 за баррель, обратив вспять примерно половину своего роста на +4,94% на прошлой неделе.

Азиатские фондовые рынки пытаются набрать обороты сегодня утром после вчерашнего обвала на Уолл-стрит. В Японии Nikkei (-0,35%) немного ниже после падения на -1,30% в понедельник. В Китае Hang Seng (-0,03%) и CSI (+0,03%) мало изменились, в то время как Shanghai Composite (+0,31%) и KOSPI Кореи (+0,15%) видят незначительные прибыли, обращающие вспять первоначальные потери. За пределами Азии фьючерсы на акции США демонстрируют умеренное восстановление, а фьючерсы на S&P 500 и NASDAQ примерно на 0,35% выше. Доходность казначейских облигаций за 10 лет (+0,5 б/с) незначительно выше после вчерашней распродажи, а доллар (-0,15%) снова снизился за одну ночь. В Европе фьючерсы на STOXX 50 торгуются на -0,47% ниже сегодня утром после праздника понедельника, который следует за отскоками +3,09% для STOXX 50 и +4,03% для STOXX 600 на прошлой неделе.

В Азии наши стратеги опубликовали проницательный доклад, в котором излагаются аргументы в пользу более сильного юаня. Они видят, что риск-вознаграждение взвешенно на понижение в USD/CNH в течение летних месяцев, при этом анализ затрат и выгод для политики Китая не благоприятствует вепонизации юаня.

С нетерпением ожидая оставшуюся часть этой недели, основными данными будут апрельские внезапные PMI в среду с акцентом на влияние тарифов США. Европейские производственные индексы PMI восстанавливаются в последние месяцы, но остаются на сжатой территории, в то время как в США индекс был лишь немного выше 50 (50,2) в прошлом месяце. Инвесторы также будут следить за индексами PMI за доказательствами перебоев в поставках и ценового давления со стороны тарифов, при этом индексы цен PMI в США выросли до 2-летних максимумов в марте.

Другие заметные экономические показатели на этой неделе включают мартовские заказы на товары длительного пользования и данные о рынке жилья в США. Наши американские экономисты видят рост заказов на товары длительного пользования (в четверг) на уровне +1,0% МОМ (+1,0% в феврале), указывая на сильное начало года для Capex до основных тарифных объявлений. ФРС также выпустит свою бежевую книгу в среду. В Европе к другим релизам относятся опрос Ifo в Германии (четверг), а также показатели потребительского доверия в Великобритании (пятница), Еврозоне (вторник) и Франции (четверг).

В других местах мировые политики собираются в Вашингтоне на весенние встречи МВФ и Всемирного банка. В рамках этого МВФ опубликует свои последние экономические прогнозы позднее сегодня, а министры финансов G20 и управляющие центральных банков также соберутся в среду и четверг. И будет много Fedspeak, включая Джефферсона, Харкера, Кашкари, Баркина и Куглера сегодня.

Мы также вступаем в пик сезона заработка. Два из Mag-7 будут отчитываться с Tesla после закрытия рынка сегодня и Alphabet в четверг, в то время как другие технические отчеты включают Intel, IBM и ServiceNow. Результаты от групп потребителей, включая P&G и PepsiCo, могут получить дополнительное внимание, учитывая недавнее смягчение потребительских настроений в США, в то время как в Европе названия для просмотра включают SAP и Dassault Systemes. Смотрите полный еженедельный календарь ниже.

Тайлер Дерден

Туэ, 04/22/2025 - 08:28