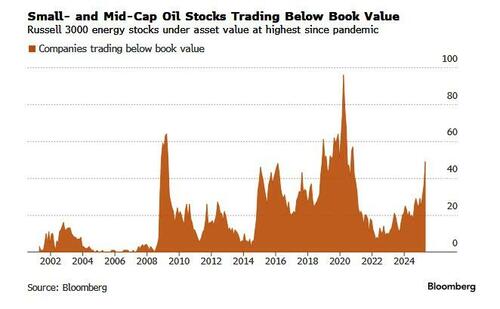

Треть энергетических компаний Russell 3000 торгуют ниже балансовой стоимости

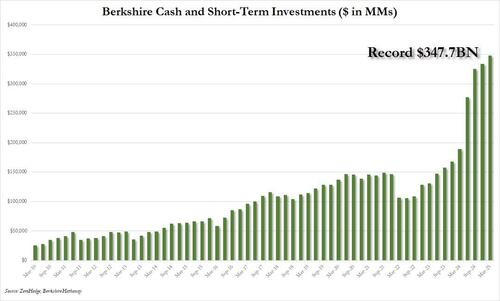

Глядя на ошеломляющие 350 миллиардов долларов наличности Berkshire...

Можно было бы подумать, что на рынке нет ничего, что стоимостный инвестор нашел бы привлекательным. Один был бы неправ: Почти половина всех запасов нефти и газа средней и малой капитализации в США в настоящее время торгуются ниже их балансовой стоимости. Это самый высокий уровень со времен пандемии. И, по словам Блумберга, это подарок для стоимостных инвесторов, поклоняющихся Евангелию Уоррена Баффета и его наставника Бена Грэма, который назвал такие возможности «сигарными окурками». "

«Мы собираемся воспользоваться множеством придурков». Коул Смид, генеральный директор Smead Capital Management, покупает дополнительные запасы нефти и газа, которые торгуются значительно ниже книги.

Энергетика была вторым худшим сектором в S&P 500 во 2 квартале, потеряв примерно 10% с момента объявления тарифов президентом Дональдом Трампом 2 апреля, поскольку цены на нефть падают из-за опасений, что глобальные торговые войны вызовут замедление экономики, а страны-члены ОПЕК наращивают производство для увеличения поставок. Две недели назад нефть West Texas Intermediate упала примерно до 55 долларов за баррель, уровень, который она коснулась в апреле и до февраля 2021 года. С тех пор он восстановился лишь незначительно и остается на уровне 15% в течение года.

Сегодня акции таких нефтегазовых компаний, как Murphy Oil, Crescent Energy и Noble Corp. Они торгуют меньше, чем стоят активы на их книгах. Это классическое определение стоимостного инвестирования, когда акции оцениваются меньше, чем стоил бы бизнес, если бы он был лишен и продан за запчасти.

На данный момент 33% энергетических акций Russell 3000 торгуются ниже своих балансовых значений. В конце прошлой недели этот показатель вырос до 40%, прежде чем США и Китай договорились о 90-дневном торговом перемирии, которое дало небольшой толчок ценам на нефть и энергетическим запасам. В последний раз это произошло, когда в 2021 и 2022 годах энергетика обрушилась на рынок и стала самым эффективным сектором.

Аналогичная доля крупных и малых канадских запасов нефти и газа также упала в том же диапазоне.

Смид, который инвестирует по обе стороны границы, считает, что акции недооценены и готовы, по крайней мере, вернуться к балансовой стоимости. «Мне не нужно иметь радужную картину» для энергетического прогноза, чтобы заработать деньги, торгуя энергетическими акциями, сказал Смид.

Смид не одинок в покупке дешевых энергетических имен. Несколько богатых нефтяных и газовых компаний заявили, что выкупят свои акции, если они резко распродадут их. Cenovus Energy выкупила 62 миллиона канадских долларов (44 миллиона долларов США) собственных акций в первом квартале и почти утроила этот показатель до 178 миллионов канадских долларов во втором квартале.

«Самое разумное распределение капитала сегодня — это выкуп акций». Вместо того, чтобы погасить долг, генеральный директор Diamondback Energy Трэвис Стис заявил на телефонной конференции 6 мая. «Обратные выкупы — это правильно на этих уровнях», — сказал Стейс, добавив, что он ожидает, что техасский производитель нефти увеличит свою программу выкупа акций.

Не все смогут воспользоваться более дешевой ценой акций, поскольку у них нет доступных денег. Chevron, например, заявила, что сократит выкуп во втором квартале после падения цен на нефть. Тем не менее, Exxon продолжает регулярно выкупать свои акции, поскольку печатает деньги квартал за кварталом.

Кроме того, идет дискуссия о том, как лучше всего оценивать производителей нефти и газа. Аналитик BMO Capital Markets Джереми Маккри (Jeremy McCrea) говорит, что балансовая стоимость не является полезным показателем для энергетического сектора, поскольку она может быстро и резко меняться с ценами на сырьевые товары. Он предпочитает денежный поток, Ebitda и резервные значения, но говорит, что акции по-прежнему дешевы.

«Как правило, лучшее время для инвестиций в энергетический сектор — это когда он чувствует себя наиболее некомфортно», — сказал Маккри. «И сейчас это довольно неудобно, учитывая эту неопределенность. Это исторически лучшие времена для выхода на рынок. "

Тайлер Дерден

Мон, 05/19/2025 - 17:20