Трамп предупредил о 25-процентных тарифах на автомобили, наркотики и чипы, которые появятся в апреле

С каждым днем Уолл-стрит становится все более уверенным в том, что тарифы Трампа — это не что иное, как горячий воздух, и подталкивает акции к новым рекордным максимумам, сегодня после того, как близкий президент Дональд Трамп попытался заверить рынок в том, что тарифы действительно идут, и сказал, что он будет Вероятно, ввести тарифы на импорт автомобилей, полупроводников и фармацевтических препаратов около 25%. Объявление будет сделано уже 2 апреля.

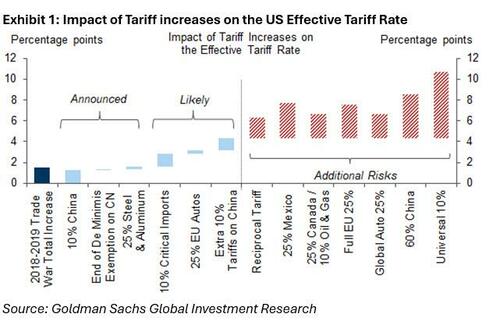

Новые пошлины, если они будут реализованы, расширят торговую войну президента. Трамп ранее объявил о 25-процентных тарифах на сталь и алюминий, которые вступят в силу в марте, но комментарии во вторник являются его самыми подробными, когда он указывает другие сектора, которые будут затронуты новыми барьерами.

Я, вероятно, скажу вам, что 2 апреля, но это будет в районе 25%. Трамп сказал журналистам в своем клубе Мар-а-Лаго, когда его спросили о его плане автомобильных тарифов.

Отвечая на вопрос о подобных сборах на фармацевтические препараты и полупроводниковые чипы, президент сказал: "Он будет на 25% и выше, и он будет значительно выше в течение года. " Трамп добавил, что хочет дать компаниям «время войти», прежде чем объявлять о новых налогах на импорт.

Когда они приезжают в Соединенные Штаты, и у них есть свой завод или фабрика, здесь нет тарифов, поэтому мы хотим дать им немного шансов. Он сказал.

Как отмечалось на прошлой неделе, Трамп также угрожал другим потокам тарифов, что является частью усилий по восстановлению баланса торговых отношений США по всему миру. Президент уже давно обвиняет другие страны в срыве американских пошлин и рассматривает импортные пошлины как способ вернуть промышленность в Америку и собрать больше доходов. Многие экономисты говорят, что они повысят потребительские цены для американцев и помешают борьбе с инфляцией.

Президент заявил, что он будет применять «взаимные» сборы по странам уже в апреле, хотя детали все еще определяются. Он также пригрозил пошлинами некоторым крупнейшим торговым партнерам США, таким как 10%-ная ставка, уже применяемая к Китаю, и 25%-ные тарифы на Канаду и Мексику, которые были отложены по крайней мере до 4 марта. Эти меры будут дополнять друг друга, а это означает, что мексиканские и канадские производители в определенных секторах могут заплатить до трех тарифов.

В целом действия Трампа, если они будут приняты, перекроют цепочки поставок и торговые потоки, а также цены в США. Тарифы оплачиваются импортерами и часто передаются потребителям, хотя иногда компенсируются снижением цен за рубежом.

Направление тарифной стратегии президента Трампа стало более ясным за прошедшую неделю, отойдя от широких универсальных сборов, которые ожидали некоторые аналитики Уолл-стрит. Вместо того, чтобы вводить универсальные тарифы, администрация США в четверг издала распоряжение, устанавливающее взаимную тарифную политику для всех текущих и потенциальных торговых партнеров США. К выходным Трамп удвоил тарифы, заявив, что этот шаг обеспечит равные условия для американских рабочих. "

В понедельник Ян Хатциус из Goldman, Алек Филлипс, Дэвид Мерикл, Ронни Уокер и другие написали записку для клиентов под названием Выводы сезона: животные духи по тарифам. "

В записке аналитики предоставили клиентам визуальное представление о том, что процент управленческих команд в корпоративной Америке, обсуждающих «тарифы» в этом сезоне доходов, превысил 40%, намного превысив предыдущий пик (около 30%) во время первого срока Трампа, когда он инициировал торговую войну с Китаем.

Больше информации от аналитиков:

Ссылки руководства на тарифы взлетели на фоне начала второй торговой войны (выставка 3). После подписания указов о введении новых тарифов на Канаду, Мексику и Китай президент Трамп отложил тарифы на Канаду и Мексику до 4 марта. Мы считаем, что дальнейшее продление возможно, но тарифный риск для обеих стран, вероятно, останется, по крайней мере, до завершения обзора USMCA, запланированного на середину 2012 года. В дополнение к уже введенным китайским тарифам мы ожидаем дальнейшего повышения тарифов на импорт из Китая, введения объявленных тарифов на сталь и алюминий, а также введения новых тарифов на автомобили ЕС и критически важный импорт (например, нефть, фармацевтические препараты, полупроводники и другое электрооборудование).

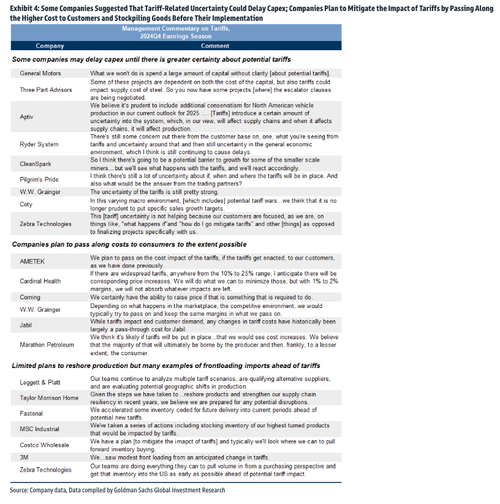

последний Комментарий управленческих групп О текущей тарифной ситуации:

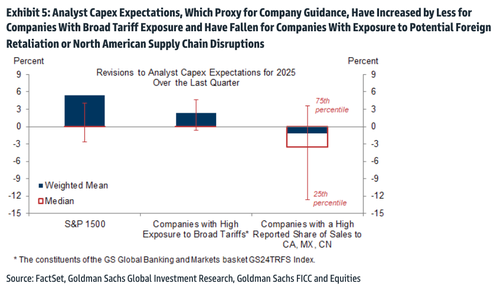

На Влияние тарифовАналитики отметили: Аналитические ожидания в отношении Capex — прокси для руководства компании — аналогично предполагают, что эскалация тарифной политики будет влиять на инвестиционные решения компаний, подверженных риску. "

Как и в прошлом квартале, компании предложили смягчить влияние тарифов. переход на более высокую стоимость для клиентов складирование товаров до их реализации. "

После того, как на прошлой неделе ИПЦ и ИПЦ, оба из которых печатались горячее, чем ожидалось, в сочетании с тарифной войной возникли опасения по поводу повторения середины 1970-х годов.

На прошлой неделе читателям была дана дорожная карта для следующей итерации торговой войны Трампа — взаимные тарифы.читатьЗдесь.

Тайлер Дерден

Туэ, 02/18/2025 - 18:00