США и Китай достигли соглашения о снижении тарифов в 90-дневный период охлаждения

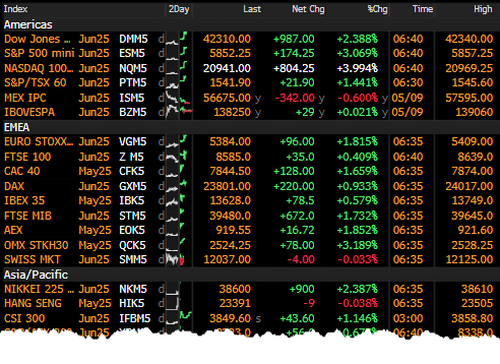

Китай и США начали ослаблять торговую напряженность в начале понедельника, согласившись на временное 90-дневное снижение взаимных тарифов на товары друг друга, говорится в совместном заявлении, опубликованном обоими правительствами по X. Соглашение, рассматриваемое как прорыв в многомесячной торговой войне между двумя крупнейшими экономиками мира, помогло вызвать ралли на глобальных рынках: фьючерсы S&P 500 выросли на 3%, в то время как фьючерсы Nasdaq выросли на 4%. Европейские рынки также продвинулись вперед, а доллар США укрепился. Государственные облигации США, проданные в качестве инвесторов, вернулись в акции и другие чувствительные к риску активы.

https://t.co/NXlayMvBWE

— Rapid Response 47 (@RapidResponse47) 12 мая 2025 г.

В совместном заявлении говорится, что США снизят пошлины на большинство китайских импортных товаров с 145% до 30% к среде.

Вот краткое изложение действий США:

Соединенные Штаты отменят дополнительные тарифы, введенные в отношении Китая 8 и 9 апреля 2025 года, но сохранят все пошлины, введенные в отношении Китая до 2 апреля 2025 года, включая тарифы Раздела 301, тарифы Раздела 232, тарифы, введенные в ответ на чрезвычайную ситуацию в стране, вызванную в соответствии с Законом о международных чрезвычайных экономических полномочиях, и тарифы наиболее благоприятствуемой нации.

США приостановят действие своего 34%-ного взаимного тарифа, введенного 2 апреля 2025 года, на 90 дней, но сохранят 10%-й тариф в период паузы.

Тариф 10% продолжает устанавливать справедливый базовый уровень, который стимулирует внутреннее производство, укрепляет наши цепочки поставок и гарантирует, что американская торговая политика сначала поддерживает американских рабочих, а не подрывает их.

Вводя взаимные тарифы, президент Трамп обеспечивает, чтобы наша торговая политика работала на американскую экономику, устраняет нашу национальную чрезвычайную ситуацию, вызванную нашим растущим и постоянным торговым дефицитом, и уравнивает игровое поле для американских рабочих и производителей.

В отличие от предыдущих администраций, президент Трамп занял жесткую, бескомпромиссную позицию в отношении Китая, чтобы защитить американские интересы и прекратить несправедливую торговую практику.

Прорыв в переговорах также привел к тому, что Китай снизил свои 125% тарифы на американские товары до 10%.

Вот краткое изложение действий Китая:

Китай отменит ответные тарифы, объявленные им с 4 апреля 2025 года, а также приостановит или отменит нетарифные контрмеры, принятые против США со 2 апреля 2025 года.

- Китай также приостановит первоначальный тариф в размере 34% на Соединенные Штаты, объявленный 4 апреля 2025 года, на 90 дней, но сохранит тариф в размере 10% в течение периода паузы.

В совместном заявлении указывается, что соглашение проложит путь для дальнейших переговоров между высокопоставленными должностными лицами. Со стороны США переговоры ведут министр финансов Скотт Бессент и торговый представитель Джеймисон Грир, а вице-премьер Хэ Лайфэн будет представлять Китай.

После принятия вышеупомянутых мер Стороны создадут механизм для продолжения обсуждения экономических и торговых отношений. Представителем от китайской стороны для этих обсуждений будет Хэ Лайфэн, вице-премьер Госсовета, а представителями от американской стороны будут Скотт Бессент, министр финансов, и Джеймисон Грир, торговый представитель США. Эти обсуждения могут проводиться поочередно в Китае и Соединенных Штатах или третьей стране по соглашению Сторон. По мере необходимости обе стороны могут проводить консультации на рабочем уровне по соответствующим экономическим и торговым вопросам.

Белый дом написал на X, что эти торговые переговоры будут касаться торговых дисбалансов Америки:

Дефицит торгового баланса США с Китаем в 2024 году составил $295,4 млрд, что является самым большим дефицитом среди всех торговых партнеров.

Сегодняшнее соглашение работает над устранением этих дисбалансов, чтобы обеспечить реальные, долгосрочные выгоды для американских рабочих, знаменитостей и бизнеса.

В ходе переговоров также рассматривался продолжающийся фентаниловый кризис.

- Соединенные Штаты и Китай предпримут агрессивные действия, чтобы остановить поток фентанила и других прекурсоров из Китая к незаконным производителям наркотиков в Северной Америке.

https://t.co/xHkmdojKE7

— Rapid Response 47 (@RapidResponse47) 12 мая 2025 г.

Вскоре после того, как было опубликовано совместное заявление, Бессент, который возглавлял американскую делегацию на переговорах, заявил журналистам в Женеве, что обе стороны «существенно снизили уровень тарифов» и «ни одна из сторон не хочет разъединения». "

"" «У нас была очень решительная и продуктивная дискуссия о шагах вперед по фентанилу», — добавил Бессент, отметив, что эти переговоры могут привести к «соглашениям о покупке» Китаем.

@SecScottBessent: Мы достигли соглашения о 90-дневной паузе и существенно снизили тарифные уровни - обе стороны, по взаимным тарифам, снизят свои тарифы на 115%. pic.twitter.com/Jxdd11U83s

— Rapid Response 47 (@RapidResponse47) 12 мая 2025 г.

Комментируя рынки, Бенедикт Лоу, стратег по акциям и деривативам в BNP Paribas Markets 360, сказал Bloomberg TV, что «деэскалация была намного лучше, чем ожидалось рынком» и «в течение следующих нескольких дней я ожидаю бычью среду на мировом рынке акций». "

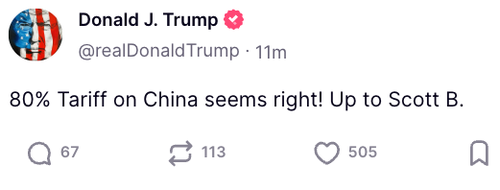

На прошлой неделе президент Трамп ввел «80%-ный тариф на Китай, кажется, правильный!», отметив, что окончательное решение остается за Бессентом.

"" «На наш взгляд, фондовые рынки возвращаются туда, куда они могли бы переместиться, если бы Дня освобождения не произошло, и Трамп только что применил 10-процентный универсальный тариф», — сказал Роберто Шольтес, глава стратегии Singular Bank.

Корпоративные основы здоровы, результаты первого квартала значительно удивили, и есть много денег, которые нужно инвестировать. "

"" Эта деэскалация гораздо более позитивна, чем ожидалось (GSe: 54% США по тарифам Китая и 34% Китая по тарифам США), и рынок реагирует как таковой. Мы наблюдаем явный разворот коротких позиций в долларах США по мере снижения рисков рецессии в США (GSe составил 45%!) и роста настроений по риску. DXY вырос более чем на 1%, фьючерсы на S&P выросли на 3%, 10y UST выросли до 4,43%, золото упало ~3%, - сказал аналитик Goldman Ичин Цай клиентам.

Фьючерсы S&P 500 выросли на 3%, а фьючерсы Nasdaq - на 4%. Европейские акции находятся в зеленой зоне.

Переход к снижению тарифов и ослаблению торговой напряженности между двумя крупнейшими экономиками мира последовал за воскресными переговорами, в ходе которых обе стороны сообщили о существенном прогрессе. "

Тайлер Дерден

Мон, 05/12/2025 - 07:05