„Something Exceptional Happening”: Copper Bull Forecasts New Record Highs On Most-Profitable Trade Ever

In an exclusive interview, Kostas Bintas, Trafigura Group’s former co-head of metals and now with Mercuria Energy Group Ltd., told Bloomberg that President Trump’s tariff threat on copper could push prices to record highs and unleash unprecedented opportunities for trading profits.

Bintas explained that massive copper inflows into the US are sending supplies lower elsewhere—most notably in top consumer China. As a result, the global market is showing signs of tightening, pushing Shanghai copper futures into their widest backwardation in over a year. Adding to the pressure, Mercuria forecasts that global demand will outstrip supply by 320,000 tons this year, and inventories ex-US will be significantly depleted.

„We think there is something exceptional happening in the copper market,” Bintas said, adding, „Is it unreasonable to expect a copper price of $12,000 or $13,000? I’m struggling to put a number on it because this has never happened before.”

The shift of inventory to the US means the Chinese copper market will be left with low stocks…

„China has been successful historically in rejecting high prices,” the trader said, warning, „This is the first time in recent history that another market is taking tons away from the Chinese market. That’s why it’s uncharted territory.”

Bintas runs a 40-person metals team at Mercuria and has been one of the most bullish voices in the space and called for a multiyear bull market after Covid on rising demand from all things electrification – i.e., 'Powering Up America’ theme and Next AI Trade.

Former Goldman metals strategist Nick Snowdon, also at Mercuria and head of metals research at the commodity trading firm, forecasted about a year ago that average copper prices would average $15,000 a ton for 2025.

Last week, Goldman’s Eoin Dinsmore, Lavinia Forcellese, and others provided clients with several key factors as to why they are „tactically cautious, structurally constructive” on copper:

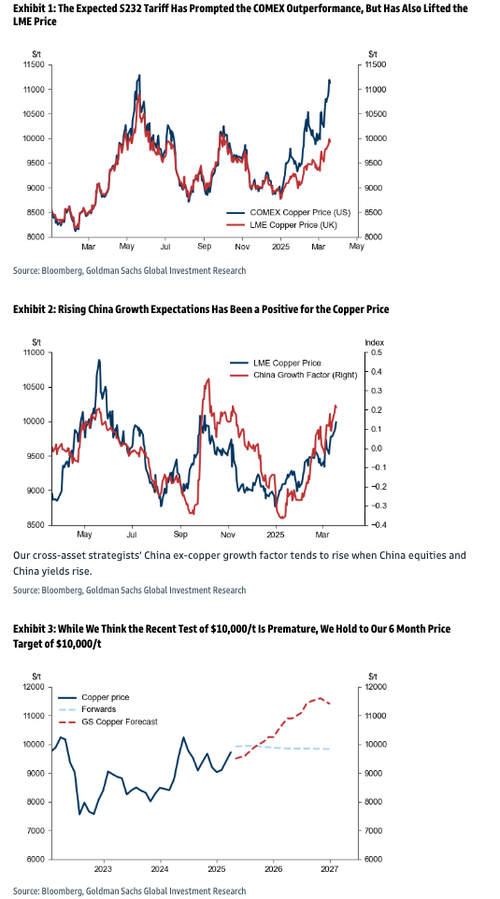

We believe two key factors are driving the recent LME copper price strength:

-

Section 232 has lifted both the COMEX and the LME price. As the COMEX US price has increased to incorporate greater certainty on US copper tariffs, it has resulted in tighter London LME spreads and additional speculative length on the LME. While we hold to our 2025 market deficit forecast of 180kt, we think stockpiling in the US will make the world ex-US appear tighter, which may pull forward the rally we forecast for H2.

-

China sentiment has turned notably more positive. This is due to the government’s commitment to boost consumption, AI optimism, and lower than feared US tariffs on China. Positive China sentiment has been further bolstered by reports that China’s State Reserve Bureau (SRB) plans to add to its copper stockpiles in 2025. We see SRB copper purchases as defensive to address potential shortages rather than opportunistic (i.e. very price sensitive), and SRB buying would help offset any price-related demand pull-back in China. While our China economists see upside risk to their 2025 4.5% growth forecast, they argue that policymakers may ease off the gas after a decent Q1 real GDP print.

-

However, trade policy uncertainty leaves us tactically cautious. We see two-sided risks from the upcoming US trade policy update on April 2nd. While the delay to European retaliation is slightly positive, our economists expect additional product specific tariffs to be announced. Any focus on China or a hawkish line on reciprocal tariffs will be negative for copper prices. We are not anticipating a S232 copper update, as the deadline for public comments only ends on April 1st[1]. We think the front month COMEX-LME premium should drop if the trade update fails to signal a speedier than typical S232 tariff implementation.

-

We remain structurally bullish. Should the April 2nd policy announcements spare the market of negative sentiment surprises, we think the net LME tightening impact from the ongoing S232 copper investigation poses a net upside risk to our Q2-Q3 2025 $9,550/t-$9,883/t price forecast. For now, we also maintain our bullish $10,200/t Q4 2025 forecast, on the back of strong electrification demand, China stimulus offsetting the drag from tariffs, and slower mine supply growth.

US inflows of copper only suggest that Chinese buyers will face aggressive competition for the metal in global markets.

The net bullish positions in LME copper have been elevated on the AI electrification trend since last May, while the latest tariff-driven fears push prices higher.

Tyler Durden

Tue, 03/25/2025 – 18:50