Government Data Is Garbage: Elon Should Focus On Fixing That Next

By Peter Tchir of Academy Securities

Data, „Rules” & Messiness

It is difficult to believe that the inauguration was only 2 weeks ago, given the fast and furious pace of executive orders and headlines. DOGE has been even more “prolific” in terms of generating headlines than I would have ever guessed, and I already thought it would be impactful. It is going to be interesting.

But that takes us away from a few key topics for today.

Data

If you thought that we were going to start with jobs data, you are mistaken. Today, “inflation expectations” deserve some attention. Right around 10am ET Friday, the stock market started to decline. Until that moment, it had done fairly well even as yields increased on the back of the jobs report. Then out came the University of Michigan CONsumer CONfidence data, showing 1-year inflation expectations jumping from 3.3% to 4.3%! This was lucky for us, as we had pointed out in our NFP Instant Reaction – What to Do With Data You Don’t Trust that we were moderately bearish risk assets. Consumer inflation expectations were not on my bingo card of what could turn stocks, so I guess that we can classify that under “better lucky than smart.” We should just run with it, but we cannot help ourselves. We have never fully understood:

- Why does the Fed place so much weight on inflation expectations, particularly from survey data? From people who aren’t experts?

- Not saying that “experts” have all the answers, but do these individuals really have precise, realistic estimates in mind? Maybe the options should be high, above average, average, below average, and very low? I’m hesitant to put a specific number on inflation for the next year and I spend a LOT of time thinking about it.

- For the first time in my life, I was motivated to go to their site and see what it takes to become a respondent. But with my VPN turned on during my flight from San Diego (where Academy just hosted a great Geopolitical Summit), I couldn’t access the site. But it is on my “to do” list now.

- But this is the real kicker!

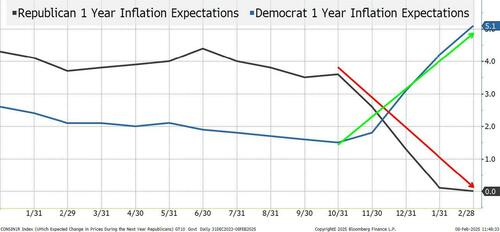

- I have no idea how UMich comes up with an average of 4.3. Nor do I really care. Not just for the reasons listed earlier, but also the fact that Republicans are expecting 0 and Democrats are looking for 5% seems insane. It is “almost” like Republicans put in low numbers, hoping the Fed sees and cuts rates (or they just believe in DOGE and the president). It is also “almost” like Democrats put in high numbers, hoping the Fed sees and doesn’t cut rates (or they don’t believe in DOGE and the president’s policies). I understand that political views could influence inflation expectations, but this seems extreme!

Since the inflation expectations data helped trigger the risk asset sell-off that I was leaning towards, I should be happy, but it seems so ridiculous that it needed to be highlighted!

“Rules”

Speaking of things so ridiculous that they need to be highlighted, let’s look at some economic “rules.”

In physics, what we consider rules are termed laws. But for most people, rules are a set of “things” that need to be followed. Whether they are laws or axioms, they are things that are clear and explicitly define and control actions. On the other hand, conjectures, educated guesses, and “rules of thumb” are general guidelines that often work or point you in the right direction. But by no means are they immutable rules that must be followed.

So why do economists insist on terming certain things rules that are really conjectures? Probably because it sounds better, especially if you want people to believe that they work. Or maybe it just makes it easier to win prestigious economic awards?

But we revisit this subject today, not to focus on how inaccurate it is to call many of these things rules, but to highlight that the so-called rules definitively don’t work when they are based on inaccurate data!

Let’s look at the Sahm Rule which came to prominence this summer. It predicts that when relatively rapid changes in the unemployment rate occur, a recession will follow. I was too lazy to look up the exact definition (airline wi-fi, limitations of working on a laptop, lack of interest), but it is something like when you get a 0.5% increase from high to low (using a 3-month average) within 6 months, we get a recession. Many claimed it happened this summer. Some, I think, argued that with rounding, it didn’t occur. But NONE OF THAT MATTERS! We just learned on Friday that the BLS said there were 2 MILLION more workers in the labor force last year than previously thought! A big enough number, that if we knew in real-time, would likely have dramatically changed all of the unemployment rate data that not only triggered things like the Sahm Rule, but also probably affected monetary policy!

*POWELL: QCEW REPORT SUGGESTS PAYROLLS MAY BE REVISED DOWN

Oh no, the Fed was relying on doctored and made up government data meant to boost Biden’s reputation and to confuse the Fed?

Unpossible

— zerohedge (@zerohedge) September 18, 2024

And let’s not even get started on things like the Taylor Rule or anything that depends on R*.

GDP – a somewhat wild guess that gets amended, often significantly.

Inflation, time and again, seems to defy what we live and breathe. With hedonics, measurement issues, and well-known issues (like the lag on OER), it is difficult to take it as seriously as we are expected to (measured to 1 or 2 decimal places).

So, basing “rules” on things where the data is unlikely to be accurate is bad enough, and then layer in the risk of treating something as a rule, rather than a decent theory, and we are ripe for more policy mistakes (yes, I believe these issues contributed to transitory, etc.). Let’s not even get started on R* or the neutral rate.

If this rant seems at all familiar, it is because we covered it last month in Jobs and AI. Maybe I’m motivated to hammer this home because I’m actually hopeful that there is the possibility of achieving some change?

Whether or not we like any, all, or none of the things this administration is doing, they do seem open to change.

If we could get better, more accurate, and timely data, we should be able to make better decisions.

That would reduce the risk of policy error, poor business decisions, etc., which would be great and is why I think it should be a priority for the government to revisit – especially in this day and age where almost everything is stored electronically, updated in real-time, and we have the ability to harness AI like we’ve never had before!

Elon, if you read this, please think about it! Wouldn’t you want better, more accurate, and more timely information in your decision making?

Messiness

Reciprocal Tariffs came up on Friday, adding to the problems stocks and bonds were facing. This is very much in line with my current concerns and the view that this year will be messy, but manageable.

- The market seems to have settled on the view that these are all just “negotiating” ploys. That has led to muted or short-lived market reactions. While we were fully on board with fading last weekend’s tariff war (kind of comical to write that sentence), we are not so comfortable fading tariffs now.

- Both Canada and Mexico got 30-day reprieves (to some extent) just for agreeing to do what they had already been planning to do on some level. Small win for the president, but not overwhelming. In the case of Canada, I expect the president to decide that it wasn’t enough, and he needs more tariffs. I think that is a mistake for many of the reasons (regarding supply chains) listed last weekend in The New Trump Tariffs. The complexity of existing agreements and the efficiencies built into the supply chain will be disrupted, causing more harm than good for both countries.

- There are many in the administration (presumably based on UMich responses) that like the idea of getting more and more revenue from tariffs (in order to cut taxes). I cannot say that I completely disagree with that view, but it could be taken to extremes.

- You can rattle the cage (so to speak) so often before the people inside that cage start making some plans of their own. Tariff uncertainty, even if intended to be a bargaining tool, could turn into tariffs depending on the responses, but could also cause changes to supply chains as companies get tired of the risk. If you assume, as I do, that supply chains are fairly optimized to be efficient, changes (for whatever reason) will be problematic (with inflation being the first potential issue).

Expect more noise on tariffs as the market has become too complacent, and I think that it is now far more likely to face a downside rather than an upside surprise from “negotiations.” A different view than I had last weekend, but things move fast in 2025!

Crypto

We now, apparently, have a sovereign wealth fund (more on that in the future). We have a “Crypto Czar” who gave a speech surrounded by crypto supporters. We have multiple states trying to pass some sort of crypto reserve (no idea why, other than it is popular and probably attracts some nice campaign promises), yet as of the time that we are writing this, Bitcoin is “only” at $96k.

That seems odd to me. Never has there been so much public support, but so much has been priced in that it is difficult for it to go higher. Maybe, also, on the down days, we realize that because it is hard enough to put a price on things that in theory we know how to value (stocks and bonds), it is nearly impossible to figure out a “fair value” for a bunch of 1s and 0s? The Rise and Fall, or more like the Meteoric Rise and Plummet of meme coins, might also be making some wonder about the validity of the “store of value” nature of this “scarce asset?”

When you get positive headline after positive headline and don’t get the response that you expect, it is time to get nervous.

Bottom Line

Look for moderately higher yields. Shorts have been squeezed. This market, which seems to rapidly oscillate between overbought and oversold, appears to be overbought again. Expect a lot more “cost savings” headlines from DOGE, especially as they start looking at big programs (like Medicare and the Defense Budget). However, it won’t be enough to offset spending, tax cuts (the deficit will continue to rise), or the very real risk that supply chains will be less efficient (due to tariffs or the response from tariff noise) creating inflation pressures (for Democrats, Republicans, and Independents, alike). Still targeting 4.8% to 5% on 10s with 2s/10s getting to at least 50, with 75 as a longer-term target. Bessent does seem focused on getting 10s down, but that might be far easier said than done, especially given the current policy priorities.

On equities, look for some overall weakness in U.S. markets. Expect value and equal weighted indices to outperform market weighted indices. Be wary of small caps. As much as I’d like to include small caps in my list of outperformers, they seem more likely to bear the brunt of tariffs and policy mistakes than large companies. Just above 5,800 on the S&P 500 is my target, with risk of a big move to the downside if markets decide we’ve been too optimistic about what can be done quickly. Longer term I’m optimistic, but I don’t like the overall market right now (especially since I don’t think yields/the Fed will be helpful).

Look for foreign markets to outperform the U.S. (positioning is so tilted the other way, that it won’t take much to get this going). Especially if the dollar continues to increase on the back of tariffs.

I don’t like commodities themselves, but I do like the commodity producers and those companies that play an important role in the extraction and processing of commodities!

For the first time in what seems like eons (I’m pretty sure it has been shorter than that) I’m leaning towards being bearish credit spreads. Last time we were bearish on corporate credit, this time it is on spreads (in addition to overall yields).

- IG is tight. We all know that, but with all the uncertainty, it could be difficult to maintain current levels of tightness. A strong dollar may hurt profitability at some large global corporations. If spreads weren’t so tight, not a big deal, but they may need to widen a touch on that. If M&A is returning (part of our thesis), that tends to be negative for IG as those are the companies that can be levered up. Not thinking a big move, but time for some caution.

- HY is more susceptible than IG. If I’m getting a bit worried about small caps, I have to worry a bit about high yield. Though there seems to be an entire cottage industry dedicated to shorting high yield, so any damage to the market should be small.

Good luck and hopefully I’m not the only one who already feels like this has been a long year! No shortage of things to think about, to react to, to anticipate, and to do!

Tyler Durden

Sun, 02/09/2025 – 14:00