Купить Джон Дикий трактор? Ведущие индикаторы сигнала точки перегиба предложения для используемого рынка

Аналитики Goldman указывают на бычью точку перегиба в сторону предложения на рынке тяжелой техники, подчеркивая, что сокращение запасов подержанного оборудования исторически приводило к росту цен на подержанное оборудование в течение 6-9 месяцев и на новое оборудование в течение примерно 12 месяцев. Эта точка перегиба говорит о том, что стратегическое окно для покупки подержанной тяжелой техники, вероятно, открылось.

Джерри Ревич и Клей Уильямс из Goldman повторили свои рейтинги «Купить» на Deere (DE), Caterpillar (CAT) и United Rentals (URI), сославшись на бычью точку перегиба стороны предложения в цикле машин. Согласно их трекеру Machinery Supply, снижение запасов подержанного оборудования - ведущий показатель - сигнализирует об ужесточении поставок и сокращении капитала впервые за три года.

Вот основные моменты записки:

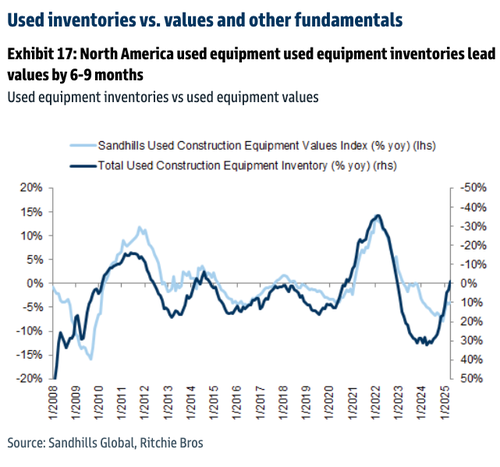

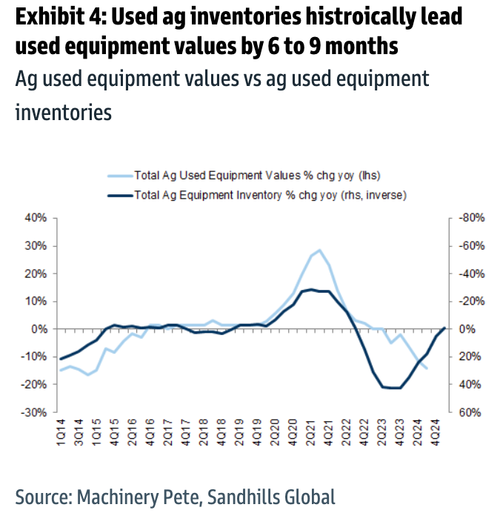

Сдвиги в запасах использованного оборудования приводят к использованным значениям на ~6-9 месяцевПроизводство нового оборудования ~ 12 месяцев, с совпадающими показателями по сравнению с запасами. Джерри делает чисто предложение-призыв, который указывает на рост за пределами экономического цикла; он видит (i) снижение запасов капитала в первый раз за три года, (ii) недопроизводство в течение последнего года на фоне сокращения запасов дилеров, (iii) оценки, которые встраивают полные тарифные встречные ветры, и (iv) оценка вверх по доходам среднего цикла.

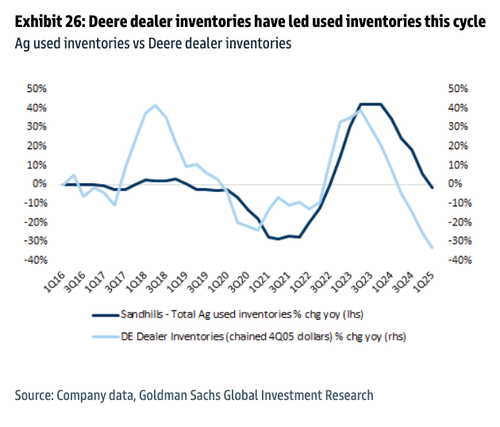

Ранее в 2016 году отклонение рынка от использованного ознаменовало начало многолетнего восстановления в оборудовании AG. Несмотря на относительно мягкие доходы фермеров. В настоящее время мы наблюдаем снижение запасов в годовом исчислении в течение последовательных месяцев, что поддерживает бычий взгляд Джерри на DE. Используемые значения исторически совпадали с ценой акций DE и исторически приводили значения используемого оборудования на 6-9 месяцев.

Мы уделяем меньше внимания отдельным названиям, таким как DE, CAT и URI, и больше внимания базовому оборудованию, используемому и новым значениям, намеченным аналитиками Goldman, что указывает на четкую точку перегиба в сторону предложения на рынке тяжелой техники.

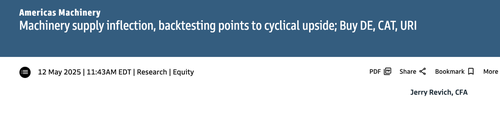

Аналитики показывают ужесточение запасов использованного строительного оборудования, при этом использованные значения, по-видимому, снижаются и начинают тенденцию к росту.

"" По мере того, как инфляционная среда нормализовалась, мы считаем, что отношения вернутся к прошлым циклам.

Выставка 17 иллюстрирует полную историю дисбаланса предложения на рынке тяжелой техники, подчеркивая, как периоды недостаточного и избыточного предложения последовательно приводили к тенденциям ценообразования на вторичном рынке.

Аналогичная динамика наблюдается на рынке подержанного оборудования.

Предстоит ли в 2016 году разворот для рынка тракторов мощностью 100 лошадиных сил?

Ag использовала запасы против дилеров Deere

Это понимание особенно ценно для владельцев бизнеса и операторов, которые взвешивают решение о покупке подержанного или нового тяжелого оборудования, предлагая более четкое представление о том, куда цены, вероятно, пойдут в предстоящих кварталах.

Тайлер Дерден

Свадьба, 05/14/2025 - 21:20