Волшебство смешного ВВП Китая: это вклад, а не результат

Стефан Купман, старший макростратег в Rabobank

Вход, а не выход

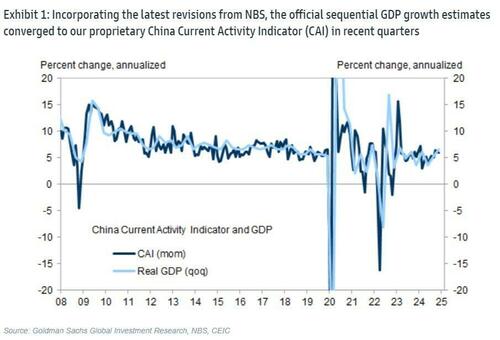

Китай только что достиг своей цели роста в 2024 году, как и всегда. По данным Bloomberg, «11-часовой стимулирующий блиц"и "некоторый экспортный бум турбированная деятельностьМы должны были пересечь черту, но вот мы здесь. Валовой внутренний продукт вырос на 5,0%, превысив прогнозы роста на 4,9%. Декабрьские данные показали быстрый рост промышленного производства на 6,2%, а также некоторые предварительные признаки роста внутреннего спроса. Розничные продажи выросли на 3,8% в последнем квартале, что является самым быстрым темпом в 2024 году. Тем не менее, его положительное сальдо торгового баланса выросло почти до 1 триллиона долларов в прошлом году - примерно до размера всей экономики Польши. Это означает, что Китай нуждается в остальном мире для своего роста, а не наоборот.

Рост на 2025 год снова нацелен на 5%. Конечно, мы все делаем вид, что прогнозируем это так, как будто этого не произойдет, но в Китае ВВП является входом, а не выходом. Мировой консенсус среди политиков и аналитиков заключается в том, что Китаю придется перейти от своей экспортозависимой модели роста, основанной на инвестициях, к модели, ориентированной на внутреннее потребление. Тем не менее, этот структурный сдвиг по-прежнему сдерживается идеологическими предпочтениями китайского руководства, которое продолжает уделять приоритетное внимание государственным экономическим стратегиям. Тем не менее, есть некоторые признаки ребалансировки. Рост денежной массы стабилизируется, и после трех лет подряд спада сектор недвижимости, возможно, достиг дна. Тем не менее, политические усилия по увеличению потребительских расходов, как правило, ослабевают, способствуя неопределенности в отношении того, как на самом деле будет достигнут этот целевой показатель в 5%.

Между тем в США экономические данные были неоднозначными. Претензии по безработице немного превзошли ожидания, в то время как розничные продажи упали. Тем не менее, продажи контрольной группы - показатель, подаваемый непосредственно в ВВП - росли быстрее, чем прогнозировалось, способствуя скромному росту в Nowcast ФРС Атланты для ВВП Q4, который теперь прогнозирует 3,0% годовых темпов роста. Несмотря на это, данные не вызвали значительной реакции рынка, особенно по сравнению с изобилием в среду, когда акции и облигации выросли после небольшого удара по базовой инфляции.

В частности, опрос ФРС Филадельфии удивил заголовком 44,3, что является самым высоким показателем с апреля 2021 года и самым большим позитивным сюрпризом с 1998 года. Это может отражать связанную с тарифами активность фронтальной загрузки, поскольку такой сюрприз в противном случае трудно рационализировать, но он может быть отражен в январском производственном ISM.

Доходность казначейских облигаций в конечном итоге упала еще на 2-4 базисных пункта. Это последовало за комментариями Уоллера из ФРС, который сказал, что FOMC может снизить ставки больше и раньше, если данные по инфляции будут оставаться благоприятными в ближайшие месяцы. Его замечания бросили немного холодной воды на повествование о том, что ФРС может быть сделано снижение ставок.

А затем был выбор казначейства Трампа, Скотт Бессент, у которого были слушания. Он заявил, что FOMC должен оставаться независимым, поклялся защищать статус доллара США как мировой резервной валюты, ненавидел экспортозависимую модель роста Китая, выступал за наращивание санкций против России и пообещал работать через проход, чтобы снять потолок долга, если этого хочет Трамп. Кроме того, он сказал, что хочет уделить приоритетное внимание продлению Закона о сокращении налогов и рабочих мест, одновременно сокращая дефицит за счет сокращения дискреционных расходов.

Тайлер Дерден

Фри, 01/17/2025 - 12:30

![Sąd: Mieszkanie 191.500 zł. Zachowki 31.916,66 zł i 10.638,88 zł. Obliczenia. Wzory [Przykład]](https://g.infor.pl/p/_files/38265000/podwyzki-38264590.jpg)