Уолл-стрит погибла на своем консенсусе в течение долгого времени, поскольку трейдеры занимают более низкую позицию по отношению к доллару

После победы на этих выходных первого премьер-министра Японии Санаэ Такаичи, который стал шоком для всех, когда Голдман сказал:Практически никто, включая СМИ, политических аналитиков, оппозиционные партии и даже инсайдеров ЛДП, не ожидал такого результата. Никто, возможно... Кроме наших читателей Кому мы сказали, что она станет следующим премьер-министром Японии месяц назад - Bloomberg сообщает, что краткосрочные настроения иены претерпели изменения Самый большой медвежий переоценка с конца июля, поскольку валюта достигает двухмесячного минимума на спотовом рынке.

Как пишет стратег BBG FX Василис Караманис (Vassilis Karamanis), почти определенное повышение про-стимула законодателя Санаэ Такаичи (Sanae Takaichi) в качестве следующего премьер-министра Японии застало трейдеров врасплох, и опционы показывают поспешность, чтобы владеть отрицательным воздействием в иене, несмотря на ее и без того крутое снижение, которое отправило ее на самый низкий уровень с начала августа и, до этого, с февраля.

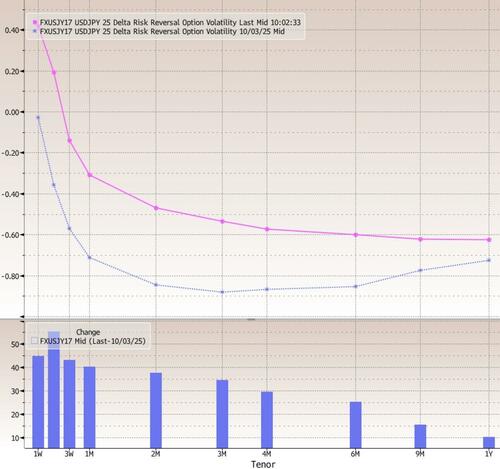

Действительно, недельный разворот риска в ралли USDJPY до 44 б/с, перезвоны через путы, после торговли на 22 б/с в пользу иены ранее. Это третье по медвежьему чтению за последние три года.

Как отмечает Караманис, это общая картина поперечного перекоса пары, которая сегодня утром смещается выше по тенорам. Самый большой шаг наблюдается на двухнедельном теноре, где развороты риска движутся к своему самому сильному закрытию в пользу доллара с сентября 2022 года.

Понятно, что вся Уолл-стрит была ошибочна в своем движении: напомним, не так давно мы показали, что наиболее согласованная торговля на всех торговых площадках Уолл-стрит должна была быть короткой по доллару (и, следовательно, длинной по различным парам G7, таким как иена).

Любимые профессии:

Goldman: короткий доллар

Morgan Stanley: короткий доллар

Deutsche Bank: короткий доллар

JPMorgan: короткий доллар

— zerohedge (@zerohedge) 7 июня 2025 г.

И, конечно же, все эти банки сделали длинную иену центральным элементом своей ненависти к доллару США. До прошлой ночи, когда банк за банком был остановлен.

Джордж Саравелос из Deutsche Bank стал одним из крупнейших долларовых медведей на Уолл-стрит, и теперь его клиенты не слишком довольны этим разворотом. Из его заметки, опубликованной в одночасье:

Мы долго шли к JPY в нашем FX Blueprint, но теперь выходим после результатов выборов ЛДП в эти выходные. Неожиданная победа Санаэ Такаичи вновь вводит слишком большую неопределенность в отношении приоритетов политики Японии и сроков цикла пеших прогулок.

Существует согласие, что инфляция является проблемой в Японии, но неопределенность в отношении того, как она будет решаться, снова растет. Мы подробно писали о растущем политическом признании инфляции как проблемы, которая способствовала потерям ЛДП на недавних выборах. Такаичи признал необходимость уделять приоритетное внимание мерам по борьбе с инфляцией и избежал повторения комментариев с 2024 года о том, что Банк Японии будет неразумно повышать ставки. Но ее позиция по борьбе с инфляцией по-прежнему отличается от традиционных политических предписаний. Мы отмечаем, что она: (1) утверждал, что инфляция в Японии больше подталкивает затраты, чем тянет спрос; (2) подчеркивал фискальное облегчение по денежно-кредитной политике для решения ценового давления и не исключал сокращения налога на потребление; (3) отметил, что правительство и Банк Японии должны тесно сотрудничать; (4) плавал план расширения коалиции, которая могла бы привлечь более голубически настроенные стороны, такие как DPP. В последние месяцы JPY изо всех сил пытался извлечь выгоду из истории пересмотра ставок ФРС, и мы утверждали, что повышение ставок BoJ станет важным катализатором для наблюдения. Повышенная неопределенность в отношении времени следующего похода приводит к отступлению к нейтральной позиции по JPY.

Мы нейтрализуем JPY в ожидании большей ясности.. Мы по-прежнему считаем, что возможное ужесточение BoJ, снижение затрат на хеджирование в долларах США, крайняя недооценка и репатриация в японские активы являются важными факторами среднесрочной перспективы JPY. Но этих позитивных катализаторов, похоже, сейчас не хватает, учитывая политический сюрприз. И без них, Бороться с негативным носителем долгого JPY слишком сложно. Мы будем активно следить за формой кабмина, коалиционными и политическими приоритетами, чтобы руководствоваться нашей точкой зрения JPY.

Вот стратег Goldman FX Майкл Кэхилл закрывает свою короткую сделку по USDJPY с убытком в 230 пунктов (полная нота здесь).

Неожиданная победа Санаэ Такаичи на выборах лидера ЛДП и небольшая премия, уплачиваемая в Форекс, оставляет возможность для быстрого сброса выше в долларах США / юанях + 1,5-2% в первые часы торгов, с повышенным двусторонним риском после этого, поскольку рынки оценивают вероятный политический путь вперед.

В базовом случае наших экономистов мы ожидаем лишь скромных изменений в фискальной позиции и никаких изменений в нашем модальном пути для Банка Японии. Это говорит о том, что большая часть новой премии за фискальный риск должна исчезнуть, подобно возможной оценке рынка после выборов в верхнюю палату и последующей отставки премьер-министра Ишиды. Однако, учитывая, что у власти находится Такаичи, и некоторые из этих вещей, вероятно, займут по крайней мере несколько месяцев, мы ожидаем, что влияние на рынок также будет более устойчивым.

В течение некоторого времени мы доказывали, что глобальные настроения риска должны быть более важными, чем внутренние события для направления иены. Однако, Похоже, что отечественные разработки добавят еще один встречный ветер к производительности Йены. Мы видим риски для наших прогнозов по USD/JPY и закрываем нашу торговую рекомендацию, чтобы сократить USD/JPY (начиная с 147,69).

Вниз по списку: UBS, Citi, MS и т.д. И пингвины поворачиваются. При прочих равных условиях мы бы сказали, что настало время закрыть нашу давнюю короткую позицию по иене, которая сейчас тонет в позитивном ключе, но мы уверены, что валюта будет продолжать падать, по крайней мере, до 160, прежде чем Банк Японии вступит в силу. В конце концов, японский экспорт падает, и экономика находится на грани очередной рецессии, а это означает, что есть только один способ начать ее: сокрушить валюту и отправить акции взлетают, он же старый верный.

Тайлер Дерден

Мон, 10/06/2025 - 11:12