Фьючерсы отскочили от крупнейшего падения 2025 года

Фьючерсы на акции США выше, европейские биржи смешанные, а азиатский рынок красный после худшей сессии года для акций США, поскольку S&P упал на 1,7%, оставив его примерно на 2% ниже своих ATH. По состоянию на 7:30 утра фьючерсы на S&P выросли на 0,5%, а фьючерсы на Nasdaq выросли на 0,4%, причем имена Mag7 смешались, поскольку Nvidia растет на ранних торгах; Рассел опережает, в то время как Фины / Банки предлагают сегодня утром, указывая на восстановление стоимости / циклики. Доходность облигаций на 1-2bps выше с плоским долларом США. Сырьевые товары в основном ниже, а WTI по-прежнему выше 70 долларов за баррель, а драгоценные металлы с небольшой ставкой отправляют золото на новый рекорд. Торговые новости на выходных были приглушены немецкими выборами и войной в Украине. Сегодня основное внимание уделяется показателям региональной активности.

В дорыночной торговле акции Berkshire Hathaway выросли на премаркете на твердых результатах, чему способствовал сильный скачок страхового андеррайтинга. Акции Apple упали после того, как она заявила, что планирует потратить 500 миллиардов долларов внутри страны в течение следующих четырех лет, чтобы нанять работников и нарастить потенциал ИИ. Nvidia и Amazon лидируют среди акций Magnificent Seven в понедельник; NVDA выросла на 1,5% в начале торгов, за несколько дней до выпуска прибыли. Вот некоторые другие известные премаркеты:

- Компания Hawaiian Electric, подписавшая мировое соглашение, связанное с лесными пожарами в Мауи, потеряла 4,6% после публикации отчета о чистых убытках в четвертом квартале.

- Акции Nike выросли на 2,5% после того, как Jefferies обновила акции, чтобы купить их у холдинга, в результате чего компания спортивной одежды позиционируется для сильного восстановления в течение следующих двух лет.

- Акции Twilio выросли на 3,6% по мере того, как Morgan Stanley переходит на избыточный вес с равного веса, заявив, что выполнение программной фирмы должно помочь с ростом и ускорением маржи.

Американские акции выглядели готовыми отступить после резкой распродажи в пятницу, когда Nvidia Corp. выросла в начале торгов. Немецкие акции выросли после того, как консерваторы во главе с Фридрихом Мерцем стали победителями.

Теперь все взоры обращены на то, что может быть самым важным выпуском квартала, когда NVDA сообщает о доходах в среду: результат станет ключевым тестом спроса на акции мегакапиталов США и безумие искусственного интеллекта, которое привело их к росту. С недавними достижениями в области искусственного интеллекта от китайской DeepSeek Nvidia находится под давлением, чтобы предоставить результаты блокбастера, чтобы подтвердить свое лидерство.

«Рынки находятся в режиме ожидания, пока мы не увидим эти доходы от ИИ, поскольку это может стать ключевым поворотным моментом», - сказала в интервью Лора Купер, глава глобальной инвестиционной стратегии в Nuveen.

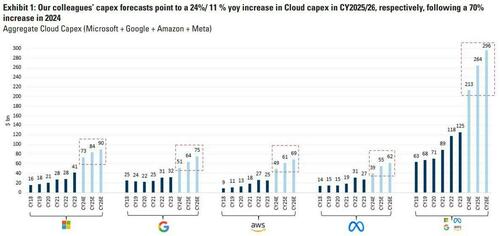

Между тем, снова начинают ползти сомнения в том, что экспоненциальный прогноз хоккейной хоккейной палочки Capex не оправдается. Прошлой ночью мы впервые сообщили, что согласно TD Cown, Microsoft начала отменять аренду значительного объема мощностей дата-центров в США. Это может указывать на то, что гигант Mag7 строит больше вычислений ИИ, чем ему потребуется в долгосрочной перспективе. Крупнейший спонсор OpenAI аннулировал договоры аренды на общую сумму «пару сотен мегаватт» мощностей, пишет в пятницу американская брокерская компания со ссылкой на проверки каналов или запросы с поставщиками цепочек поставок. Microsoft также прекратила конвертацию так называемого заявления о квалификации, которое обычно приводит к формальной аренде. Это были тактические конкуренты, такие как Meta Platforms, которые использовались ранее, когда они решили сократить капитальные расходы.

Потенциальный отказ Microsoft от расходов и строительства центров обработки данных вызывает вопросы о том, является ли компания одним из лидеров среди Big Tech в области ИИ. Растет осторожность в отношении перспектив спроса. Если это так, то большая часть тезиса ИИ, который основан на диаграмме ниже, будет гореть.

Но даже без стирания Mag 7 S&P Индекс 500 отстает от международных конкурентов в 2025 году после нескольких лет отставания, поскольку инвесторы отпугиваются неопределенностью политики президента Трампа по тарифам и их потенциалом для разжигания инфляции. Падение в пятницу привело к снижению S&P 500 на 1,7% за неделю. Тем не менее, ведущие стратеги Уолл-стрит говорят, что низкая производительность вряд ли продлится долго, учитывая устойчивые перспективы экономического роста США.

«Мы видели много инфляционных страхов, но теперь рынки переключают фокус на потенциальные эффекты роста этой политики США», — сказал Купер.

Европейский индекс Stoxx 600 и евро колебались, поскольку первоначальный энтузиазм по поводу выборов в Германии уступил место опасениям, что новому правительству может не хватить консенсуса, чтобы провести столь необходимые экономические реформы, предотвращая рост доходности облигаций и сохраняя ставку в акциях. DAX вырос на 0,9% после того, как лидер консервативной оппозиции Германии Фридрих Мерц заявил, что быстро сформирует новое правительство после того, как он выиграл федеральные выборы. Акции средней капитализации превосходят, с MDAX на 2,8%. Мерц стал победителем на воскресных выборах, но результаты дали его блоку, возглавляемому христианскими демократами, только один четкий путь к власти, и они сталкиваются с интенсивным давлением, чтобы быстро сформировать правительство и заручиться поддержкой мер, включая потенциально более свободные правила заимствования. «Центристские партии не смогли сохранить конституционное большинство, что осложнило перспективы решительной смены фискального режима», — сказал экономист Carmignac Аполлин Менут. «Требуются хитрые политические компромиссы, а также финансовая креативность. " Акции по электрификации, в том числе Siemens Energy AG, ABB Ltd и Schneider Electric SE, упали, поскольку опасения по поводу расходов на центры обработки данных выросли после того, как вышеупомянутый отчет о том, что Microsoft начала отменять аренду для значительного объема мощностей центра обработки данных. Вот некоторые другие известные движущие силы:

- Европейские запасы продуктов питания сильно выросли после того, как Prosus согласился купить Just Eat Takeaway.com за 4,1 млрд евро. Аналитики Bryan Garnier отмечают, что это вызовет спекуляции по поводу предложений для других фирм в секторе.

- Subsea 7 поднялась после объявления о том, что она в принципе согласилась создать объединенную нефтяную компанию с Saipem, с отставанием заказов в размере 43 млрд евро и ожидаемой выручкой около 20 млрд евро. Аналитики позитивны

- Акции немецких компаний, наиболее подверженных надеждам на увеличение государственных расходов в понедельник после того, как консервативный лидер Фридрих Мерц сказал, что он быстро сформирует новое правительство после того, как он выиграл выборы в воскресенье.

- Акции Almirall продвигаются на 8,1%, что является лучшим показателем по общему индексу Мадридской фондовой биржи, после того, как испанская фармацевтическая компания прогнозирует Ebitda на 2025 год в размере от 220 до 240 миллионов евро.

- Акции Bank of Ireland выросли на 3,7% до самого высокого уровня с марта 2023 года после того, как аналитики Barclays заявили, что «сильное» новое руководство фирмы должно повысить оценки прибыли. Аналитики отметили, что прибыль 2H оказалась лучше, чем ожидалось

- Акции группы тренажерного зала Basic-Fit и продуктовых услуг Elior и Sodexo растут, поскольку Citi возобновляет покрытие рейтингами покупок на каждом; акции Elior «не выглядят дорогими», по словам брокера.

- Акции Centrica выросли на 3,6% после того, как Jefferies повысила целевую цену на акции британской энергетической компании, подчеркнув силу своего баланса и возможное увеличение до консенсусных оценок прибыли.

- Акции National Grid выросли на 1,5% после того, как они согласились продать свое подразделение по возобновляемым источникам энергии в США Brookfield Asset Management за 1,7 млрд долларов. Морган Аналитики Stanley говорят, что сделка позволит британскому поставщику электроэнергии реинвестировать

- Naspers является самым большим сопротивлением индексных пунктов на бенчмарке Южной Африки в понедельник, упав на целых 7,8%, больше всего с 7 января, после того, как Prosus согласился купить Just Eat Takeaway.com за 4,1 млрд евро (4,3 млрд долларов).

- Европейские акции B&M упали на 6,8% после того, как ритейлер сократил прогноз по прибыли и заявил, что генеральный директор Алекс Руссо уходит в отставку. Аналитики заявили, что более слабые прогнозы и прошлогодние торговые показатели разочаровывают.

Ранее на сессии азиатские акции упали, взвешенные китайскими технологическими акциями после того, как Трамп усилил ограничения на вторую по величине экономику в мире. Индекс MSCI Asia Pacific ex-Japan Index снизился на 0,7%, при этом TSMC, Tencent и Alibaba стали одними из самых больших препятствий. Японские рынки были закрыты для отдыха. Настроения были осторожными после того, как акции США провели свою худшую сессию в 2025 году после более слабых, чем ожидалось, экономических данных и всплеска долгосрочных взглядов потребителей на инфляцию. Китайско-американская напряженность снова вспыхнула, поскольку Трамп решил ограничить китайские инвестиции в некоторые стратегические отрасли США, а также рассмотрел дальнейшие ограничения на исходящие инвестиции в Пекин в секторах, включая полупроводники и искусственный интеллект. Распродажа в Индии продолжилась в понедельник, даже когда Citigroup Inc. повысила акции страны до избыточного веса с нейтрального, сославшись на «значимый рост» на фоне менее требовательных оценок. В Южной Корее главный финансовый регулятор заявил, что страна находится на пути к снятию запрета на короткие продажи всех акций, начиная с 31 марта. Полное возобновление коротких продаж необходимо, и любое влияние на рынок, как ожидается, будет кратковременным, сказал высокопоставленный чиновник на регулярном брифинге.

Ожидается, что лидеры Китая соберутся на следующей неделе на ежегодном законодательном собрании, чтобы изложить экономический план на этот год. Инвесторы внимательно следят за любыми новыми мерами стимулирования. Акции в Гонконге и материковом Китае упали после колебаний в начале торгов.

В иностранной валюте EUR/USD поднялся на 0,7% до 1,0528, только чтобы сократить продвижение и торговлю около 1,0470; валюта была поддержана после того, как Азия открылась на облегчение, что крайне правая партия Германии не оказалась намного сильнее, чем ожидалось. Индекс Bloomberg Dollar Spot упал на 0,4% до самого низкого уровня с декабря, прежде чем стереть убытки. USD/JPY отменяет потери на 0,3% до 149,66; ранее он упал до 148,85, самого низкого уровня с 3 декабря.

В ставках, США Кривая казначейства скромна; Казначейские облигации торгуются дешевле по всей кривой, раскручивая часть крутых пятничных прибылей от полета к качеству. Фронт-энд приводит к убыткам с доходностью ~2 млрд. в день, опередив 2-летний аукцион купюр на 29 млрд. долларов в 1 вечер по нью-йоркскому времени. 10-летняя доходность повышается на 1bp до 4,44%, в то время как двухлетняя доходность на 2bps выше на 4,22%; немецкий аналог более чем на 2 л.с. выше; Кривая казначейства 2s10s льстит ~ 1bp в день. Доходность в Германии выросла после того, как лидер консервативной оппозиции Фридрих Мерц заявил, что он быстро сформирует новое правительство после победы на федеральных выборах в воскресенье. На этой неделе аукционный цикл Казначейства начинается с 2-летних банкнот и включает в себя $70 млрд 5-летний и $44 млрд. 7-летние распродажи во вторник и среду. Доходность WI за 2 года около 4,21% близка к результату января 4,211%, что на 0,1 п.п. выше, чем у WI в крайний срок торгов.

В сырьевых товарах цены на нефть растут, при этом WTI растет на 0,1% до $70,50 за баррель. Спотовое золото поднимается на 7 долларов до 2943 долларов за унцию. Биткойн стоит около 95 700 долларов.

Глядя на сегодняшний календарь, мы получаем январский индекс национальной активности ФРС Чикаго (8:30 утра) и февральскую производственную активность ФРС Далласа (10:30 утра). Спикер ФРС пустует в понедельник. Logan, Barr, Barkin, Bostic, Schmid, Bowman, Hammack, Harker и Goolsbee должны появиться на этой неделе.

Рыночный снимок

- Фьючерсы S&P 500 выросли на 0,6% до 6 067,25

- STOXX Europe 600 вырос на 0,2% до 554,98

- MXAP снизился на 0,4% до 189,89

- MXAPJ снизился на 0,5% до 598,74

- Nikkei вырос на 0,3% до 38 776,94

- Топикс мало изменился на 2736,53

- Индекс Хан Сена снизился на 0,6% до 23 341,61

- Shanghai Composite снизился на 0,2% до 3 373,03

- Sensex снизился на 1,1% до 74 501,68

- Австралия S&P/ASX 200 вырос на 0,1% до 8 308,24

- Kospi снизился на 0,4% до 2 645,27

- Доходность 10Y в Германии незначительно изменилась на 2,47%

- Евро вырос на 0,1% до $1,0473

- Brent Futures немного изменился на $74,48 за баррель

- Золото подорожало на 0,3% до $2 945,02

- Индекс доллара США незначительно изменился на 106,57

Лучшие ночные новости

- Microsoft отменяет аренду центров обработки данных ИИ в США, что потенциально отражает опасения по поводу избыточных мощностей. Чжоу

- Президент Трамп сказал, что Илон Маск делает хорошую работу, но он хотел бы, чтобы он стал более агрессивным. Отдельно сообщалось, что Илон Маск сказал, что в соответствии с инструкциями президента Трампа все федеральные служащие получат электронное письмо с просьбой понять, что они сделали на прошлой неделе, и неспособность ответить будет воспринята как отставка, хотя некоторые агентства сказали работникам не отвечать на электронную почту Маска.

- Трамп номинирован Генерал-лейтенант ВВС Дэн Кейн в качестве следующего председателя Объединенного комитета начальников штабов, чтобы заменить генерала Брауна, в то время как несколько других высокопоставленных чиновников были также вытеснены.

- Трамп сказал руководителям фармацевтических компаний во время встречи, чтобы перенести их производство в США.

- Рейс American Airlines (AAL) был перенаправлен в Рим из-за «возможных проблем безопасности». Однако позже авиакомпания заявила, что рейс благополучно приземлился в Риме, и после проверки правоохранительными органами было разрешено вернуться с вопросом, который был признан недостоверным: ABC

- Экономика Америки в большей степени зависит от богатых, чем когда-либо прежде (на долю 10% самых богатых или домохозяйств, зарабатывающих $250 тыс. в год, приходится почти 50% всех расходов, что является самым высоким показателем за всю историю). WSJ

- По сообщениям, американские республиканские системы электронной почты были взломаны китайскими хакерами летом 2024 года; хакеры, как сообщается, имели доступ «в течение нескольких месяцев».

- Сенатор США Уоррен, как сообщается, направил письмо в Белый дом с просьбой о том, чтобы кандидат Трампа на пост председателя Совета экономических советников взял на себя обязательства по независимости ФРС через FT.

- Apple планирует инвестировать 500 миллиардов долларов в США в течение следующих четырех лет, наняв 20 000 рабочих и производя серверы искусственного интеллекта, поскольку она стремится освободиться от тарифов Дональда Трампа на товары, импортируемые из Китая. AAPL -1% в пре. BBG

- Официальный представитель ЕЦБ Пьер Вунш предупреждает, что еврозона рискует «прогуляться» в сторону слишком большого снижения процентных ставок и должна быть готова к тому, чтобы в ближайшее время прекратить снижение расходов на добычу. FT

- Европа планирует направить на Украину около 30 тысяч своих военнослужащих, чтобы помочь сохранить любое мирное соглашение, заключенное с Россией, с США, предоставляющими техническую, логистическую и военную поддержку. ABC

- Консервативный лидер Германии Фридрих Мерц заявил, что намерен сформировать коалиционное правительство в течение двух месяцев после победы на вчерашних выборах. Он пообещал укрепить Европу, чтобы добиться «реальной независимости» от США. DAX вырос, а евро укрепился. BBG

- Местные органы власти Китая намерены выпустить беспрецедентные облигации на сумму $233 млрд в первые два месяца года, что усугубит сжатие денежной наличности в финансовой системе. BBG

- Alibaba планирует инвестировать не менее 380 млрд юаней ($52,44 млрд) в облачные вычисления и инфраструктуру искусственного интеллекта в течение следующих трех лет. РТС

- Австралийский казначей Джим Чалмерс встретится со Скоттом Бессентом в Вашингтоне, чтобы добиться освобождения от пошлин. Министр промышленности Южной Кореи посетит США на этой неделе для торговых переговоров. BBG

Выборы в Германии

- Прелим. Итоговые результатыCDU/CSU 28,6%, AFD 20,8%, SPD 16,4%, Greens 11,6%, Die Linke 8,8%, FDP 4,3% и BSW 4,9%. Это означает, что СвДП и БМП находятся ниже 5%-го порога и как таковые не войдут в Бундестаг. Однако, учитывая их близость к 5-процентному порогу, BSW почти наверняка потребует пересчета.

- Распределение местCDU/CSU 208, AfD 152, SPD 120, Greens 85, Die Linke 64, SSW 1.

- Лидер ХДС/ХСС Мерц станет следующим канцлером. Однако для управления им потребуется сформировать коалицию. Математически варианты являются Великая коалиция (CDU/CSU + SPD), Кения (CDU/CSU + SPD + Greens) или коалиция Midnight (CDU/CSU + AfD). Вайдель из АдГ заявила, что она открыта для участия в коалиции, но ожидаемый канцлер Мерц ясно дал понять, что это не вариант.

- Наиболее вероятным исходом является Великая коалиция.СДПГ ясно дала понять, что Мерц должен начать переговоры и найти компромиссы для работы правительства.

- Соответственно, Результаты означают, что АдГ и Die Linke командуют блокирующим меньшинством с более чем 1/3 мест Бундестага.. Это означает, что перспективы реформы долгового тормоза уменьшаются, хотя Мерц, возможно, сможет договориться с Die Linke о реформе, не связанной с расходами на оборону.

- Мерц заявил, что в идеале хочет, чтобы на Пасху действовало правительство. Однако это маловероятно, учитывая напряженную избирательную кампанию и политические разногласия между группами.

Тарифы/торговля

- Команда президента США Трампа, как сообщается, подталкивает Мексику к тарифам на китайский импорт, сообщает Bloomberg.

- Президент США Трамп заявил в пятницу, что США установят новые правила, чтобы помешать американским фирмам инвестировать в отрасли, которые продвигают национальную военно-гражданскую стратегию слияния Китая, и установят правила, чтобы помешать людям, связанным с Китаем, покупать критически важные американские предприятия и активы.

- Председатель Палаты представителей США Джордан раскритиковал штрафы ЕС и европейские налоги на американские компании и хочет, чтобы Европейская комиссия проинформировала судебный комитет к 10 марта и призвала антимонопольного руководителя ЕС Риберу уточнить правила обуздания крупных технологий.

Более подробный взгляд на мировые рынки любезно предоставлен Newsquawk

Акции APAC начали неделю, смешанную после распродажи в прошлую пятницу на Уолл-Стрит и на фоне спокойной торговли с японскими рынками, закрытыми на День рождения императора, в то время как участники также размышляли о результатах воскресных выборов в Германии. Торговля ASX 200 практически не изменилась, поскольку рост финансовых показателей и защитные меры были уравновешены потерями в технологическом и сырьевом секторах, в то время как был еще один поток обновлений доходов. KOSPI отставал на фоне текущих экономических проблем и в преддверии завтрашнего решения по ставке BoK. Hang Seng и Shanghai Comp были неуклюжими, но в конечном итоге оказались под давлением на фоне продолжающихся трений, связанных с торговлей, поскольку США, как говорят, подталкивают Мексику к тарифам на китайский импорт. Тем не менее, были некоторые обнадеживающие сообщения о том, что китайские государственные девелоперы снова начали покупать землю с премией, в то время как сельскохозяйственные запасы были поддержаны после того, как Китай пообещал углубить сельские реформы в рамках усилий по оживлению сельскохозяйственного сектора и укреплению продовольственной безопасности в ежегодном плане сельской политики Государственного совета.

Лучшие азиатские новости

- Китай намерен и далее углублять реформы в сельской местности и содействовать оживлению сельских районов, в то время как он будет контролировать и регулировать производственные мощности свиноводства, чтобы способствовать устойчивому росту и консолидировать результаты расширения сои, а также расширить производство рапса и арахиса. Китай намерен улучшить систему вознаграждения и субсидий для крупных зернопроизводящих стран и увеличить поддержку крупных зернопроизводящих стран. Кроме того, Китай будет поддерживать развитие умного сельского хозяйства и расширять сценарии применения технологий, в то время как он будет использовать денежные инструменты для поощрения финансовых учреждений к увеличению финансирования для оживления сельских районов и будет поощрять местные органы власти к пилотным субсидиям по специальным кредитам на выращивание зерновых и масличных культур.

- Китайские государственные девелоперы снова начинают покупать землю с премией после того, как правительство ослабило ограничения на цены на жилье, поскольку количество земельных участков, которые были проданы по крайней мере на 20% выше запрашиваемой цены, составило 37% сделок в этом году против 14% в прошлом году, согласно анализу Bloomberg сделок на сумму не менее 1 млрд юаней.

- Прибыль Shein упала в новом вызове давно запланированному лондонскому IPO с его чистой прибылью в 2024 году почти на 40% до 1 млрд долларов США, хотя продажи FY выросли на 19% до 38 млрд долларов США.

- В сообщении в пятницу говорилось, что в Китае обнаружен новый коронавирус с пандемическим потенциалом, сообщает Daily Mail.

- Великобритания и Индия возобновляют торговые переговоры в попытке увеличить инвестиционные возможности.

- Ожидается, что целевой показатель экономического роста Китая будет установлен на уровне около 5% на 2025 год, в то время как ИПЦ, вероятно, будет снижен до 2% с 3% в предыдущие годы, согласно отчету в Securities Times в понедельник со ссылкой на экономистов.

Европейские биржи (STOXX 600 + 0,2%) открылись скромно, и по обе стороны от неизменной отметки (хотя DAX 40 обогнал после выборов в Германии). При открытии наличных было замечено некоторое давление, которое затем усилилось в следующий час. После этого был замечен значительный отскок по всему комплексу; в его нынешнем виде индексы в основном более твердые. Европейские секторы смешанные, первоначально открытые с узкой широтой, но производительность теперь разнообразна. Коммунальные предприятия занимают первое место после выборов в Германии; Мерц ранее выступал за их использование. Сила немецких автомобильных имен подняла сектор автомобилей. Базовые ресурсы пока отстают, а недостаток объясняется в основном более низкими ценами на металлы.

Лучшие европейские новости

- ЕЦБ заявил, что к денежно-кредитной политике следует подходить с осторожностью, учитывая нынешнюю чрезвычайную неопределенность.

- Виллерой из ЕЦБ подтвердил, что депозитная ставка ЕЦБ должна быть на уровне 2% к предстоящему лету, и сказал, что консолидация европейского банковского сектора в целом необходима для того, чтобы европейские банки могли конкурировать на глобальном уровне.

- Вунш из ЕЦБ сказал, что ЕЦБ сталкивается с риском «прогулок во сне» из-за слишком большого количества сокращений ставок, в то время как он чувствует себя «относительно комфортно» с ожиданием рынка 2% ставок к концу года «дать или взять 50 базисных пунктов».

- Премьер-министр Венгрии Орбан заявил, что они должны освободить матерей двух или трех детей от подоходного налога и что это будет огромным расходом, но дефицит бюджета и долг будут сокращаться, в то время как правительство готово ввести ограничения на цены на продукты питания, если переговоры с розничными торговцами о сохранении цен под контролем не увенчаются успехом.

- Крупнейшие центристские партии Австрии в парламенте намекнули, что они находятся на грани согласия сформировать коалиционное правительство, которое объединит консерваторов, социалистов и либералов Австрии, в то время как оно откажется от ультраправой Партии свободы, которая выиграла выборы в сентябре.

- Представитель ЕС по иностранным делам Каллас встретится с министром иностранных дел США Рубио во вторник в США.

Форекс

- DXY немного ниже и показывает разную производительность по сравнению со сверстниками (более мягкие по сравнению с циклическими, более твердые по сравнению с гаванями) после шаткой производительности на прошлой неделе, поскольку мягкие точки данных США действовали как тормоз для доллара США. Что касается новостного потока США, тарифные действия остаются в фокусе внимания команды президента Трампа, которая, как сообщается, подталкивает Мексику к тарифам на китайский импорт. Тем не менее, рынки придают больший вес сроку тарифного отчета 1 апреля. Геополитические заголовки по-прежнему в изобилии с президентом Украины Зеленским, заявляющим, что он готов покинуть президентство, если это означает мир на Украине, который, по его словам, может быть обменен на членство в НАТО. DXY напечатал свежий минимум YTD в ночь на 106,12, но с тех пор вернулся в пятничный диапазон 106,38-106,74.

- EUR является одним из лучших игроков среди майоров после выборов в Германии, которые, вероятно, создадут Большую коалицию (CDU / CSU + SPD). Тем не менее, такой результат обеспечил бы незначительное большинство в 328/630 мест (316 требуемых) и не соответствовал бы большинству в две трети Бундестага, которое требуется для конституционной реформы (т.е. долгового тормоза). EUR/USD поднялся до 1,0528, но перестал стесняться пика 1,0532 YTD и в конечном итоге вернулся к ручке 1,04.

- USD/JPY напечатал свежий минимум YTD за ночь на уровне 148,85, но с тех пор боролся за направление на фоне смешанного аппетита к риску в Азии и отсутствия японских участников для отдыха. С другой стороны, основное внимание уделяется потенциальному возвращению 150 к росту.

- GBP немного прочнее против доллара США, но мягче против евро. Новостной поток в Великобритании был легким в выходные дни, и календарь данных на этой неделе в Великобритании особенно тонкий. Тем не менее, сегодня мы видим загруженный список спикеров с Lombardelli, Pill, Ramsden и Dhingra BoE, которые должны выступить на конференции BEAR Банка Англии 2025 года. Кабель напечатал свежий пик YTD за ночь на уровне 1,2690, прежде чем исчезнуть с ног на голову.

- Антиподы оба немного выше, и не так много в пути свежих новостей для любой из стран-антиподов. Тем не менее, некоторая позитивность, окружающая китайский рынок недвижимости в одночасье (китайские государственные девелоперы снова начинают покупать землю с премией), помогает поддержать настроения.

- PBoC установил среднюю точку USD/CNY на уровне 7.1717 против exp. 7.2495 (предыдущее 7.1696).

- Ребалансировка Barclays FX Month-End: Слабая покупка USD против большинства конкурентов, с умеренным сигналом против EUR и JPY, через Barclays.

Фиксированный доход

- Бунды открылись ниже на несколько клещей после первоначальных результатов выборов, прежде чем упасть дальше до 132,02 минимума на подтверждение того, что ХДС / ХСС является крупнейшей партией и что как СвДП, так и БСВ не будут соответствовать 5-процентному порогу для входа в Бундестаг. Тем не менее, по мере того, как были опубликованы полные результаты (хотя, вероятно, при условии пересчета, учитывая, что BSW вступает чуть ниже 5%-го порога), в Бундах наблюдался отскок, в результате чего они поднялись с вышеупомянутого минимума до пика 132,50 и ненадолго вернулись в зеленый цвет на сессии. Бычий шаг, вероятно, обусловлен присутствием блокирующего меньшинства в Бундестаге, а также позицией ХСС против участия «зеленых» в коалиции.

- В одночасье UST были немного тише из-за отсутствия торговли наличными, поскольку Япония была в отпуске. Вообще говоря, UST следовали за своим немецким коллегой, но с более сдержанными величинами и ранним утренним отскоком, происходящим не в той же степени, с UST, остающимися только в красном во все времена. Предстоящий пакет озаглавлен предложением в размере 69 млрд долларов США в 2 года, потенциальными замечаниями со стороны Barr (голосователя) ФРС и январским индексом национальной активности. В настоящее время UST находятся в красном цвете в узкой полосе от 109-16 до 109-21.

- Потолки направлены в соответствии с Бундами, хотя, как и с UST, величины немного более сдержанны, но с потолками, которым удается держать в зелени большую часть утра. Проскочил выше на 18 клещей с 92,41 пятницы, так как упомянутый отскок в Бундах уже произошел к тому времени, когда Gilts начал торговлю, а затем расширился до пика 92,66. С тех пор эталон вернулся к уровням открытия, поскольку мы ожидаем комментариев от многочисленных докладчиков Банка Англии на сегодняшней конференции «Будущее баланса Центрального банка». Таблетки, Рамсден, Ломбарделли и Дхингра все запланированы в разных точках сегодня.

- ЕС продает EUR 2,392 млрд против exp. EUR 2,5 млрд 2,875% 2027 и EUR 2,277 млрд против exp. EUR 2,5 млрд 3,375% 2039

Товары

- Сырая нефть становится немного более твердой после того, как она первоначально торговалась боком большую часть утра; трейдеры ожидают дальнейших обновлений по геополитике и ОПЕК+ на фоне растущего шума, связанного с потенциальной задержкой отмены добровольных сокращений. В недавней торговле в комплексе наблюдался небольшой отскок, в результате чего Brent May достиг максимума в 74,35 доллара США за баррель.

- Смешанная торговля драгоценными металлами с небольшим количеством новых фундаментальных факторов, стимулирующих ценовые действия, хотя спотовый палладий может отстать после того, как президент США Трамп повторил автотариф, установленный 2 апреля. Спотовое золото находится в USD 2 921,47-2 948,88 / унция Диапазон пока что.

- Подавление торговли базовыми металлами по мере восстановления доллара и ослабления настроений в начале европейской торговли, при этом проблемы с тарифами все еще остаются на заднем плане на фоне повторений Трампа. Цены были ошеломлены обнадеживающими сообщениями, в которых говорилось, что китайские государственные девелоперы снова начинают покупать землю с премией. Медь 3M LME торгуется по обе стороны от 9500 долларов США / т в текущем диапазоне 9 485,00-9 558,55 долларов США / т.

- Министр нефти Ирака заявил, что все процедуры по экспорту нефти через турецкий трубопровод завершены. Отдельно сообщалось, что власти Курдистана договорились с федеральным министерством нефти о возобновлении экспорта курдской нефти на основе имеющихся объемов, в то время как Ирак опроверг сообщения о том, что он столкнется с санкциями США, если экспорт нефти из Курдистана не будет возобновлен. Кроме того, Ирак получит 185 тыс. баррелей нефти из Курдистана на первом этапе после возобновления экспорта нефти.

- Министр нефти Ирака заявил, что через неделю возобновится экспорт из курдского региона. Министр нефти Ирака заявил, что они ждут одобрения Турции, чтобы возобновить поток нефти, курдский экспорт нефти «надеюсь, будет готов» через два дня. Министр нефти Ирака, когда его спросили, повлияет ли возобновление экспорта курдской нефти на соблюдение Ираком ОПЕК, сказал, что Ирак привержен решению ОПЕК+ и экспортирует объемы под контролем министерства.

- Прогнозы BofA Нефть марки Brent в 2025 году составит 75 долларов США за баррель, а в 2026 году - 73 доллара США за баррель, при этом рынки нефти в ближайшей перспективе останутся в умеренном профиците. В среднесрочной перспективе Brent должен составлять в среднем от 60 до 80 долларов за баррель, чтобы сохранить баланс на мировом нефтяном рынке.

Геополитика: Ближний Восток

- Израиль направил танки на Западный берег и приказал войскам подготовиться к длительному пребыванию.

- Премьер-министр Израиля Офис Нетаньяху заявил, что освобождение палестинских заключенных, запланированное на субботу, было отложено до тех пор, пока освобождение следующих заложников не будет обеспечено с задержкой из-за неоднократных нарушений ХАМАСа.

- ХАМАС решительно осудил решение Израиля отложить освобождение палестинских заключенных и заявил, что заявление Израиля о том, что церемония передачи является унизительной, является ложным и предлогом для уклонения от своих обязательств.

Геополитика: Украина

- Заместитель премьер-министра Украины заявил, что украинская и американская команды находятся на заключительных этапах переговоров по сделке по полезным ископаемым; Киев стремится завершить сделку «как можно быстрее».

- В Кремле заявили, что приветствуют и поддерживают новый подход США к диалогу с Россией. Президент России Путин должен сегодня утром сделать международный телефонный звонок в рамках информирования партнеров о переговорах с США. Дальнейшие переговоры с США на этой неделе будут сосредоточены на устранении раздражителей в связях и на работе иностранных миссий. Не вижу возможности возобновить диалог с Европой в данный момент, европейский подход контрастирует с усилиями, которые мы прилагаем с США.

- Президент Украины Зеленский заявил, что вопрос о выборах является шагом для оказания давления на Украину, и он готов уйти с поста президента, если это означает мир на Украине, который, по его словам, может быть обменен на членство в НАТО, но также прокомментировал, что ложные заявления о его рейтингах и объеме помощи США являются опасными шагами по ослаблению Украины. Зеленский заявил, что рассматривает Турцию как важного гаранта безопасности для Украины и что Украина работает над альтернативами системы Patriot, а также отметил, что если США заключат сделку с Россией, чтобы положить конец войне, она не будет успешной, если Украина не согласится на ее условия.

- Президент Украины Зеленский прокомментировал, что украинско-американские переговоры по сделке по полезным ископаемым продвигаются вперед, и все в порядке, в то время как он заявил, что проект сделки по полезным ископаемым сказал, что Украина должна вернуть два доллара за каждый доллар помощи, поставляемой США. Зеленский также сказал, что цифра в 500 миллиардов долларов больше не рассматривается в сделке по полезным ископаемым, и главный помощник сказал, что у него был конструктивный новый раунд переговоров с США по сделке по полезным ископаемым. Также сообщалось, что США могут сократить доступ Украины к интернет-сервисам Starlink из-за полезных ископаемых, сообщает Reuters.

- Президент США Дональд Трамп заявил, что, по его мнению, США довольно близки к сделке с Украиной по добыче полезных ископаемых и что они просят у Украины редкоземельных элементов, нефти и всего, что они могут получить, чтобы окупить деньги, которые США вложили в Украину.

- Госсекретарь США Рубио заявил министру иностранных дел Украины, что президент США Трамп по-прежнему привержен прекращению конфликта на Украине.

- США Министр финансов Бессент сказал, что экономическое партнерство защитит украинский народ и американских налогоплательщиков, в то время как он добавил, что экономическое будущее Украины в мире может быть более процветающим, чем в любой другой момент. Кроме того, Бессент сказал, что предложение о партнерстве между США и Украиной заключается в том, чтобы доходы, полученные Украиной от природных ресурсов, инфраструктуры и активов, были выделены в фонд, ориентированный на реконструкцию, который будет иметь права США на инвестиции. Бессент выразил надежду, когда его спросили, ожидает ли он сделки с Украиной на этой неделе.

- Посланник президента США Трампа Виткофф сказал, что есть ожидание, что американские компании могут вести бизнес в России, если мирное соглашение будет достигнуто в российско-украинской войне, сообщает CBS News.

- Президент России Путин созвал заседание своего совета безопасности и обсудил на встрече отношения с постсоветскими государствами, в то время как получил отчеты от последних поездок министра иностранных дел Лаврова и попросил его поделиться ими с советом безопасности, сообщает ТАСС. Также сообщалось, что Путин заявил, что усиление вооруженных сил России и удовлетворение потребностей войск, воюющих на Украине, являются ключевыми стратегическими приоритетами.

- Глава российского суверенного фонда Дмитриев назначен специальным посланником по международному экономическому сотрудничеству, и его новый мандат будет включать связи с США.

- Замглавы МИД РФ Рябков заявил, что вторая встреча представителей России и США запланирована на ближайшие две недели и заявил, что Россия проведет переговоры с США для устранения раздражителей в двусторонних отношениях, сообщает ТАСС. Отдельно сообщалось, что Рябков заявил, что США хотят добиться быстрого прекращения огня на Украине без долгосрочного урегулирования, и объяснил США, что единоличное прекращение огня на Украине неприемлемо, сообщает РИА Новости.

- Министр иностранных дел России Лавров посетит Турцию в понедельник и обсудит ряд тем, включая недавние переговоры США по войне на Украине и то, как Турция может внести свой вклад.

- Министерство обороны России заявило, что российские войска захватили деревни Улакли и Новоандривка в Донецкой области на востоке Украины.

- Премьер-министр Греции Мицотакис сказал президенту Украины Зеленскому, что Украина должна определиться с мирными рамками, приемлемыми для нее, и ничего не может быть решено без Украины.

- Президент Польши Дуда сказал президенту США Трампу, что присутствие США в Польше и Центральной Европе должно быть усилено.

- Премьер-министр Венгрии Орбан заявил, что Украина никогда не будет членом ЕС против интересов Венгрии.

- Президент Совета ЕС Коста заявил, что 6 марта они решили созвать специальный Европейский совет по Украине и обороне ЕС.

- Премьер-министр Канады Трюдо и президент США Трамп выступили в субботу, где обсудили войну на Украине и борьбу с фентанилом.

- Два дипломата ЕС заявили, что министры иностранных дел ЕС одобряют 16-й пакет санкций против России.

Геополитика: другой

- Китай выступил в защиту своих недавних военно-морских учений в Тасмановом море и обвинил Австралию в «умышленном раздувании» военных учений.

Календарь событий США

- 08:30: Январь Chicago Fed Nat Activity Index, est. -0.05, prior 0.15

- 10:30: Feb. Dallas Fed Manf. Activity, est. 6.4, prior 14.1

Джим Рид из DB завершил ночную обертку

Пять лет назад мировые рынки впервые начали паниковать после выходных, когда из него вышли 11 итальянских городов. Пять лет спустя у нас была мини-паника в пятницу, когда внимание было сосредоточено на отчете ранее на этой неделе о новом открытии коронавируса у летучих мышей из печально известной лаборатории Ухань, с аналогичными свойствами Covid-19. Обратите внимание, что до сих пор не сообщалось о передаче вируса людям, и, насколько нам известно, он был обнаружен в лаборатории. Мы все, вероятно, параноики, и трудно понять, что делать с этой информацией, но перед выходными, и с воспоминаниями о тех судьбоносных выходных пять лет назад, неудивительно, что люди хотели облегчиться с S&P 500 (-1,71%), видя его худший день в году. В овернайт-трейдинге фьючерсы на акции США выросли по сравнению с фьючерсами на S&P 500 (+0,49%) и NASDAQ 100 (+0,48%).

Если говорить о пяти годах, будут ли выборы в Германии рассматриваться как ключевой момент, когда мы оглянемся на них в 2030 году? Для финансовых рынков состав Бундестага, вероятно, был столь же важен, как и общие результаты, и одно из выводов заключается в том, что правоцентристские и левоцентристские партии должны иметь достаточно мест для формирования большой коалиции, но в целом центристским партиям не хватает большинства в две трети. Последнее означает, что любые будущие реформы по списанию долгов будут сложными и могут потребовать компромисса и торговли лошадьми.

С точки зрения деталей, предварительные результаты подтверждают победу правоцентристского ХДС/ХСС (28,6%), за которым следуют крайне правые АдГ (20,8%), левоцентристская СДПГ (16,4%) и Зеленые (11,6%). Из более мелких партий левый Линке (8,8%) с комфортом превысил порог 5%, но крайне левый БСВ (4,97%) и либеральный СвДП (4,3%) не дотянули. Узкий отказ BSW войти в Бундестаг, который может занять несколько дней, чтобы быть окончательно подтвержденным, имеет важные последствия выхода из ХДС / ХСС и СДПГ в сочетании с прогнозируемыми 52% мест. Это оставляет большую коалицию как наиболее вероятный результат, являясь единственным вариантом избежать необходимости трехпартийной коалиции, учитывая, что основные партии исключили партнерство с АдГ. Наши немецкие экономисты видят перспективу двухпартийной коалиции во главе с сильным ХДС/ХСС как позитивную для корпоративного сектора Германии, обещая меньше политического тупика и неопределенности, чем при уходящем правительстве. Смотрите их реакцию здесь для большего. Ранее лидер ХДС Мерц заявил, что хочет сформировать коалицию в течение следующих двух месяцев.

Несмотря на то, что результат может снизить риски особенно нестабильных переговоров по коалиции, он по-прежнему подтверждает продолжающуюся тенденцию к анти-истеблишменту, которая была видна как в Германии, так и в Европе в целом. Это самый низкий показатель за всю историю голосования двух основных партий, несмотря на то, что явка (82,5%) была самой высокой с 1990 года. И это оставляет центристским партиям не хватает конституционного большинства в 2/3 голосов, а ХДС/ХСС, СДПГ и «зеленые» вместе занимают чуть менее 66% мест. Это означает, что любая реформа долгового тормоза, в том числе для расходов на оборону, потребует поддержки одной из сторон. Возможно, это и не невозможно, но это потребует значительных политических компромиссов.

После напряженной ночи европейские активы набрали обороты, поскольку появилась вероятность простого большинства «большой коалиции». Евро сегодня утром торгуется на +0,58% выше, достигнув месячного максимума по отношению к доллару, в то время как фьючерсы на DAX выросли чуть более чем на процент, а фьючерсы на Euro Stoxx 50 - на +0,46% выше. Тем временем фьючерсы на Bund немного снижаются, когда я проверяю свои экраны.

С точки зрения других событий на этой неделе, прибыль Nvidia в среду может стать крупнейшим двигателем рынков. Интересно, что из 62 аналитиков, которые покрывают акции Bloomberg, 56 имеют рейтинг покупки только с одной продажей. В настоящее время DB является одним из 5 с рейтингом владения. Вне этой инфляции занимает центральное место с основным PCE США, немецким, французским и итальянским флэш-ИПЦ, а также токийским ИПЦ в пятницу с эквивалентом Испании, выходящим в четверг. Что касается остальных основных глобальных релизов, опрос Ifo в Германии сегодня будет менее актуальным, учитывая выборы, но позже у нас есть производственные опросы ФРС Далласа и Чикаго. Завтра состоится релиз потребительского доверия Conference Board, который будет интересен после слабого пятничного эквивалента UoM. В среду в США ожидаются новые продажи жилья и инфляция в Австралии. В четверг на январском заседании ЕЦБ будут представлены данные о личных доходах и расходах США, а также опрос потребительских ожиданий ЕЦБ. В течение недели также много спикеров центральных банков, в том числе на встрече руководителей центральных банков и министров финансов G20 в Кейптауне в среду и четверг. Вы можете увидеть основные из них в дневном календаре в конце, как обычно, вместе с ключевыми релизами о доходах и всеми другими данными.

Перейти к основным данным США на этой неделе. По мнению наших экономистов, личный доход в пятницу (+0,3% прогноз против +0,4% ранее) и потребление (+0,2% против +0,7%), вероятно, будут более мягкими из-за лесных пожаров в Лос-Анджелесе и плохой погоды с более высоким, но не таким экстремальным, как ИПЦ из-за более мягких субкомпонентов в последующем ИПЦ. Это понизит значение YoY-ядра PCE на две десятых до 2,6%. В завтрашнем потребительском доверии в США серия рабочих мест, которые трудно получить, важна как хороший показатель уровня безработицы. В четверг наши экономисты обращают внимание на ситуацию в округе Колумбия, в частности, учитывая сообщения прессы о существенных увольнениях федерального правительства. Около 20% из 2,3 млн федеральных государственных служащих живут в Вашингтоне, Мэриленде и Вирджинии. По нашим оценкам, с тех пор, как администрация Трампа вступила в должность, было примерно 14 тыс. потенциальных увольнений с 12 тыс. до разрешения судебных дел. Очевидно, что это только в течение первого месяца.

Азиатские фондовые рынки в основном дрейфуют ниже в начале недели после значительных потерь на Уолл-стрит. По всему региону также снизился Hang Seng (-0,64%) с Shanghai Composite (-0,26%). КОСПИ -0,42% ниже. Японские рынки закрыты для государственных праздников, но фьючерсы на Nikkei примерно на один процент ниже. С этим праздником в Азии нет казначейских облигаций.

Теперь ситуация изменилась на прошлой неделе, которая закончилась большим риском в пятницу после более стагфляционных данных США наряду с некоторыми опасениями по поводу сообщений о новом коронавирусе, обнаруженном исследователями в Уханском институте вирусологии. В пятую годовщину первого спада на рынках, связанных с Covid, это последнее, что хотел услышать мир. Согласно журналу, который сообщил эту историю еще в прошлую пятницу, вирус еще не был обнаружен у людей, но этот вирус, по-видимому, проникает в клетки, используя тот же шлюз, что и вирус Covid-19. Это немного напугало рынки и привело к всплеску запасов вакцин, таких как Moderna (+5,34% в пятницу), примерно в то время, когда Европа закрылась на день.

Однако более ранние данные положили начало мягкости. Первыми были февральские внезапные ИМТ, которые впервые за 13 месяцев увидели, что заголовки сервисов читают (49,7 против 53,0, как ожидалось). В то же время цены на производственные материалы PMI взлетели до самого высокого уровня с октября 2022 года (+6,1 пт до 63,5). Спустя 15 минут итоговый опрос потребителей Мичиганского университета показал, что средние инфляционные ожидания за 5-10 лет выросли до максимума после 1995 года в 3,5% (по сравнению с 3,3% в флеш-релизе), даже когда настроения потребителей упали до 15-месячного минимума. Это усилило опасения по поводу американского потребителя, которые возникли из-за слабых январских розничных продаж в прошлую пятницу и разочаровывающих результатов Walmart в четверг утром. Как всегда, мы отмечаем, что для долгосрочных инфляционных ожиданий результаты являются экстремальными по партийному признаку, а сторонники демократов ожидают 4,2%, а республиканцы - 1,5%.

Тем не менее, общий фон повлиял на активы риска, при этом S&P 500 (-1,71%) опубликовал свой худший день 2025 года, оставив его на -1,66% ниже на неделе. Больше всего пострадали небольшие ограничения, с падением Russell 2000 -2,94% в пятницу (-3,71% на неделе), а также акции технологических компаний, с падением Mag-7 -2,51% (-3,52% на неделе). Оба индекса попали в отрицательную территорию YTD. В отличие от этого, в Европе фондовые рынки закрылись до худшего спада в США, а Stoxx 600 (+0,52% в пятницу) почти опубликовал девятый подряд недельный прирост (+0,26%).

Другие рискованные активы также пострадали в пятницу, при этом спреды по кредитам с высокой доходностью в США показали самый большой ежедневный всплеск YTD (+10bps до 271bps). А в сырьевом секторе нефть марки Brent показала самое большое снижение с октября (-2,97%), в результате чего она снизилась на 0,71% за неделю до $74,21 за баррель. Тем не менее, золото подорожало на 1,86% за неделю до 2936 долларов за унцию, несмотря на незначительное отступление в пятницу (-0,10%) от рекордного максимума четверга.

Облигации выросли на фоне среды риска в пятницу, с 10 лет Доходность казначейства падает -7.4bps до 4.43% и публикует шестое подряд еженедельное снижение (-4.5bps). В Европе доходность 10yr bund также упала -6,4 б/с в пятницу, но все еще была выше на 3,7 б/с на неделе до 2,47% после более раннего роста на фоне повышенных ожиданий более высоких расходов на оборону в Европе.

Тайлер Дерден

Мон, 02/24/2025 - 07:59