Фьючерсы готовы к массовому истечению 5,3 триллиона долларов

Американские акции готовятся к тихому завершению напряженной недели, в которой первый шаг ФРС в серии быстрых сокращений процентных ставок подтолкнул рынки к новым максимумам. После того, как все четыре основных индекса - DJIA, SPX, Nasdaq и Russel - закрылись на рекордно высоком уровне впервые с ноября 2021 года, фьючерсы сегодня утром не изменились, а Nasdaq вырос на 0,1%, поскольку акции Mag 7 в основном выше, во главе с +1,1% и +0,7% в TSLA и AAPL. Ночью Банк Японии напугал рисковые активы, когда он сохранил ставки, как и ожидалось, но удивил рынки, объявив о ежегодной продаже своих огромных активов ETF в размере 330 млрд. Доходность 10-летних казначейских облигаций выросла на три базисных пункта до 4,13% после вчерашнего резкого повышения, что помогло доллару подняться на третий день. Сырьевые товары смешиваются: нефть ниже, в то время как предыдущие металлы / мешки выше этим утром. Сегодня ожидается долгожданный телефонный разговор между Си и Трампом в 9 утра в Нью-Йорке, а TikTok и торговля, вероятно, в повестке дня.

В дорыночной торговле акции Mag 7 в основном выше, а NVDA отстает. Tesla (TSLA) поднимается на 0,6%, поскольку Baird модернизирует производителя электромобилей, чтобы превзойти его, отметив, что компания все чаще рассматривается как лидер в области физического ИИ (Nvidia -0,2%, Alphabet +0,1%, Microsoft +0,1%, Apple +0,9%, Amazon +0,4%, Meta +0,2%).

- FedEx (FDX) выросла на 3% после того, как компания восстановила прогнозы прибыли и продаж. Акции однорангового United Parcel Service (UPS) выросли на 1,3%.

- Акции Intel (INTC) на 0,4% ниже, поскольку Citigroup понижает цены, указывая на высокую оценку производителя чипов. Акции выросли на 23% в четверг после того, как Nvidia согласилась инвестировать в компанию 5 миллиардов долларов.

- Lennar (LEN) снизился примерно на 3% после того, как застройщик прогнозировал новые заказы на четвертый квартал, которые пропустили среднюю оценку аналитиков.

- Orla Mining Ltd. (ORLA) упала на 4% после того, как Newmont Corp. продала долю в компании на сумму 605,4 млн. канадских долларов через незарегистрированную торговлю блоками в конце четверга.

- Реплимун (REPL) снизился на 1,7% после того, как JPMorgan понизил уровень веса до нейтрального, сославшись на сложное одобрение препарата.

- Scholastic (SCHL) упала на 10% после того, как издательская компания сообщила о более широком скорректированном убытке в первом квартале на акцию, чем за тот же период год назад. Компания также зафиксировала более резкое снижение выручки по сравнению с аналогичным периодом прошлого года.

В корпоративных новостях Apple выпускает несколько новых дизайнов iPhone с iPhone 17 Pro, Pro Max и iPhone Air, которые поступят в продажу в пятницу. Jefferies одобрила предложение SMFG о повышении своей доли владения до 20% с 15% по мере углубления партнерства. OpenAI находится под следствием из-за рисков для безопасности подростков после слушания в сенате. Nvidia планирует инвестировать £2 млрд ($2,7 млрд) в поддержку индустрии искусственного интеллекта Великобритании в партнерстве с несколькими венчурными компаниями.

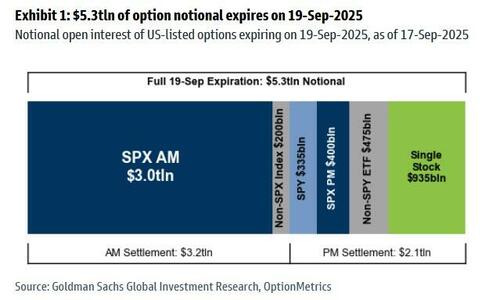

Сегодня рекорд, за сентябрь, четверная пятница с Более $5,3 триллиона условных опционов истекают включая $3,0 трлн опционов SPX и $935 млрд условного опциона на акции

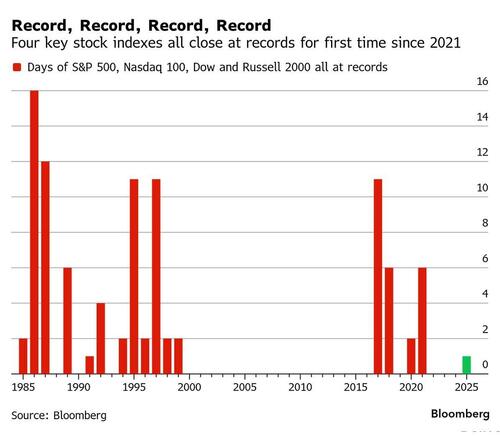

Ценовое действие в четверг привело к тому, что индекс S&P 500, Nasdaq 100, Dow Jones Industrial Average и Russell 2000 закрылись на рекордных максимумах - редкое явление, наблюдаемое всего 25 дней в этом веке, свидетельствуют данные, собранные Bloomberg.

Бычий импульс бросил вызов сезонным встречным ветрам, поскольку стратеги поднимают свои прогнозы на год; действительно, даже пятничный тройной срок действия опционов в размере 5 триллионов долларов, как ожидается, не приведет к волатильности - по крайней мере, не сразу - с трейдерами, сосредоточенными скорее на следующем отчете о заработной плате несельскохозяйственного сектора для более крупных шагов.

Несмотря на растущие риски и рекордные оценки, FOMO продолжает подталкивать рынок выше, чем обычно в медвежьем месяце. S&P 500 вырос на 2,7% в сентябре, достигнув новых рекордных максимумов по быстрым объемам, причем небольшие и средние капитализации заметно опережают, поскольку они догоняют Big Tech. Преобладающее повествование заключается в том, что ФРС сокращает мягкую посадку, Сценарий, рассматриваемый как очень бычий для акций. Эта перспектива будет проверена, когда фокус снова перейдет к данным о занятости.

Инвесторы по-прежнему видят много, чтобы сохранить акции, поднимающиеся после звездного ралли, с более свободной политикой, добавляющей плавучее настроение от оптимистичных доходов и устойчивой экономики. Президент Федерального банка Миннеаполиса Нил Кашкари, известный голубь, заявил в пятницу, что поддерживает решение по ставке на этой неделе и написал в своем Twitter. Два дополнительных сокращения в этом году.

«Ясно, что ФРС готова поддержать рост и рынки труда, а не слишком заботиться об инфляции, хотя мы должны увидеть, как это переводится в экономику», — сказал он. Андреа Габеллоне, глава отдела глобальных акций KBC Global Services. «Финансовые условия теперь легче. "

Как глобальные, так и американские фондовые фонды наслаждались своим положением. Самая большая неделя притока С декабря, по данным BofA, Майкл Хартнетт ссылается на данные EPFR Global. Тем не менее, настроения могут измениться, если доходы от компаний ИИ окажутся разочаровывающими; они представляют больший риск для глобального ралли акций, основанного на технологиях, чем продолжающаяся геополитическая напряженность. Рэй Далио предупредил, что США не могут сократить безудержные расходы, которые угрожают денежному порядку.

В Европе Stoxx 600 мало изменился, стерев прибыль, а автомобили заняли первое место в подсекторе после модернизации Stellantis NV в Беренберге, а поставщик автомобилей Aumovio был зарегистрирован на Франкфуртской фондовой бирже в четверг. Man Group выросла на 5,4% после обновления UBS. Вот некоторые из крупнейших европейских перевозчиков сегодня:

- Акции Man Group выросли на 5,4%, больше всего с апреля, поскольку UBS модернизирует акции, чтобы покупать у нейтральных на отскок в стратегиях AHL группы с конца июля.

- Акции PureTech Health выросли на 8,1%, больше всего за более чем четыре месяца, после того, как подача заявки на фондовую биржу показала, что Tang Capital Management владеет 3,07% акций биотерапевтической компании.

- Акции Nexity подскочили на 13%, больше всего с июля, поскольку Oddo повышает свой рейтинг во французской группе недвижимости, чтобы превзойти нейтральный.

- Акции Spire Healthcare выросли на 9% после того, как компания подтвердила, что начала процесс переговоров с рядом сторон по опционам, включая потенциальную продажу.

- Акции Wickes выросли на 4,9% после того, как Jefferies инициировала покрытие британского ритейлера рейтингом покупок

- Акции Kuehne + Nagel упали на 8,2%, больше всего с апреля, после того, как Deutsche Bank понизил рейтинг транспортной компании, чтобы удержать ее от покупки из-за макроэкономических проблем

- Акции Scout24 упали на 4,6% после того, как согласились купить онлайн-платформы недвижимости в Испании примерно за 153 млн евро, что Bloomberg Intelligence считает высокой оценкой.

- Акции Victrex упали на 7,5% после того, как Jefferies понизила рейтинг компании, предупреждая, что ей будет трудно увеличить прибыль в 26 финансовом году, поскольку они сократили свои оценки.

- Акции Ashtead Group упали на 1,6%, достигнув месячного минимума, после того как аналитики RBC Capital Markets понизили стоимость аренды оборудования, сославшись на ряд проблем.

- Акции Stabilus упали на 5,8% после того, как производитель заявил о запуске программы трансформации и предупредил, что прибыль FY25 будет ниже ожиданий.

- Акции Stroeer упали на 4,1% до самого низкого уровня за три года после того, как немецкая рекламная фирма сократила свои прогнозы по выручке FY и росту Ebitda.

Фунт и долгосрочные позолоты падают после того, как дефицит бюджета Великобритании подорвал прошлые прогнозы, усилив финансовые опасения. Стерлинг падает примерно на 0,5% и является худшим исполнителем в G-10. Доходность в Великобритании за 30 лет выросла на пять базисных пунктов до парирования. Европейские облигации и казначейские обязательства также падают.

Ранее на сессии азиатские акции стерли более ранние прибыли, чтобы упасть в пятницу, поскольку настроения инвесторов ослабли после плана Банка Японии разгрузить свои биржевые фонды. Индекс MSCI Asia Pacific упал на 0,5%, причем TSMC, Sony Group и MediaTek оказались в числе самых больших препятствий. Акции в Японии упали после решения Банка Японии оставить процентную ставку без изменений и объявления о плане продажи своих запасов ETF на сумму более 75 триллионов иен. Цены на акции в Южной Корее и Тайване также упали, в то время как на Филиппинах и в Австралии выросли. Объявление о продажах ETF «привело к ухудшению настроений, ожидая, что давление на продажи будет расти, особенно среди крупных технологических акций, где Банк Японии имеет высокий коэффициент владения», - сказал Хироки Такей, стратег Resona Holdings Inc. Кроме того, с двумя членами совета директоров, голосующими против ставок холдинга, быстро появились спекуляции о повышении ставок, что еще больше повлияло на рынок. Несмотря на снижение в пятницу, региональный бенчмарк MSCI по-прежнему находится на пути к третьему подряд еженедельному приросту - самой длинной серии с мая - поддерживаемому оптимизмом в отношении перспектив технологического сектора и надеждами на ослабление торговой напряженности.

В иностранной валюте доллар вырос на 0,2%, установив курс на самую длинную серию побед с июля и продлив отскок от минимума 2022 года. Фунт и долгосрочные позолоты падают после того, как дефицит бюджета Великобритании подорвал прошлые прогнозы, усилив финансовые опасения. Стерлинг падает примерно на 0,5% и является худшим исполнителем в G-10. Доходность в Великобритании за 30 лет выросла на пять базисных пунктов до парирования.

В процентных ставках двухлетняя доходность в Японии достигла самого высокого уровня с 2008 года после того, как план продаж ETF Банка Японии и ставка удерживаются в оспариваемом голосовании. Золото выше примерно на 12-3555 долларов за унцию. Европейские облигации и казначейские обязательства также падают. Казначейство дает более дешевую доходность на 1 п.п. до 2 б.п. по кривой, при этом спреды широко торгуются в базовой точке закрытия четверга. 10-летняя доходность в США составляет около 4,125%, а фунты и позолоты торгуются в широком диапазоне. На кривой Великобритании долгосрочная доходность отстает, повышая кривую Великобритании после превышения заимствований

В сырьевых товарах цены на нефть падают, а Brent падает ниже 67 долларов, а еженедельная прибыль от нефти находится на краю ножа.

Экономические данные США пусты для сессии. В число спикеров ФРС входят Миран (11 утра и 4 вечера), Дали (2:30 вечера).

Рыночный снимок

- S&P 500 мало изменился

- Мини-версия Nasdaq 100 мало изменилась

- Russell 2000 Мини-мало что изменилось

- Stoxx Europe 600 +0,1%

- DAX +0,1%

- CAC 40 +0,7%

- 10-летний Доходность казначейства +2 базисных пункта 4,12%

- VIX -0,2 балла в 15,53

- Индекс доллара Bloomberg +0,1% на 1197,26

- евро -0,2% на $1,1767

- Нефть WTI -1% $62,95/баррель

Лучшие ночные новости

- Джимми Киммел хотел ответить на бурю из-за своих замечаний об убийстве Чарли Кирка в среду. Руководство компании опасается, что ситуация ухудшится: WSJ

- Руководители Disney встретятся с Киммелом и оценят будущее ток-шоу

- Законодатели США планируют двухпартийный законопроект об освобождении кофе от тарифов, который может быть введен в пятницу

- Эрика Кирк назначена генеральным директором Turning Point USA после убийства мужа

- Администрация Трампа рассматривает план по стимулированию строительства заводов и другой инфраструктуры для стимулирования производственного сектора США с использованием фонда в 550 миллиардов долларов США, созданного путем переговоров с Японией.

- Трамп написал, что республиканцы в Палате представителей проголосуют за принятие законопроекта о чистом финансировании в пятницу и что «Лидер демократов, Крийн Чак Шумер, хочет закрыть правительство». Республиканцы хотят, чтобы правительство оставалось открытым. Каждый республиканец в Палате представителей должен голосовать и голосовать! "

- Спикер Палаты представителей Джонсон сказал, что он считает, что у них есть голоса, чтобы принять законопроект о временном финансировании, в то время как лидер большинства в Сенате США Тун сказал, что Сенат также проголосует по законопроекту о временном разрыве в Палате представителей в пятницу.

- Белый дом рассматривает дополнительных кандидатов на пост председателя CFTC, поскольку процесс утверждения Брайана Квинтенца застопорился, в то время как возможные кандидаты включают правительственных чиновников, сосредоточенных на криптовалютной политике.

- Доля правительства США в Intel после сделки с Nvidia составила $13 млрд

- FedEx видит рост продаж в признаке восстановления спроса на посылки

- CDC Группа по вакцинам проголосовала против расстрела Мерка для детей младше 4 лет: RTRS

- Они не ожидали этого: SoftBank Vision Fund сокращает 20% рабочих мест после поворота сына к ИИ

- Boeing: Латинская Америка к 2044 году удвоится

Тарифы/торговля

- Президент Мексики Шейнбаум сказала, что у нее был отличный разговор с премьер-министром Канады Карни и согласилась с Канадой укрепить соглашение о свободной торговле USMCA, добавив, что они будут продолжать работать вместе с уважением.

- Премьер-министр Канады Карни сказал, что они привержены совместному партнерству с США и создадут новый двусторонний диалог по безопасности с Мексикой, а также прокомментировал, что они могут найти корректировки для повышения конкурентоспособности в Северной Америке.

BOJ

- Как и ожидалось, ставки оставались неизменными на уровне 0,50%, при этом решение было принято 7-2 голосами, в которых члены Совета Таката и Тамура предложили повысить ставку на 25 базисных пунктов. Тем не менее, центральный банк удивил рынки объявлением о начале продажи своих ETF и J-REIT Holdings темпами 330 млрд и 5 млрд иен в год, соответственно, с решением о продажах ETF и J-REIT, принятым единогласно, в то время как он заявил, что темпы продаж могут быть изменены на будущих MPM после начала продажи ETF и J-REIT, на основе фундаментальных принципов и опыта продаж. Банк Японии также заявил, что экономика Японии восстанавливается умеренно, хотя была замечена некоторая слабость, и отметил, что частное потребление было устойчивым, а инфляционные ожидания умеренно выросли, но экспорт и производство остаются более или менее неизменными как тенденция. Кроме того, в нем говорится, что экономический рост Японии, вероятно, замедлится из-за влияния торговой политики на глобальный рост, но вновь ускорится, а базовая инфляция в Японии застопорится из-за замедления экономического роста, но постепенно ускорится после этого.

- BoJ Press Губернатор Уэда говорит, что экономика Японии восстанавливается умеренно, хотя и с некоторой слабостью; будет продолжать повышать ставки, если экономика и цены будут двигаться в соответствии с прогнозом.

- Об экономике: Понижательные риски для экономики все еще присутствуют.

- О политике: не рассматривает возможность изменения темпов продаж ETF для корректировки денежно-кредитной политики. Не думаю сейчас о выкупе ETF в качестве инструмента денежно-кредитной политики. Решение о сроках следующего повышения ставки будет зависеть от риска материализации влияния тарифов США и курса продовольственной инфляции.

- О торговле/тарифах: Внутренняя экономика выдерживает влияние тарифов. Тарифные расходы, вероятно, будут переданы потребителям в США с ноября. Не вижу негативного влияния тарифов США на экономику Японии.

- Подводя итог, Уэда не слишком много отдал, сосредоточившись на экономике, данных и тарифах. В целом, похоже, что октябрьский ход на картах, предполагая, что данные, 1 октября Танкан в фокусе, не представляет сюрпризов, а 4 октября конкурс лидерства ЛДП происходит без крупного кривого шара; полезно, что Уэда планирует выступить 8 октября.

- Предполагаемые шансы на повышение составляют около 45% за октябрь против 30% в четверг.

Более подробный взгляд на мировые рынки любезно предоставлен Newsquawk

Акции APAC торговались неоднозначно, поскольку регион лишь частично поддерживал импульс от Уолл-стрит, где S&P 500. DJIA и NDX поднялись до новых рекордных максимумов, поскольку настроения по поводу риска были поддержаны обнадеживающими данными, в то время как участники переварили неожиданное объявление BoJ о начале продажи своих ETF и J-REIT холдингов. ASX 200 поднялся выше с несколькими защитными секторами, ведущими достижения, и с большинством отраслей, помимо телекоммуникаций. Nikkei 225 сплотился на открытом рынке после того, как последние данные ИПЦ в основном соответствовали оценкам, но смягчились по сравнению с предыдущими, хотя индекс немного отошел от рекордных максимумов с некоторыми колебаниями, которые наблюдались, когда участники ожидали объявления «отложенного» BoJ, в то время как спад ускорился после того, как BoJ решил начать продажи ETF и J-REIT. Hang Seng и Shanghai Comp были в диапазоне на фоне предварительности в преддверии запланированного звонка Трампа-Си и с продолжающейся неопределенностью, связанной с торговлей, в то время как специальный комитет Палаты представителей США по КПК призвал к действиям в письме президенту США Трампу в ответ на вооружение Китаем критических цепочек поставок полезных ископаемых.

Лучшие азиатские новости

- Японский депутат от ЛДП Такаичи предлагает снизить подоходный налог и выплату наличных семьям в предвыборном обещании для правящей партии, в то время как она будет призывать к постепенному снижению отношения государственного долга к ВВП в своем предвыборном обещании. Министерство финансов должно представить план экономического роста.

- PBoC заявляет, что 14-дневные операции Reverse Repo на открытом рынке будут проводиться с помощью фиксированного объема и процентных ставок с множественным распределением цен.

- Китайский валютный регулятор говорит, что коммерческие банки приобрели чистую сумму в 14,7 млрд долларов США в августе (против чистой покупки в 22,8 млрд долларов США в июле), приобрели чистую сумму в 12,1 млрд долларов США в январе-августе (против чистой продажи в 2,5 млрд долларов в январе-июле).

- Губернатор БоДж Уэда выступит на Парижском форуме Europlace в Токио 8 октября.

Европейские биржи (STOXX 600 + 0,3%) в основном более устойчивы; в Европе сегодня превосходят CAC 40 и FTSE MIB. В то время как AEX (под давлением отката в названиях Tech) и FTSE 100 (активы Великобритании сегодня избегают) отстают. Европейские секторы имеют небольшой положительный уклон, и только несколько отраслей находятся на отрицательной территории. Авто занимает первое место сегодня, с ростом, обусловленным ростом в Stellantis (+4,5%), который выигрывает от обновления брокера в Berenberg. Сектор строительства и материалов следует за ним и поддерживается силой в Винчи (+1%) после того, как компания получила контракт на 885 млн евро, связанный с электрификацией Rail Baltica. Технологический сектор очень незначительно ниже, что, по-видимому, снижает некоторые значительные преимущества, наблюдаемые в предыдущей сессии после того, как ИТ-сектор вырос более чем на 5,6% в предыдущей сессии. Большая часть роста в четверг была обусловлена ASML (-0,5%), который получил обновление PT в BofA после партнерства NVIDIA-Intel.

Лучшие европейские новости

- Центробанк по-прежнему видит инфляционные риски в сторону снижения; ЕЦБ не может слишком долго терпеть инфляцию ниже 2%; прогноз инфляции 2028 года, вероятно, будет ниже 2%.

- UBS Wealth Management, Morgan Stanley & Bof В этом году больше не стоит ждать снижения ставки.

Форекс

- DXY расширяет свою победную серию до третьей сессии и опирается на вчерашние успехи, которые частично были обусловлены снижением еженедельных данных о претензиях и сильным отчетом ФРС Филадельфии. Диссидент-Довиш Миран объяснит свое решение поддержать более крупный шаг в 50 б/с в какой-то момент сегодня. Однако, учитывая, что он настолько отличается от FOMC и к нему не присоединились Уоллер или Боуман, его взгляды, вероятно, окажутся непостоянными для рынка. Также основное внимание будет уделено потенциальному считыванию встречи президента Трампа и Си, а затем и Дэйли. DXY находится чуть ниже пика четверга в 97,60.

- Евро более мягкий по сравнению с более твердым долларом США с дополнительными макроэкономическими драйверами для еврозоны, как это было в течение недели. После печати многолетнего максимума в начале недели в 1,1919 пара с тех пор в четверг опустилась до 1,1750.

- JPY является единственным из крупнейших фирм по сравнению с долларом США после объявления политики BoJ. Как и ожидалось, банк остановился на ставках. Тем не менее, решение сделать это было предметом ястребиного инакомыслия со стороны Такаты и Тамуры из-за опасений по поводу рисков роста инфляции. Другим источником удивления стало решение BoJ начать продажи своих ETF и J-REIT Holdings со скоростью 330 млрд иен в год и 5 млрд иен в год соответственно. Ястребиное инакомыслие понизило USD/JPY и отправило пару на сессию в 147.21, прежде чем исчезла основная часть недостатков, направляющихся на пресс-конференцию губернатора Уэды. При этом он повторил, что банк продолжит повышать ставки, если цены будут двигаться в соответствии с прогнозом. С точки зрения ястребов, он отметил, что внутренняя экономика выдерживает влияние тарифов, и Банку не обязательно ждать, чтобы увидеть полное влияние тарифов США на инфляцию, чтобы принять решение о дополнительном ужесточении. При этом он признал, что понижательные риски для экономики все еще присутствуют, и не сделал никаких явных сигналов о движении в следующем месяце, что могло бы стать драйвером угасания силы JPY. USD/JPY поднялся выше 50DMA @ 147.65 и находится в верхней части диапазона 146.76-148.26 в четверг.

- GBP увеличивает вчерашние убытки по сравнению с EUR и USD, поскольку рынки переваривают вчерашнее заявление о политике Банка Англии и последнюю партию данных Великобритании. Розничные продажи в Великобритании печатаются лучше, чем ожидалось (M / M 0,5% против Exp 0,3%). Тем не менее, выпуск был омрачен заметным ростом чистых заимствований в государственном секторе Великобритании (17,962 млрд против, Exp. 12,75 млрд, prev. 2,818 млрд). В настоящее время кабель торгуется около 1,3496.

- Оба антипода более мягкие по сравнению с долларом США в тихом новостном потоке для Австралии и Новой Зеландии, при этом снижение экспорта NZ практически не прослеживается в NZD.

- PBoC установил среднюю точку USD/CNY на уровне 7.1128 против exp. 7.1174 (Prev. 7.1085).

Фиксированный доход

- Ночью на BoJ было оказано давление на JGB. Несмотря на то, что решение осталось без изменений на уровне 0,50%, как и ожидалось, оно было принято двумя ястребиными инакомыслящими (Таката и Тамура), которые хотели сократить скорость на 25 б/с. Кроме того, банк должен начать продажи своих акций ETF и J-REIT очень медленными темпами, подчеркнул Уэда, который сказал, что для выхода из их позиции в текущем темпе потребуется более 100 лет. Уэда не слишком много отдал, сосредоточившись на экономике, данных и тарифах. Тем не менее, хотя он и знаком, его основной посыл о том, что процесс нормализации может продолжаться, если экономика и цены будут продолжаться в соответствии с прогнозом, особенно в контексте внутренней политической нестабильности.

- Потолки не работают. Открылся ниже на 28 клещей, а затем упал еще на 18 до 90,72 корыта. Давление возникло из-за лидерства сверстников с JGB в красном, Bunds на свежей базе WTD и утренних данных по Великобритании. Розничные продажи были сильнее, чем ожидалось, но в конечном итоге были омрачены PSNB, который составил 17,96 млрд фунтов стерлингов, затмив консенсус в новостной ленте и прогноз OBR на 12,5 млрд фунтов стерлингов. Цифры, которые усиливают давление на канцлера Ривза, находятся под осенним бюджетом в конце ноября. Доходность 30 лет в Великобритании превысила 5,55%, и теперь ожидается пик YTD на уровне 5,75%, если фискальная ситуация продолжит ухудшаться.

- UST ждут выступления ФРС, поскольку период после отключения FOMC поднимается. Диссентер Миран сосредоточится на том, чтобы оценить, насколько он хочет видеть облегчение (хотя точки дали некоторые указания) и его взгляды на сентябрьскую встречу. Помимо ФРС, призыв Трампа-Си является еще одной важной точкой фокуса. UST находятся в красном цвете, повторяя одноранговые, хотя с действием, более содержащимся перед обсуждаемыми катализаторами. На уровне 112-24+, чуть выше базы WTD в четверг 112-23+.

- Бунды более мягкие, следуя вышесказанному. До нового минимума WTD на 128,18. Если давление усилится, мы надеемся поддержать цифру до 127,82, 127,63 и 127,61 за последние недели. Августовские цены производителей достигли сегодня утром, оказавшись отрицательными и печатая ниже прогнозного диапазона. Дестатис определил, что падение было в основном связано с более низкими ценами на энергоносители, и при корректировке на энергию этот показатель составлял 0,8% по сравнению с -2,2%. Теперь внимание обращается к обзору DBRS по Франции.

Товары

- WTI и Brent остаются подавленными после аналогичной сессии APAC и после неповоротливой работы, наблюдаемой в течение предыдущего дня. В четверг были замечены встречные ветры после комментариев президента США Трампа о нефти, предполагая, что в Северном море осталось много нефти, и цены на нефть должны снизиться еще больше. Трамп также повторил призыв к странам прекратить закупки у членов ОПЕК+. WTI в настоящее время находится в ограниченном диапазоне $ 63,15-63,65 / фунт, в то время как Brent находится в диапазоне $ 67,11-67,57 / фунт.

- Драгоценные металлы смешиваются с спотовым золотом, постепенно окаймляясь выше за ночь, прежде чем снова стать жертвой доллара США, после того же встречного ветра вчера. Волатильность в желтом металле была замечена во время открытия Китая, хотя это было недолгим, в то время как некоторые всплески были замечены во время объявления BoJ, поскольку более твердый JPY толкнул вниз доллар США в то время. Спотовое золото в настоящее время находится в диапазоне $3 632,38-3 661,35 унции, что значительно ниже вчерашнего параметра $3 627,96-3673,20 унции.

- Смешанная торговля между базовыми металлами сегодня утром, с дневным торговым диапазоном красного металла, в конечном итоге, смешанный аппетит к риску в Азии.

- Сообщается, что ЕС рассматривает положение в 19-м пакете санкций против России о поэтапном прекращении закупок российского СПГ на год раньше, чем в настоящее время запланировано.

- Демократическая Республика Конго рассматривает возможность продления запрета на экспорт кобальта как минимум на два месяца.

Геополитика

- Премьер-министр Израиля Нетаньяху: «Мы нанесем тяжелый удар по ХАМАСу, мы не остановимся и не прекратим эту войну, пока не достигнем всех наших целей».

- Заместитель министра иностранных дел Ирана заявил, что действия европейских стран по возобновлению санкций будут политически предвзятыми и предлогом для эскалации.

- Президент Совета ЕС Коста приглашает лидеров на неформальный саммит 1 октября. Основное внимание будет уделено укреплению европейской общей обороны и усилению поддержки Украины.

США Расписание событий

- Никаких макро-событий не запланировано

Спикеры ФРС

- 11:00: Миран из ФРС появился на CNBC

- 2:30 вечера: Дейли из ФРС говорит в чатах об ИИ

- 4:00: Миран из ФРС появился на Fox Business

Джим Рид из DB завершил ночную обертку

Тайлер Дерден

Фри, 09/19/2025 - 08:30