Devaluing The US Dollar: How To Make America Poorer Again

Authored by Daniel Lacalle,

In recent days, we have read numerous articles about a possible agreement between the US administration and its main trading partners to devalue the US dollar. It has been named “The Mar-A-Lago Accord”, a concept inspired by the Plaza Accord of 1985, which aimed to devalue the US dollar to address trade imbalances. That plan failed.

The objective, according to the financial media, would be to weaken the US dollar, boost US export competitiveness, and rebalance global trade. Another proposal involves restructuring US debt by swapping existing obligations for longer-term bonds, such as 100-year Treasury bonds, to ease fiscal pressures. However, this would be a dangerous and potentially counterproductive idea.

The Mar-A-Lago Accord concept starts from two wrong premises, which are to believe that US exports are not large enough due to a strong currency and that debt is too high because of a robust US dollar. Both are simply incorrect.

US exports are relatively low compared to other nations, at 11% of GDP, compared to 42% for Germany, 29% for the UK, or 21% for Japan, for example. However, the main reasons for the US’s relatively small exports have nothing to do with the currency. The United States is an enormous market, and domestic businesses do not need to export to strengthen their earnings and sales. It is also rich in natural resources, which makes it relatively self-sufficient, reducing the need for imports and, by extension, limiting the incentive to export. The United States is the largest oil and gas producer in the world, and the estimated value of its natural resources is approximately $45 trillion. Furthermore, with 331 million people in 2023, consumer spending accounts for approximately 70% of the U.S. GDP.

The United States is one of the largest markets in the world, but more importantly, it is the richest. Median individual consumer spending is much higher than in countries like China or India, and the top third of the income distribution accounts for about 56% of spending. At $5 trillion in 2024, it is the largest retail market in the world. Furthermore, the United States economy is mostly a services economy. Services, including professional and business services, are more difficult to export, and the size and wealth of the domestic market make it unnecessary to sell abroad in most cases.

Manufacturing in the United States is not small, at 10% of GDP, due to a strong domestic currency but due to the burdens imposed by regulation on industries. Furthermore, artificially lowering costs with a weaker currency is a losing formula, as there is always someone else willing to destroy their currency faster.

US manufacturing cannot compete abroad by destroying the purchasing power of the currency. It means immediate poverty for Americans. It must compete on value-added products, as the technology and other sectors have proven.

Swapping existing short-term debt for long-term bonds is also a terrible idea because it would create the incentive for the government to increase borrowing and not address its structural spending problem. Restructuring debt by forcing an artificial depreciation of the US dollar would also scare bond investors, who would rightly fear that other administrations would resort to the same trick in the future. Why would you buy a 100-year bond from a nation that may devalue its currency regularly every time those debt challenges come back? This proposal is not a tool to keep the US dollar as the world reserve currency but a guarantee of losing its global status.

None of the United States’ export and debt challenges would improve with a devaluation of the US dollar, and a crucial one would deteriorate: inflation.

The United States already suffers elevated inflation due to the wrong fiscal and monetary policies. The cumulative inflation of 24% suffered by Americans in the past four years came precisely from the interventionist measures on the quantity and price of money, bloating government spending and debt, which led to a decades-high record money supply growth and, with it, the current inflationary pressures. With a devaluation, prices would immediately rise in US dollars, and the purchasing power of salaries would decline.

Devaluation does not improve productivity or industrial added value, so any decline in costs would translate to the impoverishment of American workers and savers.

Devaluing is a de facto default and the manifestation of the insolvency of a nation.

You cannot expect to devalue the currency while simultaneously controlling inflation and debt. Devaluation makes the government abandon the necessary adjustment to its spending habits, and the debt sustainability problem resurfaces in a short period of time. Real wages suffer, real consumption weakens, the entire economy is made artificially poorer in US dollars as inflation rises, and only crony sectors and the government benefit because they can perpetuate their inefficiencies and imbalances in an increasingly worthless currency.

Devaluing is not a solution to indebtedness. It incentivises more borrowing in a government that is already addicted to spending. Furthermore, it worsens the crowding-out effect, as government debt displaces private sector credit, which becomes more expensive as the currency weakens and inflation rises.

If devaluing the currency was a real measure of competitiveness, Argentina and Venezuela would be the most competitive nations on the planet.

Devaluing zombifies a few uncompetitive crony sectors and a fiscally irresponsible government at the expense of making everyone else poorer.

A strong US dollar reduces inflationary pressures and keeps interest rates low. Both effects are positive for savers, workers, and families as the private economy strengthens and real wages improve. A strong US dollar is also positive for the government and companies. Capital and foreign direct investment flow to the US, and corporations and government borrowing costs are kept low by rising demand. Corporations can also make international acquisitions at a cheaper cost, both in lower rates and currency adjustments.

A sound monetary policy and a strong currency are also essential to keep the world reserve currency status. If a small proportion of the US economic sectors suffer from a strong dollar, it is a price worth paying in exchange for being the world’s richest nation, with the most-used currency, a reserve of value, and a worthy investment for the rest of the world.

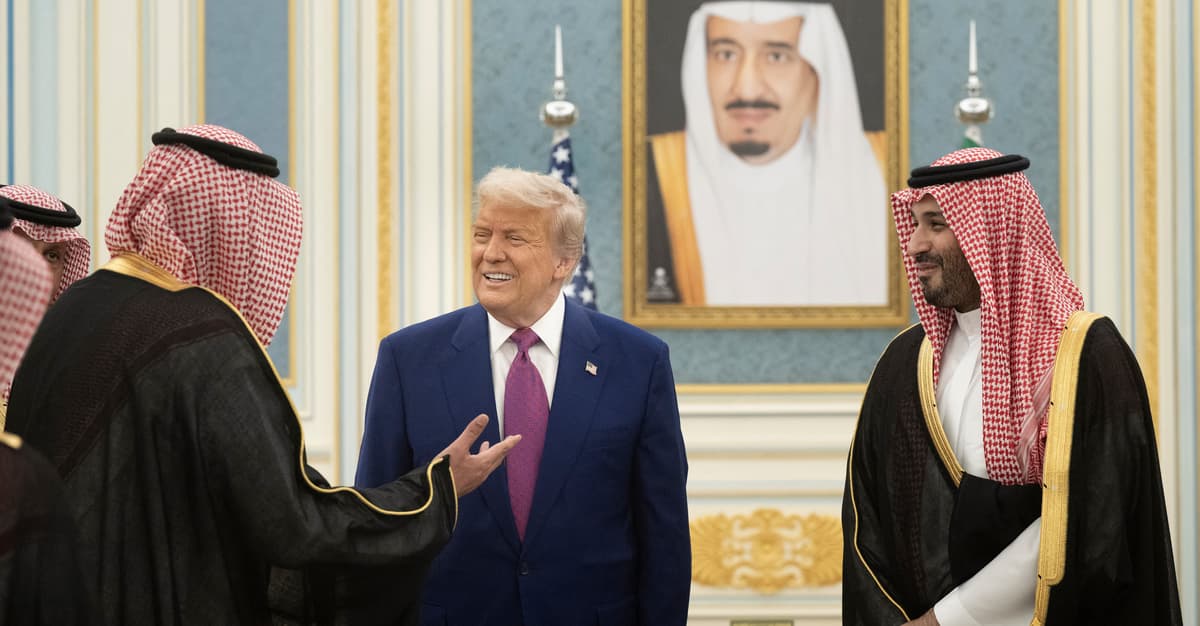

The greatest mistake that can be made by the Trump administration is to follow beggar-thy-neighbour devaluation policies to disguise a structural government imbalance.

Devaluation is not a tool for exports. It is a tool for cronyism and always ends with the demise of the currency as a valuable reserve.

The United States problems are complex and there is no easy fix. It needs to address its excessive regulation and taxation that burden manufacturers, but it also needs to curb government spending and the endless monetary easing that erodes the purchasing power of salaries and makes families and small businesses suffer.

If the current administration works to defend American jobs, workers’ wages, and families, a strong US dollar is proof that it is achieving its goals.

A strong economy does not need a weak currency.

Tyler Durden

Mon, 03/24/2025 – 13:10