Китайский экспорт растет быстрее, чем ожидалось, из-за роста поставок, чтобы уклониться от тарифов Трампа

Экспорт Китая вырос быстрее, чем ожидалось в прошлом месяце, показали последние таможенные «данные», в преддверии истечения на следующей неделе тарифного перемирия с США, которое угрожает возобновить торговую напряженность между мировыми экономическими сверхдержавами, если она не будет продлена, хотя теперь кажется, что еще 90 дней продления в значительной степени гарантировано.

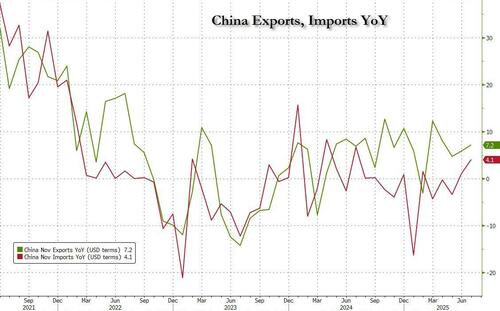

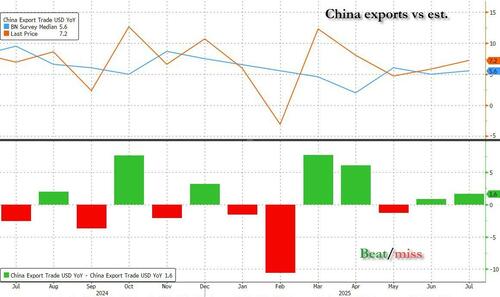

Экспорт увеличился на 7,2% в июле по сравнению с годом ранее в долларовом выражении, что является самым быстрым темпом роста с апреля, в то время как импорт прибавил 4,1%. Профицит торгового баланса страны в прошлом месяце составил $98,2 млрд, что ниже $114,7 млрд в июне из-за скачка импорта.

Недавнее укрепление китайского экспорта почти полностью связано с продолжающимся сокращением срока тарифа (который, кстати, всегда TACOed 3 месяца вперед), и привело к тому, что 4 из последних 5 месяцев китайского экспорта печатают выше ожиданий.

Данные, опубликованные в четверг таможенной администрацией Китая, появились, когда новые тарифы Дональда Трампа вступили в силу для торговых партнеров США из Индии в Швейцарию, подтолкнув пошлины Вашингтона к самому высокому уровню за столетие.

Последняя волна тарифов США напрямую не повлияла на Китай, который уже несколько месяцев находится в тесном контакте с Вашингтоном по поводу тарифов и торговых потоков товаров, начиная от редкоземельных элементов и заканчивая полупроводниками.

Стороны договорились о 90-дневном перемирии, которое снизило тарифы с уровней до 145% в апреле, поскольку первоначальные соглашения породили надежды на долгосрочную сделку. Прекращение огня и связанные с ним сниженные тарифные уровни истекают во вторник, но, как указывает этот заголовок Bloomberg, это, вероятно, будет продлено еще раз.

- ЛУТНИК: США, похоже, продлят китайскую линию смерти еще на 90 дней

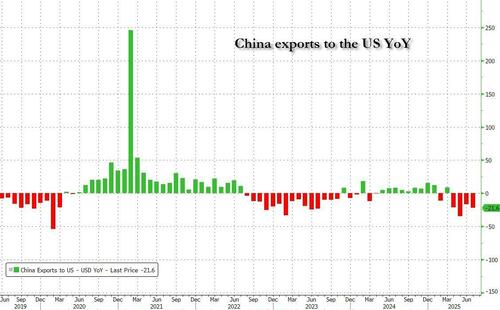

Тем не менее, даже несмотря на то, что судьба тарифов Китая по-прежнему связана с ТБД, торговля между двумя странами уже существенно пострадала, и июльские цифры показали, что экспорт Китая в США сократился на 22% годом ранее, после того, как в мае он упал больше всего с начала пандемии Covid-19.

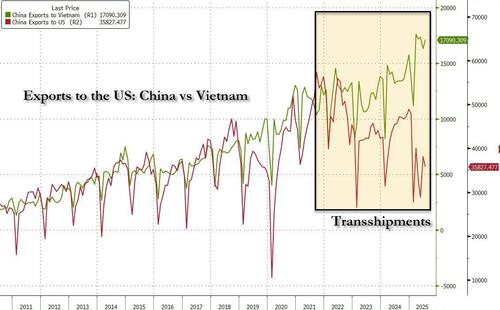

Экспорт Китая в Юго-Восточную Азию, который, напротив, продолжал расти двузначными темпами в последние месяцы, привлек внимание к так называемой «перевалке» товаров через сторонние страны, прежде чем достичь конечного пункта назначения.

Действительно, для наглядного примера того, как Китай обходит американские тарифы, посмотрите не дальше, чем китайский экспорт во Вьетнам - региональный перевалочный узел - который затем перегружает китайскую продукцию в США.

Рост китайского экспорта в страны, которые облагаются меньшими тарифами, объясняет последний тарифный залп Трампа, который включал общий сбор в размере 40% на перевалочные товары, хотя он не предложил более подробную информацию о том, как эти поставки будут определены.

Мы считаем, что простая перевалка сейчас менее привлекательна. Аналитики Citi написали, указывая на «жесткие меры США по предотвращению уклонения от тарифов». Однако, если посмотреть на экспорт во Вьетнам, это не так.

Экспорт Китая стал ключевым фактором роста для политиков во второй по величине экономике мира, учитывая четырехлетний спад в секторе недвижимости, который повлиял на доверие потребителей. Власти нацелены на рост ВВП примерно на 5% к 2025 году.

Администрация Трампа в апреле ввела высокие сборы во всем мире, но меры были в значительной степени приостановлены, чтобы позволить двусторонние переговоры с торговыми партнерами.

Президент также пообещал ввести 100%-ный тариф на импорт полупроводников, однако в очередной раз с огромными лазейками, освобождающими компании, которые инвестировали в США. Новость заставила иностранных производителей чипов взлететь, в то время как такие отечественные иконы, как Intel, упали после того, как Трамп развязал тираду на Truth Social, требуя отставки генерального директора INTC Лип-Бу Тана.

Тайлер Дерден

Ту, 08/07/2025 - 13:05