Африка намерена протестировать валюту, обеспеченную критическими минералами

Автор: Даррен Тейлор, The Epoch Times (выделено нами),

Крупные страны и региональные блоки в Африке бросают свой вес за амбициозный план по созданию «не циркулирующей» валюты, обеспеченной критически важными минералами.которые имеют решающее значение для технологического развития, обороны и экономического роста.

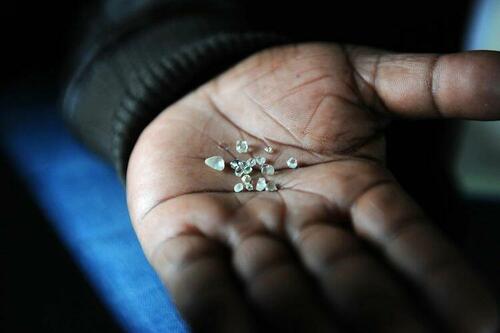

Шахтер показывает алмазы, вырытые из заброшенной шахты в Комагасе, Южная Африка, в июне 2012 года. Александр Джо / AFP / Getty Images

Шахтер показывает алмазы, вырытые из заброшенной шахты в Комагасе, Южная Африка, в июне 2012 года. Александр Джо / AFP / Getty ImagesАналитики говорят деноминация, основанная на сырьевых товарах, может снизить зависимость Африки от иностранных валют.- особенно доллар США - и уменьшить свою зависимость от кредитов из Китая, Европы, США и глобальных финансовых институтов, таких как Всемирный банк.

Предлагаемая денежная единица временно называется африканскими расчетными единицами (AUA) в соответствии с планом, разработанным Африканским банком развития (AfDB) и KPMG South Africa.

Новая валюта поддерживается Африканским союзом и Южной Африкой, крупнейшей экономической державой континента, и вскоре может быть опробована на тестовом рынке.

В предложении говорится, что AUA будет торговаться на международном валютном рынке и будет менее подвержена колебаниям отдельных африканских валют или доллара США, что сделает его более привлекательным для инвесторов.

Экономисты говорят, что поддержка валюты запасами полезных ископаемых может снизить риск, воспринимаемый кредиторами, что потенциально приведет к снижению процентных ставок по кредитам для проектов развития, особенно в энергетическом секторе Африки.

В то время как некоторые в горнодобывающей промышленности Африки с оптимизмом смотрят на потенциал такой валюты, другие предупреждают, что Китай может «вооружить» ее, учитывая доминирование Пекина в глобальных критически важных цепочках поставок полезных ископаемых.

Международное энергетическое агентство и другие организации прогнозируют, что спрос на критически важные минералы, такие как кобальт, медь, платина и литий, в ближайшее время увеличится в четыре раза, а мировые державы будут стремиться обеспечить поставки.

Африка находится в центре соревнований.

По данным Международного валютного фонда, это самый бедный и наименее развитый регион в мире, но он содержит почти треть мировых запасов важнейших полезных ископаемых.

Минералы необходимы для современных технологий, таких как смартфоны и компьютеры, в электросетях и в оружии, таком как ракетные системы, истребители и военные корабли.

Президент США Дональд Трамп считает важнейшие полезные ископаемые жизненно важными для будущего Соединенных Штатов, и он хочет как можно скорее обезопасить цепочки поставок.

Геологическая служба США (USGS) перечисляет 50 минералов, необходимых для экономики и национальной безопасности Америки, включая кобальт, литий, марганец, платину, тантал, вольфрам и ванадий.

Большинство из них находится в Африке.

Например, Южная Африка является крупнейшим в мире производителем марганца и платины; Зимбабве является одним из ведущих мировых производителей лития, а Демократическая Республика Конго (ДРК) добывает около 70 процентов мирового кобальта.

«Хорошо управляемая и структурированная валюта важнейших полезных ископаемых может укрепить позиции Африки на мировых рынках ресурсов и дать ей возможность использовать свои богатые природные ресурсы,— сказал Моэлетси Мбеки, южноафриканский экономист.

Это, сказал он The Epoch Times, особенно важно в то время, когда континент стремится смягчить экономический ущерб от глобальной неопределенности, вызванной конфликтами и рыночными потрясениями. "

«Если мы рассмотрим тарифы, которые Трамп вводит, и глобальные торговые войны, происходящие сейчас и в будущем, возможно, эта новая валюта может помешать Африке быть побочным ущербом», — сказал Мбеки.

В предложении AfDB и KPMG говорится, что валюта будет обеспечена корзиной некоторых из наиболее важных важнейших полезных ископаемых Африки и будет частью инициативы по созданию «более единой и стабильной финансовой системы». "

В рамочном документе предлагалось, чтобы ключевые производители важнейших полезных ископаемых обязались заранее согласовать долю доказанных запасов сырьевых товаров для "содействия региональной финансовой интеграции, сотрудничеству и трансграничной торговле. "

Муно Мупотола, директор AfDB в Южной Африке, сказал The Epoch Times, что банк принимает решение о включении минералов в «тест» и намерен выбрать «пилотную страну», где будет проводиться исследование осуществимости новой валюты.

Мбеки сказал, что валюта может помочь Африке взять на себя ответственность за свои важнейшие минералы и их переработку.

«У нас есть все эти полезные ископаемые, но мы не получаем от них большой выгоды, потому что цепочка создания стоимости в Африке настолько слаба», — сказал он.

«Мы обрабатываем менее пяти процентов полезных ископаемых внутри страны, а это означает, что реальные прибыли получают иностранцы, особенно Китай.

«Если мы сможем использовать общую валюту для объединения горнодобывающей промышленности Африки и их правительств, это станет реальным шагом на пути к большей независимости и большей местной выгоде и прибыли, поступающей в африканские карманы. "

Профессор Хамбаба Химайма, исследователь международных отношений в Университете Замбии, сказал, что шаги Африки к валюте являются признаком того, что она хочет как можно большей экономической независимости как от Китая, так и от Запада.

«Африка устала быть обязанной Западу за помощь и торговлю, а Китаю за инвестиции и кредиты,Об этом он рассказал The Epoch Times. "Он хочет использовать критически важные минералы и связанную с ними валюту в качестве основы для индустриализации и большего политического влияния..

«Африка передала Китаю контроль над важнейшими полезными ископаемыми. Украина хочет вернуть этот контроль. Он хочет добывать и совершенствовать собственные ресурсы. Критические минералы являются козырем Африки. Валюту следует рассматривать в этом свете. "

Но другие эксперты, такие как экономист из Уганды и бывший министр финансов восточноафриканской страны Эзра Сурума, настроены скептически.

«Критические полезные ископаемые еще не являются безопасными инвестициями, которыми является золото», - сказал он. "Цены нестабильны. Если есть стабильность, то, безусловно, стоит изучить идею критической валюты минералов. "

Фрэнк Блэкмор, KPMG Ведущий экономист Южной Африки рассказал The Epoch Times, что несколько факторов препятствуют созданию ресурсной валюты.

«Большинству африканских производителей потребуется много времени, чтобы получить полное вознаграждение от своих важнейших минералов», — сказал он.

«Многие места не имеют достаточного количества электроэнергии; транспортные узлы истощены. Все это идет вразрез с производством. Существует также нехватка квалифицированной рабочей силы. "

Однако Мбеки предложил использовать первоначальный запас полезных ископаемых в качестве обеспечения для финансирования развития и индустриализации.

«Этот фонд может быть использован для поощрения местных исследований и добычи полезных ископаемых», — сказал он.

Мбеки также предупреждает, что Китай, который часто заявляет о своей приверженности прогрессу в Африке, все еще может быть «мухой в мази» в создании валюты, обеспеченной важнейшими минералами.

«Китай обычно не поддерживает планы, которые могут подорвать его власть», — сказал экономист. «Я могу предвидеть, что китайцы не будут очень сотрудничать в этом отношении, и они могут даже вооружить валюту, чтобы попытаться убедиться, что африканские страны придерживаются своих линий.

«До тех пор, пока китайцы обладают такой большой властью в критических цепочках поставок полезных ископаемых, эта новая валюта находится на шаткой почве. "

Тайлер Дерден

Солнце, 08/10/2025 - 10:30