Japan Panicks As Yields Explode, Will Trim Super-Long Bond Issuance To Calm Market

One of the most famous modern aphorisms on Wall Street belongs to Bank of America Chief Investment Strategist, Michael Hartnett, who a decade ago wisely said that „markets stop panicking when policymakers start panicking.” Last night, Japan’s policymakers – faced with record long-end rates and record paper losses on insurer books – finally panicked.

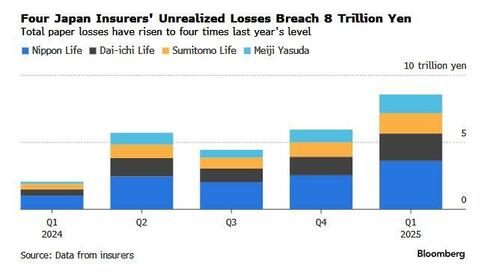

Just hours after we reported that Japan’s life insurance companies are facing staggering losses…

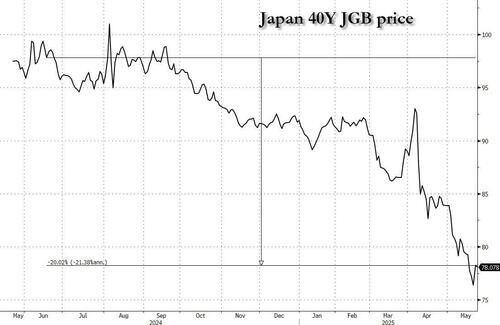

… first Reuters and then Bloomberg reported (which means that this was not a „scoop” but a premeditated trial balloon by Tokyo meant to hit all major news outlets) that Japan will take a page right out of Janet Yellens’ Activist Treasury Issuance playbook and will „consider” trimming issuance of super-long bonds in the wake of recent sharp rises in yields for the notes, in an attempt to remove long-dated supply which has slammed prices for long-dated bonds to record low as policymakers seek to soothe market concerns about worsening government finances.

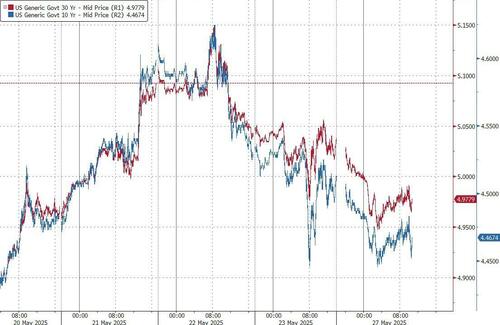

Predictably, super-long bond yields slumped on the report, pushing down the Japanese yen and U.S. Treasury yields along the way, as markets cheered Tokyo’s readiness to arrest spikes in long-term interest rates by shifting duration from the long-end to the short-end.

According to Reuters, Japan’s Ministry of Finance (MOF) will consider tweaking the composition of its bond program for the current fiscal year, which could involve cuts to its super-long bond issuance, said the sources who had direct knowledge of the plan. This is very similar to the ATI Yellen unveiled a little over two years ago when she shifted much of the bond issuance from coupons to bill, in order to keep funding the US deficit through Bills, and the draining of the Reverse Repo account, which is now almost empty.

The MOF will make a final decision after discussions with market participants around mid- to late-June, the sources said.

The plan followed the recent record surge in super-long bond yields to never before seen levels due to a freeze in demand from traditional buyers such as life insurers and global market jitters over steadily rising debt levels.

The yield on the 30-year Japanese government bond (JGB) fell 18 basis points to 2.85% after the report, its lowest since May 4. The benchmark 10-year yield dropped 7 points to 1.43%.

The slide in super-long JGB yields also helped push long-dated US Treasury yields, which were set for their biggest one-day fall since mid-April. The yield on 30-year bonds was down 7 basis points at 4.963% in early London trading on Tuesday.

„We’ve been arguing that something had to give to correct the supply-demand imbalance in long-end JGBs. The market is thinking it will be the MOF,” Societe Generale said in a note, echoing what we in turn have been saying for weeks.

If the MOF were to reduce issuance of 20-, 30- or 40-year JGBs, it would likely increase issuance of shorter-dated debt instead, the sources said; As such, the total planned size of JGB issuance for the current fiscal year that ends March 2026 will remain unchanged from 172.3 trillion yen ($1.21 trillion), they said.

Such a move would also mean that any marginal demand for duration would have to head to the US, which thanks to the Trump Big, Beautiful, Budget Busting Deal will have lots of long-dated supply for years to come.

Global markets have been rattled by sharp bond sell-offs recently, including for US Treasuries, as President Trump’s sweeping tariffs and erratic policies heightened worries about the status of U.S. sovereign debt as the world’s safest haven. In Japan, super-long bonds were also sold off as Prime Minister Shigeru Ishiba faced political pressure for tax cuts and big spending ahead of an upper house poll in July, policies that could add to the country’s already huge public debt.

Japan’s government is considering compiling another spending package, though ruling coalition executives agreed on Tuesday to avoid issuing fresh deficit-financing bonds. The clash over fiscal policy prompted Japan’s PM to say the quiet part out loud, admitting last week that Japan’s financial condition was worse than Greece.

The JGB collapse has also turned investors’ attention to whether the MOF, which oversees debt issuance, and BOJ could take measures to tame rises in super-long yields.

The BOJ, for its part, is unlikely to make any big tweaks to its current bond-taper (or QE) program, sources told Reuters. But the recent market rout could affect its taper plans for fiscal 2026 onward, which will be decided at next month’s policy meeting, they said.

„Issuance of super-long JGBs could decline in July at the earliest,” which would ease concern over the outcome of Wednesday’s 40-year JGB auction, said Katsutoshi Inadome, senior strategist at Sumitomo Mitsui Trust Asset Management.

„But this offers only temporary relief and won’t lead to a decline in Japan’s debt balance,” he said. „With the MOF likely doing its part, politicians now need to make efforts to avoid increasing debt.”

Separately, Bloomberg reported that a Japanese government advisory panel urged authorities to step up fiscal consolidation efforts, as the Bank of Japan’s ongoing monetary tightening efforts raise the risk of higher debt-servicing costs for the world’s most indebted developed nation.

The Fiscal System Council warned that the BOJ’s interest rate hikes and scaled-back bond purchases are fueling a steady rise in government bond yields, and the country’s finances need more attention, according to a proposal submitted to Finance Minister Katsunobu Kato on Tuesday.

“We must manage finances with a heightened sense of urgency to prevent rising debt costs from crowding out essential policy spending,” the panel said. The call for fiscal prudence came as the BOJ continues to unwind its ultra-loose policy, following its first interest rate hike in 18 years in March last year.

The panel cautioned that Japan could face a sovereign credit rating downgrade if fiscal discipline continues to erode.

„A downgrade of government bonds is not a far-fetched scenario,” the proposal said, referencing Moody’s Ratings’ recent downgrade of US sovereign debt as a precedent. “If trust in Japan’s public finances erodes, it could trigger a downgrade, sharp interest rate hikes, market turmoil and ultimately negative consequences for households and businesses,” it said.

* * *

Commenting on the MOF’s trial balloon, Goldman’s head of EMEA Delta-One trading Rich Privorotsky said that the Japanese strategy would be short-term helpful „but if this is the long term solution then the issue will be the FX.”

Sure enough, the yen – which at last check saw record long hedge fund exposure – is sliding, with Privorotsky listing the following reasons for the currency weakness:

- yields mechanically come lower in the end of curve, compressing yield differentials

- more of debt will be owned by the domestic population hence less demand for yen

- not being able to sell debt is not a generally a good thing as a larger percentage gets owned by your CB.

Privo’s conclusion is that while for now it remains „a small overall move for the JPY… it’s worth but worth watching if this becomes a theme outside US, as a result of the near record pile up of dollar shorts recently.”

Tyler Durden

Tue, 05/27/2025 – 11:25

![Słono zapłaci za brawurę. Pirat drogowy ukarany [WIDEO]](https://radio.lublin.pl/wp-content/uploads/2025/05/355-267196_g-2025-05-27-211855.jpg)

![Cudowne uzdrowienie przez ZUS a stopień niepełnosprawności [znaczny i umiarkowany]](https://g.infor.pl/p/_files/38439000/podwyzki-38438685.jpg)