These Are The States Most And Least Dependent On The Federal Government

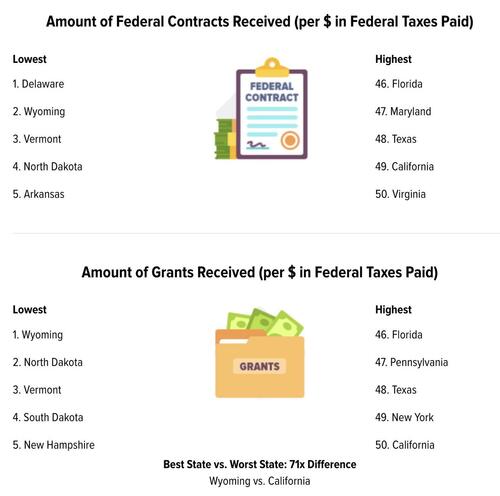

A new study highlights how much states rely on federal aid compared to what they contribute in taxes. The study evaluates three key metrics: return on federal taxes, federal funding as a share of state revenue, and the percentage of federal jobs in each state.

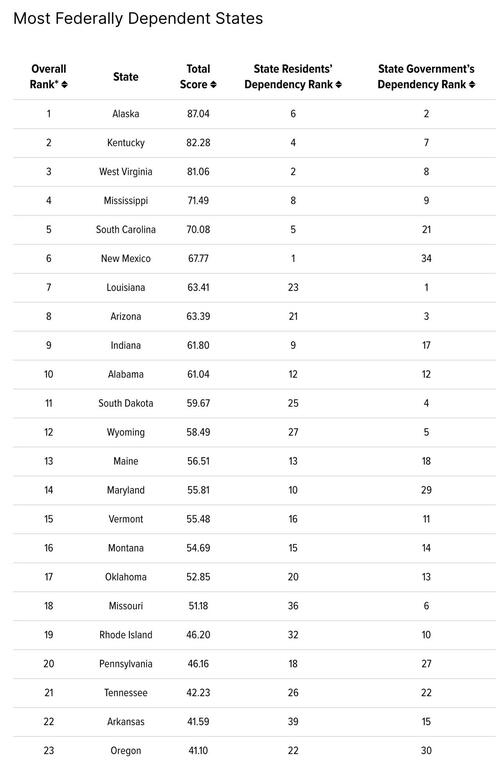

Most dependent states include Alaska, Kentucky, and West Virginia, while New Jersey, California, and Delaware are the least reliant, according to a new WalletHub study.

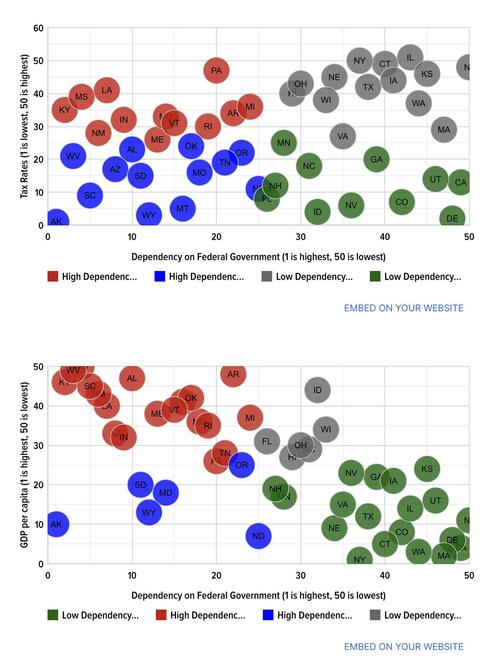

The report found that Red States (average rank: 21.48) depend more on federal funding than Blue States (32.05). Additionally, states with lower per-capita GDP tend to receive more federal support. Notably, Illinois ranks among the least dependent but has the nation’s highest tax rates, while Alaska, the most dependent state, has the lowest taxes.

WalletHub writes that Alaska ranks as the most federally dependent state, with over 50% of its revenue coming from federal funding. The state’s harsh weather, large landmass, and small population contribute to its reliance on federal dollars for infrastructure, disaster relief, and resource management.

Additionally, nearly 5% of Alaska’s workforce is employed by the federal government, significantly higher than the 1-3% range seen in most states. The financial return is also substantial—for every $1 Alaskans pay in taxes, the state receives $2.36 in federal funding. This heavy reliance, coupled with Alaska’s low tax rates, underscores its unique economic relationship with the federal government.

Kentucky follows as the second-most dependent state, primarily due to its high federal funding-to-tax ratio. For every $1 paid in federal taxes, Kentucky receives $3.35, one of the highest returns in the country. More than 46% of the state’s revenue comes from federal funding, ranking among the top nationwide.

Despite this, only 1.8% of Kentucky’s workforce is employed by the federal government, placing it in the middle of the pack for federal employment. Similarly, West Virginia ranks third, receiving $2.72 in federal funding per $1 paid in taxes. The state derives over 45% of its revenue from federal aid, and 3.7% of its workforce is employed by the federal government, highlighting its strong economic dependence on federal support.

A broader analysis of federal dependency shows a strong correlation between low GDP per capita and high reliance on federal funds.

Many Red States rank among the most dependent, with an average dependency rank of 21.48, compared to 32.05 for Blue States. Additionally, states with low tax rates, such as Alaska and West Virginia, often receive significant federal support, while high-tax states like New Jersey and Illinois rank among the least dependent. This dynamic reflects ongoing debates about federal resource distribution, tax policies, and economic sustainability across the U.S.

WalletHub analyst Chip Lupo highlights the benefits of federal dependency, stating that residents in the most dependent states receive several dollars back in federal funding for every dollar paid in taxes. This often translates into better infrastructure, education, and public services. Alaska, the most federally dependent state, receives $2.36 per dollar paid and relies on federal funding for over 50% of its revenue, with nearly 5% of its workforce employed by the federal government.

Dr. Howard A. Frank of Florida International University argues that while redistributive policies in health, education, and welfare should be federally managed, excessive spending can drive affluent residents to lower-tax states like Texas and Florida. He points to the 2017 tax law changes that capped state and local tax deductions, accelerating migration out of high-tax states. However, he notes that local education funding has long been an American tradition, contributing to disparities that some economists believe the federal government should address.

“The division of responsibilities between federal, state, and local governments in the United States is rooted in the principle of fiscal federalism. The federal government is responsible for broader issues like national defense, foreign policy, immigration, Social Security, civil rights protection, and interstate commerce regulation,” said Lucy Dadayan, PhD, Principal Research Associate, Tax Policy Center, Urban Institute & Brookings Institution.

„These programs require a unified national approach and affect all people equally. In contrast, state and local governments are generally responsible for programs such as education, law enforcement, local infrastructure, public health services, and parks and recreation. These areas benefit from localized decision-making and implementation to address specific community needs,” she continued.

Tyler Durden

Wed, 03/12/2025 – 19:40

![Поляки разделились: следует ли Дональду Туску уйти в отставку после поражения Тшасковского? [ОПРОС]](https://dailyblitz.de/wp-content/uploads/2025/06/198683-polacy-podzieleni-czy-donald-tusk-powinien-ustapic-po-porazce-trzaskowskiego-sondaz.png)

![Obława na Zatorzu. W akcji m.in. pies tropiący [ZDJĘCIA]](https://static.olsztyn.com.pl/static/articles_photos/43/43923/34c31b9908a7d7e8c0d641b954773bfa.jpg)

![Zarzuty i areszt dla sprawców gigantycznej kradzieży [WIDEO]](https://www.rdc.pl/brepo/panel_repo/2025/06/07/vkwv5e/cover-620-314-zatrzymany.jpg)