WTI спустилась после крупнейшего с января строительства

Сегодня утром цены на нефть упали, что является признаком Большой прирост запасов сырой нефти в США Это подрывает комментарии Объединенных Арабских Эмиратов и Саудовской Аравии о жестких рыночных условиях.

В США API сообщил, что запасы нефти выросли на 7,1 млн баррелей на прошлой неделе. Это будет самый большой рост с января, если подтвердятся правительственные данные, которые должны быть позже в среду.

Ожидаемый прирост запасов вызвал некоторую холодную воду в комментариях министра энергетики ОАЭ Сухаила Аль Мазруэя о том, что отсутствие крупных запасов показывает, что рынок нуждается в производстве, которое возрождается ОПЕК +, в то время как Saudi Aramco видит здоровый глобальный спрос, несмотря на торговые проблемы и тарифы.

API

Сырая +7,1 мм

Кушинг +100к

Бензин -2,2 мм

Дистилляты -800k

ДОУ

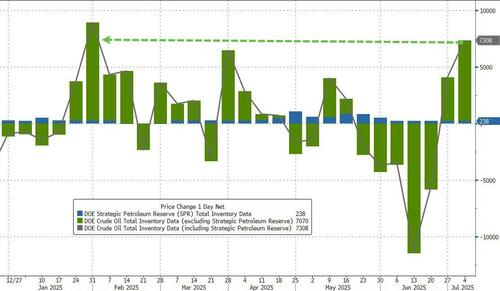

Crude +7.07mm - самая большая сборка с января

Кушинг +464k

Бензин -2,66 мм

Дистилляты -825k

Официальные данные подтвердили большую сборку нефти API, в то время как продукты сократили запасы.

Источник: Bloomberg

С добавлением 238 тыс. к SPR общие запасы сырой нефти выросли больше всего с января на прошлой неделе.

Источник: Bloomberg

Добыча сырой нефти в США остается на рекордно высоком уровне, даже когда количество буровых установок в США падает.

Источник: Bloomberg

ВТИ Сырость уже не за горами...

Источник: Bloomberg

Текущие рыночные условия достаточно жесткие. Об этом сообщил Оле Хансен, глава отдела товарной стратегии Saxo Bank A/S.

«Но я все еще несколько обеспокоен тем, что профицит будет расти в осенние месяцы, поскольку спрос замедляется. "

По словам министра иностранных дел Израиля Гидеона Саара, прекращение огня в почти двухлетнем конфликте в Газе, а также сделка с заложниками «достижимы».

Тайлер Дерден

Свадьба, 07/09/2025 - 10:37