Фьючерсы скользят после исторического восстановления в понедельник

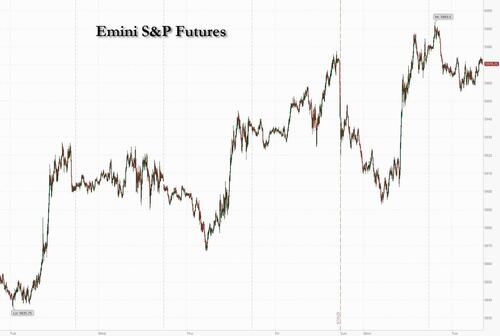

Фьючерсы на акции в США слабее из-за недостаточной эффективности технологий, угрожая шестидневной победой, которая привела S&P 500 на грань бычьего рынка. Опять же, понедельник начался еще хуже, а затем мы увидели самый большой всплеск розничных покупок за всю историю, что привело к одному из самых больших внутридневных разворотов в новейшей истории.По данным JPM, здесь), так что готовьтесь к более неожиданным движениям. По состоянию на 8:00, Фьючерсы на S&P упали на 0,2%, в то время как фьючерсы на Nasdaq 100 упали на 0,3% С акциями Mag7, смешанными на фоне слабости в полуфинале, на сегодняшней конференции разработчиков Google I/O; здравоохранение возглавляет Defensives over Cyclicals. Кривая доходности скручивается круче с плоской доходностью 10Y и ослаблением доллара США. Товары смешиваются с сырой нефтью вниз, натгазами вверх, базовыми металлами вниз, драгоценными вверх и Ags обычно выше. Данные Macro легки, только PMI Philly без mfg на палубе перед отпечатками Flash PMI & Claims в четверг, но у нас есть еще один раунд спикеров ФРС, где сообщение продолжает быть терпеливым.

В дорыночных торгах акции Mag 7 были смешанными (Tesla +1,4%, Alphabet +0,5%, Nvidia -0,2%, Microsoft -0,1%, Apple -0,3%, Amazon -0,2%, Meta Platforms -0,3%). Home Depot вырос на 2,2% после поддержания прогноза на финансовый год, поскольку продажи в США выросли. Это признак того, что потребительские расходы продолжают расти, несмотря на экономические потрясения. Акции Vipshop в США (VIPS) упали на 8% после того, как китайский онлайн-рынок сообщил о результатах первого квартала и дал прогноз. Вот некоторые другие известные премаркеты:

- Воздушная аренда (AL) увеличивается на 1,2% по мере того, как Citi обновляется, заявляя, что возможное распределение капитала создает «тактические возможности». "

- ASP Isotopes (ASPI) подскочил на 15% после подписания соглашений о финансировании и поставках с TerraPower для поддержки строительства нового объекта по обогащению урана.

- ImmunityBio (IBRX) вырос на 4% после того, как Пайпер Сэндлер повысила вес разработчика лекарств, заявив, что запуск недавно одобренного препарата Anktiva для лечения рака мочевого пузыря.

- Pegasystems Inc. (PEGA) поднимется на 6%, так как компания по управлению взаимоотношениями с клиентами присоединится к индексу S&P Midcap 400 до открытия торгов 22 мая.

- Pony AI ADRs (PONY) подскочил на 5% после того, как китайская компания, занимающаяся автономным вождением, сообщила о выручке за первый квартал в размере 14 миллионов долларов против 12,5 миллионов долларов в годовом исчислении.

- Акции Trip.com (TCOM) в США упали на 4% после того, как онлайн-турагентство сообщило о результатах первого квартала.

- Yalla (YALA) упала на 8% после того, как оператор социальной сети увидел снижение числа платных пользователей на своей платформе.

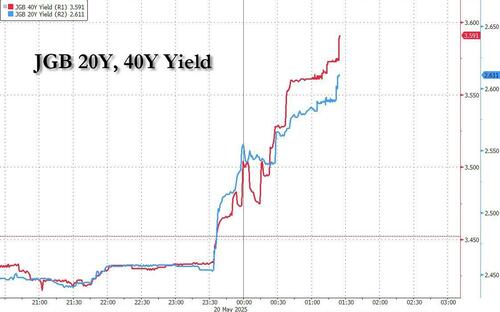

По иронии судьбы, поскольку все ожидали в понедельник спада в казначейских облигациях США - и получили прямо противоположное - большой шаг был в Японии, где облигации рухнули, а доходность долгосрочных облигаций взлетела до рекордно высокого уровня после того, как почти провалившийся аукцион государственных облигаций увидел самый слабый спрос с 2012 года и самый большой хвост с 1987 года, указывая на растущие опасения по поводу поддержки инвесторов, поскольку Банк Японии набирает свои огромные долговые запасы.

По мере того, как рынки продолжают таять, инвесторы ищут ясность в направлении рынка, а стратеги в опросе Bloomberg теперь гораздо более оптимистичны в отношении европейских акций, чем рынок США. Тем временем Джейми Даймон предупреждает о рисках, связанных с инфляцией и кредитными спредами, для геополитики. «Рынок упал на 10%, он вырос на 10%; я думаю, что это необычайное самодовольство. "

Между тем, угроза тарифов США появилась в китайских поставках смартфонов, которые упали на 72% в апреле, согласно таможенным данным Китая.

Технология была основной движущей силой недавнего отскока рынка и будет оставаться в центре внимания на следующей неделе. Google проводит конференцию разработчиков ввода-вывода, с основным докладом в 4:30 вечера по восточному времени. Более широкое развертывание режима ИИ в поиске Google будет в центре вниманияОб этом сообщает Bloomberg Intelligence.

Ряд спикеров ФРС будут внимательно следить сегодня за подсказками о перспективах экономики США и любыми комментариями о понижении рейтинга Moody's. Два чиновника ФРС предположили в понедельник, что политики могут быть не готовы снизить ставки до сентября, поскольку они сталкиваются с мрачными экономическими перспективами.

В Европе Stoxx 600 поднимается на 0,4%, по темпам четвертой сессии прироста, во главе с коммунальными услугами, телекоммуникациями и здравоохранением. Немецкий индекс DAX впервые превысил 24 000. Среди отдельных акций Orange авансы после того, как Bloomberg сообщил, что Патрик Драхи взвешивает продажу SFR. Стратеги Уолл-стрит делают ставку на то, что европейские акции будут иметь лучшие показатели по сравнению с США, по крайней мере, через два десятилетия по мере улучшения экономических перспектив региона. В то время как акции США выросли в последние недели, два федеральных чиновника предупредили в понедельник, что они будут придерживаться выжидательного подхода, прежде чем снижать процентные ставки. Вот самые известные европейские перевозчики:

- Акции Orange выросли на 3,1% после того, как Bloomberg сообщил, что Altice France миллиардера Патрика Драхи рассматривает возможность продажи контрольного пакета акций SFR, что вызывает надежды на дальнейшую консолидацию отрасли на конкурентном рынке.

- Smiths Group выросла на 4,4%, до самого высокого уровня с 31 января, после того, как британская инжиниринговая фирма заявила, что годовой органический рост выручки, как ожидается, будет в верхней части своего диапазона.

- Программное обеспечение Одна акция выросла на 4,5% после того, как Kepler Cheuvreux повысила рекомендацию по покупке акций из холдинга, заявив, что сокращение расходов набирает обороты, и 1Q должен показать раннее восстановление маржи.

- Акции Greggs выросли на 8,8% до трехмесячного максимума после того, как британский ритейлер Food-on-the-go сообщил об обновлении торгов, в котором он сказал, что видит улучшенные показатели и сохранил свои ожидания на год без изменений.

- Акции Diploma выросли на 18%, достигнув рекордного уровня, поскольку аналитики приветствуют положительные показатели поставщика строительных компонентов в первом полугодии, в основном за счет его подразделения Controls.

- Акции SSP выросли на 5,3% до самого высокого уровня за три месяца после того, как оператор магазинов продуктов питания и напитков в местах путешествий подтвердил свой прогноз на весь год, несмотря на более мягкую текущую торговлю в Северной Америке на фоне более слабого спроса на поездки.

- Акции Schaeffler выросли на 7,6% после того, как немецкая фирма по производству автозапчастей была дважды модернизирована для покупки в Bank of America, что означает удвоение скорректированного Ebit к 2028 году.

- Акции Orsted выросли на 15%, администрация Трампа отменила заказ, который остановил строительство проекта Equinor стоимостью 5 миллиардов долларов у побережья Нью-Йорка.

- Акции Fincantieri выросли на 9,7% после того, как компания обнародовала цели для недавно созданного подразделения подводных систем вооружения.

- Акции UBS снизились на 3,5%, что является самым большим показателем с 9 апреля, после того как Bloomberg News сообщил, что кредитор, вероятно, столкнется с поражением в своих усилиях по смягчению закона швейцарского правительства, который может заставить его сохранить до 25 миллиардов долларов дополнительного капитала.

- Сальмар падает на 5,6%, больше всего почти за месяц, после того, как норвежская компания по производству морепродуктов и лосося сообщила о своей последней прибыли, которую DNB Carnegie описывает как «большую промах». "

- Kingfisher падает на 4,8%, поскольку Barclays сокращает свою рекомендацию по строительству в Великобритании и поставщику DIY, чтобы снизить вес с равного веса. 25-процентное ралли в этом году является «чрезмерно щедрым».

Азиатские акции выросли впервые за четыре сессии, а акции, котирующиеся в Гонконге, лидируют благодаря ряду позитивных корпоративных событий. Индекс MSCI в Азиатско-Тихоокеанском регионе вырос на 0,6%, что является самым высоким показателем почти за неделю, при этом Alibaba и Sony вошли в число ключевых игроков. Акции Xiaomi подскочили после того, как генеральный директор сказал, что компания начинает массовое производство нового чипа, в то время как китайские акции здравоохранения выросли после того, как биотехнологическая компания 3SBio заключила соглашение с Pfizer. Акции в Индии упали. Моментум возвращается к азиатским акциям с ослаблением напряженности на торговом фронте, в то время как глобальный рост кажется неповрежденным. Китайский аккумуляторный гигант CATL дебютировал в Гонконге после завершения крупнейшего в мире первичного публичного предложения в этом году, продемонстрировав аппетит к таким темам в регионе.

На майской встрече RBA, как и ожидалось, сократила ставку на 25 б.п., но с четкими голубиными элементами на встрече в целом. Заявление было существенно более позитивным в отношении прогресса, достигнутого в отношении мандата по инфляции, при этом инфляция, как ожидается, останется в пределах целевого диапазона RBA в 2-3%, а с удалением предыдущего языка будет определено «устойчивое возвращение инфляции к целевому уровню». Обновленные макропрогнозы также были существенно мягче, в соответствии с ожиданиями наших экономистов, с более низкими показателями роста и инфляции и более высоким уровнем безработицы. Возможно, самой заметной голубиной новостью было то, что губернатор Буллок отметил, что на сегодняшнем заседании Совет обсудил сокращение на 50 б.п., что предполагает более четкий разрыв с их ранее более осторожным мышлением. Экономисты Goldman пересмотрели свой призыв к RBA дополнительное сокращение на ноябрьской встрече, Кроме сокращений они продолжают ожидать на июльских и августовских встречах.

В Fx индекс Bloomberg Dollar Spot упал на 0,1%. Aussie отстает от конкурентов G-10, снизившись на 0,6% по сравнению с долларом после того, как губернатор RBA Мишель Буллок сказал, что совет директоров рассмотрел снижение ставки на 50 б/с, прежде чем выбрать 25. Доллар продолжает отставать, но в пределах ограниченных диапазонов сегодня утром. Ценовое действие в евро (+10 б/с) остается конструктивным после того, как предвзятость торгового стола перекосилась в сторону продаж вчера. Наши спот-трейдеры (KBS) отмечают, что вчера было отсутствие интереса со стороны HFs к погоне - частично элемент некоторых все еще склоняющихся к предыдущим ранам, но мы, похоже, достигли предела ложных запусков без четкого идентифицируемого катализатора, который HFs готовы преследовать. USDJPY торгуется на -25 б/с ниже после неповоротливого ценового действия в одночасье. Несмотря на продолжающиеся спотовые движения ниже в USDJPY и возросшие спекуляции о том, что может быть какая-то «валютная сделка» в рамках торговых переговоров, наши трейдеры отметили, что понижательная гамма USDJPY снизилась (1 м ATM -0,25v против рулона), при этом рынок изо всех сил пытается переварить поставки в течение последних 48 часов. USDCNH торгуется на 10 б. п. выше после того, как он подскочил на заголовки, которые впервые с октября снизили базовые ставки кредитования. Выброс за ночь был AUD (-70bps), среди голубиных 25bps, вырезанных из RBA.

В ставках казначейские обязательства смешиваются, поскольку сессия в США начинается с более крутой кривой доходности. Первичная доходность на 1bp-2bp ниже в день, в то время как 30-летний выше примерно на 3bp около 4,93%. Кривая казначейства вращается вокруг малоизмененного 7-летнего сектора. с 10-летним периодом около 4,46%, Отстаивающие узлы и позолоты в секторе на 1,8 и 2,5 л.с. Бунды и позолоты превосходят результаты после более мягких, чем ожидалось, немецких данных PPI и ценообразования на синдицированный позолоченный выпуск стоимостью 4 миллиарда фунтов стерлингов 2056 года. Gilts лидирует в ралли европейских облигаций, а доходность 10-летних облигаций Великобритании снизилась на 3bps до 4.63%. Трейдеры отмахнулись от предупреждения главного экономиста Банка Англии Хью Пилла о том, что процентные ставки могут снижаться слишком быстро. Календарь экономических данных США включает только региональный индикатор, однако несколько спикеров ФРС намечаются. Аукционы казначейства в преддверии этой недели включают в себя 20-летний новый выпуск на 16 миллиардов долларов в среду и 18 миллиардов 10-летних TIPS, возобновляющихся в четверг.

В сырьевых товарах нефть парирует более ранние успехи, наблюдаемые после того, как верховный лидер Ирана Хаменеи выразил скептицизм по поводу переговоров с США. WTI упал на 0,2% до $62,50. Спотовое золото поднимается на 8 долларов до 3238 долларов за унцию.

Календарь экономических данных США включает майскую непроизводственную деятельность ФРС Филадельфии (8:30 утра). Спикер ФРС включает в себя Bostic, Barkin (9 утра), Collins (9:30 утра), Musalem (1 вечера), Kugler (5 вечера), Hammack и Daly (7 вечера)

Рыночный снимок

- S&P 500 mini -0,2%;

- Nasdaq 100 mini -0,3%,

- Russell 2000 mini - 0,3%

- Stoxx Europe 600 +0,4%

- DAX +0,2%,

- CAC 40 мало изменился

- 10-летний Доходность казначейства мало изменилась на 4,45%

- VIX +0,3 балла в 18,44

- Индекс доллара Bloomberg -0,1% на 1223,55

- евро +0,2% на $1,1262

- Сырая нефть WTI -0,1% при $62,6/баррель

Лучшие ночные новости

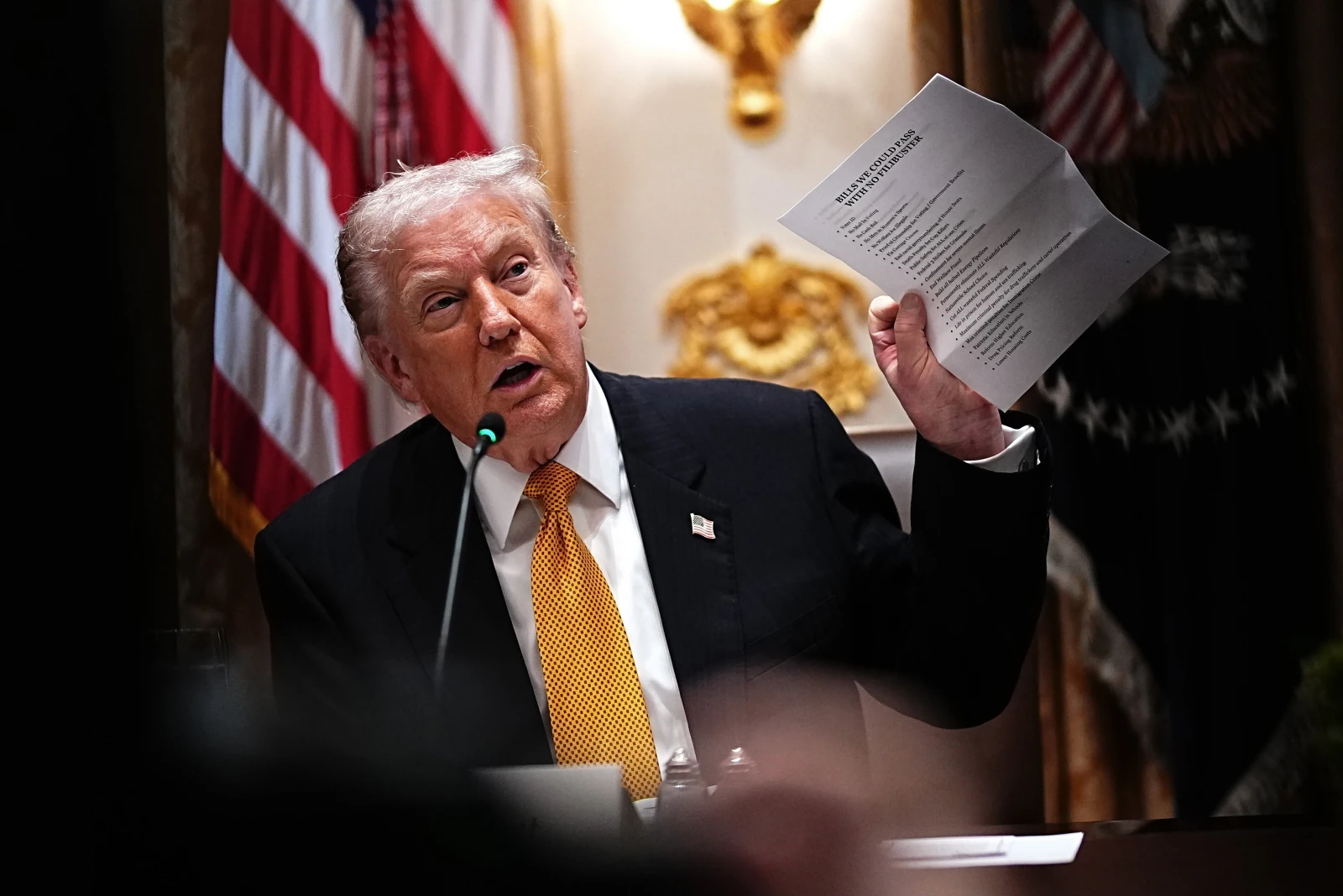

- Председатель Freedom Caucus Харрис сказал, что голосов за законопроект Трампа нет, и прогнозирует, что сделка по налоговому законопроекту будет отложена до июня.

- Трамп заявил, что Россия и Украина «немедленно» начнут переговоры о подготовке к мирным переговорам, но дал понять, что покидает Москву и Киев, чтобы найти сделку без США в качестве посредника. FT

- Криптовалюта одержала большую победу после того, как группа демократов отказалась от своей оппозиции законодательству о стейблкоинах. Законопроект может быть принят на этой неделе. BBG

- Верховный лидер Ирана аятолла Али Хаменеи заявил, что переговоры с США по ядерной программе его страны вряд ли приведут к сделке, и назвал последние требования администрации Трампа в отношении Ирана «возмутительными». "

- Китай впервые с октября снизил базовые ставки кредитования, в то время как крупные государственные банки снизили ставки по депозитам, поскольку власти работают над смягчением денежно-кредитной политики, чтобы помочь защитить экономику от последствий китайско-американской торговой войны. РТС

- Экспорт смартфонов из Китая в США в прошлом месяце упал на 72%, опередив общее падение поставок на 21%. В то же время стоимость экспорта телефонных компонентов в Индию увеличилась примерно в четыре раза. BBG

- На этой неделе Банк Японии объявит участников рынка, чтобы оценить их мнение о том, насколько агрессивно он должен продолжать количественное ужесточение, поскольку доходность выросла почти через год после того, как он начал сокращать свои огромные покупки облигаций. BBG

- Главный торговый переговорщик Японии, Рёсей Аказава, заявил во вторник, что нет никаких изменений в позиции Токио, требующего отмены тарифов США в двусторонних торговых переговорах.

- Токио не будет спешить с заключением торговой сделки, если это может нанести ущерб интересам страны. РТС

- Индия обсуждает торговую сделку США, структурированную в три транша, и рассчитывает достичь временного соглашения до июля, когда будут введены взаимные тарифы президента Дональда Трампа, по словам чиновников в Нью-Дели, знакомых с этим вопросом. BBG

- Дональд Трамп планирует сегодня отправиться в Капитолий, чтобы подтолкнуть республиканцев Палаты представителей поддержать его законопроект о сокращении налогов. Встреча спикера Майка Джонсона с несогласными членами Республиканской партии из штатов с высокими налогами не привела к заключению сделки по SALT. BBG

Тарифы/торговля

- По сообщениям Kyodo, Япония рассматривает возможность снижения тарифов США, а не освобождения от них. Сообщается, что японское правительство рассматривает вариант принятия снижения ставки дополнительных тарифов и взаимных тарифов на автомобили и другие товары. Из-за того, что США, по словам источников, отказались отменить тарифы на предыдущих переговорах и, как говорят, «указали на свое намерение исключить из переговоров дополнительные тарифы на автомобили, сталь и алюминий, которые важны для Японии».

- США Министр финансов Бессент отправится в Канаду для участия в совещании министров финансов и управляющих центральных банков G7, в то время как он сосредоточится на необходимости решения глобальных экономических дисбалансов и нерыночных практик.

- Министр экономики Японии Аказава заявил, что Япония и США провели переговоры на рабочем уровне по двусторонней торговле в понедельник, добавив, что в позиции Японии, требующей отмены тарифов США, нет никаких изменений. Также сообщалось, что США и Япония могут провести переговоры уже в эту пятницу, хотя ожидается, что министр финансов США Бессент не будет присутствовать.

- Президент Тайваня Лай сказал, что тарифные переговоры с США идут гладко, в то время как он добавил, что Тайвань должен инициировать фонд национального благосостояния и расширить экономические связи с другими странами, кроме США.

- Индия обсуждает торговую сделку США, структурированную в три транша, и рассчитывает достичь временного соглашения до июля.

Более подробный взгляд на мировые рынки любезно предоставлен Newsquawk

Акции APAC были незначительно выше, поскольку регион получил импульс от отскока штата, где основные индексы постепенно окупили потери, вызванные понижением рейтинга США, и как S&P 500, так и Dow, отмеченные шестидневными победными сериями. ASX 200 лидировал по показателям в области технологий и финансов, в то время как внимание было сосредоточено на RBA, которая обеспечила ожидаемое снижение ставок. Nikkei 225 сплотился на открытом рынке в тандеме с ростом USD/JPY, но затем вернул большую часть добычи на фоне колебаний валютных курсов и с небольшим количеством новых катализаторов для Японии. Hang Seng и Shanghai Comp держались на плаву после того, как крупнейшие банки Китая снизили ставки по депозитам и снизили базовые ставки по кредитам на 10 базисных пунктов, руководствуясь губернатором PBoC Паном, в то время как настроения также были подкреплены скачком акций CATL на его дебюте в Гонконге.

Лучшие азиатские новости

- Китайский государственный планировщик заявил, что приложит больше усилий для привлечения и использования иностранного капитала, в то время как Китай разрабатывает правила управления кредитами для проектов по обновлению, и большая часть политики будет реализована до конца июня.

- BoJ публикует информационные материалы, используемые на встрече с участниками рынка облигаций: некоторые члены отмечают, что функциональность рынка JGB улучшается в связи с сокращением BoJ. Некоторые ищут окончательный конец покупке облигаций, некоторые после более крупных сокращений в следующем плане. Некоторые ищут существенные сокращения за один раз. Ухудшение спроса на сверхдлинные JGB не может быть исправлено.

РБА

- Как и ожидалось, RBA снизила ставку на 25 б/с до 3,85%, в то время как она заявила, что инфляция продолжает снижаться и что прогноз остается неопределенным. RBA подтвердила, что поддержание низкой и стабильной инфляции является приоритетом, и совет посчитал, что риски для инфляции стали более сбалансированными, а также оценила, что этот шаг по ставкам сделает денежно-кредитную политику несколько менее ограничительной. Кроме того, RBA заявила, что инфляция, вероятно, вырастет в течение следующего года примерно до верхней части группы, поскольку временные факторы ослабевают, и остается осторожным в отношении прогноза, особенно учитывая повышенный уровень неопределенности как в отношении совокупного спроса, так и предложения. RBA также опубликовала ежеквартальное заявление о денежно-кредитной политике, в котором отмечалось, что эскалация глобального торгового конфликта является ключевым риском для экономики и что перспективы глобального роста были понижены, в то время как она добавила, что неопределенность увеличилась из-за тарифной политики США и она сократила свои основные внутренние прогнозы инфляции.

- Губернатор Буллок: готов к дальнейшим действиям по ставкам, если потребуется; рост цен замедлился; Буллок добавляет, что это было уверенное снижение ставок; Была дискуссия между сокращением на 50 или 25 б/с; обсуждались ставки удержания или сокращение. Не могу сказать, где окажется ставка наличных денег, не одобряет рыночное ценообразование (примечание: ~55 млрд.

Европейские биржи (STOXX 600 + 0,3%) открылись по всем направлениям и до сих пор торговались в узком диапазоне, учитывая отсутствие соответствующих обновлений. Европейские секторы смешанные, и, кроме топ-исполнителя, широта рынка довольно узкая. Коммунальные услуги занимают первое место, а настроения в названиях ветров усилились после того, как администрация Трампа отменила работу над проектом оффшорной ветроэлектростанции Equinor (+ 1,3%) в Нью-Йорке; название выше примерно на 1,5% - такие сверстники, как Orsted (+ 14%), также оказались выше.

Лучшие европейские новости

- «Несогласное голосование проистекает из опасений, что темпы снятия ограничений денежно-кредитной политики с прошлого лета — ежеквартальное сокращение на 25 б.п. — слишком быстры, учитывая баланс рисков для стабильности цен». Несогласие соответствовало его предпочтению «осторожного и постепенного» снижения ставки, выраженного за последние двенадцать месяцев. Он бы охарактеризовал свое несогласное голосование как «пропуск» в ежеквартальной схеме снижения ставки. Не следует рассматривать его как благоприятствующее прекращению (и тем более отмене) этого снятия ограничений. Он обеспокоен тем, что структурные изменения в поведении цен и заработной платы увеличили внутреннюю устойчивость процесса инфляции в Великобритании. Основная дезинфляция продолжается. Перспективный путь банковской ставки отсюда вниз. Несогласие с последним решением не отражает принципиальной разницы с МПК. По его словам, «мы не должны зависеть от того, как будут выглядеть данные». Нельзя предположить, что «боль» инфляции от новых экономических потрясений быстро рассеется. Согласен с МПК, что на рынках труда идет послабление, есть вопросы по темпам. Некоторые ключевые показатели оплаты труда «остаются довольно сильными».

- Шнабель из ЕЦБ говорит, что дезинфляция идет полным ходом, хотя новые потрясения могут создать новые проблемы. Тарифы могут быть дефляционными в краткосрочной перспективе, но в среднесрочной перспективе могут привести к росту риска. «Мы сталкиваемся с исторической возможностью укрепить международную роль евро» и «Когда режим инфляции изменится, мы должны быть готовы быстро реагировать».

- Немецкая ассоциация химической промышленности VCI: производство Q1 +0,6% Y/Y; Доход +1,8% Y/Y; отмечает, что в этом году ожидается стагнация производства и незначительное снижение продаж в отрасли.

Форекс

- После ограниченного старта DXY расширился в понедельник, что было в значительной степени связано с понижением рейтинга Moody’s в США в пятницу. Newsflow на торговом фронте был неинкрементным, за исключением статьи источников Reuters, в которой отмечается, что Казначейство США не ожидает каких-либо объявлений о торговых сделках на встрече G7 Finance в Канаде на этой неделе.

- PBoC установил среднюю точку USD/CNY в 7.1931 против exp. 7.2112 (Prev. 7.1916). Сегодняшний список спикеров включает в себя Bostic, Barkin, Collins, Musalem, Kugler, Daly & Hammack. DXY держится выше отметки 100.

- Незначительно более твердый евро по сравнению с долларом США с точки зрения новостного потока в еврозоне, за исключением продолжающегося разговора ЕЦБ с членом Исполнительного совета Шнабелем, отмечающим, что дезинфляция идет полным ходом, хотя новые потрясения могут создать новые проблемы. EUR/USD находится в верхней части диапазона 1.1169-1.1288 в понедельник.

- JPY на вершине списка лидеров G10 с некоторыми шагами, приписываемыми движениям в японской доходности с доходностью 30yr JGB, достигающей самого высокого уровня с момента своего дебюта с 1999 года после мягкого аукциона JGB в одночасье. Министр экономики Японии Аказава заявил, что Япония и США провели переговоры на рабочем уровне по двусторонней торговле в понедельник. Ожидается, что министр финансов Японии Като и министр финансов США Бессент обсудят обменные курсы в кулуарах встречи G7 в Канаде на этой неделе. USD / JPY опустился до 144,10, но перестал стесняться отметки 144.

- GBP является более жестким по отношению к доллару США и устойчивым по отношению к евро. Сегодня утром появились замечания от главного экономиста BoE Pill, который не согласился с решением по ставке 8 мая, проголосовав за неизменную ставку против консенсуса по сокращению на 25 б/с. Пилл отметил, что его несогласие связано с обеспокоенностью тем, что темпы снятия ограничений денежно-кредитной политики с прошлого лета слишком быстры, учитывая баланс рисков для стабильности цен. Он добавил, что его голосование должно рассматриваться как пропуск, а не прекращение процесса снятия ограничений. Замечания имели мало общего с GBP; в настоящее время около 1,3370.

- Антиподы оба более мягкие по сравнению с долларом США, а AUD отстает от основных после RBA. Как и ожидалось, РБА нажал на спусковой крючок при сокращении на 25 б/с, предложив осторожный взгляд на перспективы и понизив свои прогнозы инфляции в своем сопроводительном заявлении по денежно-кредитной политике. На последующей пресс-конференции AUD/USD достиг минимума в 0,6409 после того, как губернатор Буллок сообщил, что совет обсуждал сокращение на 25 или 50 б/с.

Фиксированный доход

- JGB изначально были более устойчивыми, вписываясь в окружение сверстников после возможного внутридневного восстановления в понедельник от давления со стороны Moody's. Тем не менее, рост в Японии был ограничен в поставках. Но из-за неудачных выходов в 20 лет JGB упал с 134,40 до базы 138,78 - давление, которое с тех пор уменьшилось.

- USTs испытали небольшой медвежий всплеск на вышеупомянутом аукционе. Тем не менее, внутридневное восстановление в понедельник осталось нетронутым для UST в течение ночи, и с тех пор эталонный показатель увеличился до 110-14+, рассматривая 110-21+ с прошлой недели в качестве следующей точки сопротивления. Сегодняшний список спикеров включает в себя Bostic, Barkin, Collins, Musalem, Kugler, Daly & Hammack.

- Сегодня они немного более крепкие, в сочетании со сверстниками. Ранние комментарии Шнабеля сегодня утром, хотя ничего принципиально не изменило повествование. Впереди многочисленные ораторы. Cipollone, Knot & Nagel. Аналогичным образом, ни один переход к немецким ценам производителей не будет печатать ниже ожиданий и предыдущих, что обусловлено в первую очередь ценами на энергоносители для обоих компонентов. Продолжает восстанавливаться от давления понедельника, в лучшем случае было 15 клещей выше пика этой сессии 130,60. Немецкие аукционы 10 и 30 лет были хорошо приняты, но мало повлияли на немецкую бумагу.

- Потолки более прочные и в настоящее время превосходят. Результативность, которая приходит, поскольку Gilts не получил столько времени, чтобы извлечь выгоду из отскока поздней двери в понедельник, и как ориентир Великобритании был неэффективным, учитывая обновления ЕС-Великобритания. На верхнем уровне 91.45-91.91 полосы. Пилл из BoE отметил, что его голосование в мае, чтобы оставить ставки без изменений, было «промахом». В соответствии с его предпочтением «осторожных и постепенных» сокращений и исходя из мнения, что последние квартальные темпы «слишком быстры, учитывая баланс рисков для стабильности цен». В Гилтсе нет движения к его речи.

- Менеджеры пенсионных фондов Гонконга, как сообщается, бьют тревогу по поводу возможной принудительной продажи активов Казначейства США после понижения рейтинга Moody’s в США, согласно источникам Bloomberg, Ассоциация инвестиционных фондов Гонконга (HKFIA) рекомендовала сделать исключение из правила максимального владения 10% для казначейских облигаций США, чтобы позволить фондам инвестировать выше предела, даже если США оценены на одну ступень ниже AAA, согласно источникам. Японская R&I по-прежнему имеет рейтинг AAA в США и не рассматривает возможность понижения в настоящее время «не думаю, что ситуация, описанная там, значительно изменилась».

- Прогноз цен Великобритании на новые 5,375% 2056 Потолок в продаже через синдикацию видел +1,75bps до +2,25bps более 4,25% 2055 Gilt, заказы более GBP 70bln.

Товары

- Сырая нефть сегодня утром ниже, несмотря на более мягкий доллар, но на фоне осторожного тона риска в Европе и после некоторых более оптимистичных тонов от президента США Трампа в отношении России, в то время как рост был замечен на менее примирительных комментариях от верховного лидера Ирана. Он сказал, что «не думает, что ядерные переговоры с США будут успешными». Brent Jul’25 вырос с $65,07 за баррель до $66,00 за баррель за три минуты — движение, которое с тех пор в основном исчезло.

- Относительно плоская и слабая торговля драгоценными металлами на фоне отсутствия соответствующих макроэкономических драйверов сегодня утром и после относительно сдержанной сессии в понедельник. Спотовое золото находится в текущем диапазоне USD 3,204,67-3,232,85 / унция.

- Смешанная торговля базовыми металлами и в узких диапазонах на фоне отсутствия соответствующих катализаторов во время европейской сессии, в то время как более широкий тон риска остается осторожным. 3M LME медь в настоящее время находится в $ 9 443,05-9 520,90 / т.

Геополитика: Ближний Восток

- Верховный лидер Ирана Хаменеи заявил: «Я не думаю, что ядерные переговоры с США будут успешными». Он заявил, что США должны отказаться от возмутительных требований. Заявления о том, что Ирану не будет позволено обогащать уран, являются чрезмерными и возмутительными.

- Израильское вещание Корпорация: Нетаньяху продлевает пребывание израильской переговорной команды в Дохе еще на один день, — говорится в сообщении.

- Премьер-министр Израиля Нетаньяху заявил, что «война в Газе может закончиться завтра», если заложники вернутся, а лидеры ХАМАСа сложат оружие.

- Иран получил предложение о следующем раунде непрямых переговоров с США, сообщает Iran International.

- Официальный представитель МИД Ирана: Время и место очередного раунда ядерных переговоров с США пока не определены, сообщает Sky News Arabia.

Геополитика: Россия-Украина

- Президент США Дональд Трамп заявил, что США не отступают от российско-украинских переговоров и что было бы полезно провести украинско-российские переговоры в Ватикане, в то время как он повторил, что это не его война, и думает, что что-то произойдет с Россией и считает, что Путин хочет прекратить. Кроме того, Трамп сказал, что у него есть красная линия в голове, когда он перестанет давить на Россию и Украину, но не скажет, что это за красная линия, и отметил, что может быть время, когда санкции России произойдут.

- Пресс-секретарь Кремля сказал, что президент США Трамп и президент России Путин говорили о прямом разговоре между Путиным и президентом Украины Зеленским, хотя пока нет решения о месте следующего прямого контакта между Россией и Украиной. Пресс-секретарь заявил, что не может быть срока для подготовки меморандума между Россией и Украиной, а также отметил, что все заинтересованы в скорейшем урегулировании на Украине и что Россия заинтересована в устранении коренных причин конфликта.

Календарь событий США

- Филадельфия Обследование активности не-Mfg

Спикеры Центрального банка

- 9:00: Федрезерв дает вступительные замечания

- 9:00: Баркин выступает на конференции ФРС в Ричмонде

- 9:30: Фед Коллинз проводит мероприятие в Нью-Гемпшире

- 1:00: Мусалем говорит об экономике и политике

- 5:00: Фед Куглер дает стартовый адрес

Джим Рид из DB завершил ночную обертку

Вчера казалось, что мы находимся где-то на грани «смерти от тысячи сокращений» в отношении финансовой ситуации в США. Трудно сказать, где мы находимся в этой тысяче, но, вероятно, гораздо ближе к тысяче, чем при нуле, даже несмотря на то, что вчера мы увидели обратную распродажу. В конце дня потеря окончательного рейтинга США в тройном рейтинге поздно вечером в пятницу ничего не меняет сразу, но она держит каплю, каплю, каплю плохих финансовых новостей на фоне плотины долговой устойчивости. В любом случае, достаточно метафор.

In Yesterday’s CoTD (ссылка) Я подчеркнул, что базовый случай Moody’s в настоящее время заключается в том, что дефицит США достигнет почти 9% к 2035 году, и спросил во внезапном опросе, произойдет ли это, или как этого можно было бы избежать или справиться, если бы это произошло. Я буду держать опрос открытым в течение нескольких часов, прежде чем публиковать результаты в моем CoTD в это обеденное время в Лондоне. Посмотри сюда. Это займет менее 5 секунд, и все отзывы приветствуются.

Мы увидели большую круглую поездку в казначейских облигациях вокруг новостей, с доходностью 30 лет, ненадолго достигающей своего самого высокого внутридневного уровня с 2023 года, на уровне 5,035%, прежде чем отыграть этот шаг, чтобы закрыться на 4,90%, -4,1 млрд. Это восстановление началось вскоре после открытия США и продолжалось по ходу сессии. Это, возможно, указывает на медленную тенденцию иностранных инвесторов продавать казначейские облигации, но отечественные инвесторы увеличивают свои запасы.

Ранее в ходе кросс-активных операций произошло незначительное повторение того, что произошло после Дня освобождения, поскольку активы США потеряли позиции по всем направлениям. S&P 500 восстановился с -1,05% при минимумах до конца +0,09% выше. Американским активом, который боролся больше всего, был доллар, причем индекс (-0,72%) показал лишь скромное восстановление с -1,02% внутридневного минимума. Это снижение доллара повторило в начале апреля параллели с сценариями бегства капитала, часто наблюдаемыми на развивающихся рынках, где валюта борется, хотя ставки растут.

Это происходит в деликатное время, потому что администрация США стремится продлить сокращение налогов Трампа в 2017 году, которое в настоящее время истекает в конце 2025 года. Мой CoTD показал, что CBO считает, что федеральный долг США, удерживаемый общественностью, вырастет до 220% к 2055 году, если будет продлено снижение налогов, при этом дефицит достигнет 12% ВВП. Опять же, не стесняйтесь голосовать в флэш-опросе CoTD, если вы хотите выразить мнение о том, произойдет ли что-то до того, как мы доберемся до такого уровня, или мы сделаем это в наших шагах, как и любой другой показатель долга / дефицита в последние годы.

С точки зрения этого движения облигаций более подробно, распродажа была первоначально очень агрессивной, с доходностью 30 лет, достигающей 5,035%, и на пути к своему максимальному закрытию с 2023 года и фактически выше всего за шесть рабочих дней с 2007 года. Тем не менее, это было затем отброшено назад, и это фактически закончило день -4,1bps ниже на 4,90%. Аналогичным образом, доходность 10 лет достигла внутридневного максимума в 4,56%, но в конечном итоге закрылась на -3,0bps ниже на 4,45%. Таким образом, первоначальные опасения дня в конечном итоге не материализовались, когда американские покупатели вмешались, и в конце 2-го года доходность упала до 3,98%. Ночью доходность движется меньше, чем базисная точка по кривой.

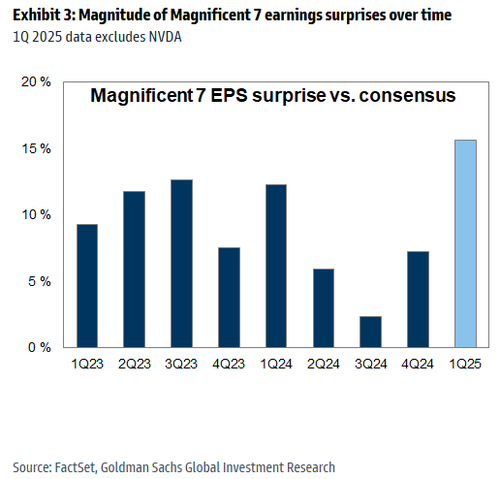

Аналогично движению ставок, S&P 500 поднялся с более чем -1% вниз на открытом уровне до +0,09% к концу, отметив шестой подряд прирост. Наибольшие успехи были отмечены в оборонных секторах, включая здравоохранение (+0,96%) и потребительские товары (+0,42%). В отличие от этого, акции технологических компаний не полностью восстановились, а Magnificent 7 упала на 0,25% после лучших еженедельных показателей за последние два года. Небольшая шапка Russell 2000 (-0,42%) также уступила позиции. И отражая рост волатильности, индекс VIX вырос (+0,90 пт) с семинедельного минимума в пятницу до 18,14 пт.

В то время как финансовые новости США доминировали над вниманием, в геополитическом пространстве у нас был президент Трамп, держащий звонок с президентом Путиным, но это дало мало нового в решении войны на Украине. Трамп заявил, что Украина и Россия «немедленно начнут переговоры». Тем не менее, комментарии Трампа не повторили ранее угрозы новых санкций против России и не оказали немедленного давления на Москву, чтобы добиться прекращения огня, и его пост предположил, что США теперь могут занять больше места в переговорах. Между тем Путин довольно расплывчато относился к предстоящим переговорам, вновь ссылаясь на «необходимость устранить коренные причины этого кризиса». "

В противном случае вчера несколько Чиновники ФРС дали понять, что не спешат снижать ставки. Вице-председатель Джефферсон сказал: «Я считаю, что уместно подождать и посмотреть, как политика будет развиваться с течением времени». Президент ФРБ Атланты Бостик сказал: «Я думаю, нам придется подождать три-шесть месяцев, чтобы начать видеть, где это все улаживается», и повторил свое ожидание еще одного снижения ставки в этом году. Президент Федеральной резервной системы Нью-Йорка Вильямс заявил, что «в июне мы не поймем, что происходит здесь или в июле». Президент Федеральной резервной системы Миннеаполиса Кашкари отметил: «На самом деле просто подождите и посмотрите, пока мы не получим больше информации». Поэтому неудивительно, что инвесторы по-прежнему считают краткосрочное снижение ставки маловероятным, и только 35% шансов на снижение цен к июльской встрече.

Ранее в Европе рынки показывали гораздо более стабильные показатели, при этом STOXX 600 (+0,13%) показывал небольшой прирост. Это отразилось и на стороне ставок, где доходность на 10yr bunds (-0,2bps), OATs (-0,4bps) и BTPs (+0,1bps) мало изменилась. Между тем, Великобритания и ЕС также достигли соглашения, которое углубило связи между ними после Brexit. Великобритания согласилась продлить права ЕС на рыболовство в обмен на отмену большинства пограничных проверок на экспорт сельскохозяйственной продукции. Это согласуется с соглашением об обороне и безопасности, а также с потенциальной схемой мобильности молодежи, хотя последняя будет предметом дальнейшего обсуждения. Наши британские экономисты вчера рассмотрели сделку, и их оценки показывают, что долгосрочные выгоды составят около 0,5% ВВП к 2040 году.

Для тех из нас, кто в Великобритании сыт по горло тем, что не может использовать электронные ворота в ЕС, сделка относится только к «потенциальному использованию электронных ворот, когда это необходимо». Я был в стольких длинных очередях в последние пару лет, когда EGates были пусты.

В Азии настроения риска были поддержаны после того, как центральный банк Китая объявил о сокращении ключевых ставок кредитования впервые с октября, усиливая ожидания более мягкой денежно-кредитной политики для поддержки экономики страны. По всему региону Hang Seng (+1,29%) лидирует, в то время как CSI (+0,62%) и Shanghai Composite (+0,38%) также приближаются к росту. В других странах Nikkei (+0,26%), S&P/ASX 200 (+0,54%) набирают обороты, но KOSPI (+0,05%) скатывается назад к плоскости. Фьючерсы S&P 500 (-0,29%) и NASDAQ 100 (-0,43%) возвращают часть вчерашнего восстановления от минимумов.

Возвращаясь в Китай, НБК снизил 1-летнюю ставку прайм-кредита (LPR), базовую ставку для ценообразования всех новых кредитов и непогашенных кредитов с плавающей ставкой, до 3,0% с 3,1% и 5-летнего LPR до 3,5% с 3,6%. Между тем, RBA только что снизил ставки на 25 б/с (как и ожидалось), поскольку я заканчиваю это с продолжающимся прессером. До сих пор он наклоняется голубино.

К сегодняшнему дню и релизам данных относятся канадский индекс потребительских цен и немецкий индекс потребительских цен за апрель, а также предварительный показатель потребительского доверия Европейской комиссии за май для Еврозоны. Из центральных банков мы услышим от Bostic ФРС, Barkin, Collins, Musalem, Kugler, Hammack и Daly, Wunsch ЕЦБ, Knot и Cipollone и таблетки Банка Англии. Наконец, выпуски доходов включают Home Depot.

Тайлер Дерден

Туэ, 05/20/2025 - 08:36