Фьючерсы отстают от Macro Data и зарабатывают

Фьючерсы на акции США опередили ключевые данные по ВВП и PCE. По состоянию на 8:00, фьючерсы S&P 500 снизились на 0,3%, в то время как контракты Nasdaq 100 потеряли 0,5%, причем имена Mag 7 в основном ниже (NVDA -1,4%, TSLA -1,1% и META -0,6%), поскольку слабая прибыль повлияла на настроения риска после того, как Super Micro упала на 16%, опередив Microsoft и Meta в среду. Доходность облигаций ниже на 1bps до 4,15%, в то время как доллар США выше. За одну ночь китайский завод PMI скатился в худшее сокращение с декабря 2023 года (49 против 49,7 минусов) из-за негативного влияния более высоких тарифов США, в то время как Трамп на митинге в Мичигане возобновил свою критику Пауэлла, отметив, что он «не очень хорошо работает» и что он знает больше о процентных ставках. Сегодня утром ИПЦ еврозоны был смешанным, в то время как данные по ВВП в 1 квартале были немного более твердыми, чем ожидалось, на уровне 1,2% в годовом исчислении (против 1,1%). Сырьевые товары смешиваются: нефть на 1,8% ниже; предыдущие металлы ниже, в то время как базовые металлы в основном выше. После вчерашнего закрытия доходы были скромно отрицательными. В частности, SBUX упал на 6,7% на фоне маржинального давления и роста в верхней строке. BKNG отметил, что в въездных поездках в США наблюдается умеренность, но пока глобальный спрос на досуг остается стабильным. Заглядывая в будущее сегодня, мы имеем ADP занятости, Q1 ВВП, PCE и индекс стоимости занятости. Спикеров ФРС не планируется, учитывая отключение перед майским заседанием FOMC.

В дорыночной торговле акции Mag7 были в основном ниже (Alphabet -0,1%, Amazon -0,6%, Apple -0,4%, Meta Platforms -0,9%, Microsoft +0,1%, Nvidia -2%, Tesla -1,3%). Первая солнечная электростанция упала на 12% после того, как производитель солнечных модулей, производящих электроэнергию, сократил прогноз прибыли на этот год из-за тарифов, введенных администрацией Трампа. Норвежская круизная линия упала на 7% после предупреждения о том, что спрос на круизы, который долгое время бросал вызов тревожным тенденциям в путешествиях, начинает ослабевать. Snap упал на 13% после того, как компания отказалась выпускать прогноз продаж на текущий период, заявив, что она ориентируется на макроэкономические «ветры» для своего рекламного бизнеса. Starbucks упал на 8% после того, как более слабые, чем ожидалось, результаты в последнем квартале усилили давление на новое руководство компании. Вот некоторые другие известные премаркеты:

- BridgeBio Pharma (BBIO) собрала 9% после того, как производитель лекарств сообщил о продажах своего недавно одобренного препарата для сердца Attruby, что разрушило ожидания.

- Etsy (ETSY) вырос на 1% после того, как онлайн-рынок ремесел сообщил о доходах за первый квартал, которые превзошли среднюю оценку аналитиков.

- Freshworks Inc. (FRSH) выросла на 9% после того, как компания, предоставляющая программное обеспечение в качестве услуги, повысила прогноз прибыли и выручки за год.

- Garmin (GRMN) упал на 6% после того, как производитель продуктов с поддержкой GPS опубликовал результаты первого квартала и предоставил прогноз на год.

- Oddity Tech (ODD) подскочила на 17% после того, как компания, ориентированная на потребителей, повысила прогноз чистого дохода на весь год до уровня, превышающего ожидания Уолл-стрит.

- Qorvo (QRVO) вырос на 8% после того, как поставщик Apple сообщил о скорректированной прибыли в 4Q, которая превысила оценки.

- Акции Regulus Therapeutics (RGLS) были приостановлены после того, как компания заключила соглашение о приобретении компанией Novartis AG.

- Seagate (STX) набирает 7% после того, как компания, занимающаяся компьютерным оборудованием и хранением, сообщила о доходах и доходах за третий квартал, которые превзошли среднюю оценку аналитиков.

- Stride Inc. (LRN) выросла на 3% после того, как компания онлайн-образования повысила свой прогноз доходов на весь год. Выручка за третий квартал выросла на 18%.

- Super Micro Computer (SMCI) упал на 16% после предварительных результатов, которые не соответствовали оценкам аналитиков, что свидетельствует о том, что его план возвращения был медленным.

- Tenable (TENB) упал на 17% после того, как компания по кибербезопасности сократила свои годовые прогнозы, а аналитики отметили более низкую видимость акций из-за неопределенности федеральных расходов США.

- Wabash National (WNC) упал на 13% после того, как компания по производству полуприцепов сократила свои прогнозы по доходам на весь год.

Инвесторы были осторожно оптимистичны: Nasdaq 100 близок к стиранию всех своих потерь в этом месяце, после повышения тарифов и спекуляций ФРС снизит процентные ставки, чтобы предотвратить рецессию.

Возможно, мы прошли пик неопределенности. Ким Кроуфорд, портфельный менеджер по глобальным ставкам в JPMorgan Asset Management, сказал Bloomberg TV. «Администрация имеет более примирительный тон в отношении тарифов и, в некоторой степени, независимости ФРС». 10-летний рубеж Казначейские обязательства стабилизировались после шести дней прибыли, при этом доходность составила 4,16%. Золото упало.

Четыре из так называемой Великолепной семерки — Microsoft, Apple Inc., Meta и Amazon.com Inc. — отчет о прибылях на этой неделе. Аналитики ожидают, что группа, в которую также входят Alphabet Inc., Tesla Inc. и Nvidia Corp., обеспечит рост прибыли в среднем на 15% в 2025 году, прогноз, который едва изменился с начала марта, несмотря на обострение торговой напряженности.

«Даже если вы уберете результаты тарифной истории, я думаю, что есть проблема для Big Tech, и рынок, вероятно, начнет переориентироваться на это, когда мы получим этот сезон доходов.Кристофер Вуд, глобальный руководитель стратегии справедливости в Jefferies, сказал Bloomberg TV. "У нас все еще есть проблема с огромным количеством капитальных затрат на Big Tech, они перерасходуют на эту историю ИИ. "

Экономические барометры США также связаны с экономическим здоровьем. Инфляция и данные по ВВП в среду, которые дадут снимок активности Незадолго до того, как президент Дональд Трамп 2 апреля ввел пошлины на конкретные страны, реальный рост ВВП США, вероятно, замедлился в первом квартале на фоне сбоев в результате политических сдвигов, сообщает Bloomberg Economics.

Ветеран инвесторов развивающихся рынков Марк Мобиус сказал, что он держит 95% своих средств наличными, поскольку он ждет неопределенности, связанной с торговлей. Хедж-фонды неохотно делают крупные ставки на фоне суматохи, при этом единственным значительным сдвигом в позиционировании в апреле стало увеличение ставок против акций США, сообщает Bloomberg.

В последнем повороте торговой стратегии Трампа президент США подписал распоряжение, облегчающее влияние его автомобильных тарифов, предотвращающее укладку пошлин на автомобили иностранного производства поверх других сборов и уменьшающее сборы на запчасти из-за рубежа, используемые для производства автомобилей в США. Новость поддержала настроения в отношении европейских автомобильных акций в среду, когда Mercedes-Benz Group AG и Stellantis NV выросли даже после снятия своих прогнозов на этот год, ссылаясь на неопределенность торговых барьеров.

На митинге, посвященном его первым 100 дням пребывания в должности, Трамп защитил свою тарифную политику, отметив свой 100-й день пребывания в должности. Он также вновь подверг критике председателя ФРС Пауэлла, заявив, что он «на самом деле не делает хорошую работу». "

В Европе Stoxx 600 растет седьмую сессию подряд, хотя и незначительно, поскольку разочаровывающие доходы сдерживают рост. Туристические и развлекательные акции являются худшими исполнителями. Энергетические и банковские акции также отстают с заметным снижением TotalEnergies и Credit Agricole после соответствующих обновлений. Вот некоторые из самых важных событий в среду:

- Акции Societe Generale выросли на 5,7% после того, как французский кредитор превзошел оценки, поскольку торговля акциями достигла рекорда, и он забронировал прибыль от выбытия.

- Акции DSV выросли на 11% после того, как датская логистическая фирма дала обнадеживающий набор результатов, а аналитики подчеркнули синергию, которую она изложила в своей сделке с DB Schenker.

- Акции Schindler выросли на 8,2% после того, как швейцарский производитель лифтов и эскалаторов сообщил о впечатляющих результатах 1Q с динамическим потреблением заказов и отсутствием изменений в руководстве, несмотря на тарифы США.

- Акции Stellantis выросли на 4,2% в Милане после того, как автопроизводитель выпустил торговое обновление, которое, по словам Бернштейна, включало в себя некоторые положительные моменты.

- Акции VW выросли на 1,4% после того, как немецкий автопроизводитель подтвердил свое годовое руководство, шаг JPMorgan назвал положительным сигналом.

- Акции Deutsche Post выросли на 4,1% после того, как Ebit компании-поставщика оказался выше, чем ожидалось, в первом квартале, чему способствовали подразделения Express и Post & Parcel.

- Акции Aixtron выросли на 14% после того, как результаты немецкого чип-инструмента в первом квартале показали лучший, чем ожидалось, доход, уровень заказов и положительный свободный денежный поток.

- Акции Remy выросли на 5,7%, поскольку аналитики отметили обнадеживающие признаки в прибыли производителя коньяка, включая улучшение на рынке США, а также лучший прогноз на 2026 год.

- UMG поднимается на 7,1%, поскольку рост подписки помогает обеспечить результаты первого квартала выше ожиданий.

- Акции Befesa выросли на 13% после того, как годовое руководство по доходам немецкой компании по переработке удивило рост.

- Акции AMS-Osram взлетели на 17%, а аналитики ZKB заявили, что швейцарский производитель чипов сообщил о хорошем начале года из-за высоких показателей в своем полупроводниковом бизнесе.

- Credit Agricole снизился на 4,5% по сравнению с ожидаемыми расходами, а налоговый счет повлиял на прибыль.

- Акции TotalEnergies упали на 4,3% после того, как французская энергетическая компания сообщила о результатах, которые соответствовали ожиданиям.

- Акции Mercedes упали на 2,8% после того, как автопроизводитель заявил, что волатильность тарифов слишком высока, чтобы дать надежный прогноз.

- Акции Evolution упали на 18%. Оператор азартных игр сообщил о промахе в доходах и Ebitda в первом квартале, который руководство приписывает действиям, включая регулируемые рынки в Европе и противодействие кибератакам в Азии.

Ранее на сессии азиатские акции выросли на четвертый день прибыли, поскольку инвесторы были воодушевлены продолжающимся ралли на Уолл-стрит и оптимизмом по поводу потенциальных торговых сделок с США. Индекс MSCI Asia Pacific составил 0,7%. Sony была одним из самых больших улучшений после того, как Bloomberg сообщил, что рассматривает возможность отключения своего полупроводникового блока, в то время как AIA поднялась на сильные квартальные результаты. Региональный бенчмарк может закрыться в апреле более чем на 2% выше, что приведет к резкому внутримесячному убытку, вызванному тарифами США. Рынок стремится к различным уступкам со стороны Вашингтона, а также к переговорам отдельных стран с США. Президент Дональд Трамп во вторник подписал распоряжение, облегчающее влияние его автомобильных тарифов, в то время как появились новости о дискуссиях с Южной Кореей и Австралией. Производственная активность Китая в апреле показала худшее сокращение с декабря 2023 года, обнажив ранние признаки слабости крупнейшей экономики Азии от торговой войны с США. Акции китайских банков были одними из самых больших препятствий для оценки акций в Гонконге и материковом Китае после слабой прибыли.

В валюте индекс Bloomberg Dollar Spot мало изменился. Австралийский доллар опережает рост на 0,2% по отношению к доллару после того, как базовая инфляция выросла больше, чем ожидалось. AUD / USD вырос на 0,5% до 0,6418, прежде чем сравнять этот шаг; базовая инфляция в стране в первом квартале превзошла оценки, ослабив ожидания быстрого снижения ставок. Фунт и иена были одними из худших показателей, снизившись на 0,3% и 0,4% по отношению к доллару соответственно.

В ставках казначейские облигации смешались с долгосрочными показателями, где доходность снизилась примерно на 2 млрд в день, чему способствовал более широкий рост, наблюдаемый в долгосрочных облигациях Германии и Великобритании после шквала европейских экономических данных. В преддверии сегодняшнего ежеквартального объявления о возврате средств 10-летняя доходность в США снизилась на 1 п.п. до 4,16%. Доходность в США немного дешевле по фронт-энду, в то время как более богатая в длинном конце кривой, сплющивание 2s10s и 5s30s распространяется на 1,8bp и 2,5bp в день; 10-летняя доходность в США снижается примерно до 4,16%, более богатая на 1bp в день с фунтами и позолотами, опережающими 2bp и 2,5bp в секторе. Европейские правительственные облигации выигрывают с небольшой реакцией на шквал экономических данных, включая удар по ВВП еврозоны в первом квартале. Европейские государственные облигации выросли; доходность Германии была на 4bps ниже по кривой, с позолотами, отражающими этот шаг; доходность Великобритании за 10 лет снизилась на 4bps до 4,40%

В сырьевых товарах цены на нефть снижаются, при этом WTI падает на 1% до $59,80 за баррель. Спотовое золото падает на 36 долларов до 3280 долларов за унцию. Биткоин стабилен около $94 800.

Экономический календарь США включает апрельское изменение занятости ADP (8:15 утра), 1Q расширенный ВВП (8:30 утра), апрельский MNI Chicago PMI (9:45 утра), мартовский личный доход / расходы, индекс цен PCE, ожидающие продажи жилья (10 утра). Отключение внешних коммуникаций ФРС в преддверии заседания FOMC 7 мая

Рыночный снимок

- S&P 500 mini - 0,1%

- Nasdaq 100 mini -0,2%

- Russell 2000 Мини-мало что изменилось

- Stoxx Europe 600 +0,2%

- DAX +0,5%, CAC 40 +0,4%

- 10-летний Доходность казначейства -1 базисный пункт 4,16%

- VIX +0,3 балла в 24,48

- Индекс доллара Bloomberg незначительно изменился на 1222,44

- евро -0,1%, $1,1371

- Нефть WTI - 1,3% - $59,63/барр.

Лучшие ночные новости

- Президент США Трамп сказал, что он достиг 100 самых успешных дней для президента в истории США, в то время как он отметил, что многие автомобильные рабочие места и компании приходят, и мы восстанавливаем верховенство закона и заканчиваем кошмар инфляции. Трамп возобновил свою критику Джерома Пауэлла, заявив, что председатель ФРС «не очень хорошо работает». Он также отстаивал свой тарифный режим на митинге, который состоялся всего через несколько часов после того, как он подписал несколько исполнительных указов, отменяющих некоторые из его автомобильных сборов.

- Госсекретарь США Марко Рубио планирует поговорить с министрами иностранных дел Индии и Пакистана в попытке успокоить напряженность. BBG

- Трамп продолжает выдвигать новые предложения по снижению налогов, в то время как республиканцы изо всех сил пытаются договориться о способах снижения стоимости законопроекта о примирении. Аксиос

- Главный советник Трампа, как сообщается, изо всех сил пытался успокоить инвесторов на переговорах после суматохи на рынке, в которой Стивен Миран встретился с хедж-фондами и крупными управляющими активами после того, как тарифы вызвали беспорядки на Уолл-стрит.

- Китайская фабрика PMI проскользнула в худшее сокращение с декабря 2023 года, обнаружив ранний ущерб от тарифов США. Пекин создал список продуктов американского производства, которые будут освобождены от своих тарифов в 125%. BBG

- Китайский суверенный инвестор CIC продает около $1 млрд своего инвестиционного портфеля прямых инвестиций на вторичном рынке. Активы находятся в нескольких фондах, управляемых восемью управляющими фондами США, включая Blackstone Inc и Carlyle Group. РТС

- Huawei начала поставки своего передового «кластера» чипов ИИ китайским клиентам, которые увеличивают заказы после того, как были отрезаны от полупроводников Nvidia из-за экспортных ограничений Вашингтона. FT

- Данные по Японии не соответствуют показателям Mar, включая розничные продажи (-1,2% M/M против Street -0,7%) и промышленное производство (-1,1% M/M против Street -0,4%). BBG

- Экономика еврозоны выросла на 0,4% в прошлом квартале, что больше, чем ожидалось, хотя пока не ощущает всю силу тарифов США. Экономика Германии и Франции вернулась к росту. BBG

Более подробный взгляд на мировые рынки любезно предоставлен Newquawk

Акции APAC не смогли поддержать положительную передачу от Wall St и торговались неоднозначно в конце месяца, поскольку регион переварил множество данных, включая разочаровывающие китайские официальные PMI, в то время как была приглушенная реакция и очень мало сюрпризов от речи президента США Трампа в ознаменование его первых 100 дней пребывания в должности. ASX 200 показал умеренный рост, поскольку сила в технологиях, здравоохранении и финансах компенсировала потери в секторах коммунальных услуг и связанных с сырьевыми товарами, но с ограничением роста после того, как более твердые, чем ожидалось, данные ИПЦ показали, что денежные рынки полностью оценили шансы на более крупное снижение ставки RBA на 50 б/с в мае. Nikkei 225 был неповоротлив с перевесом, содержащимся после разочаровывающего промышленного производства и розничных продаж, в то время как BoJ также начал свою двухдневную политическую встречу, и были некоторые комментарии от группы, представляющей крупных иностранных автопроизводителей, которые отметили, что последний тарифный заказ президента Трампа на автомобили обеспечивает некоторое облегчение, но необходимо сделать больше. Hang Seng и Shanghai Comp были нерешительными после того, как официальные китайские производственные и непроизводственные PMI разочаровали, хотя прогнозы Caixin Manufacturing PMI превысили прогнозы, в то время как материковая часть страны отправляется в пятидневный уик-энд из-за закрытия праздников Дня труда, и участники также размышляли о ключевых выпусках доходов, включая разочаровывающие результаты от крупных банков Китая 4.

Лучшие азиатские новости

- Президент Китая Си Цзиньпин говорит, что Китай должен скорректировать экономические планы, основанные на глобальных изменениях; содействовать трансформации традиционных отраслей; говорит, что они должны стабилизировать рынки и ожидания. Призывает к достижению целей во всех аспектах. Говорит, чтобы понять влияние изменений в международной ситуации. Китай оптимизирует экономическое планирование в зависимости от ситуации. Настоятельно призывает к мерам по стабилизации занятости. Пропагандирует трансформацию традиционных отраслей. Китай намерен скорректировать свой экономический план на основе глобальных изменений. Китай должен адаптироваться к меняющимся ситуациям.

- Постоянный комитет НПЦ Китая принял закон о продвижении частного сектора, который вступит в силу 20 мая.

- Австралийский казначей Чалмерс сказал, что рынок ожидает большего снижения процентных ставок после показателей инфляции, и он не видит в данных ничего существенного изменения ожиданий рынка.

Европейские биржи (STOXX 600 + 0,2%) открылись в основном более прочно и торговались ориентировочно в узком диапазоне перед ключевыми событиями дня. Европейские сектора имеют сильную положительную предвзятость; СМИ (поднятые силой пост-заработок в UMG) и Telecoms занимают первые места, в то время как Travel & Leisure и Basic Resources отстают. Рнинги включают: Mercedes Benz (-0,8%) вниз Y / Y, высокая неопределенность отмечена; Volkswagen (U / C) промах, ожидает результаты на нижнем уровне руководства; UBS (+0,2%) бить; Stellantis (+1,5%) в линии, приостанавливает руководство; Barclays (-0,3%) бить, модернизирует NII руководство; GSK (+4%) бить; TotalEnergies (-3,2%) смешанные, продолжайте выкупы, уверенные в цели роста; ASM International (U / C) заказы и маржинальный ритм; Air France (+1,6%) бить, подтверждает прогноз; Iberdrola (-1,3%) смешанные, ожидайте сильную производительность впереди.

Лучшие европейские новости

- Германская SPD Он одобрил коалиционное соглашение с ХДС/ХСС, сообщает Reuters со ссылкой на источники. Клингбейл из СДПГ станет вице-канцлером и министром финансов нового правительства Германии, сообщают немецкие СМИ.

Форекс

- DXY в настоящее время наращивает прибыль во вторник в тихой торговле. Двумя основными драйверами ценовых действий были облегчение тарифного фронта (авто) и мягкие данные США (JOLTS и доверие потребителей). Данные, вероятно, обеспечат некоторый импульс для Greenback сегодня с ВВП Q1 / PCE и ежемесячным PCE. В некоторых кварталах ВВП в 1-м квартале может считаться устаревшим, учитывая, что он предшествует объявлению тарифов США. DXY поднялся до 99,43 с пиком понедельника в 99,83.

- Евро мягче по сравнению с долларом США в то, что было напряженным утром данных, которые начались с устойчивого французского ВВП, горячей французской инфляции и встроенного немецкого ВВП, который видел нацию избежать технической рецессии, но в конечном итоге показал сокращение Y / Y. После этого ВВП еврозоны превзошел ожидания (Q/Q 0,4% против Exp. 0,2%), но не смог повлиять на евро, учитывая, что он не отражает влияние тарифов Трампа (кроме некоторой потенциальной предварительной загрузки заказов).

- USD/JPY выше после того, как японское промышленное производство и розничные продажи разочаровали в одночасье, вызвав опасения по поводу отрицательного роста ВВП в 1 квартале. Внимание теперь обращается к Банку Японии, где, как ожидается, Банк будет поддерживать стабильные ставки. USD/JPY находится к северу от максимума во вторник на уровне 142,75, но пока не приближается к отметке 143.

- GBP немного мягче по сравнению с USD и EUR со свежими макрос драйверами на светлой стороне. Данные Tier 2 через Lloyds Business Barometer и Nationwide House Index мало повлияли на GBP. На торговом фронте официальные лица США разделили торговые переговоры на три этапа; Великобритания, как сообщается, была помещена либо во второй, либо в третий этап. Официальные лица Великобритании также обеспокоены тем, что любая сделка между ЕС и Великобританией может сделать переговоры с США более сложными.

- AUD является предельным лидером среди майоров из-за показателей инфляции фирм в одночасье (Q / Q 0,9% против exp. 0,8%, Y / Y 2,4% против exp. 2,3%).

- PBoC установил среднюю точку USD/CNY на 7.2014 против exp. 7.2670 (Prev. 7.2029).

Фиксированный доход

- Относительно сдержанное начало сессии с UST, держащими трофеи вторника, более твердыми горсткой клещей в полосе 112-03 - 112-09. Ограниченное сопротивление в ближайшей перспективе, ничего особенного до 114-03+ с начала апреля и после 114-10. На фронте данных докет начинается с ADP в качестве предварительного просмотра NFP в пятницу. Затем следует ВВП Q1, PCE и затраты на занятость. Затем мы получаем ежемесячный показатель PCE.

- Бунды начали утреннее проведение в верхней части параметров вторника 131,16-46, в соответствии с UST. Затем, после открытия европейского денежного капитала, EGB начали постепенно набирать обороты, и, несмотря на то, что их ненадолго сбивали чуть более горячие показатели индекса потребительских цен в Германии, чем предполагает континентальный консенсус, Бунды достигли нового пика в 131,74. Показатели ВВП EZ оказались выше ожиданий, но в конечном итоге мало повлияли на комплекс, учитывая, что период опроса не включает в себя реализацию тарифов Трампа. Немецкие аутсайдеры 2041 и 2044 годов были смешанными, но в конечном итоге мало повлияли на комплекс.

- Потолки превзошли показатели, увеличились чуть более чем на 10 клещей, а затем встроились в EGB после того, как открытый денежный капитал начал расти и достиг максимума 93,68 для сессии. Сила возникает, несмотря на отсутствие свежих драйверов в сегодняшней сессии, кроме предложения, аукциона, который прошел с другим b / c, хорошо очищенным от отметки 3x и тонким хвостом. Результаты вызвали скромную заявку в Gilts, но она произошла в существующих пределах 93,35-68.

- Великобритания продает 4,5 млрд фунтов 4,375% 2028 Gilt: b/c 3,48x (предыдущее 3,27x), средняя доходность 3,834% (предыдущее 4,263%) и хвост 0,2bps (предыдущее 0,4bps).

- Германия продает 1,143 млрд. евро против экс. 1,5 млрд. евро 2,60% 2041 и 0,452 млрд. евро против экс. 0,5 млрд. евро 2,50% 2044 Бундов.

Товары

- Сырая нефть стала мягче для третьей сессии подряд после вчерашнего слайда, который теперь показывает, что WTI возвращается ниже 60 долларов за баррель. Рабочие столы подчеркивают обратную сторону текущих тарифных рисков наряду с ожиданиями ОПЕК + дальнейшего открытия кранов. Кроме того, медвежий отчет частной инвентаризации во вторник только добавляет настроения. Brent July в диапазоне $ 62,17-63,34/bbl.

- Драгоценные металлы ниже по всем направлениям на фоне более твердого доллара в течение дня и после того, как президент США Трамп смягчил тарифы на автомобили, что еще больше ослабляет некоторую премию за риск. Спотовое золото находится в диапазоне $3280,28-3,328,16 / унция на момент написания статьи, в диапазоне $3268-3,353,20 / унция в понедельник.

- Значительные потери по базовым металлам на фоне более твердого доллара в сочетании с осторожным тоном риска. Медь 3M LME в настоящее время находится в диапазоне 9 206,17-9 436,60 долларов США на момент написания.

- Генеральный директор Equinor (EQNR NO) говорит, что европейские хранилища газа находятся на низком уровне, ожидайте жесткого рынка во время пополнения запасов. Европе потребуется 200-300 дополнительных грузов СПГ для пополнения запасов в этом году.

- Данные по частным запасам США (bbls): Crude +3,8 млн (exp. +0,5 млн), Distillate -2,5 млн (exp. -1,7 млн), Бензин -3,1 млн (exp. -1.2 млн), Cushing +0,7 млн.

- Председатель чилийского Codelco заявил, что апрельское производство меди +22% в год.

Геополитика: Ближний Восток

- Заявление израильского правительства: По указанию Нетаньяху армия нанесла удар по группе, которая пыталась атаковать друзов в Сахнае (Сирия) через Sky News Arabia.

- Министр иностранных дел Ирана Аракчи заявил, что санкции США посылают негативный сигнал во время ядерных переговоров; E3 проведет переговоры в Риме в пятницу и с США в субботу.

- Британские войска участвовали в совместной операции с американскими силами против военной цели хуситов в Йемене, в то время как Великобритания заявила, что удар был нанесен после наступления темноты, когда вероятность того, что в этом районе будут находиться гражданские лица, была снижена, и все самолеты благополучно вернулись.

Геополитика: Украина

- Пресс-секретарь Кремля заявил, что урегулирование должно быть достигнуто с Украиной, а не с США, через Tass.

- Президент США Трамп сказал, что он думает, что президент России Путин хочет мира, но он не был счастлив, когда увидел, как Путин стреляет ракетами.

- Пресс-секретарь Белого дома заявил, что президент Трамп уверен, что сделка по добыче полезных ископаемых на Украине будет подписана.

Геополитика: другой

- Министр информации Пакистана заявил, что у них есть достоверные доказательства того, что Индия планирует «военную агрессию» против Пакистана в течение 24-36 часов.

- Северная Корея провела первые испытательные стрельбы нового военного корабля, сообщает Yonhap. Также сообщалось, что южнокорейская разведка оценила, что боевые возможности Северной Кореи улучшились и что Северная Корея пострадала от 600 смертей во время отправки войск в Россию, в то время как южнокорейская разведка следит за возможным внезапным саммитом между Северной Кореей и США.

Календарь событий США

- 7:00: 25 апреля Ипотечные заявки MBA -4,2%, предыдущие -12,7%

- 8:15 утра: Apr ADP Employment Change, est. 115k, prior 155k

- 8:30 утра: 1Q ВВП Годовой QoQ, est. -0,15%, ранее 2,4%

- 8:30 утра: 1Q Личное потребление, est. 1.16%, до 4%

- 8:30 утра: 1Q A Индекс цен на ВВП, est. 3.1%, prior 2.3%

- 8:30 утра: 1Q A Core PCE Индекс цен QoQ, est. 3.1%, предыдущие 2.6%

- 8:30 утра: 1Q Индекс стоимости занятости, est. 0,9%, prior 0,9%

- 9:45 утра: Apr MNI Chicago PMI, est. 45.9, prior 47.6

- 10:00: Mar Personal Income, est. 0,4%, prior 0,8%

- 10:00 утра: Мар Личные расходы, est. 0.6%, prior 0.4%

- 10:00 утра: Mar PCE Индекс цен MoM, est. 0%, prior 0,3%

- 10:00 утра: Mar PCE Индекс цен YoY, est. 2.2%, prior 2.5%

- 10:00 утра: Mar Core PCE Индекс цен MoM, est. 0.1%, prior 0.4%

- 10:00 утра: Mar Core PCE Индекс цен YoY, est. 2.6%, prior 2.8%

- 10:00: Mar Pending Home Sales MoM, est. 1%, prior 2%

Джим Рид из DB завершил ночную обертку

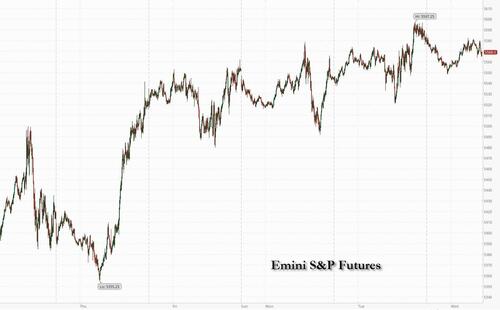

Добро пожаловать в конец 100 дней Трампа 2.0, когда рынки в настоящее время находятся в периоде редкого затишья. Действительно, вчера S&P 500 (+0,58%) вышел на 6-ю сессию подряд и отметил свой лучший 6-дневный пробег (+7,81%) с марта 2022 года. Интересно, что последний прирост означает, что индекс снова вышел из зоны технической коррекции, и теперь «только» стоит на -9,49% ниже своего рекордного максимума в середине февраля и на -1,94% ниже уровня до Дня освобождения. Это опережает доходы Microsoft и Meta после сегодняшнего звонка, а Amazon и Apple - завтра. Таким образом, это будет иметь большое значение для диктовки настроений рынков, учитывая, что сейчас мы находимся вне самого интенсивного тяготения Дня освобождения. Кажется, что за последний месяц или около того ИИ вряд ли обсуждался как инвестиционная тема после 2 лет, когда он был единственной игрой в городе.

Главным спусковым крючком для вчерашнего настроения, связанного с риском, стали заголовки о том, что Трамп объявит о некотором снижении тарифов на автозапчасти в преддверии вступления в силу тарифов на автозапчасти в ближайшие выходные. Эти меры, подписанные позднее в тот же день, не позволяют тарифам на автомобили, сталь и алюминий накладываться друг на друга и обеспечивают частичные скидки для отечественных автопроизводителей на импортные автозапчасти в течение первых двух лет. Президент охарактеризовал этот шаг как предоставление компаниям «небольшой гибкости» на митинге вчера вечером, на котором Трамп также возобновил свою критику председателя ФРС Пауэлла, заявив, что он «не очень хорошо выполняет свою работу».

Эти заголовки о тарифах поддерживали рынки, несмотря на слабую порцию экономических данных. Это включает в себя последний индикатор потребительского доверия Conference Board, который упал до 86,0 в апреле (против 88,0). Мало того, что самый слабый с мая 2020 года на пике пандемии, но компонент ожиданий показал еще больший спад до 54,4, что является самым низким показателем с октября 2011 года, когда восстановление после GFC застопорилось, а еврокризис обострился. Между тем, последний отчет JOLTS также показал, что количество вакансий упало до 6-месячного минимума в марте на 7,192 млн. Очевидно, что это охватывает период до Дня освобождения, поэтому рынки не были слишком сосредоточены на этом, но это все равно означало, что соотношение вакансий на безработных упало до 1,02, что является самым низким показателем до сих пор.

Прочтение рисковых активов, вероятно, было ограничено тем фактом, что чтение Конференц-совета по-прежнему является опросом, и хотя в последнее время опросы неизменно отрицательны, жесткие данные в основном сохранялись. Таким образом, это не привело к серьезной переоценке перспектив роста, как это мог бы сделать отчет о негативных рабочих местах. Кроме того, детали отчета JOLTS действительно включают в себя некоторые более позитивные элементы, поскольку уровень увольнений тех, кто добровольно уходит с работы, достиг 8-месячного максимума в 2,1%. Он также не показал эскалации увольнений, поскольку уровень увольнений и увольнений снизился до 9-месячного минимума в 1,0%. Таким образом, это означало, что инвесторы все еще могли правдоподобно верить повествованию о том, что рецессии удастся избежать, даже если настроения сильно пострадают.

Однако более негативные данные сразу же привели инвесторов к снижению ставок ФРС в этом году. Например, сумма снижения цен к декабрю выросла до 97 б/с, что является самым высоким показателем с 8 апреля, как раз перед тем, как Трамп объявил о 90-дневном продлении тарифа. В свою очередь, это привело к тому, что доходность казначейских облигаций упала по всей кривой, а доходность в 2 года (-4,4 б/с) упала до 3,65%, самого низкого уровня с октября, в то время как доходность в 10 лет (-3,6 б/с) упала до 4,17%.

Заглядывая вперед, мы получим ключевую часть данных сегодня с выпуском ВВП Q1. Очевидно, что это отсталый взгляд и охватывает период до Дня освобождения, но это даст четкое представление о том, в какой степени люди могли попытаться импортировать товары, чтобы опередить тарифы. Действительно, вчера мы обнаружили, что дефицит торговли товарами достиг рекордных 162 млрд долларов в марте (против ожидаемых 145 млрд долларов). Это привело к приличному удару по показателям ВВП, учитывая, что импорт вычитается из роста ВВП. Действительно, оценка ВВП ФРС Атланты в 1 квартале в настоящее время находится на годовом сокращении -2,7%, а их альтернативная модель, которая корректирует импорт и экспорт золота, по-прежнему находится на уровне сокращения -1,5%. И наши собственные американские экономисты обновили свои ожидания, что реальный ВВП сократится на -0,9% в 1 квартале из-за роста импорта (см. их примечание здесь). Если сегодняшнее число действительно покажет снижение, это будет первое квартальное сокращение с 1 квартала 2022 года.

По крайней мере, на данный момент акции продолжили свое ралли: S&P 500 (+0,58%) поднялся до самого высокого уровня со дня освобождения, во главе с финансами (+0,97%) и материалами (+0,93%). Энергетические запасы (-0,37%) отставали, поскольку нефть марки Brent упала на -2,44% до $64,25 за баррель. В Европе также были высокие показатели: STOXX 600 (+0,36%) показал 6-й подряд прирост, в то время как DAX (+0,69%) превзошел показатели. DAX полностью стер свои потери с Дня освобождения, оставив индекс +0,16% выше своего уровня 2 апреля и +12,64% YTD в отличие от -5,45% для S&P 500. Между тем, в Великобритании FTSE 100 (+0,55%) показал 12-й подряд прирост, что сделало его самым длинным показателем с 2017 года.

Ночные фьючерсы S&P 500 (-0,47%) и NASDAQ 100 (-0,64%) упали, чему не помогло падение на -17% после нескольких часов после публикации разочаровывающих результатов. Это компания, которая была любимицей мира ИИ и достигла пика в 118 в начале 2024 года и, вероятно, откроется в 30-х годах. Остальная часть Азии в значительной степени консолидируется с S&P/ASX 200 (+0,24%), Nikkei (+0,17%) и Hang Seng (+0,22), наблюдая небольшой рост, но с акциями материкового Китая в целом. В других странах КОСПИ (-0,60%) отстает от своих региональных аналогов.

Возвращаясь в Китай, официальный производственный индекс PMI сократился до 49,0 в апреле, не дотянув до ожидаемых 49,7 и значительно ниже, чем в предыдущем месяце 50,5. Это сокращение явно связано с эскалацией торговой войны с США. Непроизводственный PMI также разочаровал, опустившись до 50,4 в апреле, ниже ожидаемых 50,6 и ниже 50,8 в марте. Следовательно, совокупный индекс PMI в Китае снизился до 50,2 в апреле с 51,4 в марте, едва превысив порог расширения 50.

В других странах инфляция в 1 квартале в Австралии выросла до +2,4% в годовом исчислении (ожидается +2,3%), удерживаясь на четырехлетнем минимуме. Предпочтительный средний уровень инфляции RBA снизился с пересмотренного +3,3% до +2,9% в марте (ожидаемый +2,8%). Данные, вероятно, укрепят осторожную позицию центрального банка и ослабят ожидания агрессивного снижения процентных ставок в ближайшей перспективе. На этом фоне австралийский доллар держится на росте, укрепившись на +0,27%, чтобы торговать на отметке 0,6401 по отношению к доллару. Между тем, доходность по чувствительным к политике 3-го года государственным облигациям на -0,7 б/с ниже и составляет 3,31%.

Обратившись к Германии, сегодня важно сформировать новое правительство, так как голосование членов СДПГ по коалиционному договору завершается. В свете этого наши экономисты выпустили новую записку, посвященную этому голосованию, а также бюджетные сроки для бюджета 2025 года. Они считают, что от голосования СДПГ мало риска, и что они не ожидают каких-либо дополнительных мер фискальной поддержки (за пределами коалиционного договора), если не появятся ощутимые признаки торгового шока.

Наконец, в Европе суверенные облигации показали достойные результаты по всему континенту, при этом доходность на 10yr bunds (-2,3 млрд. п.), OATs (-1,9 млрд. п.) и BTPs (-2,1 млрд. п.) снизилась. Это произошло, когда последний индикатор экономических настроений Европейской комиссии упал более чем ожидалось в апреле, до 4-месячного минимума 93,6 (против 94,5). Отдельно опрос ЕЦБ потребительских инфляционных ожиданий показал 1 год ожидания до +2,9%, что является самым высоким показателем с апреля.

На сегодняшний день и публикации данных в США включают инфляцию PCE за март, ВВП Q1, индекс стоимости занятости Q1 и отчет ADP о частных платежных ведомостях за апрель. Между тем, в Европе мы получим флеш-счет ИПЦ за апрель из Германии, Франции и Италии, а также немецкую безработицу за апрель. Из центральных банков мы узнаем от Мюллера, Вильероя и Махлуфа из ЕЦБ. Наконец, сегодняшние выпуски прибыли включают Microsoft, Meta и Caterpillar.

Тайлер Дерден

Свадьба, 04/30/2025 - 08:17