Фьючерсы падают, нефть взлетает, как пятница 13-е крапивы в новой войне на Ближнем Востоке

Фьючерсы все ниже, но уже примерно на 100 б/с выше, чем ночные минимумы, и все смотрят на геополитическую напряженность на Ближнем Востоке после того, как Израиль фактически начал войну с Ираном, отправив VIX до 20 рукояток. По состоянию на 8:00 утра фьючерсы на SPX снижаются -90 б/с и торгуются чуть менее 6000; Nasdaq 100 futs снижаются на 110 б/с, при этом все акции Mag 7 торгуются ниже (TSLA -2,8%, NVDA -2,0%, GOOG / L -2,0% отстают) и небольшие ограничения -140 б/с Глобальные индексы ниже, хотя и не так резко, с азиатским рынком вниз ~ 75 б/с в одночасье и Европой вниз 100-150 б/с в данный момент. Рынки Дубая и Абу-Даби снизились на 3/4%. Ночью основными заголовками были широкомасштабные атаки Израиля на ядерную программу Ирана и военное руководство. Нефть резко возросла до $75, но также не достигла максимумов сессии, поскольку до сих пор первоначальная израильская атака избегала энергетических целей, но Израиль может продлиться в течение нескольких дней, а Иран обещает ответить. Также неясно, будет ли Ирану позволено продолжать контрабанду нефти в Китай после этой эскалации. Сырая нефть выросла на 7,8% по сравнению со вчерашним закрытием, поднявшись на 13% раньше - это самый большой скачок за 3 года - и со всеми CTA все еще на 100% короче, это может быть только началом сжатия. Золото прибавило +0,9%. Доходность в основном не изменилась; USD выше. Список экономических данных США включает июньские предварительные настроения Мичиганского университета в 10 утра; чиновники ФРС находятся в периоде отключения внешних коммуникаций перед решением о ставке 18 июня.

В дорыночной торговле великолепные акции Seven ниже, так как инвесторы вращаются из акций и в активы-убежища (Tesla -1,6%, Amazon -1,9%, Meta Platforms -1,5%, Nvidia -1,5%, Alphabet -2%, Microsoft -0,8%, Apple -0,2%). Энергетические и оборонные запасы растут после авиаударов Израиля против Ирана (Exxon Mobil +3,3%, Chevron +2,6%, Occidental Petroleum +5,5%; RTX +5,5%, Lockheed Martin +4,8%). Авиакомпании и туристические акции падают после предрассветных атак Израиля. Вот некоторые другие известные премаркеты:

- Delta Air Lines -4,4%, United Airlines (UAL) -5%, American Airlines (AAL) - 4%

- Royal Caribbean Cruises -3,7%, Carnival Corp -5,5% и Norwegian Cruises - 4%

- Adobe упала на 3% после того, как компания дала прогноз продаж на текущий квартал, который превысил оценки аналитиков, но инвесторы по-прежнему скептически относятся к тому, что лидер в области креативного программного обеспечения может вытеснить выскочек, ориентированных на ИИ.

- RH подскочил на 19% после того, как люксовая мебельная компания сообщила о скорректированной прибыли на акцию за первый квартал, которая превзошла среднюю оценку аналитиков. Аналитики отмечают, что неизменное годовое руководство является позитивным признаком спроса со стороны высококлассных потребителей.

- Visa падает на 2,7%, а Mastercard (MA) падает на 2,4%, поскольку Wall Street Journal сообщает, что крупные торговцы, включая Walmart и Amazon, изучают, как выпускать или использовать стейблкоины, чтобы обойти традиционные сборы карточных систем.

- US Steel упала на 4% после того, как Nikkei сообщила, что запланированный поглощение Nippon Steel американской компании может не состояться, если у японской компании будет недостаточная свобода управления.

Это очень напряженная пятница для трейдеров, оценивающих рыночные риски в выходные дни. Фьючерсы на акции упали и Нефть подскочила больше всего за три года после ударов Израиля по Ирану. Гавани, особенно золото, пользуются спросом.

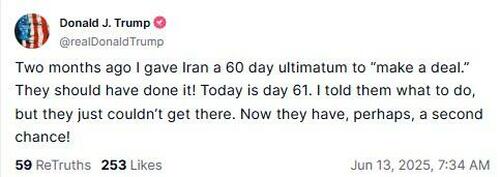

Воздушные удары по ядерной программе Ирана и объектам баллистических ракет возобновили противостояние между двумя противниками, которое рискует перерасти в более широкий конфликт. В то время как реакция была самой сильной в сырой нефти, другие сегменты рынка предположили, что инвесторы следят за тем, как долго продлится напряженность и обострится ли ситуация. Нетаньяху заявил, что атаки были нацелены на ядерную программу и вооруженные силы Тегерана и будут продолжаться до тех пор, пока угроза не будет устранена. Иран пообещал принять ответные меры против Израиля и, возможно, американских активов на Ближнем Востоке, хотя Трамп призвал Иран заключить сделку, пока не стало слишком поздно. "

Удары последовали за неоднократными предупреждениями премьер-министра Израиля Биньямина Нетаньяху, чтобы нанести ущерб ядерной программе Ирана. Ранее Иран заявлял, что откроет новый объект по обогащению урана в ответ на осуждение со стороны МАГАТЭ его ядерной программы.

"" Мы видим поведение, полностью соответствующее риску. Джефферсон Yu, FX и макростратег Bank of New York Mellon Corp. «Вероятно, это отправная точка для рынков, но, как мы знаем, в последние недели корреляции были переменными и многое будет зависеть от реакции Ирана, США и других стран. "

"" В краткосрочной перспективе он будет использоваться инвесторами в качестве предлога или катализатора для получения прибыли после очень сильного возврата рисковых активов.- сказал Винсент Мортье, главный инвестиционный директор Amundi SA. "Реакция цен на исторические убежища была минимальной. Мы считаем, что события прошлой ночи останутся локализованными и не перерастут в нечто более глобальное. "

Атаки происходят в то время, когда фондовые рынки оправились от спада в апреле, вызванного тарифной войной президента США Дональда Трампа. Индекс мировых акций достиг рекордного уровня в четверг, набрав более 20% от низкого показателя в апреле. Любой постоянный рост цен на нефть может подпитывать инфляцию, усугубляя проблемы, с которыми сталкиваются ФРС и другие центральные банки, поскольку политики также борются с последствиями торговой войны Трампа. Пока что, Изменения цен на фьючерсы на нефть указывают на опасения затяжного конфликта.

«Это идет вразрез с тем, что центральные банки ожидали от цен на нефть, и потенциально может изменить их сценарий, разогревая инфляцию и замедляя рост», - сказал Александр Хезез, главный инвестиционный директор группы Richelieu.

Между тем, фондовые фонды США только что пережили самый большой отток почти за три месяца, согласно данным, опубликованным Майклом Хартнеттом из BofA со ссылкой на данные EPFR Global, еще одним признаком того, что ралли может застопориться. Около $9,8 млрд было выкуплено из акций США за неделю до среды, самое большое за 11 недель. Конфликт на Ближнем Востоке также рискует нарушить быстрое возвращение S&P из-за падения тарифов в апреле. Bloomberg Intelligence ранее писал, что возвращение к своим прежним пикам в течение следующих нескольких недель будет означать самое быстрое восстановление после снижения более чем на 15% с 1980 года.

Европейские акции падают, а военные удары Израиля по иранской ядерной программе стимулируют большие движения по энергетическим и авиационным запасам, которые наиболее чувствительны к скачку цен на нефть. Stoxx 600 падает на 0,8%, а туристические, автомобильные и потребительские товары снижаются. Среди отдельных акций Novo Nordisk обогнала SAP, чтобы вернуть себе позиции самой ценной публичной компании Европы. Акции Novo подняты планами по продвижению экспериментального лечения амикретина на поздней стадии. Вот наиболее заметные движущие силы:

- Энергетические запасы растут после роста цен на нефть после того, как Израиль нанес волны воздушных ударов по Ирану.

- BAE Systems и другие поставщики военной техники движутся вверх, поскольку напряженность подстегивает прогнозы увеличения военных поставок.

- Акции Novo Nordisk выросли на 2,3%. Фирма планирует продвинуть экспериментальное лечение амикретином на поздней стадии после обратной связи с регулирующими органами.

- Акции Intrum выросли на 2,4% после того, как компания, предоставляющая услуги по управлению кредитами, была модернизирована до нейтральной от низкого веса в JPMorgan. Аналитики отмечают лучшую рентабельность в обслуживании.

- Акции авиакомпаний являются худшими показателями после всплеска цен на нефть после того, как Израиль нанес волны воздушных ударов по Ирану, что вызвало обеспокоенность по поводу стоимости авиатоплива.

- Burberry, Hugo Boss и другие роскошные акции падают из-за опасений по поводу снижения спроса со стороны путешественников.

- Акции Soitec упали на 5,7%. Производитель микросхем сокращается в Jefferies, поскольку аналитики не ожидают краткосрочного циклического подъема.

- Акции Mitie упали на 3%. Компания по обслуживанию зданий была понижена до уровня Jefferies, поскольку аналитики считают, что для поддержания рейтинга покупок недостаточно роста, отметив, что акции выросли примерно на 30% в годовом исчислении.

- Акции Clas Ohlson упали на 7,2%, отступив от рекордного максимума в четверг. Kepler Cheuvreux понизил рейтинг ритейлера, заявив, что его оценка выглядит полной и что существует риск более жестких условий в будущем.

- Акции PGE упали на 6,3%, большинство из них за почти два месяца, поскольку новая стратегия предусматривает выделение $64 млрд в капитале к 2035 году, не уточняя, когда крупнейшая компания Польши вернется к выплате дивидендов.

Акции в Азии упали на фоне растущих настроений на риск после нападений Израиля на военные объекты Ирана, которые потенциально могут спровоцировать более широкую войну на Ближнем Востоке. Индекс MSCI Asia Pacific Index увеличил свой убыток до 1,2% во второй половине дня, что является наибольшим показателем почти за два месяца. Большинство основных рынков были в минусе, а Япония и Гонконг лидировали по снижению. TSMC, Alibaba и Samsung Electronics были среди акций, которые больше всего весили на региональном уровне. «Угрожающая эскалация сегодня утром является ударом по настроениям риска и наступает в решающий момент после того, как макро- и систематические фонды восстановили длинные позиции, а настроения инвесторов восстановились до бычьего уровня», - сказал аналитик рынка IG Australia Тони Сикамор. «Мы, вероятно, увидим дальнейшее ухудшение настроений в отношении рисков, поскольку трейдеры сокращают позиции, ищущие риски, в преддверии выходных.

В иностранной валюте доллар восстановился на 0,5% по сравнению с трехлетним минимумом четверга, поскольку индекс Bloomberg Dollar Spot вырос на 0,4%, поскольку доллар укрепляется по отношению ко всем своим аналогам G-10. Иена гавани и швейцарский франк первоначально растут на новостях об атаке, только чтобы обратить вспять эти успехи в лондонской торговле; USD / JPY и USD / CHF растут на 0,3. Больше всего страдают валюты с более высоким риском, причем австралийский и новозеландский доллары падают примерно на 1% по сравнению с долларом. Реакция коленного сустава на новости о риске указывает на динамику гавани для доллара, но позиционирование и получение прибыли на шортах перед выходными должны быть приняты во внимание, а также повышение доллара из-за более высоких цен на нефть.

В ставках, казначейские фьючерсы Опуститься на раннюю сессию в США Раскручивая ночную заявку на полет к качеству после того, как Израиль нанес авиаудары по ядерным и баллистическим ракетам Ирана, отправив нефтяные фьючерсы выше. Казначейская доходность выше на пару базисных пунктов по срокам погашения, а спреды кривой мало изменились. 10-летний показатель составляет около 4,38%, а британский аналог дешевле на дополнительные 3,5 млрд. п., что приводит к потерям среди европейских аналогов. Потолки отстают, наряду с большинством европейских облигаций, после немецких и французских данных ИПЦ. Фьючерсы на нефть WTI остаются более чем на 8% выше в этот день.

В сырьевых товарах рентовая нефть выросла на 7,6%, ранее поднявшись на целых 13% в крупнейшем внутридневном скачке с марта 2022 года. Золото выросло на 1% до самого высокого уровня более чем за месяц.

Заглядывая в будущее сейчас, и данные из США включают предварительный индекс потребительских настроений Мичиганского университета за июнь, а в Еврозоне мы получим промышленное производство за апрель. Спикеры Центрального банка включают Escriva ЕЦБ

Рыночный снимок

- S&P 500 mini - 1,2%

- Nasdaq 100 mini - 1,5%

- Russell 2000 mini - 1,7%

- Stoxx Europe 600 -0,9%

- DAX -1,4%, CAC 40 -1,1%

- 10-летний Доходность казначейства -2 базисных пункта 4,34%

- VIX +3.1 баллов в 21.12

- Индекс доллара Bloomberg +0,4% на 1204,54

- евро -0,5% на $1,1528

- Сырая нефть WTI +7,6% при $73,22/баррель

Лучшие ночные новости

- Израиль начал волны авиаударов по ядерной программе Ирана и местам баллистических ракет, убив главу Корпуса стражей исламской революции и начальника штаба вооруженных сил. Нефть подскочила на 13%, поскольку премьер-министр Биньямин Нетаньяху пообещал новые атаки. Иран пообещал принять ответные меры, отправив беспилотники, которые были перехвачены. BBG

- Дональд Трамп может продолжать использовать войска для борьбы с протестами в Лос-Анджелесе, постановил апелляционный суд, через несколько часов после того, как судья сказал, что федеральное правительство должно прекратить эти усилия и вернуть контроль Национальной гвардии лидерам штата Калифорния. Во вторник суд назначил слушание для обсуждения дальнейших действий. BBG

- Случай снижения ставки ФРС усиливается, поскольку инфляция остается приглушенной, несмотря на тарифы, в то время как на рынке труда появляются признаки ухудшения (ФРС не будет сокращаться на следующей неделе, но передовой язык руководства может развиваться в голубином направлении). WSJ

- Ведущий торговый переговорщик Японии ожидает, что торговая сделка с США избавит Токио от более высоких автомобильных тарифов, даже если Трамп увеличит их против других стран. BBG

- Почти все iPhone, экспортируемые Foxconn из Индии, отправились в Соединенные Штаты в период с марта по май, показали таможенные данные, намного превышающие средний показатель 2024 года в 50% и явный признак усилий Apple по обходу высоких тарифов США, введенных в отношении Китая. Apple также планирует весной 2026 года отложить обновление Siri. РТС

- Китай обременен самыми убыточными промышленными компаниями с 2001 года, в результате чего правительство борется с противоречивыми целями: закрытие предприятий, а также попытки избежать массовой безработицы. BBG

- Официальные лица Банка Японии видят, что цены растут немного сильнее, чем они ожидали ранее в этом году, что может открыть дверь для дискуссий о том, повышать ли процентные ставки, если напряженность в мировой торговле ослабнет. BBG

- Британские работодатели сократили найм в мае после резкого повышения налогов и глобальной торговой войны, показало исследование REC и KPMG. BBG

- Meta завершила инвестиции в масштабный ИИ, который, как говорят, составил 14,3 миллиарда долларов. BBG

Тарифы/торговля

- Министр торговли США Лутник сказал, что тарифная пауза в Китае, вероятно, не будет продлена, а ее лучшие фишки никогда не обсуждались и не будут касаться сделки с Китаем.

- Министерство торговли США сделало продукцию из производных стали предметом дополнительных тарифов, согласно Федеральному реестру.

- США рассматривают план использования Закона об оборонном производстве для редкоземельных элементов, хотя сроки для инициативы Трампа по редкоземельным элементам неясны, сообщает Bloomberg со ссылкой на источники.

- Китай, по сообщениям, отложил одобрение слияния Synopsys (SNPS) и Ansys (ANSS) на сумму 35 миллиардов долларов на фоне торговой войны Трампа.

- Премьер-министр Японии Исиба проведет переговоры с президентом США Трампом в пятницу через NHK.

Более подробный взгляд на мировые рынки любезно предоставлен Newsquawk

Акции APAC торговались ниже, а фьючерсы на акции США находились под давлением на фоне ухудшения геополитической ситуации на Ближнем Востоке после того, как Израиль нанес превентивные удары по иранским ядерным и военным целям. Израильские военные заявили, что нанесли удары по десяткам объектов по всему Ирану, в то время как премьер-министр Израиля Нетаньяху сказал, что операция продлится столько дней, сколько потребуется, и Иран предупредил, что Израиль и США заплатят высокую цену за израильскую атаку. ASX 200 был снижен из-за потерь в циклических ценах, но с негативными последствиями, вызванными тем, что энергетические и золотодобытчики извлекли выгоду из геополитического роста соответствующих базовых цен на сырьевые товары. Nikkei 225 опустился ниже уровня 38 000 после недавнего укрепления валюты и усиления геополитической напряженности. Hang Seng и Shanghai Comp соответствовали негативному настроению, поскольку в заголовках доминировали многочисленные удары Израиля и угрозы возмездия Ирана.

Лучшие новости Азии

- Чиновники Банка Японии видят, что цены растут немного сильнее, чем они ожидали ранее в этом году, и ожидают, что процентная ставка будет поддерживаться на уровне 0,5% на следующей неделе.

Европейские биржи находятся в красном цвете, Euro Stoxx 50 -1,4%, учитывая мрачные настроения риска, которые были вызваны событиями на Ближнем Востоке. Энергетика (+1,0%) является единственным сектором в «зеленом» секторе, учитывая рост базовых цен. Оборонительные названия также хорошо себя зарекомендовали, что в совокупности привело к тому, что FTSE 100-0,3% оказался относительно успешным. И наоборот, энергетическая мощь оказывает давление на Travel & Leisure (-2,5%), в то время как Auto (-2,2%) пострадали от комментариев Трампа о возможном повышении тарифов.

Лучшие европейские новости

- Джонсон из IFS предупредила, что канцлер Великобритании Ривз является «занудой» от необходимости повышать налоги в осеннем бюджете, несмотря на то, что канцлер настаивает на том, что ее планы «полностью финансируются».

- Bank of England/Ipsos Inflation Attitudes Survey, May 2025: Средние ожидания темпов инфляции в следующем году составили 3,2%, по сравнению с 3,4% в феврале 2025 года.

Форекс

- DXY на передней ноге, а доллар США получает выгоду от своего статуса безопасной валюты. Он поднялся до 98,39, но перестал стесняться вчерашнего лучшего @ 98,51.

- GBP оказал давление на доллар США, но плоский против евро. Действия, продиктованные долларом США, поэтому EUR/GBP почти не изменились, в то время как сам Кейбл отошел от ночного многолетнего максимума в 1,3632, до 1,3522.

- Евро под аналогичным давлением против доллара США. Единая валюта упала до 1,1513 базы, хотя в четверг она была немного меньше, чем 1,1487 базы. Как указано выше, ценовое действие, продиктованное геополями и долларом США, еще предстоит увидеть, если движение энергии изменит прогноз инфляции и предоставит некоторые боеприпасы для ястребиного контингента ЕЦБ.

- JPY несколько удивительно мягче по отношению к доллару США, несмотря на неприятие рисков на мировых рынках. Ночью доллар США / JPY опустился ниже уровня 143,00 из-за притока гавани в иену, но позже поднялся выше 144,00 до нынешнего максимума 144,16.

- Антиподы торгуют в соответствии с тоном риска и сильно пострадали, находясь на вершине списка лидеров G10. AUD/USD на базе 0,6457 и NZD/USD до испытания 0,60.

Фиксированный доход

- В целом, фиксированные ориентиры были приведены к пикам WTD в ночь на утро, когда Израиль ударил по иранским объектам. С тех пор этот шаг сократился, и мы живем в параметрах четверга, поскольку интенсивность геополитических новостей немного замедляется, и мы ожидаем обновлений от Ирана.

- UST достигли максимума в 111-13 за ночь, новый максимум WTD и просто клещ + застенчивый из лучших 111-14 на прошлой неделе. С тех пор эталон снизился и почти не изменился, удерживаясь чуть ниже пика 111-06 в четверг.

- Бунды, учитывая вышеизложенное. Нажмите на пик 131,95, отмечая новый максимум WTD. Этот шаг произошел с учетом действия по снижению риска, вызванного тем, что Израиль нанес удар по объектам Ирана и связанному с ним FTQ. В соответствии с UST, EGB заметно отступили от вышеупомянутого пика и в настоящее время находятся только в красном и от 20 до 30 клещей ниже лучших в четверг; для Bunds этот показатель держится около 131,20.

- Доходность немецкого 10yr упала примерно на 5 б/с до 2,42%, когда Bunds достигли своего пика WTD. С тех пор 10yr восстановил ход и теперь выше чуть более чем на bps на сессии, прощупывая 2,50% вверх.

- Потолки достигли пика 93,68, когда торговля возобновилась этим утром, увеличившись на 37 клещей, а затем еще на 10 к этому максимуму и затмив 93,55 в четверг. Тем не менее, это оказалось недолгим, поскольку фиксированные ориентиры, как правило, уже снижали большую часть своих ночных достижений, и это давление стало известно в Gilts в течение нескольких минут после открытия. Теперь, держа несколько клещей выше корыта 92,94 и, соответственно, выше минимума 92,80 в четверг.

Товары

- Сессия, в которой доминирует геополитика; см. раздел «Геополитика» ниже и / или заголовок. Brent достиг максимума в 78,50 долларов за баррель за ночь, WTI достиг 77,62 доллара за баррель.

- Короче говоря, операция Израиля, получившая название «Восходящий лев», была направлена на ряд ядерных и военных целей. Глава IRCG Хоссейн Салами и ученый-ядерщик Аббаси были убиты. Участок обогащения Натанз в Иране подвергся воздействию. В ответ Иран пообещал принять ответные меры, отметив также, что США заплатят высокую цену «теперь, когда Израиль перешел все красные линии, Иран не видит никаких ограничений для ответа на это преступление». США заявили, что не участвовали в акции.

- На протяжении всего европейского утра, хотя все еще заметно более твердые, бенчмарки отошли от максимумов, поскольку участники поблекли от первоначального шага и ожидали свежих обновлений. Это привело к тому, что WTI и Brent упали до 71,00 долларов США за баррель и 72,10 доллара США за баррель.

- После этого произошел новый всплеск (в ночных диапазонах), поскольку Тасс процитировал замечания из офиса премьер-министра Израиля о том, что они готовы к возможности полномасштабной войны с Ираном. Это повысило ориентиры в сторону текущих уровней выше 73,15 доллара США за баррель и 74,50 доллара США за баррель для WTI и Brent соответственно.

- Совсем недавно Трамп прокомментировал: «Иран должен заключить сделку, прежде чем ничего не останется».

- Впереди дальнейшие потенциальные катализаторы для нефти включают иранский ответный удар, деятельность Ормузского пролива, признаки участия США (заседание Совета Безопасности США в 16:00 BST) и продолжительность израильской операции.

- Европейские цены на газ выросли, учитывая вышесказанное, голландский TTF в лучшем случае более чем на 1,50 евро / МВтч; совсем недавно министр энергетики Израиля заявил, что они могут распорядиться о временном закрытии натгазовых резервуаров.

- Спотовое золото упрочило свой статус гавани и FTQ. Тем не менее, рост ограничивается заметно более твердым долларом США. Оставляя XAU на пике 3444 долларов США / унция, с ATH на уровне 3500 долларов США / унция следующей точкой фокуса.

- Базовые металлы в красном цвете, учитывая риск выключения тона и сильный доллар США. 3M LME Медь упала почти на 1%, ранее достигнув отметки в 9,57 тыс. долл.

Геополитика

- Израильские военные нанесли удары по ядерным и военным целям в Иране, а также по десяткам объектов и заявили, что иранская ядерная программа представляет собой экзистенциальную угрозу для Израиля, в то время как иранский режим продвигает секретную программу по созданию ядерного оружия, и у Ирана достаточно термоядерного материала, чтобы сделать 15 ядерных бомб в течение нескольких дней.

- Премьер-министр Израиля Нетаньяху заявил, что их пилоты наносят удары по многим целям в Иране и что операция будет продолжаться столько дней, сколько потребуется, что нанесет ущерб ядерной инфраструктуре Ирана, заводам по производству баллистических ракет и военному потенциалу. Нетаньяху также заявил Они нанесли удар в самое сердце иранской программы ядерного обогащения и программы ядерного оружия, а также главного объекта обогащения Ирана в Натанзе. Кроме того, он сказал, что они Он нацелился на ведущих иранских ученых-ядерщиков, работающих над иранской бомбой, и позже заявил, что они нанесли успешный удар.

- Министр обороны Израиля Кац объявил специальное чрезвычайное положение на внутреннем фронте во всем государстве Израиль и заявил после превентивного удара Израиля по Ирану, что ракетная и беспилотная атака против Израиля ожидается в ближайшем будущем. Отдельно сообщалось, что Два израильских чиновника заявили, что Израиль готовится к ответу Ирана в ближайшие часы, и ответ Ирана может включать запуск сотен баллистических ракет.

- Верховный лидер Ирана Хаменеи заявил, что Израиль получит суровое наказание и что Израиль «отпустил свою злую и кровавую» руку в преступлении против Ирана, в то время как он добавил, что несколько командиров и несколько ученых были «мучены». И с этой атакой, Израиль приготовил для себя горькую судьбу, которую он непременно получит.

- Иранская революция Охранники заявили, что Израиль заплатит высокую цену за убийство главнокомандующего КСИР Салами и что нападение было совершено при полном знании и поддержке «злых правителей в Белом доме и террористического режима США». ?Хотя также сообщалось, что Советник верховного лидера и командующий КСИР Шамхани был тяжело ранен, а глава вооруженных сил Ирана Багери был убит в результате израильского нападения.

- Министерство иностранных дел Ирана заявило, что ответ Израилю является его правом по международному праву, и США как главный сторонник Израиля будут нести ответственность за последствия авантюризма Израиля, в то время как официальный представитель вооруженных сил Ирана ранее предупредил, что Израиль и США заплатят высокую цену. За израильскую атаку.

- Госсекретарь США Рубио заявил, что Израиль предпринял односторонние действия против Ирана, и США не участвуют в ударах по Ирану. Он добавил, что Главным приоритетом является защита американских сил в регионе, и Иран не должен наносить удары по интересам или персоналу США.

- Официальные лица США заявили, что они все еще намерены провести переговоры в воскресенье между посланниками США и Ирана.

- США заявили Израилю, что не будут напрямую участвовать в каком-либо ударе по Ирану. По данным Axios.

- Генеральная Ассамблея ООН потребовала немедленного, безусловного и постоянного прекращения огня в Газе, в то время как она приняла резолюцию Сектора Газа с 149 голосами «за».

- Национальная иранская нефтеперерабатывающая и распределительная компания заявила, что нефтеперерабатывающие заводы и хранилища нефти не понесли ущерба в результате израильской атаки..

- Посол Израиля во Франции заявил, что операция против Ирана может продолжаться несколько дней, а не месяцев. Они уже уничтожили часть иранской ядерной программы.

- Израильские чиновники сообщают «Предположение заключается в том, что были ликвидированы дополнительные высокопоставленные должностные лица в Иране, чьи смерти еще не были публично раскрыты».

- ВВС Израиля начали перехват беспилотников над «небесами Саудовской Аравии»Через канал 12.

- Моссад и израильские военные провели серию тайных операций против иранских стратегических ракетных комплексов.Как сообщает Reuters со ссылкой на израильский источник в сфере безопасности, Израиль развернул высокоточное управляемое оружие на открытых площадках вблизи иранских ракетных комплексов «земля-воздух». После этого израильские военные заявили, что завершили крупномасштабный удар по массиву ПВО Ирана, сообщает Reuters.

- Израиль готов к возможности полномасштабной войны с ИраномОб этом сообщает офис премьер-министра Нетаньяху через Tass.

- Министр обороны Израиля Кац заявил, что большинство руководителей ВВС КСИР были ликвидированы в результате удара.

- Израильские военные заявляют, что готовы к этому (т.е. к действиям против Ирана) в течение нескольких дней; частично зависит от ответа Ирана.. Уже многое достигнуто, оценки продолжаются. Все еще пытаюсь определить, как все прошло. Иран отправил в Израиль более 100 беспилотников, многие из которых уже были перехвачены.

- Иранский нефтеперерабатывающий завод Abadan Co. заявляет, что они производят и предоставляют услуги на полную мощность.

- Иранские вооруженные силы заявили, что «теперь, когда Израиль пересек все красные линии, Иран не видит никаких ограничений для ответа на это преступление». "Через журналиста Аслани.

- Организация по атомной энергии Ирана заявила, что на объекте по обогащению Натанза был нанесен ущерб, никакого химического или радиоактивного загрязнения не было обнаружено.

- МАГАТЭ Компетентные иранские власти подтвердили, что место обогащения Натанз подверглось воздействию и что нет повышенного уровня радиации.

- МАГАТЭ заявляет, что завод по обогащению топлива в Фордо не пострадал; ядерный объект в Исфахане не пострадал.

- Верховный лидер Ирана Хаменеи назначил Мохаммеда Пакпура новым командующим КСИРПосле того, как Салами был убит израильским ударом, Пакпур был направлен на «повышение возможностей, готовности и внутренней сплоченности КСИР».

- Иранская Fars News сообщает о возобновлении удара Израиля по северо-западному городу Тебриз.

- Президент Ирана в ближайшее время выступит с речьюСогласно сообщению X. [опубликовано около 10:15BST/05:15ET]

- Иран запросил специальную сессию «совета губернаторов» в понедельник через Jerusalem Post со ссылкой на источники.

Геополитика: другой

- Шестой раунд (ядерных) переговоров не состоится из-за израильских атакОб этом сообщает Tehran Times.

- Frontline «гораздо более нерешительно» предлагает свой корабль для перемещения грузов из Персидского залива после израильских ударов по Ирану.

- Поставки газа из Ирана не пострадали от израильской атаки, сообщают иракские государственные СМИ.

- Ливанская Хезболла говорит, что группа не будет инициировать нападение на Израиль в ответ на удары по Ирану.

- «Я давал Ирану шанс за шансом заключить сделку» и «Иран должен заключить сделку, прежде чем ничего не останется, и спасти то, что когда-то было известно как Иранская империя»..

Календарь событий США

- 10:00: Jun P. U. of Mich. Чувства, est. 53.6, prior 52.2

Джим Рид из DB завершил ночную обертку

В одночасье на Ближнем Востоке произошли огромные события, поскольку Израиль нанес авиаудары по ядерным и военным объектам Ирана. Мы все еще ждем дальнейших подробностей, но в сообщениях прессы говорится, что взрывы были слышны в Тегеране и Натанзе, где находится одна из иранских атомных электростанций. Иранское государственное телевидение сообщило, что Хоссейн Салами, глава Революционной гвардии, был убит вместе с начальником штаба вооруженных сил Мохаммадом Багери. Премьер-министр Израиля Нетаньяху заявил, что операция «будет продолжаться столько дней, сколько потребуется для устранения этой угрозы», хотя госсекретарь США Марко Рубио заявил, что США не участвовали в ударах.

Новость привела к значительным опасениям по поводу эскалации и более широкого регионального конфликта. Например, представитель вооруженных сил Ирана заявил, что Израиль и США получат «жесткий удар» в ответ, а Верховный лидер Ирана сказал, что Израиль «должен ожидать сурового наказания». В свою очередь, цены на нефть выросли на новостях, а нефть марки Brent выросла на 9,00% сегодня утром до $75,60 за баррель. Если это будет продолжаться, это будет самый большой ежедневный скачок цен на нефть с мая 2020 года, поскольку мировая экономика восстанавливается после блокировок Covid. И это немного ниже пика, когда цены достигли $78,50 за баррель.

Последствия атаки каскадировались на мировых рынках с сильным движением риска для нескольких классов активов. Акции упали: фьючерсы на S&P 500 сегодня утром упали на 1,65%, в то время как фьючерсы на немецкий DAX также упали на 1,65%. Между тем, цены на золото выросли, поднявшись на +1,26% до $3,428 за унцию. США Казначейские облигации также увидели свежее ралли сегодня утром, а доходность 10 лет снизилась еще на -1,4 б/с до 4,35%, что является самым низким показателем за последний месяц. А индекс доллара (+0,36%) стабилизировался после закрытия вчера на 3-летнем минимуме.

Заглядывая вперед, внимание теперь смещается к тому, какую форму может принять ответный удар Ирана. Также неясно, продолжатся ли переговоры между США и Ираном по их ядерной программе, хотя AFP сообщило, что США все еще хотели провести переговоры в это воскресенье. Мы еще не слышали напрямую от президента Трампа, хотя в его публичном графике говорится, что он будет присутствовать на заседании Совета национальной безопасности в Ситуационной комнате в 11 утра по восточному времени.

Реакция была очевидна и на азиатских рынках, где все основные индексы потеряли позиции в ответ. Это включает Nikkei (-1,25%), KOSPI (-1,29%), Hang Seng (-0,70%), CSI 300 (-0,76%) и Shanghai Comp (-0,72%). Аналогичным образом, суверенные облигации выросли, при этом доходность Японии в 10 лет снизилась на -3,5 млрд. и Австралии -6,3 млрд.

До забастовок рынки показывали стабильные результаты. По общему признанию, были предположения об ударе, а сам Трамп сказал: «Смотрите, есть вероятность массового конфликта», в то время как ABC News сообщила, что Израиль рассматривает военные действия против Ирана. Тем не менее, были надежды, что это может быть тактикой давления до запланированных американо-иранских переговоров в выходные дни, и американские облигации и акции продвинулись вперед.

Ралли облигаций было обусловлено голубиной партией данных США, в том числе более мягким, чем ожидалось, показателем PPI. Это укрепило уверенность инвесторов в том, что ФРС все равно снизит ставки в этом году, что привело к снижению доходности казначейских облигаций и привело к тому, что индекс доллара (-0,72%) достиг трехлетнего минимума. Геополитические проблемы добавились к ралли облигаций, но рисковые активы также были поставлены на приличную сессию, чему способствовала перспектива снижения ставок и тот факт, что более низкая доходность помогла ослабить опасения вокруг фискальной ситуации. Таким образом, S&P 500 (+0,38%) по-прежнему достиг трехмесячного максимума, закрывшись всего на -1,61% ниже своего рекордного пика с середины февраля.

Чтение индекса потребительских цен США за май стало основным драйвером вчерашнего ралли, поскольку оно добавило к мнению, что прохождение тарифов было меньше, чем ожидалось, и не вызвало большого всплеска инфляции. Теперь мы должны добавить оговорку, что мы не ожидаем, что полное влияние тарифов будет очевидным в майских данных, и с тех пор многие тарифы выросли еще больше (например, на сталь и алюминий). Но тот факт, что инфляция до сих пор была довольно мягкой, добавляет уверенности инвесторам в том, что инфляционное воздействие будет не таким большим, как опасались. Например, ежемесячный индекс PPI вырос всего на +0,1% в мае (против +0,2%), в то время как базовый индекс PPI вырос только на +0,1% (против +0,3%).

Этот мягкий инфляционный отпечаток привел к растущему ожиданию того, что ФРС снизит ставки в ближайшие месяцы, не в последнюю очередь учитывая более низкий, чем ожидалось, показатель ИПЦ за предыдущий день. Более того, еженедельные заявления о безработице также были выше, чем ожидалось вчера, что вызвало некоторую нервозность по поводу состояния рынка труда и помогло поддержать рассказ о сокращении ставок. Фактически, продолжающиеся претензии по безработице поднялись до самого высокого уровня с конца 2021 года, составив 1,956 млн за неделю, закончившуюся 31 мая (против 1,910 млн ожидаемых). Первоначальные претензии также выросли в последние недели, и 4-недельный средний показатель теперь составляет 240,25 тыс. за неделю, заканчивающуюся 7 июня, что является самым высоким показателем с августа 2023 года.

Учитывая все это, вчера фьючерсы были оценены в большем сокращении ставок со стороны ФРС, а к декабрьскому заседанию ожидается снижение на 52 б/с, что на 2,9 б/с в день. Ночью новости увидели, что движение дальше, с 55bps ценой сегодня утром. Таким образом, вчера это привело к значительному ралли для казначейских облигаций, при этом доходность 10 лет (-6,1 б/с) упала до 4,36%, в то время как доходность 30 лет (-7,6 б/с) достигла месячного минимума в 4,84%. Важную роль сыграл солидный аукцион 30 лет, который прошел гладко, несмотря на недавнюю обеспокоенность по поводу спроса на долгосрочные облигации. В свою очередь, снижение доходности означало, что индекс доллара вчера достиг трехлетнего минимума, в то время как евро впервые с 2021 года поднялся выше 1,16 доллара.

Другие примечательные новости вчера включали в себя то, что Трамп повторил свою критику в адрес председателя ФРС Пауэлла, добавив, что он может «придти к чему-то», если ФРС не снизит ставки. В комментариях в Белом доме Трамп также сказал, что может захотеть повысить тарифы на автомобили еще больше, чем на 25%, «в не слишком отдаленном будущем». Запасы автомобилей столкнулись с трудностями: Ford (-1,22%), GM (-1,22%) и Stellantis (-1,84%) откатились назад. А в других торговых новостях Бессент прокомментировал, что ЕС был «очень неразрешим» в переговорах.

Несмотря на геополитические опасения и более мягкие данные, акции США вчера смогли показать достойные результаты, поскольку снижение доходности оказалось благоприятным. Например, индекс S&P 500 (+0,38%) показал умеренный рост, как и NASDAQ (+0,24%). Маг-7 (-0,005%) показал смешанные движения, при этом Tesla (-2,24%) откатилась назад, но Nvidia превзошла (+1,52%) и Microsoft (+1,32%), достигнув нового рекордного максимума. Настроению для акций, связанных с ИИ, помогла Oracle (+13,31%), прогнозирующая очень сильный рост в своем бизнесе облачной инфраструктуры. Тем не менее, это была не вся хорошая новость, с небольшой кепкой Russell 2000 (-0,38%).

Ранее в Европе рынки показали гораздо более слабые показатели, причем STOXX 600 (-0,33%) показал 4-е снижение подряд. Не помогли некоторые слабые данные по росту в Великобритании: ежемесячный ВВП сократился на -0,3% в апреле (против -0,1%). Также было ясное влияние тарифов, поскольку экспорт товаров в США упал на 2,0 млрд фунтов стерлингов в апреле. Слабые показатели роста означали, что инвесторы оценили в большем сокращении ставок от Банка Англии, и позолоты превзошли своих коллег в других местах, а доходность 10 лет снизилась -7,6 млрд. Но облигации все еще сплотились по всему континенту, с доходностью 10yr bunds (-6,1bps), OATs (-4,5ps) и BTPs (-4,1bps) все движутся ниже.

К сегодняшнему дню и публикациям данных из США относится предварительный индекс потребительских настроений Мичиганского университета за июнь, а в Еврозоне мы получим промышленное производство за апрель. Спикеры Центрального банка включают Escriva ЕЦБ

Тайлер Дерден

Фри, 06/13/2025 - 08:36