Фьючерсы, ставки Плоские перед высокими ставками ИПЦ Доклад

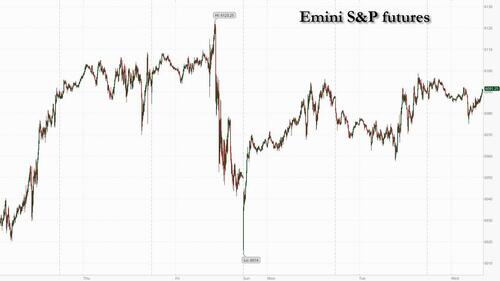

Фьючерсы на акции США плоские, с доходностью и долларом немного выше в преддверии утренних отчетов по ИПЦ США (полный предварительный просмотр здесь). По состоянию на 8:00 утра по восточному времени фьючерсы на S & P не изменились, в то время как фьючерсы Nasdaq растут на 0,2%, а акции Mag 7 в основном плоские, за исключением большого колебания на премаркете TSLA, который теперь торгует сделками +1% после скольжения -2% ранее на фоне растущей конкуренции со стороны BYD. Европейские акции находятся на третьем рекордно высоком уровне подряд, чему способствуют позитивные новости о прибыли. Индекс азиатских акций вырос. Доходность казначейства выросла, с 10-летним добавлением базового пункта до 4,55%, поскольку доллар США тикает выше; вчерашние показания Пауэлла в значительной степени соответствовали январскому FOMC и текущим рыночным ценам (нет необходимости срочно сокращать ФРС). Сырьевые товары в основном ниже; WTI -1,1%; Медь -0,9%. Сегодня ключевым макро-фокусом будет ИПЦ (наш предварительный просмотр, а также анализ сценариев JPM и Goldman), при этом рынок находится на грани: по данным JPM, рынки опционов ожидают 1,2%-ное колебание S&P сегодня, самое большое за более чем год. Показания Пауэлла в Палате представителей, доходы CSCO и любые обновления от Трампа о его взаимном тарифном плане

В дорыночной торговле Super Micro Computer (SMCI) подпрыгивает на 10% после агрессивного долгосрочного прогноза доходов и говорит, что он «верит» в то, что он выполнит крайний срок для подачи проверенных финансовых результатов. Tesla лидирует по прибыли для Великолепной семерки (GOOGL -0,1%, AMZN -0,2%, AAPL +0,06%, MSFT -0,1%, META +0,2%, NVDA +0,3% и TSLA +2,2%). Вот некоторые другие известные премаркеты:

- Confluent (CFLT) вырос на 14% после того, как компания-разработчик прикладного программного обеспечения сообщила о результатах четвертого квартала, которые превзошли ожидания и дали прогноз, который считается положительным.

- CVS Health (CVS) подскочил на 10% после того, как его прибыль в четвертом квартале превзошла ожидания Уолл-стрит, что является признаком улучшения показателей для компании, чьи страховые и аптечные подразделения оказались под давлением.

- Edwards Lifesciences (EW) набирает 4% после того, как производитель сердечных клапанов предоставил прогноз прибыли на 1 квартал с средней точкой, которая превзошла оценки.

- Freshworks (FRSH) выросла на 6% после того, как компания-разработчик прикладного программного обеспечения сообщила о результатах 4Q выше оценок.

- Gilead Sciences (GILD) прибавила 4% после того, как руководство биофармацевтической компании к 2025 году превзошло оценки аналитиков.

- Kraft Heinz (KHC) снизился на 3% после предоставления прогноза скорректированной прибыли на акцию к 2025 году, который пропустил среднюю оценку аналитика.

- Lyft (LYFT) упал на 13% после неутешительного прогноза по брутто-бронированию в первом квартале, предупреждая, что холодная погода повредила спросу на град и прокат велосипедов.

- OneStream (OS) упал на 19% после того, как компания-разработчик прикладного программного обеспечения сообщила о последовательном замедлении ключевых показателей, включая ежегодный повторяющийся рост доходов и выставления счетов.

- Teradata (TDC) упала на 13% после того, как компания по разработке программного обеспечения для инфраструктуры дала более слабый, чем ожидалось, прогноз, лишающий аналитиков надежд на признаки более выраженного восстановления.

- Upstart (UPST) взлетел на 26% после того, как рынок кредитования ИИ сообщил о более сильных, чем ожидалось, результатах четвертого квартала и обеспечил оптимистичный прогноз.

Ставки на рынках высоки, если учитывать индекс потребительских цен в среду. Экономисты ожидают, что основной ИПЦ без учета продовольствия и энергии вырастет на 0,3% по сравнению с предыдущим месяцем в январе, поднявшись с роста на 0,2% в декабре. Это соответствует годовому показателю в 3,1%.

Мы должны очень внимательно следить за доходностью 10-летних казначейских облигаций. Кеннет Бру, стратег Societe Generale в Лондоне. Более высокая, чем ожидалось, инфляция может легко подтолкнуть доходность к 4,60%, и вся торговля рисками будет приостановлена.

Как отмечалось вчера вечером, торговый отдел JPMorgan Market Intelligence оценивает, что индекс S&P 500 упадет на 2%, если январский индекс потребительских цен покажет увеличение на 0,4% или более по сравнению с предыдущим месяцем.

- 0,40% или выше. Этот первый побочный результат, вероятно, будет обусловлен всплеском в Shelter, а также тем, что некоторые части основных товаров перейдут от дефляционного к инфляционному (HH, Medical и Alcohol). Ожидайте, что рынок облигаций будет реагировать бурно, поскольку он смещает свое мнение на то, что фонды ФРС не являются ограничительными, и наиболее вероятным следующим действием ФРС будет повышение, а не сокращение. Движение доходности облигаций приведет к росту доллара США, что еще больше окажет давление на акции. Ищите NDX, чтобы превзойти SPX и RTY. Вероятность 5,0%; SPX теряет 1,5% - 2%.

- От 0,33% до 0,39%. Этот результат, скорее всего, обусловлен более горячими товарами, чем услугами с более приглушенной реакцией на рынке облигаций, но аналогичной реакцией на акции. Этот отпечаток вряд ли полностью устранит все ожидания сокращения для FY25, но, вероятно, подталкивает подразумеваемые вероятности к тому, что мы получим одно сокращение в FY25. По состоянию на пятницу, 37,5 б/с снижения цен на рынке облигаций. Вероятность 25,0%; SPX теряет 75 б/с - 1,5%.

- От 0,27% до 0,33%. Базовый сценарий, который показывает умеренное увеличение МД, но согласуется с тенденцией, наблюдаемой с сентября, которая является отклонением выше инфляции, которая имеет тенденцию выше с улучшенным ростом / наймом, хотя и с потенциально более мягкими темпами. Ищите доходность облигаций, чтобы оставаться в диапазоне и для положительного результата для акций. Верхний диапазон не совсем Goldilocks, но учитывая устойчивость рынка акций YTD, вероятно, подтолкнуть выше во главе с RTY. Коэффициенты 40,0%; SPX теряет 25 б/с, чтобы получить 1%.

- От 0,21% до 0,27%. Это Goldilocks, особенно если мы объединим это с более сильным количеством розничных продаж. Ищите рынок, чтобы полностью снизить цену в 2 раза в этом году, и чтобы акции отреагировали благоприятно во главе с SMid-caps. Вероятность 25,0%;

- SPX набирает 1% - 1,5%.

- 0,20% или ниже. Другой побочный результат, потенциально достигнутый снижением в Shelter, когда Core Goods возвращается к чистой дефляции. Облигации дают бычий круче в этом сценарии, что приводит к превосходству материала по RTY против SPX. USD, вероятно, имеет негативную реакцию, помогающую акциям EM, которые, вероятно, превосходят RTY. Вероятность 5,0%; SPX набирает 1,25% - 1,75%.

"Ожидается, что рынок облигаций будет реагировать жестко, поскольку он смещает свое мнение на то, что фонды ФРС не являются ограничительными, и наиболее вероятным следующим действием ФРС будет повышение, а не сокращение,Команда во главе с Эндрю Тайлером написала в записке. «Движение доходности облигаций приведет к росту доллара США и дальнейшему давлению на акции. "

Цифры ИПЦ должны быть представлены незадолго до второй половины двухдневного марафона показаний для председателя ФРС Джерома Пауэлла, который вчера сказал законодателям, что центральный банк не спешит снова корректировать ставки.

«Пока мы не получим большей ясности относительно среднесрочных инфляционных тенденций, доходность облигаций, вероятно, останется липкой», - сказал Даниэль Мюррей, главный исполнительный директор EFG Asset Management. «Это также явно сказывается на настроениях инвесторов в акционерный капитал, в частности в США, где сочетание более ястребиных ожиданий в отношении ставок наряду с неопределенностью в отношении тарифов способствовало расширению рынка. "

Stoxx 600 в Европе растет третий день Установление нового внутридневного рекорда в процессеПовышенный солидными заработками. Продукты питания и напитки являются самым сильным сектором, чему способствовало ралли Heineken на 13% - самое большое с 2008 года - после того, как производитель напитков сообщил о результатах за весь год, которые опережали консенсус, и объявил о выкупе акций на 1,5 миллиарда евро. ABN Amro Bank подскочил более чем на 8% после того, как его чистый процентный доход превысил прогнозы. Энергетические запасы обеспечивают сопротивление, поскольку они отслеживают падение нефти. Вот основные движущие силы Европы:

- Акции Deutsche Boerse выросли на 1,9%, ненадолго достигнув нового максимума, после того, как компания сообщила о солидной прибыли и объявила о новом неожиданном выкупе акций на 500 миллионов евро.

- Акции Heineken взлетели на 13%, самый крутой внутридневный аванс с 2008 года, после того, как пивовар сообщил о результатах FY, которые опередили оценки и объявили о выкупе акций на 1,5 млрд евро.

- АБН Акции Amro продвигаются на 8,9%, достигнув самого высокого внутридневного уровня с сентября 2019 года, при этом чистый процентный доход превышает оценки.

- Акции Barratt Redrow продвигаются на 9,4%, больше всего с 2020 года, после того, как британский домостроитель заявил, что ожидает, что годовая скорректированная прибыль до налогообложения будет в верхней части ожиданий.

- Акции Lufthansa выросли на 4,6% после того, как немецкий флагманский перевозчик был модернизирован, чтобы превзойти Бернштейна, в то время как владелец British Airways IAG был сокращен до рыночных показателей.

- Акции TeamViewer выросли на 6,2% после того, как немецкая софтверная фирма сообщила о 4Q Ebitda, которая превзошла оценки. Прогноз на 2025 год оправдал ожидания аналитиков JPMorgan и Morgan Stanley.

- Акции Ahold Delhaize упали на 2,9% после того, как компания сообщила о результатах 4Q. Хотя результаты соответствовали ожиданиям, аналитики отметили скорректированную операционную маржу США.

- Акции Aker BP упали на 2,4%, что стало самым большим падением за три недели после того, как норвежский производитель нефти предоставил руководство по добыче в 2025 году, которое, по словам Парето, было «немного мягким». "

- Акции Randstad упали на 6,2% после того, как рекрутинговая компания представила «беспорядочное» обновление, содержащее более высокие, чем ожидалось, разовые расходы.

- Акции Carl Zeiss Meditec упали на 7,4%, больше всего за два месяца, при этом аналитики отметили более слабую, чем ожидалось, Ebita, которая затмила доходы немецкого поставщика медицинских услуг.

- Акции Alior Bank упали на 3,2%, а Budimex на 3,1% в начале торгов в Варшаве после того, как MSCI объявила об исключении обеих компаний из своих основных индексов, начиная с 28 февраля.

- Акции Close Brothers упали на 4,1% после того, как компания, предоставляющая финансовые услуги, заявила, что планирует выделить до 165 миллионов фунтов стерлингов в 1 час 2025 года после регуляторного расследования своего бизнеса по автокредитованию.

Ранее на сессии выросли азиатские акции, Во главе с ростом акций Китая и Гонконга по поводу продолжающегося оптимизма в отношении искусственного интеллекта, Компенсация опасений по поводу политики процентных ставок Федеральной резервной системы. Индекс MSCI в Азиатско-Тихоокеанском регионе вырос на 0,4%, при этом Alibaba и Tencent были одними из самых больших. Индекс китайских технологических акций, котирующихся в Гонконге, вырос на 2,7%, чему способствовало сообщение о том, что Alibaba работает с Apple над функциями ИИ. Инвесторы все более оптимистичны в отношении перспектив китайских акций Энтузиазм DeepSeek и других разработок искусственного интеллекта стимулирует фундаментальное переосмысление привлекательности рынка. Для более широкого региона настроения были более оптимистичными в среду после того, как Джером Пауэлл указал, что ФРС не спешит снижать процентные ставки, поскольку экономические данные остаются твердыми. В других местах ключевой показатель акций Индонезии восстановился после падения до трехлетнего минимума во вторник. Тайваньские акции отставали от региона.

В FX индекс Bloomberg Dollar Spot вырос на 0,1%. Японская иена является самой слабой из валют G-10 на фоне опасений по тарифам, упав на 0,8% против доллара США и подтолкнув USD / JPY к ~ 153,65. Японское правительство попросило Трампа в среду освободить национальные компании от его новых тарифов. Швейцарский франк превосходит с ростом на 0,2%.

В ставках доходность казначейских облигаций немного ниже по кривой, поскольку трейдеры ожидают январских данных ИПЦ в 8:30 утра по нью-йоркскому времени и показаний Пауэлла на панели финансовых услуг House в 10 утра. 10-летняя доходность в США примерно на 1 п.п. выше в день около 4,55%, а фунты и позолоты отстают на дополнительные 1,5 п.п. и 1 п.п. в секторе; спреды кривой узко смешиваются после закручивания в течение последних двух сессий. Занятый список событий также включает в себя продажу 10-летних банкнот на сумму 42 миллиарда долларов в 1 час вечера после сильного спроса на аукцион 3-летних банкнот во вторник.

В сырьевых товарах фьючерсы на нефть Brent упали на 1% до $76,30 за баррель. Спотовое золото падает на 17 долларов до 2880 долларов за унцию.

Календарь экономических данных США включает отчет об ИПЦ за январь (8:30 утра) и баланс федерального бюджета (2 вечера). Спикер ФРС включает показания Пауэлла в Комитете Палаты представителей США по финансовым услугам (10 утра), Bostic (12 вечера) и Waller (5:05 вечера).

Рыночный снимок

- Фьючерсы S&P 500 снизились на 0,2% до 6 080,50

- STOXX Europe 600 вырос на 0,2% до 548,02

- MXAP вырос на 0,3% до 185,08

- MXAPJ вырос на 0,8% до 584,79

- Nikkei вырос на 0,4% до 38 963,70

- Топикс мало изменился на 2 733,33

- Индекс Хан Сена вырос на 2,6% до 21 857,92

- Shanghai Composite вырос на 0,9% до 3 346,39

- Sensex снизился на 0,2% до 76 145,08

- Австралия S&P/ASX 200 вырос на 0,6% до 8 535,26

- Kospi вырос на 0,4% до 2 548,39

- Доходность 10Y в Германии незначительно изменилась на 2,45%

- Евро вырос на 0,1% до $1,0373

- Brent Futures упал на 0,9% до $76,32 за баррель

- Brent Futures упал на 0,9% до $76,32 за баррель

- Золото упало на 0,3% до $2 889,78

- Индекс доллара США мало изменился на 107,98

Лучшие ночные новости

- Команда президента Трампа работает над тем, чтобы уже на этой неделе ввести взаимные тарифы для стран, которые ввели пошлины на экспорт США, используя исполнительные действия, чтобы воплотить в жизнь далеко идущее предложение с его первого срока, которое так и не было реализовано. WSJ

- По сообщениям, советники президента США Трампа рассматривают консолидацию регуляторов банков и, как говорят, обсуждают консолидацию OCC и FDIC регуляторов банков.

- Чиновники администрации Трампа обсуждают планы по сокращению и объединению полномочий банковских регуляторов. После закрытия и остановки CFPB Белый дом теперь рассматривает возможность консолидации других банковских регуляторов (Fed, OCC, FDIC, Treasury). WSJ

- Белый дом планирует выдвинуть Джонатана Маккернана, чтобы возглавить CFPB на полный рабочий день, а Джонатан Гулд возглавит OCC.

- Президент США Трамп выстроился в очередь для участия в конференции, поддерживаемой Саудовской Аравией, в Майами в этом месяце: Рейтер

- Вице-председатель ФРС Уильямс сказал, что денежно-кредитная политика имеет хорошие возможности для достижения целей ФРС, и экономика США находится в хорошем месте, в то время как инфляционные ожидания хорошо закреплены, а уровень безработицы в США должен оставаться между 4% и 4,25%. Уильямс также заявил, что в этом и следующем году США должны вырасти примерно на 2%, в то время как инфляция должна составить около 2,5% в этом году и 2% в ближайшие годы. Кроме того, Уильямс сказал, что трудно определить, влияет ли неопределенность на экономику, а также отметил, что денежно-кредитная политика находится там, где она должна быть.

- Закупки Китаем оборудования для производства чипов в этом году будут снижаться после трех лет роста, поскольку отрасль борется с избыточными мощностями и сталкивается с более серьезными ограничениями со стороны санкций США. РТС

- Австралия «убивает» алюминиевый рынок США, сказал советник Трампа, что может нанести удар по ее усилиям по обеспечению освобождения. Япония попросила Трампа исключить ее фирмы из налогов. BBG

- Еврозона рассматривает введение временного ограничения на местные цены на газ на фоне рекордного разрыва по сравнению с США. Европейские цены на природный газ на этой неделе достигли самого высокого уровня за последние два года, отчасти из-за низких температур и отсутствия ветра, который остановил производство возобновляемой энергии. FT

- Канцлер Рейчел Ривз и правительство Великобритании находятся под давлением, чтобы либо сократить расходы, либо повысить налоги. FT

- Экономика Великобритании, возможно, сократилась в четвертом квартале, при этом экономисты ожидают, что ВВП упал на 0,1% после застоя в третьем квартале. По оценкам Банка Англии, вероятность того, что Великобритания уже находится в технической рецессии, составляет 40%. BBG

- Запасы сырой нефти в США выросли на 9 миллионов баррелей на прошлой неделе, сообщает API. Это будет самый большой рост за год, если подтвердится ОВОС сегодня. Рынок будет следить за официальными цифрами, чтобы увидеть, увеличились ли притоки из Канады. BBG

Тарифы

- Помощник Трампа в США Наварро, как говорят, является ведущим сторонником взаимных тарифов, сообщили источники WSJ, которые также могут выходить за рамки простого соответствия тарифам других стран с учетом нетарифных торговых барьеров. Потенциально оставляет Японию, Европу и Китай на крючке для более высоких тарифов.

- Президент США Трамп ответил «Посмотрим», когда спросят, будут ли взаимные тарифы в среду.

- Белый дом заявил, что 25% тарифы на сталь будут накладываться на другие сборы, сообщает канадская пресса.

- Министр промышленности Японии Муто сказал, что они попросили США исключить Японию из тарифов на сталь и алюминий, в то время как министр финансов Като сказал, что они оценят влияние тарифов США на японскую экономику и ответят соответствующим образом.

- Первый разговор между президентом Еврокомиссии фон дер Ляйеном и вице-президентом США Джей Ди Вэнсом вчера был «очень конструктивным» и сосредоточен на областях, где интересы совпадают, согласно источникам, цитируемым FT.

- Президент США Трамп подпишет указы в 14:30 EST (19:30 GMT) через Punchbowl.

Более подробный взгляд на мировые рынки любезно предоставлен Newsquawk

Акции APAC в конечном итоге были смешанными с ценовыми действиями, несколько неустойчивыми после аналогичных показателей в штате после недавних тарифных объявлений Трампа и с данными ИПЦ США на горизонте. ASX 200 торговался выше, поскольку сила в финансовом секторе и промышленности искупилась за потери в технологиях, в то время как участники переварили ключевые выпуски доходов, в том числе от крупнейшего банка Австралии и самой ценной компании CBA. Nikkei 225 продвигался по возвращении со вчерашнего закрытия на фоне недавней слабости валюты, но на мгновение сократил все свои прибыли на фоне роста доходности и неопределенности, связанной с тарифами. Hang Seng и Shanghai Comp отличались превосходством в Гонконге во главе с силой в технологических акциях, включая Alibaba после сообщений о том, что Apple сотрудничала с Alibaba для разработки функций ИИ для пользователей iPhone в Китае, в то время как SMIC выиграла после того, как она опубликовала более сильный, чем ожидалось, доход и управляемый рост доходов. И наоборот, материк был ограничен ценовым действием на фоне продолжающихся торговых трений и усилий по ликвидности PBoC.

Лучшие азиатские новости

- Губернатор Банка Японии Уэда заявил, что они будут проводить денежно-кредитную политику надлежащим образом для достижения целевого показателя в 2% и будут контролировать влияние тарифной и иммиграционной политики США. Уэда сказал, что темпы денежно-кредитной корректировки должны зависеть от экономических ситуаций, и он знает, что рост инфляции, включая свежие продукты, оказывает негативное влияние на домохозяйства, в то время как он добавил, что могут быть риски того, что рост цен на свежие продукты не может быть временным и может повлиять на настроения людей.

Европейские биржи, как правило, скромнее, несмотря на смешанную передачу от сессии APAC. Европейские секторы имеют положительную предвзятость; Недвижимость занимает первое место, поддерживаемое пост-заработной силой в жилищном строительстве Барратта Редроу (+5,6%). Heineken (+11,4%) подскочил на открытой позиции после того, как Co. обыграла прибыль и объявила о выкупе акций. Энергетика явно отстает, учитывая слабость цен на нефть сегодня.

Лучшие европейские новости

- Хольцман из ЕЦБ заявил, что снижение ставок на 50 б/с в этом году «не будет мудрым шагом».

- Бунге из Риксбанка заявил, что инфляция в январе была выше, чем ожидалось, но причины этого неизвестны, и цифры следует интерпретировать с осторожностью.

Форекс

- DXY устойчиво опережает предстоящие данные по ИПЦ США, согласно которым ожидается, что основной ИПЦ М/М будет повышаться до 0,3% с 0,2%, Y/Y будет снижаться до 3,1% с 3,2%, заголовок М/М будет падать до 0,3% с 0,4%, а Y/Y, как ожидается, будет устойчивым на уровне 2,9%. Сегодня в другом месте Пауэлл обращается к дому. Бостик и Уоллер также должны (позже речь идет о стейблкоинах). DXY вернулся ниже отметки 108 и находится в непосредственной близости от своего 50DMA на отметке 107,95.

- EUR сильнее доллара США в течение третьей сессии подряд. Тем не менее, еще предстоит увидеть, насколько устойчивым будет недавний рост, учитывая неопределенные перспективы роста еврозоны, ослабление предвзятости ЕЦБ и уязвимость еврозоны к тарифным действиям со стороны администрации Трампа. Нагель из ЕЦБ должен сегодня поговорить о естественном курсе. EUR/USD достиг отметки 1,0379, но еще не достиг вчерашнего пика в 1,0381.

- JPY является явным отставанием среди крупных компаний, потенциально фактором относительно более высокой урожайности. Драйверы, ориентированные на Японию, были на легкой стороне, за исключением некоторых неинкрементных замечаний от губернатора BoJ Уэды, который заявил, что темпы денежной корректировки должны зависеть от экономической ситуации, и он знает, что рост инфляции, включая свежие продукты питания, оказывает негативное влияние на домохозяйства. USD/JPY теперь снова выше своего 200DMA на 152,70 с пиком текущей сессии на 153,88. В настоящее время проводится тест 154.

- GBP стабилен по отношению к доллару США, а одинокий акцент в сегодняшнем календаре Великобритании прозвучал в речи члена MPC Грина в 15:00 GMT. Замечания Грин последуют за вчерашними высказываниями голубиного инакомыслящего Манна, который дал ей аргументы в поддержку своего голубиного инакомыслия на последней встрече, но отметил, что ее «активная политика ставок не означает сокращение, сокращение, сокращение» и предположил, что она не может выбрать еще одно сокращение на 50 б/с на следующей встрече. Кабель ненадолго поднялся над вчерашним пиком 1.2454, но выдохся перед 50DMA на отметке 1.2476.

- Антиподы немного мягче в спокойной торговле для антиподов. AUD/USD делает паузу для дыхания после двух последовательных сессий выигрыша, которые подняли пару выше ее 50DMA на 0,6271, но не смогли выдержать движение выше отметки 0,63 с текущим пиком сессии на 0,6309.

- PBoC установил среднюю точку USD/CNY на уровне 7.1710 против exp. 7.2971 (предыдущее 7.1716).

Фиксированный доход

- UST уверенно опережают предстоящие данные US CPI. Онлайн-отчет может укрепить рыночный взгляд на инфляционную липкость, учитывая, что в последнем заявлении ФРС не было указано, что инфляция достигла цели в 2%. На торговом фронте WSJ сообщает, что взаимные тарифы могут выходить за рамки простого соответствия тарифам других стран с учетом нетарифных торговых барьеров. Для дела сегодня: поставки в 10 лет в США, а ФРС говорит от Бостика, Уоллера и Пауэлла. После печати базы на уровне 4,40% 5 февраля доходность 10 лет в США выросла на 5 сессий подряд и достигла сегодня 4,556%.

- Бунды ниже примерно на 20 клещей. Немецкая доходность снова выше после сильного вчерашнего показа, который Rabobank приписывает избытку (особенно суверенной) эмиссии, учитывая отсутствие какого-либо новостного потока движущегося рынка (включая отсутствие свежих данных EZ или изменение тона от спикеров центрального банка). EZ-docket довольно легкий, но Нагель из ЕЦБ должен; ИПЦ США будет сосредоточен. Немецкие линии 2054/2050 прошли без проблем, что вызвало небольшое движение в немецкой газете.

- Потолки немного выше после вчерашней сессии потерь. Одинокое событие в сегодняшнем календаре Великобритании прозвучало в речи члена MPC Грина в 15:00 GMT. Мар-25 Потолки в настоящее время находятся чуть ниже отметки 93,00 с соответствующей 10-летней доходностью выше отметки 4,5%.

- Германия продает 1,189 млрд евро против exp. EUR 1,5 млрд 2,50% 2054 Bund и 0,795 млрд евро против Exp. EUR 1 млрд 0,00% 2050 Bund.

Товары

- Мягкая сессия для сырого комплекса сегодня, возвращая часть геополитического подъема на предыдущей сессии; но основная напряженность по-прежнему остается нерешенной в отношении США-Израиля и Газы. Журналист Кайс сообщил, что есть «некоторый оптимизм» по поводу достижения решения. В настоящее время Brent торгуется в нижней части диапазона 76,22-91 доллара США.

- Спотовое золото сегодня немного ниже, в настоящее время примерно на 5 долларов США за унцию; ценовое действие было очень ограниченным и содержалось в пределах 2883,79-2900,75 долларов США за унцию.

- Смешанная торговля базовыми металлами с рынками, осторожными перед ИПЦ США и потенциальными взаимными тарифами Трампа. Медь 3М LME сегодня утром находится в диапазоне $9347,85-9,416.00 / т.

- ЕС рассматривает временное ограничение цен на газ для противодействия расходам с США, хотя это предложение вызвало негативную реакцию со стороны отрасли, которая предупредила, что это может нанести ущерб доверию.

- Глава Vitol заявил, что европейский Цены на СПГ достигают уровней, на которые спрос начнет влиять. Для обеспечения адекватных зимних поставок СПГ потребуется вмешательство правительства ЕС.

- Министр энергетики ОАЭ сказал: «Я не думаю, что развитие ИИ Deepseek повлияет на спрос на ядерную энергию». Будет огромный спрос на энергию, возможно, более зеленую, для снабжения центров обработки данных. «Оптимистично, что у нас будет достаточно энергии, чтобы обеспечить бум ИИ». Обеспечить стабильность рынка в интересах стран-производителей и стран-потребителей очень сложно, особенно с сокращением доли рынка ОПЕК.

- Российский вице-премьер Новак заявил, что полностью выполнил соглашение о сокращении добычи нефти ОПЕК+ в январе и сделает то же самое в феврале. Ожидается, что в 2025 году будет продолжаться или увеличиваться переработка нефти. Обсуждения газовых свопов с Азербайджаном для экспорта в Европу через Украину не ведется.

Геополитика: Ближний Восток

- Журналист Кайс сказал, что Катар и Египет находятся в контакте с США по вопросу прекращения огня, и есть некоторый оптимизм по поводу достижения решения.

- Верховный лидер Ирана Хаменеи заявил, что Тегеран должен продолжать совершенствовать свой оборонный сектор, точность иранских ракет должна быть дополнительно улучшена.

- Сирийские источники: Израильская армия проникает в город Саида Голан в южной сельской местности Кунейтры через Sky News Arabia.

- "" Переговорная группа [Израиля] посоветовала министрам кабинета министров урегулировать кризис с ХАМАСом и не позволять сделке рухнуть, — сообщают израильские источники в Al Jazeera.

- Госсекретарь США Рубио заявил, что если ХАМАС не выполнит соглашение к субботе, он думает, что Израиль снова вмешается, в то время как он добавил, что Трамп хочет немедленно вывести всех задержанных из сектора Газа и что ХАМАС нарушает соглашение о прекращении огня в секторе Газа, сообщает Asharq News.

- Египет планирует предложить всеобъемлющее предложение по восстановлению Газы, обеспечивая при этом, чтобы палестинцы оставались на своей земле, и надеется на сотрудничество с президентом США Трампом для достижения всеобъемлющего и справедливого мира в регионе. Египет также подтвердил отказ от любого предложения о выделении земли жителям Газы.

Геополитика: Украина

- Кремль заявил, что Россия никогда не будет обсуждать смену украинской территории, которую она контролирует, или территории, которую Украина занимает в Курской области.

- Зампред Совбеза РФ Медведев заявил, что «мы можем добиться мира силой», а Россия показала силу ракетами и ударами беспилотников по Киеву (Украина).

- Президент Украины Зеленский заявил в недавнем интервью AFP, что он готов обменять российскую территорию, захваченную Украиной в Курской области, на украинскую территорию, захваченную Россией на востоке, в рамках мирного урегулирования путем переговоров, чтобы положить конец продолжающейся войне.

- Российская воздушная атака вызвала пожары в двух киевских районах, сообщил глава военной администрации Киева. Кроме того, помощник президента Украины Зеленского заявил, что Россия нанесла ракетный удар по Киеву, в то время как мэр города сказал, что экстренные службы были вызваны в несколько районов.

- Президент США Трамп заявил, что отправит министра финансов США Бессента на Украину, чтобы встретиться с Зеленским, в то время как он добавил, что война должна закончиться и скоро закончится. Советник Белого дома по национальной безопасности Вальц заявил, что они движутся в правильном направлении, чтобы положить конец жестокой и ужасной войне на Украине.

Геополитика: другой

- США Военно-морской флот подтвердил, что два военных корабля США осуществили транзит через Тайваньский пролив с севера на юг, и сказал, что это было обычным делом, в то время как военные Китая организовали свои военно-морские и военно-воздушные силы для наблюдения за американскими кораблями, пересекающими Тайваньский пролив с 10 по 12 февраля.

- Управление по делам Тайваня Китая заявило, что решительно выступает против и никогда не допустит иностранного вмешательства, в то время как у него есть полное доверие и достаточная способность защищать национальный суверенитет и территориальную целостность. США должны разумно и должным образом решать вопросы, связанные с Тайванем, а не посылать неверные сигналы сепаратистским силам независимости.

- По данным государственных СМИ, береговая охрана Китая провела патрулирование в «территориальных водах» островов Дяоюйдао / Сенкаку в среду.

Календарь событий США

- 07:00: Февраль. Ипотечные заявки MBA 2,3%, ранее 2,2%

- 08:30: Jan. CPI MoM, est. 0,3%, prior 0,4%

- 08:30: Jan. CPI YoY, est. 2,9%, prior 2,9%

- 08:30: Январь CPI Ex Food and Energy MoM, est. 0,3%, prior 0,2%

- 08:30: Jan. CPI Ex Food and Energy YoY, est. 3,1%, prior 3,2%

- 08:30: Ян. Real Avg Hourly Earning YoY, ранее 1,0%, пересмотрено на 1,2%

- 08:30: Ян. Real Avg Weekly Earnings YoY, ранее 0,7%, пересмотрено на 0,5%

- 14:00: Январь. Баланс федерального бюджета, est. - $94.8b, предыдущий - $86.7b

Джим Рид из DB завершил ночную обертку

Я просыпаюсь в Париже сегодня утром и буду просыпаться в больнице в Лондоне сегодня вечером после короткой седации после очередной инъекции в спину. Я на последнем шансе в салуне перед операцией на спине, которую я пытаюсь отложить до осени. Один из моих дисков в нижней части спины медленно коллапсировал без места для нерва, который поэтому постоянно сжимается. Таким образом, у меня был постоянный ишиас в течение последних 3-4 лет. Я работаю над своим ядром 4-5 дней в неделю, делал бесчисленные физио-сессии, многочисленные инъекции, а 2 года назад мне сделали несколько более простую операцию на спине. Ничего не работает. Если у кого-то есть опыт термоядерной хирургии или какой-либо совет в последнюю минуту о том, как ее избежать, мне было бы интересно услышать, но я пробовал большинство вещей без хирургического вмешательства. Трудно перестроить диск, который стар и не в форме! Хорошей новостью является то, что мне все еще удалось сыграть в 2.5-фунтовый гольф, несмотря на боль. Плохая новость заключается в том, что я буду потенциально вне гольфа в течение 6 месяцев, когда у меня будет операция. Меня вдохновляет тот факт, что Тайгер Вудс выиграл Мастерс через два года после операции по синтезу! Моим эквивалентом будет Worplesdon Golf Club Over 50s Cup в 2026 году!

Говоря о 2026 году, рынки в последние дни стали немного больше беспокоиться о том, где инфляция будет в следующем году. Мы узнаем немного больше о краткосрочном направлении путешествий сегодня с ИПЦ США позже. В преддверии этого облигации продолжали продаваться с минимумов доходности 2025 года, наблюдавшихся на прошлой неделе. Вчера было несколько катализаторов, но комментарии председателя ФРС Пауэлла, который сказал, что «нам не нужно торопиться с корректировкой нашей политической позиции», были фактором, даже если мы ожидали, что он скажет. Но помимо этого, новый рост цен на энергоносители и перспектива ответных тарифов со стороны ЕС привели к опасению, что инфляция будет оставаться выше целевого уровня в течение некоторого времени. Действительно, инфляционный своп в США в 2 года (+4,2 млрд. п.) закрылся на самом высоком уровне почти за два года — 2,796%.

Этот фон делает его интересным днем, чтобы получить печать ИПЦ США на январь, который даст первый большой ключ к инфляции в 2025 году. Сегодняшний отчет получает приличное внимание, отчасти потому, что в январском отчете был сильный сюрприз, поэтому мы опасаемся, что мы можем получить еще один рост в новом году, который огорчает ожидания рынка по поводу того, что ФРС все еще сократится в этом году. Это особенно верно, потому что последние данные склонились в более ястребином направлении: 3-метровый годовой показатель ИПЦ уже достиг +3,9% в декабре, в то время как 6-метровый показатель составил +3,0%.

С точки зрения того, что ожидать, наши американские экономисты ищут ежемесячный индекс потребительских цен на уровне +0,31%, который будет держать годовой курс на уровне +2,9%. Затем для базового ИПЦ они ищут ежемесячную печать + 0,28%, при этом годовой показатель снижается на десятую до +3,1%. Другим ключевым моментом, на который следует обратить внимание, будет ежегодный пересмотр факторов сезонной корректировки, которые могут повлиять на последние 5 лет данных. В прошлом году изменения не сильно изменили картину, но два года назад они показали, что инфляция не замедляется так быстро, как мы думали. Подробнее см. полный предварительный просмотр наших американских экономистов здесь и как подписаться на их вебинар немедленной реакции.

До этого основная история вчера исходила от председателя ФРС Пауэлла, который выступал с полугодовыми показаниями перед банковским комитетом Сената. Как обсуждалось выше, его главный комментарий заключался в том, что ФРС не нужно торопиться, и он также сказал, что если «экономика останется сильной, а инфляция не продолжит устойчиво двигаться к 2%, мы можем дольше сохранять политическую сдержанность». В противном случае заголовков было не так много. Отметим, что Пауэлл выступает сегодня перед Комитетом Палаты представителей по финансовым услугам во втором своем полугодовом двойном законопроекте в Конгрессе. Обычно второй акт не получает столько заголовков, но есть шанс, что сегодняшний ИПЦ может вызвать немного другой тон или поощрить разные вопросы. Все зависит от того, где релиз относительно ожиданий.

Пока мы ждали этого, появились свежие новости о тарифном фронте, поскольку ЕС заявил, что тарифы США на металлы «приведут к твердым и пропорциональным контрмерам». Тарифы США вступят в силу не раньше 12 марта, поэтому теоретически это может дать время для задержки или соглашения, которое должно быть достигнуто, как это произошло с Канадой и Мексикой на прошлой неделе. Но для рынков это может привести к росту инфляции по обе стороны Атлантики. И эти настроения усугубились еще одним ростом цен на энергоносители вчера, когда нефть марки Brent (+1,17%) выросла на 3-й день до $76,76 за баррель.

Все это привело вчера к значительной распродаже суверенных облигаций, особенно в Европе. Например, доходность на 10yr bunds выросла +6,8bps до 2,43%, что является их самым большим ежедневным увеличением 2025 года, хотя и хорошим 22bps от максимумов YTD в первой половине января. Аналогичным образом, урожайность на 10yr gilts (+5.1bps), OATs (+12.1bps) и BTPs (+8.0bps) также подскочила выше. А в США доходность казначейских облигаций выросла по всей кривой: доходность в 2 года выросла до +1,0 б/с до 4,28%, в то время как доходность в 10 лет выросла до +3,9 б/с до 4,535% (4,545% в Азии). Обострение произошло на фоне сильного спроса на почти устаревшие государственные облигации США, поскольку аукцион 3-летних облигаций Казначейства США на сумму 58 миллиардов долларов показал рекордно низкий показатель в 10,2%.

Инвесторы также снизили вероятность снижения ставки ФРС, причем вероятность снижения ставки к июню снизилась до 59% с 63% за предыдущий день. Это происходит на фоне очередной волны спикеров ФРС, проповедующих терпение. Президент Федеральной резервной системы Нью-Йорка Уильямс заявил, что он ожидает, что инфляция продолжит двигаться к заявленной цели банка в 2%, но важно отметить, что экономические перспективы остаются крайне неопределенными, особенно в отношении потенциальной фискальной, торговой, иммиграционной и регуляторной политики. У него все еще был целевой показатель инфляции на конец года в 2,5%, при этом цель в 2% прибыла «в ближайшие годы». Президент ФРС Кливленда Хаммак, которая не голосовала в этом году, не согласилась с сокращением в декабре, сказала, что будет поддерживать ставки устойчивыми, чтобы изучить новую политику правительства и ждать дальнейших доказательств более низкого ценового давления.

Что касается акций, то за последние 24 часа они показали более высокие показатели, особенно в Европе. Например, STOXX 600 (+0,23%), DAX (+0,58%) и FTSE 100 (+0,11%) поднялись до рекордных максимумов. Это укрепляет DAX как самый сильный показатель 2025 года, поднявшись на +10,69% с начала года и сделав его самым сильным началом года к этому моменту с 2012 года. Между тем, в США индекс S&P 500 (+0,03%) был в основном плоским, но по-прежнему оставался менее чем на 1% ниже своего исторического максимума с января. Автомобили (-5,82%) отставали в основном из-за того, что TSLA (-6,34%) отставала, поскольку китайский конкурент BYD объявил о планах по внедрению технологий автономного вождения в свои автомобили. Этот последний слайд означает, что автопроизводитель снизился на 31,5% по сравнению с рекордными максимумами, достигнутыми в середине декабря. Автомобили также находились под давлением, поскольку ходили сообщения о том, что генеральный директор Ford (снижение -0,32% вчера, -6,97% YTD) Джим Фарли сегодня встретится с законодателями в Вашингтоне, чтобы выступить против призрака тарифов, которые влияют на отрасль.

Азиатские фондовые рынки в основном выше с Hang Seng (+1,56%), лидирующим ростом в регионе, а акции EV растут на фоне ажиотажа вокруг ИИ. Между тем, Nikkei (+0,18%) растет после возвращения из отпуска с KOSPI (+0,22%) и S&P/ASX 200 (+0,51%). В других странах акции материкового Китая перекрывают региональную тенденцию: CSI (-0,12%) и Shanghai Composite (-0,01%) колеблются между прибылью и убытком. Фьючерсы в США упали примерно на десятую часть процента.

Акции Alibaba Group подскочили более чем на 8%, достигнув четырехмесячного максимума по сообщениям о стратегическом партнерстве с Apple Inc для разработки функций искусственного интеллекта (ИИ) для iPhone в Китае. BYD Co. (+5,5%) поднялась до нового рекорда после новостей о самоуправляемости, которые мы обсуждали выше.

В иностранной валюте японская иена (-0,76%) продолжает терять позиции в течение третьего дня подряд на 1-недельном минимуме 153,65 по отношению к доллару из-за взаимной неопределенности тарифов. Недостаточная производительность Йены контрастирует с прошлой неделей, когда валюта укрепилась в течение четырех прямых сессий по растущим ставкам, что Банк Японии снова повысит ставки в этом году. Сегодня утром индексные свопы (OIS) предполагают 77% вероятность повышения ставки BOJ к июлю и полное повышение ставки к октябрю.

Вчера данных было немного, хотя в США индекс оптимизма малого бизнеса NFIB упал немного больше, чем ожидалось в январе. Это снизилось до 102,8 (против 104,7), сместившись с 6-летнего максимума в декабре. В противном случае уровень безработицы во Франции снизился до 7,3% в 4 квартале (против 7,5%).

На сегодняшний день выпуски данных включают печать ИПЦ США за январь и итальянское промышленное производство за декабрь. Из центральных банков председатель ФРС Пауэлл выступит перед Комитетом по финансовым услугам Палаты представителей, и мы также услышим от Бостика и Уоллера ФРС, Элдерсона и Нагеля ЕЦБ и Грина Банка Англии.

Тайлер Дерден

Свадьба, 02/12/2025 - 08:14