Тарифы и потребители Неопределенная чумная цель на весь год

Цель предупредил о «значимом» давлении на прибыль в этом квартале и прогнозировал плоские продажи за год, ссылаясь на монтаж неопределенность потребителей и Эскалация торговой напряженности Президент Трамп повышает тарифы на китайский импорт. Осторожный прогноз ритейлера подчеркивает проблемы сети «большого ящика» в бурной экономической среде. Учитывая эту неопределенность, руководители розничной торговли могут действовать более осторожно при продвижении товаров, связанных с ЛГБТК, для детей.

Целевой финансовый директор Джимми Ли написал в пресс-релизе, что розничный торговец В феврале продажи показали «небольшое снижение» из-за снижения доверия потребителей. "

Заглядывая вперед, мы ожидаем увидеть умеренность в этой тенденции, поскольку продажи одежды реагируют на более теплую погоду по всей стране, а потребители обращаются к Target для предстоящих сезонных моментов, таких как пасхальный праздник. Мы будем следить за этими тенденциями и Мы будем оставаться достаточно осторожными с нашими ожиданиями на предстоящий год.- сказал Ли.

Цель предупредила: В свете неопределенность потребителей и Небольшое снижение чистых продаж в феврале в сочетании с неопределенностью тарифов и ожидаемые сроки некоторых расходов в течение финансового года, Компания рассчитывает увидеть значимое давление на прибыль в первом квартале по сравнению с остальной частью года"

Цель Прогноз на весь год не соответствовал средней оценке аналитика.

Аналитики Goldman Кейт МакШейн, Эмили Гош и другие Резюмировал мрачный прогноз на весь год:

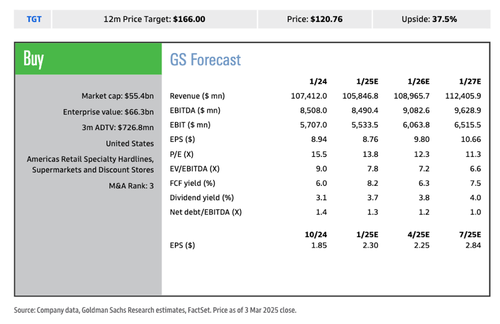

TGT представила руководство FY25 с ростом чистых продаж на +1%, что отражает плоский SSS (против GS / консенсуса +2,8% / + 1,9%), скромное увеличение операционной маржи и EPS на $8,80-9,80 (против GS / консенсуса на уровне $9,80 / $9,31). TGT ожидает увидеть значительное давление на прибыль в 1 кв.25 относительно оставшейся части года, ссылаясь на продолжающуюся неопределенность в отношении потребителей и небольшое снижение чистых продаж в феврале, наряду с неопределенностью тарифов и ожидаемыми сроками определенных затрат в 25 финансовом году.

Мрачный прогноз сопровождался лучшими, чем ожидалось, результатами за четвертый квартал (предоставлено аналитиками GS):

TGT сообщила о 4Q24 EPS в размере $2,41, выше GS/консенсуса (Refinitiv) в размере $2,30/$2,26. SSS составил +1,5% против консенсуса +1,3%, с увеличением трафика (+2,1%) и снижением билетов (-0,6%). По каналам продажи в магазине снизились на -0,5%, в то время как продажи в электронной коммерции увеличились на +8,7% (свыше 25% в тот же день доставки через Target Circle 360 у/у). Обратите внимание, что тенденции компа в одежде и жестких линиях ускорились почти на 4 ppts от 3Q.

Аналитики отметили:

Мы Покупка оценена по TGT с 12-месячной ценовой целью в 166 долларов. На основе нашей системы вознаграждения за риск с относительными P / E кратными 65% / 75% / 80%.

Побочные риски1) тенденции трафика и продаж замедляются из-за слабости потребительских расходов; 2) инфляционное давление, связанное с издержками на продукцию, фрахтом/транспортом и/или заработной платой; 3) конкурентная среда вынуждает TGT более агрессивно конкурировать по цене; 4) маржа подвергается давлению со стороны всеканальных инвестиций в цепочки поставок и смещения смещения.

Целевые акции в Территория коррекции в годовом исчислении упала почти на 50% с пика около $266. в ноябре 2021 года. В дорыночной торговле акции упали на 3%.

Жихан Ма, розничный аналитик Bernstein, сказал клиентам: «Мы считаем, что Target нужно больше инвестировать в ценообразование и рекламные акции, чтобы стимулировать рост». В Target отметили, что в прошлом году снизили цены на 10 000 товаров.

Конкурент Walmart стал явным победителем в ценностных войнах между ритейлерами. Подробнее об этом читайте здесь...

Проблемы с прибылью и тарифы Target Только предположим, что руководители откажутся от раздражения половины своей клиентской базы проснувшимися товарами или рискуют, что эти люди перейдут на низкие цены Walmart.

Тайлер Дерден

Туэ, 03/04/2025 - 13:05