«Сильный спрос» на препарат для снижения веса, омраченный сокращением руководящих указаний, упал

Обновление (1340ET):

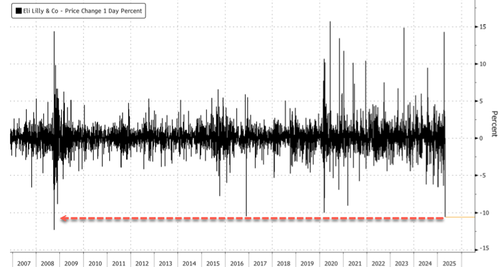

Ранее акции Eli Lilly упали более чем на 10,5%, превысив падение, наблюдавшееся 23 ноября 2016 года, и отметив самое крутое падение акций с 9 октября 2008 года.

** **

Акции Eli Lilly & Co. упали на предпродажных торгах в Нью-Йорке Сократил прогноз прибыли на весь годСсылаясь на увеличение расходов на исследования и разработки, несмотря на размещение доходов и доходов в первом квартале, которые превзошли ожидания аналитиков, что обусловлено высоким спросом на его препарат против ожирения, Mounjaro.

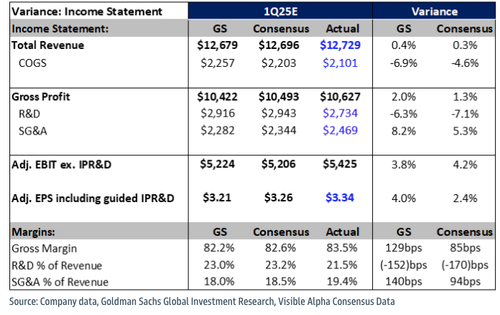

Аналитики Goldman, в том числе Асад Хайдер, предоставили клиентам первое представление о доходах Lilly в первом квартале, указывая на то, что результаты 1Q25 показывают:немного превзошли ожидания"

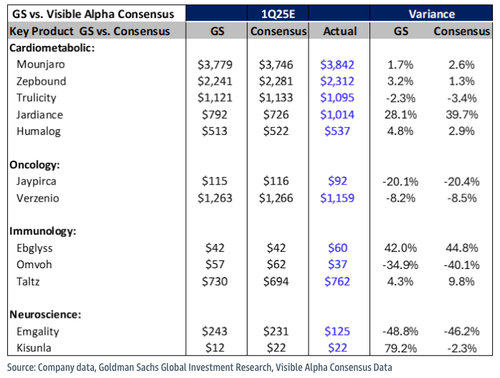

Прибыль LLY 1Q25 немного превысила ожидания, где франшиза тирзепатида (Zepbound + Mounjaro) обогнала GS/Visible Alpha Consensus Data ($6 млрд), отражая Сохраняющийся высокий спросчастично компенсируется более низкими реализованными ценами. Мы отмечаем, что последние данные IQVIA показывают, что импульс Zepbound продолжается до апреля. Производительность была немного неравномерной среди других статей портфеля, с Jardiance (который включал единовременное преимущество в 370 миллионов долларов) и Ebglyss, в то время как Jaypirca, Omvoh и Emgality не оправдали ожиданий.

Экспонаты 1 и 2 дают больше информации о результатах заработка:

Фактический vs. GS/Consensus- Income Statement and Margins

Фактический vs. GS/Consensus- Income Statement and Margins

Затмение первого квартала стало шагом Lilly по сокращению годового дохода из-за обвинений, связанных с недавней сделкой по лечению рака.

Лилли отметила в отчете о доходах, что существующая тарифная и торговая среда была учтена в обновленном руководстве. Однако новое руководство не отражает каких-либо изменений в политике, включая тарифы на фармацевтический сектор, которые могут повлиять на бизнес.

Больше цвета в обновленном руководстве через Goldman’s Haider:

2025 EPS руководство сократить (от $22,50-$24,00 до $20,78-$22,28) был полностью обусловлен 1Q25 IPR & D заряд $1,57 млрд, что означает $1,72 на EPS

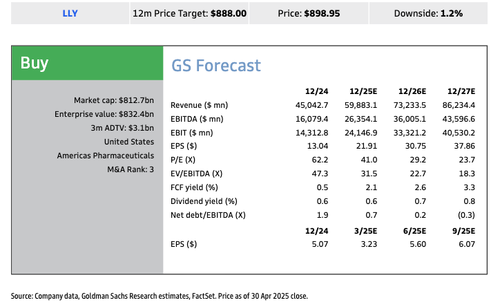

Хайдер сохранил рейтинг «Купить» на Lilly с 12-месячной ценовой целью в 888 долларов.

Акции упали на 6% в дорыночной торговле, поскольку снижение ориентиров заняло центральное место, затмив солидный первый квартал. Несмотря на снижение, акции остаются чуть ниже 12-месячного целевого показателя Goldman и недалеко от рекордных максимумов.

В дополнение к давлению, CVS Health объявила о сделке по расширению доступа к конкурирующему препарату от ожирения Novo Nordisk, который, возможно, еще больше повлиял на настроения Lilly на фондовом рынке.

Ранее генеральный директор Eli Lilly Дэйв Рикс представил CNBC обновленную информацию о тарифах: «Я думаю, что на самом деле угроза тарифов уже возвращает критически важные цепочки поставок в важные отрасли, чипы и фармацевтику». Я не так уверен. "

Тайлер Дерден

Ту, 05/01/2025 - 12:05