Ожидания потребителей упали до 14-летнего минимума, ожидания инфляции взлетели

Еще один день, еще одна мера чувств разочаровывает...

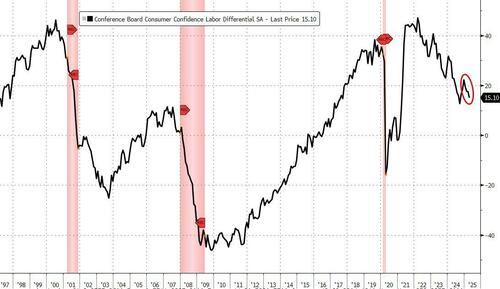

Доверие потребителей США упало в апреле до почти пятилетнего минимума на фоне растущего пессимизма в отношении перспектив экономики и рынка труда из-за тарифов. Уровень доверия Conference Board снизился почти на 8 пунктов до 86, что является самым слабым показателем с мая 2020 года. Это было пятое ежемесячное снижение подряд, самое длительное с 2008 года.

Хуже того, Ожидания потребителей на ближайшие полгода упали до самого низкого уровня с 2011 годаВ то время как показатель текущих условий также упал.

«Доверие потребителей снижалось пятый месяц подряд в апреле, падая до уровней, не наблюдавшихся с начала пандемии COVID», - сказала Стефани Гичард, старший экономист по глобальным показателям в Conference Board.

"Снижение было в значительной степени обусловлено ожиданиями потребителей. Три компонента ожиданий — условия ведения бизнеса, перспективы занятости и будущий доход — резко ухудшились, что отражает повсеместный пессимизм в отношении будущего.

В частности, Доля потребителей, ожидающих сокращения рабочих мест в течение следующих шести месяцев (32,1%), была почти такой же высокой, как и в апреле 2009 года. В середине Великой рецессии. Кроме того, впервые за пять лет ожидания относительно перспектив будущих доходов стали явно негативными, что говорит о том, что опасения по поводу экономики теперь распространились на потребителей, беспокоящихся о своих личных ситуациях.

Тем не менее, мнения потребителей в настоящее время не изменились, что привело к общему снижению индекса."

Условия на рынке труда ослабли, продлив их совсем недавний нисходящий тренд.

Высокая волатильность финансового рынка в апреле отодвинуло взгляды потребителей на фондовый рынок вглубь негативной территории; 48,5% ожидают снижения цен на акции в течение следующих 12 месяцев (самая высокая доля с октября 2011 года).

Между тем, средние 12-месячные инфляционные ожидания в апреле достигли 7% - максимума с ноября 2022 года. Когда в США была очень высокая инфляция.

Примечательно, что показатель инфляционных ожиданий NYFed (и показатель инфляционных ожиданий рынка) не кричат выше, как опросы UMICH и CONF BOARD.

Наконец, мы отмечаем, что Апрельское падение доверия было широко распространено во всех возрастных группах и большинстве групп дохода. Снижение было самым резким среди потребителей в возрасте от 35 до 55 лет, а потребители в домохозяйствах зарабатывали более 125 000 долларов в год.

Гичард добавил, что ответы на вопросы о том, какие темы влияют на взгляды экономики, показали, что Тарифы сейчас на вершине потребительского сознанияС упоминаниями о тарифах, достигающих рекордно высокого уровня.

Потребители прямо упомянули опасения по поводу повышения тарифов и негативного влияния на экономику.

Инфляция и высокие цены по-прежнему важны для взглядов потребителей на экономику. Хотя большинство жаловались на высокую стоимость жизни, были также некоторые ссылки на снижение цен на газ и некоторые продукты питания.

Снижение доверия разделялось всех политических партий.

Тайлер Дерден

Туэ, 04/29/2025 - 10:14

![Monitoring na nowo. Końskie miastem pod kamerami [wideo, zdjęcia]](https://tkn24.pl/wp-content/uploads/2025/09/Monitoring-w-Konskich.jpg)