Китай приостанавливает QE, чтобы обратить вспять падение доходности, поскольку акции выходят на медвежий рынок

Один из них может свободно называть покупку облигаций китайским центральным банком.QE"или Не QE«(аналогично шараде, которую ФРС пыталась пройти еще в 2019 году в США), но конечный результат тот же: центральный банк покупает облигации, впрыскивает ликвидность в систему и угнетает валюту в процессе, эффективно дефляируя экономику». Или, как это может быть, больше не является Теперь, когда бродячие банды китайских мародеров, обналичивающих импульсы, так сильно захватили центральный банк, доходность облигаций упала до рекордных минимумов. НБК был вынужден временно приостановить покупку казначейских облигаций в пятницу. Ненадолго поднимая доходность и стимулируя спекуляции, он усиливает защиту валюты юаня, которая скользит с конца сентября или до избрания Дональда Трампа президентом США. Этот шаг прерывается пятью месяцами покупок и совпадает с жестокой распродажей на мировых рынках облигаций, предполагая, что Народный банк Китая также пытается обеспечить рост доходности на внутреннем рынке в тандеме или, по крайней мере, прекратить падение.

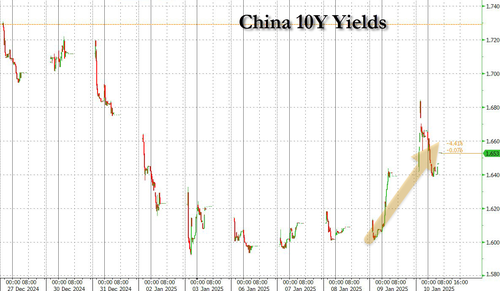

Доходность подскочила после объявления, хотя ориентировочные 10-летние ставки были немного ниже к вечеру. Доходность 10-летнего казначейства Китая первоначально выросла на четыре базисных пункта, но в последний раз снизилась чуть более чем на половину базисного пункта до 1,619%. Юань немного вырос, хотя в последний раз торговался на уровне 7,3326 за доллар, около 16-месячного минимума.

НБК сослался на нехватку облигаций на рынке в качестве причины, по которой он остановил покупки, которые были частью его операций по смягчению денежно-кредитных условий и повышению экономической активности.

Сдвиг в политике и неприятный ответ рынка указывают на жонглирующий акт, который пытается предпринять НБК, стремясь оживить экономический рост, облегчая денежно-кредитные условия, а также пытаясь обуздать беглый рост облигаций, усиливая дефляционный коллапс страны, одновременно стабилизируя валюту на фоне политической и экономической неопределенности.

"" Он указал на готовность ослабить политику дальше ... однако слабость (юаня) из-за сильного доллара и расширяющегося дифференциала с ставками США усложнит позицию НБК, - говорится в записке аналитиков Commerzbank.

Центральный банк заявил в своем заявлении Он возобновит покупку облигаций через операции на открытом рынке «в надлежащее время в зависимости от спроса и предложения на рынке государственных облигаций».

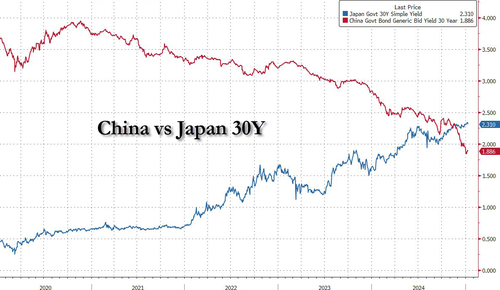

"" Одной из ключевых причин обесценивания юаня является расширенный разрыв в доходности между Китаем и США, поэтому центральный банк посылает сигнал рынку о том, что ставка доходности вряд ли упадет дальше, - сказал Кен Чунг, главный азиатский валютный стратег Mizuho Bank, - хотя ставка доходности падает не столько потому, что НБК отчаянно пытается ее контролировать, сколько потому, что Китай сейчас попал в порочную дефляционную долговую ловушку, такую же, которая десятилетиями тянула доходность Японии до 0.

И, говоря о доходности облигаций ZIRPing, которая является Японией, ее доходность облигаций 30Y теперь примерно на 50 б/с выше, чем у Китая!

В то время как его фондовые рынки рухнули, цены на облигации в Китае находятся на десятилетнем ралли, которое два года назад привело к росту, поскольку проблемы в секторе недвижимости и слабость на фондовом рынке вызвали поток средств, поступающих в банковские депозиты и долговой рынок, одновременно начав период беспрецедентной дефляции.

На этой неделе рынок бросил вызов глобальной распродаже, сплотившись на непреодолимом спросе на безопасные активы и ставках инвесторов на дальнейшее снижение ставок во второй по величине экономике мира.

Между тем, НБК в течение нескольких месяцев предупреждал о рисках, связанных с пузырями, поскольку урожаи с давних времен достигли рекордных минимумов, хотя в то же время власти предвещали дальнейшее смягчение.

Неудивительно, что на фоне этого массивного монетарного стимула (не называйте его QE) китайский юань упал почти на 5% с сентября, как из-за опасений, что угрозы Трампа о новых торговых тарифах будут оказывать большее давление на китайскую экономику, но в основном из-за осознания того, что даже НБК теперь быстро заменяет свою валюту физическим золотом.

Хуан Сюэфэн, директор по исследованиям в Shanghai Anfang Private Fund Co в Шанхае, сказал, что он ожидает, что нисходящий тренд доходности облигаций сохранится, поскольку «рынок продолжает бороться с ситуацией голода активов», где существует нехватка хороших инвестиционных возможностей.

Конечно, это Китай, парадоксы никогда не заканчиваются, и в пятницу Financial News, издание НБК, процитировало экономиста, который сказал, что рынок должен избегать чрезмерных ожиданий по смягчению денежно-кредитной политики. Что нелепо, так как при отсутствии дальнейшего смягчения денежно-кредитной политики дефляционная работа Китая станет полным спринтом.

И хотя НБК пытается сдержать неистовство покупок в китайских облигациях, акции страны не имеют такой проблемы, а акции Китая упали за одну ночь. В пятницу индекс MSCI China снизился на 1,1%, снизившись с 7 октября почти до 20%. Индекс CSI 300 наземных китайских акций снизился на 0,9% и потерял почти 5% в новом году.

Акции Китая начали 2025 год на слабой ноте - более 4500 акций, перечисленных в Шанхае, Шэньчжэне и Пекине, упали в пятницу, что далеко от краткой эйфории, вызванной стимулами, с сентября прошлого года, поскольку инвесторы готовятся к более высоким тарифам, которые могут продлить экономический спад Китая. На этой неделе США внесли в черный список Tencent Holdings и CATL (или Contemporary Amperex Technology Co) за предполагаемые связи с китайскими военными, в то время как администрация Байдена обдумывает еще один раунд ограничений на экспорт чипов искусственного интеллекта. Эти шаги возродили опасения, что напряженность будет только ухудшаться при новом президенте Трампе.

«Это отражает многочисленные неопределенности, связанные с ослаблением макроэкономических показателей, инаугурацией Трампа, валютным давлением из-за укрепления доллара США и затишьем в стимулировании до двух сессий», - сказал Синь-Яо Нг, директор по инвестициям в Сингапуре в Abrdn Plc. Я думаю, что быстрые деньги могут остаться в стороне в первом квартале и подождать, пока ситуация станет более ясной, особенно тарифы Трампа. "

Ошеломляющее ралли китайских акций в конце прошлого года потеряло силу, поскольку надежды инвесторов на более мощные фискальные стимулы не принесли плодов. Хотя власти продолжают внедрять новые меры поддержки, они носят разрозненный характер и далеко не соответствуют ожиданиям рынка.

Пессимизм по поводу экономики, погрязшей в жилищном кризисе и дефляционном давлении, продолжается. Потребительская инфляция в Китае еще больше ослабла к нулю в декабре, замедляясь четвертый месяц подряд в результате неудачной попытки правительства повысить спрос. В своих последних усилиях власти обнародовали планы по субсидированию большего количества потребительских товаров и увеличению финансирования модернизации промышленного оборудования. Центральный банк также подтвердил обещание снизить процентные ставки и коэффициент резервных требований для банков «в надлежащее время» для содействия росту.

Не хватает позитивных катализаторов для рынка, учитывая вероятное затишье в основных политических объявлениях до так называемого ежегодного законодательного собрания Китая в марте.

Наконец, в то время как рынок отчаянно нуждается в том, чтобы Пекин запустил поток триллионов бюджетных стимулов – подобно тому, что Китай сделал во время кризиса 2008 года – проблема заключается в том, что страна настолько перегружена (ее отношение долга/ВВП было к северу от 350% на последнем этапе проверки), что она была вынуждена прибегнуть к таким смехотворным «программам стимулирования». субсидирование потребителей, которые торгуют старыми приборами, такими как кондиционеры и стиральные машины, поскольку политики стремятся противостоять слабому потреблению во второй по величине экономике мира.

Политическая инициатива, взятая прямо из «Байдена».Наличные для клюкеров" Playbook, который был запущен в прошлом году для стимулирования покупок автомобилей и бытовой техники, теперь также будет включать в себя микроволновые печи, рисовые плиты, посудомоечные машины и очистители воды, а также смартфоны и планшеты стоимостью менее 6 000 юаней.

Излишне говорить, что вытягивание спроса из будущего в сегодняшний день с помощью...Скидка 20% Соглашение не изменит дефляционный вихрь страны.

Тайлер Дерден

Фри, 01/10/2025 - 14:00