Китай может перейти от казначейских облигаций США к криптовалюте, золоту, BlackRock Exec

Автор Амин Хакшанас через CoinTelegraph.com,

Центральные банки, особенно Китай, могут начать отходить от казначейства США, изучая альтернативы, такие как золото и биткойн, по словам Джея Джейкобса, главы BlackRock по тематике и активным ETF.

В недавнем интервью CNBC Джейкобс сказал, что геополитическая напряженность и растущая глобальная неопределенность ускоряют стратегии диверсификации среди центральных банков.

Он указал на долгосрочную тенденцию, когда страны снижают свою зависимость от долларовых резервов в пользу таких активов, как золото и, все чаще, биткоин.

«Вся эта диверсификация от традиционных активов к таким вещам, как золото, а также крипто-активы. Вероятно, это началось три-четыре года назад. Джейкобс объяснил.

Он сказал, что недавняя геополитическая фрагментация усилила движение к альтернативным запасам стоимости.

Джейкобс сослался на растущую обеспокоенность по поводу замораживания активов российского центрального банка на 300 миллиардов долларов после вторжения в Украину, предполагая, что такие события побудили такие страны, как Китай, пересмотреть свои стратегии резервирования.

Исполнитель BlackRock Джей Джейкобс на CNBC. Источник: YouTube

Геополитическая фрагментация формирует глобальные рынки

В интервью Джейкобс сказал, что BlackRock, крупнейший в мире управляющий активами, определил геополитическую фрагментацию как определяющую силу для глобальных рынков в ближайшие десятилетия.

«Мы действительно определили геополитическую фрагментацию как мега-силу, которая двигает мир вперед в течение следующих нескольких десятилетий. "

Он отметил, что эта среда подпитывает спрос на некоррелированные активы, а биткойн все чаще рассматривается наряду с золотом как актив-убежище.

«Мы наблюдали значительный приток в золотые ETF. Мы видели значительный приток в биткойн. И это все потому, что люди ищут те активы, которые будут вести себя по-другому, - сказал Джейкобс.

Инвесторы подчеркивают Биткойн-разъединение

Примечательно, что Джейкобс не одинок в подчеркивании снижения корреляции биткоина с американскими акциями. Несколько аналитиков также отметили, что биткоин начинает отделяться от фондового рынка США.

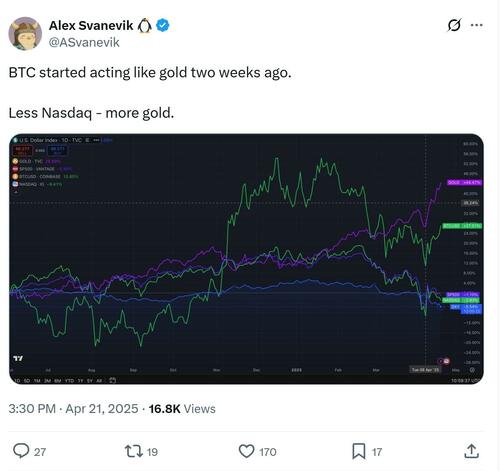

22 апреля Алекс Сваневик, соучредитель и генеральный директор платформы криптоаналитики Nansen, сказал: Цена биткоина демонстрирует его растущую зрелость как глобального актива, становясь «меньше Nasdaq — больше золота». "

Он добавил, что биткоин был «удивительно устойчивым» на фоне торговой войны по сравнению с альткойнами и индексами, такими как S&P 500, но остается уязвимым для проблем экономического спада.

Источник: Alex Svanevik

Вторя этому настроению, QCP Capital сказал в записке Telegram от 21 апреля, что Биткойн, похоже, разделяет часть внимания золота в качестве хеджирования против макроэкономической неопределенности.

«Поскольку акции на прошлой неделе закончились в минусе и продлили апрельское сокращение, повествование о BTC как о безопасном убежище или хеджировании инфляции снова набирает обороты. Если эта динамика сохранится, это может обеспечить новый попутный ветер для институционального распределения BTC.

Тайлер Дерден

Фри, 04/25/2025 - 10:25