Приготовьтесь к еще одному серьезному пересмотру отрицательной заработной платы, снизив сентябрьскую ставку на 50 б/с

Почти ровно год назад постоянный поток BS, выходящий из BLS (Бюро трудовой статистики), наконец-то лопнул.

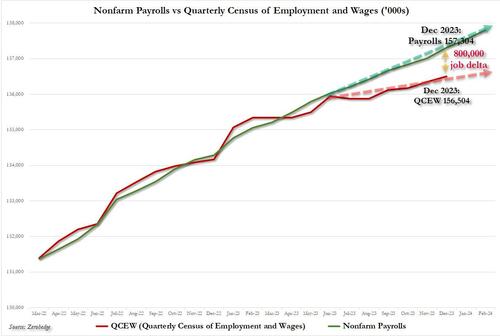

В течение многих лет ZeroHedge писал, что Бюро статистики труда Байдена массировало данные о рабочих местах, чтобы сделать экономику более сильной, чем она была, хотя бы для того, чтобы дать мертвой марионетке в Белом доме точки разговора, с помощью которых можно было бы заполнить бесчисленные неловкие молчания, хронически пересматривая данные каждого предыдущего месяца ниже, переоценивая текущий месяц (до пересмотра в сторону понижения в следующем месяце), используя каждый трюк, который можно себе представить, чтобы скрыть ухудшающуюся реальность: меньше рабочих мест на полный рабочий день, больше рабочих мест на неполный рабочий день, ошеломляющий разрыв между опросами истеблишмента и домохозяйств, хронические переоценки корректировок рождаемости и домашних хозяйств, щедрые повышения от сезонных корректировок, рекордные многочисленные владельцы рабочих мест, а также неместные (читай нелегальные иммигранты) работники. Все пришло в голову в марте 2024 года, когда мы сообщили, чтоФРС Филадельфии признает, что зарплаты в США завышены как минимум на 800 000 человек. "

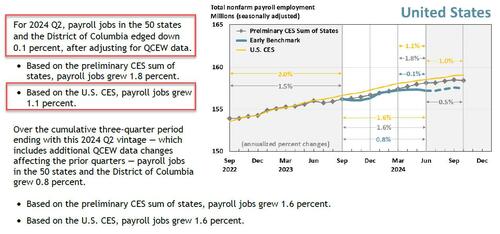

Как мы писали в то время, по оценкам гораздо более точной ежеквартальной переписи занятости и заработной платыКЛДЖ ДокладчикBLS завысила зарплаты на 800 000 до декабря 2023 года (и больше, если расширить серию данных до 2024 года). Это действительно статистически замечательно, как каждый раз ошибка данных в пользу более сильной, если поддельной, экономики.""

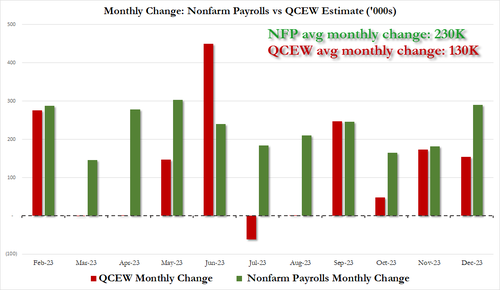

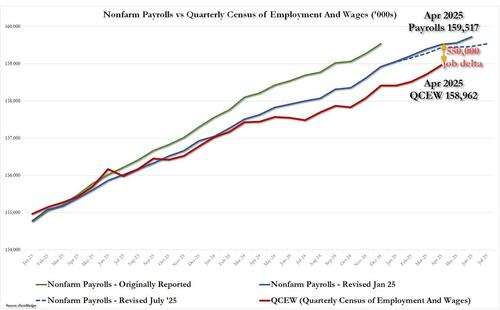

Анализ также показал, что в 2023 году среднемесячное увеличение заработной платы в 230 тысяч человек, которое Белый дом будет повторять снова и снова как прямое доказательство преимуществ биденомики, было далеко от звездного. Истинное среднемесячное увеличение заработной платы в 2023 году составило всего 130 тысяч! Полное ежемесячное изменение в заработной плате, как первоначально сообщалось BLS (зеленый) и фактическое ежемесячное число, в соответствии с QCEW (красный) показано ниже.

И хотя в отчете был небольшой, хотя и вокальный ответ, наиболее быстро они продолжили свою жизнь, перейдя от последнего обвинения в том, что BLS щедро исказила данные рынка труда.

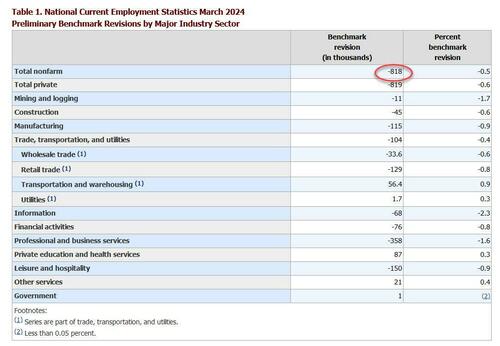

Но через пять месяцев все рухнуло, когда 21 августа BLS подтвердила все, что мы сказали, когда она представила в своем ежегодном объявлении CES Preliminary Benchmark Announcement, что Предварительная оценка пересмотра эталона указывает на корректировку к марту 2024 года общей занятости в несельскохозяйственном секторе -818 000 (-0,5%) Или чуть выше 800 000, как говорили, ожидалось в марте.

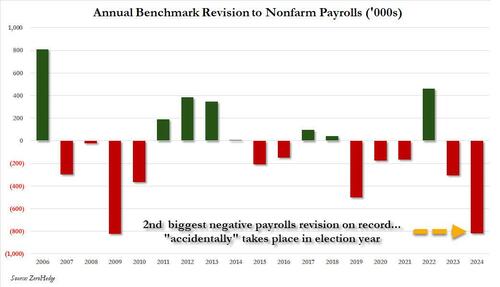

Насколько велика цифра в 818 тысяч? Как показано на рисунке ниже, Редакция 2024 года была самой большой за последнее десятилетие и второй по величине за всю историю, с только 824K нисходящей ревизией в 2009 году..

Что еще более важно, это помогло закрепить снижение ставки, которое последовало всего через 3 недели, когда 17 сентября Пауэлл потряс рынки, сократив не 25 б/с, как все ожидали, а колоссальные 50 б/с. Были различные объяснения шокирующе большого сокращения, и лучшее было сделано Майклом Каждым из Rabobank, который правильно назвал тот факт, что Пауэлл отчаянно подталкивал ниточки, чтобы получить Камалу избранным.

У Пауэлла был явный стимул для сокращения на 50 б. п. до дня выборов, потому что Трамп уже дал понять, что он не будет повторно назначать его председателем ФРС. На самом деле, он может решить удалить его преждевременно. Таким образом, единственный шанс Пауэлла на новый срок — это угодить Камале Харрис и ее коллегам-демократам в Сенате.

Но поскольку Пауэлл никогда не признает, что ФРС была политической организацией, он должен был придумать экономическое обоснование для этого шага, и именно это было почти рекордным пересмотром. Обратите внимание на этот обмен между репортером Economist Саймоном Рабиновичем и Джеромом Пауэллом во время пресс-конференции ФРС:

Саймон Рабинович. Спасибо, Стул Пауэлл. Симон Рабинович с The Экономист. Вы упомянули, как внимательно вы следите за рынком труда, но вы также отметили, что цифры заработной платы были немного менее надежными в последнее время из-за больших изменений в сторону понижения. Это в значительной степени влияет на уровень безработицы? И учитывая, что прогноз SEP в 4,4 процента в основном является пиком в цикле, будет ли это выше, что вызовет еще одно снижение на 50 базисных пунктов?

Чайр Поуэлл. Поэтому мы будем продолжать изучать широкий спектр данных о рынке труда, включая данные о заработной плате. Мы не отказываемся от них. Я имею в виду, мы, конечно, посмотрим на них, Но мы будем мысленно склоняться к их корректировке на основе корректировки QCEW, о которой вы упомянули.

Конечно, Пауэлл рассматривал почти рекордную корректировку QCEW всего за три недели до этого, если не по какой-либо другой причине, то для того, чтобы иметь предлог для первого снижения ставки после коллапса: снижение ставки, которое произойдет всего за два месяца до выборов и в то время, когда либеральный пропагандистский аппарат СМИ хвалил состояние экономики США и рынка труда всем, кто потрудился слушать.

Ну, Пауэллу придется еще раз прислушаться, потому что всего через десять дней экономика США столкнется с еще одним чудовищным негативным пересмотром рабочих мест. Тот, который, скорее всего, склонит чашу весов для еще одного снижения ставки на 50 б/с 17 сентября, когда консенсус по снижению ставки на 25 б/с уже в пакете.

Многие, возможно, пропустили его из-за ажиотажа вокруг президентского перехода и надвигающихся праздников, но 17 декабря ФРС Филадельфии снова ошеломила мировых экономистов, когда она раскрыла последнюю фабрикацию данных из BLS, когда сообщила, что во втором квартале 2024 года вместо 1,1% роста рабочих мест в США истинное изменение заработной платы в США фактически снизилось на 0,1%. Мы подробно описали эту находку в «Байден лгал обо всем: Филли Фед находит, что все рабочие места, «созданные» во 2-м квартале, были поддельными». "

Таким образом, учитывая это, совсем не трудно предвидеть, что последние данные ФРС Филадельфии выявят еще больше фальсификаций данных и манипуляций со стороны BLS и даже ниже. реальный Числа рабочих мест. Что, конечно, мы теперь знаем, было так... но впереди еще много чего.

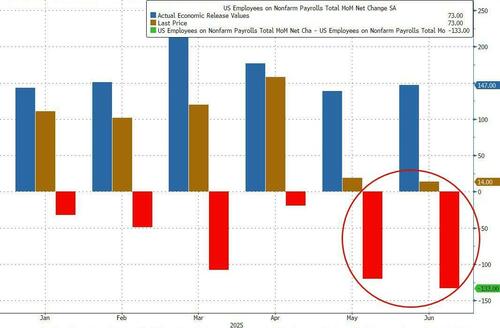

Во-первых, напомним, что в прошлом месяце произошло шокирующее событие, когда заработная плата за июль была не только намного ниже оценок, всего на 73 тыс., что является самым низким показателем с прошлого года, но настоящим шоком стали массовые ежемесячные пересмотры, которые сократили предыдущие два месяца почти на рекордную сумму:

- Май был пересмотрен вниз на 125 000, с +144 000 до +19 000,

- Июнь был пересмотрен на 133 000, с 147 000 до 14 000.

С этими изменениями занятость в мае и июне была на 258 000 меньше, чем сообщалось ранее, что, по мнению Голдмана, было одним из худших двухмесячных пересмотров в истории.

Кульминацией этого стал яростный Дональд Трамп, уволивший комиссара BLS — назначенного Байденом Эрику Макинтарфера — и назначивший скептика BLS, Э.Дж. Антони, главного экономиста Фонда наследия и того, кто часто переваривал и усиливал наши наблюдения и анализ рынка труда. Но это только начало.

9 сентября 2025 года Бюро статистики труда (BLS) опубликует свой предварительный ежегодный пересмотр эталона для несельскохозяйственных начислений заработной платы. Это будет значительным пересмотром предыдущих ежемесячных отчетов о занятости, поскольку он будет корректировать данные о заработной плате несельскохозяйственных предприятий с апреля 2024 года по март 2025 года. Это будет в этом году версия шокера от августа 2024 года, который, как отмечалось выше, стал триггером для Пауэлла, чтобы сделать гигантское снижение ставки.

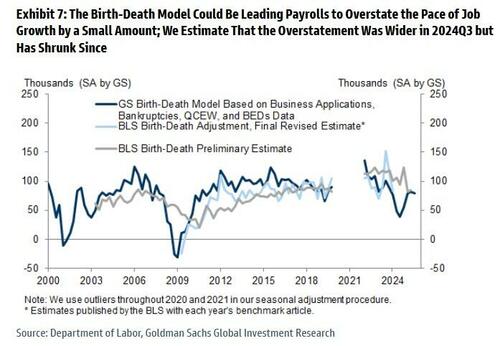

Проблема, как мы широко обсуждали в последние годы, заключается в том, что есть достаточное оправдание для еще одного масштабного негативного пересмотра, если не по какой-либо другой причине, кроме хронической переоценки BLS корректировок рождаемости и смерти, не говоря уже обо всем остальном, что Бюро предполагает, чтобы положить помаду на свинью рынка труда, только для того, чтобы спокойно пересмотреть все это. Но не верьте этому нашему слову.

В отчете, опубликованном 17 августа (доступном здесь для профессиональных подписчиков), экономист Goldman Дэвид Мерикл написал, что после шокирующе плохого июльского отчета о рабочих местах оценка банка о тренде роста рабочих мест «сейчас явно ниже даже этой низкой планки в 30 тыс. в месяц», но что более важно,Будущие изменения в росте занятости, скорее всего, будут отрицательными, потому что модель рождения-смерти, вероятно, слишком щедра, изменения в тренде роста заработной платы первоначально могут быть частично несопоставимы с изменениями сезонных факторов, изменения в необработанных данных о заработной плате, как правило, были отрицательными в прошлых замедлениях, данные ADP вызывают сомнения в официально зарегистрированном росте заработной платы в здравоохранении, и опрос домашних хозяйств теперь завышает рост иммиграции и занятости. "

Они звучат почти как мы. Из всего вышесказанного мы остановимся только на двух моментах, поднятых Гольдманом, начиная с корректировки «Рожденная смерть» — фальшивого фактора, который мы неоднократно пренебрежительно называли в последнее десятилетие хроническим источником переоценки истинной рабочей силы.

Почему 1 миллион рабочих мест будет тихо удален из заработной платы? Потому что, как отмечено ниже, 57% всех рабочих мест YTD являются статистическими подделками от адаптации к рождению/смерти, которые предполагают ту же новую динамику бизнеса, что и сразу после covid (что было в основном для облегчения мошенничества с ГЧП). https://t.co/YHvKRyYFds

— zerohedge (@zerohedge) 20 августа 2024 г.

В отдельном докладе, обсуждающем, как и почему BLS переоценивает рост заработной платы (доступный здесь для профессиональных субподрядчиков), Голдман объяснил, что «рост рабочих мест в опросе QCEW и истеблишмента может отличаться, потому что QCEW предлагает более полную картину чистого прироста рабочих мест от открытия и закрытия предприятий». Опрос истеблишмента не охватывает занятость в открывающих фирмах. В результате BLS исключает потери рабочих мест при закрытии фирм и приписывает чистое создание рабочих мест от открытия и закрытия бизнеса. "

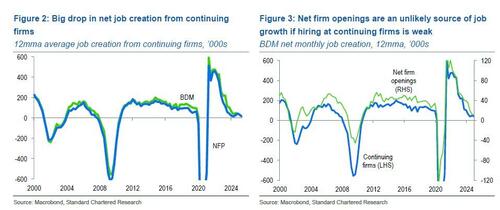

Чтобы проверить, может ли модель рождения-смерти привести к завышению прибыли от заработной платы, в следующем графике Goldman «обновить свою модель чистой прибыли от работы на основе данных о высокочастотном формировании бизнеса и банкротствах, а также подробных данных из программы динамики занятости в бизнесе». Модель Голдмана предполагает, что модель рождения-смерти, вероятно, завысила прирост заработной платы в 2024H2. и оправдал бы примерно 45 тыс./месяц крупного нисходящего пересмотра со стороны КСРВ — Но это завышение сократилось в последнее время, поскольку оценки рождаемости и смертности несколько снизились, а формирование чистого бизнеса стабилизировалось.

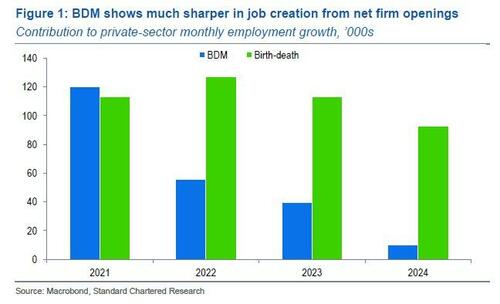

Почти идентичный анализ исходит от Стивена Инглэндера, главы FX-исследований в Standard Chartered, который согласен с тем, что рождение / смерть является непревзойденным фактором обмана, и недавно написал, что его лучшая оценка заключается в том, что Опубликованные данные NFP завышают реальный рост NFP примерно на 70 тыс. в месяц. ""Инвесторы и политики, которые принимают опубликованные цифры буквально, вероятно, вносят ястребиный уклон в ожидания денежно-кредитной политики. Мы считаем, что завышение NFP происходит из-за корректировки рождаемости и смертности BLS, которая основана на ауторегрессивной модели, заранее определенной в начале года (игнорируя последующие условия на рынке труда). Он также все больше расходится с точным количеством рабочих мест, созданных чистыми открытиями фирм. "

Еще более шокирующим является открытие Англичанина, что если взять опубликованные данные NFP буквально, С начала 2024 года продолжающиеся фирмы в частном секторе добавили только 25 тыс. рабочих мест в месяц. В то время как чистые открытия фирм добавили более 100 000 рабочих мест в месяц. Это противоречит данным Business Employment Dynamics (BDM), которые считаются золотым стандартом. Чистые открытия компаний составили около 20% от общего объема создания рабочих мест в 2024 году.. Более того, данные BDM показали гораздо более резкое падение, чем данные NFP, в рабочих местах, созданных чистыми открытиями фирм.

Данные BDM обеспечивают точный расчет создания рабочих мест с чистых вакансий фирмы. И они показывают падение в 2024 году до менее чем 20% от уровня 2022 года! Если при рождении смерть отражала одно и то же падение, NFP будет работать на 70 тыс. ниже ежемесячно (рисунок ниже). Англикан считает, что число NFP, опубликованное BLS, должно быть около 170 тыс., чтобы сохранить баланс на рынке труда. Это 170 тыс. рабочих мест включает 100 тыс. «реальных» рабочих мест (оценка базового равновесного роста, обусловленного демографией и иммиграцией) и 70 тыс. рабочих мест, которые отражают смещения в данных BLS.

Кроме того, данные BDM, показанные выше, повсеместно считаются более точными, хотя и отстающими (последние доступные данные на 2024 год). Они основаны на тех же административных данных, которые используются для получения данных ежеквартальной переписи занятости и заработной платы (QCEW), которые используются для бенчмарка NFP (и это то, что подсказало нам в прошлом году о предстоящем пересмотре в сторону понижения на 800 тысяч). Данные BDM не основаны на выборке; скорее, они представляют собой подсчет, основанный на всех платежах в систему страхования от безработицы. Если БДМ говорит, что создание рабочих мест из чистых вакансий фирм упало, это основано на подсчете занятости в фирмах, которые только начали платить в систему страхования от безработицы за вычетом тех, которые только что прекратили.

В любом случае, крайне вероятно, что эта тенденция сохранится и в 2025 году, поскольку данные BDM и NFP показали низкий уровень чистого создания рабочих мест продолжающимися фирмами в 2024 году, а данные NFP показывают, что это продолжается и в 2025 году (рисунок 2). Несмотря на то, что в марте 2024 года NFP была привязана к QCEW/BDM, данные показывают ту же слабость. Как отмечает Goldman, очень маловероятно, что открытие новых рабочих мест станет основным источником чистых новых рабочих мест, если с начала 2024 года продолжающиеся фирмы создавали в среднем только 25 тыс. рабочих мест в месяц. Создание рабочих мест на открытых предприятиях, как правило, тесно связано с созданием рабочих мест на постоянных предприятиях (рисунок 3).

Конечно, это не только модель смерти при рождении. Как подчеркнул Голдман, похоже, повторяя все, что мы говорили в последние годы, есть несколько других причин, по которым данные о рабочих местах, вероятно, намного хуже, чем первоначально сообщалось (любопытно, почему банк не сообщал об этих негативных факторах в то время, но только после драматических негативных изменений BLS в данных о рабочих местах, почти как если бы предвидеть их заключение). Среди них:

- Коллапс нелегальной иммиграции: По данным Goldman Sachs, ежемесячные незаконно Иммиграция. Банк считает, что безубыточный темп роста заработной платы сегодня составляет 80 тыс. в месяц и будет продолжать падать в ближайшие годы, поскольку эффект отставания от входа тех, кто пришел во время всплеска 2022-2024 годов, исчезает. Кроме того, сложности иммиграционного хаоса, оставленного администрацией Байдена, делают эту оценку гораздо более неопределенной, чем обычно. Какая доля иммигрантов, ожидающих слушаний о предоставлении убежища и разрешения на работу в любом случае, попадают ли те, кто это делает, в официальные данные о занятости, и в какой степени рейды на рабочих местах, потеря временного защищенного статуса и другие аспекты ужесточения иммиграционной политики в этом году делают работников-иммигрантов менее склонными к работе и быть захваченными в официальные данные, очень трудно понять.

- Сезонные корректировки: Алгоритм сезонной корректировки имеет тенденцию первоначально ошибочно относить часть изменения темпов роста заработной платы к изменению сезонных факторов. Когда данные за последующие месяцы подтверждают, что тенденция действительно замедлилась, алгоритм меняет это на сезонные факторы и правильно пересматривает рост заработной платы с учетом сезонных колебаний.

- Хронические отрицательные корректировки: Существует тенденция к тому, что необработанные (не скорректированные по сезонам) данные о заработной плате будут пересмотрены, поскольку дополнительная информация поступила в конце, когда экономика замедлилась в прошлом. Это происходило, например, в каждой рецессии, кроме одной с 1979 года, когда начинаются данные о составе пересмотров.

- ADP: Расходящиеся данные, представленные ADP, вызывают сомнения в официальных данных BLS о росте заработной платы в отрасли здравоохранения. Индустрия здравоохранения особенно важна на данный момент, потому что на нее приходится больше, чем весь рост заработной платы за последние три месяца. Разрыв BLS-ADP увеличился до более чем 100 тыс. рабочих мест в месяц, в то время как разрыв в данных в реальном времени был близок к 50 тыс. в предыдущие годы. Хотя цифры BLS более соответствуют тенденциям в расходах на здравоохранение, количество занятых в крупных медицинских компаниях и мнения наших аналитиков сектора здравоохранения показывают, что правда может быть где-то посередине.

- Домашнее обследование: Опрос домашних хозяйств в настоящее время, вероятно, завышает рост населения и, следовательно, рост занятости домашних хозяйств. Причина в том, что она использует оценку иммиграции, которая была разумной в начале года, но сейчас, вероятно, слишком высока, что является противоположностью проблемы прошлых лет, когда она недооценивала иммиграцию. Предполагаемый темп прироста населения может быть до миллиона в год слишком высоким, что будет означать, что рост занятости домашних хозяйств, который в этом году в среднем составлял 30 тыс. в месяц на основе эквивалента заработной платы, может быть завышен примерно на 50 тыс. в месяц.

Что приводит нас к последней оценке QCEW. Глядя на последние данные по пересмотру раннего бенчмарка ФРС и применяя тот же анализ к базовым данным Excel, которые мы сделали еще в марте 2024 года, когда мы правильно предсказали падение на 800 К, мы обнаружили, что еще один серьезный отрицательный пересмотр находится на рассмотрении.

На диаграмме ниже показаны три серии данных. Первая (в зеленом цвете) - это первоначально сообщенные данные о заработной плате, которые, однако, были резко пересмотрены еще в феврале для серии, заканчивающейся в декабре 2024 года, что привело к потере 610 тыс. рабочих мест из предварительно пересмотренных данных в пересмотренные данные о заработной плате. Голубая линия - это самые последние данные о заработной плате, в то время как пунктирная синяя линия показывает последние негативные изменения в месячных. Это, однако, не является всеобъемлющим пересмотром, который будет опубликован 9 сентября и который мы пытаемся оценить. Наконец, красная линия - это последние предварительные данные QCEW, представленные ФРС Филадельфии. Как и в прошлый раз, когда мы смотрели на него, он показывает, что BLS снова резко переоценивает данные о рабочих местах, и по мере сближения двух серий мы ожидаем, что BLS представит еще один драматический отрицательный пересмотр за десять дней. Когда 9 сентября Департамент труда объявит, что еще 550 000 рабочих мест никогда не существовало!

Сложив все это вместе, мы можем заключить, что рынок труда намного слабее, чем он был представлен, и, несмотря на недавние пересмотры - либо в рамках ежегодных оптовых, либо периодических месячных пересмотров - все еще есть существенный улов до истинных базовых данных, в основном в результате ошибочных предположений о рождении-смерти и гораздо меньшего количества нелегальных иммигрантов, поступающих на рынок труда. Попытка количественно оценить данные показывает, что надвигающийся отрицательный пересмотр составляет где-то между 40K в месяц (в рамках догоняющего QCEW) или целых 70K (по расчетам Standard Chartered), предполагая, что 9 сентября BLS пересмотрит «фактическое» число заработной платы ниже на 550K-800K.

Последствия огромны: как правильно сказал один из ведущих трейдеров Goldman, все, что имеет значение сейчас - после голубиного поворота Пауэлла на рабочие места - это не инфляция, а «платежные ведомости, которые будут диктовать темпы Пауэлла», и еще один массовый пересмотр в сторону понижения рабочих мест точно в то же время, что и в прошлом году, когда та же самая стрижка QCEW была процитирована Пауэллом в качестве предлога для его гигантского сокращения, заставит председателя ФРС провести аналогичное гигантское сокращение, как он сделал в сентябре прошлого года, хотя бы для того, чтобы подтвердить, что снижение ставки на 50 б/с в сентябре было не политическим, а обусловлено экономическими причинами.

И на случай, если председатель ФРС забудет, что поставлено на карту, его заменит Крис. Уоллер обязательно ему напомнит. Только вчера вечером Уоллер сказал, что «основываясь на имеющихся данных», он не «считает, что в сентябре требуется сокращение больше, чем [0,25 процентных пункта]», но он быстро добавил, что его мнение «Может измениться, если отчет о занятости за август, который должен выйти через неделю с завтрашнего дня, указывает на существенное ослабление экономики и инфляцию».

Излишне говорить, что еще один огромный негативный пересмотр рабочих мест, который, безусловно, является серьезным. не В данных под рукой - будет только показатель того, что экономика ослабевает достаточно, чтобы гарантировать не 25 б/с, а колоссальное снижение ставки на 50 базисных пунктов. Как и год назад, по словам бывшего босса Уоллера.

Гораздо больше в полных заметках от Goldman (здесь и здесь) и Standard Chartered (здесь), доступных для подлодок.

Тайлер Дерден

Туэ, 09/02/2025 - 06:35

![Nietypowa interwencja policjantów z drogówki. Uratowali rannego drapieżnika [zdjęcia]](https://storage.googleapis.com/intergol-pbem/nowaruda24/articles/image/a487f86c-b86a-4cd1-9d03-11d97df27ab3)