Впервые с момента обвала COVID задолженность по кредитным картам сокращается второй месяц

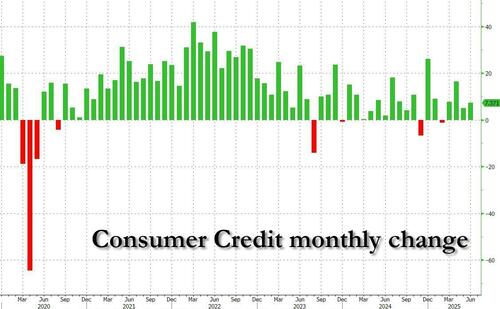

На первый взгляд, в сегодняшнем отчете о потребительском кредите не было никаких серьезных сюрпризов: после увеличения в прошлом месяце на 5,1 миллиарда долларов консенсус ожидал последовательного увеличения на 7,5 миллиарда долларов, и он получил почти то же самое: увеличение на 7,37 миллиарда долларов до 3,758 триллиона долларов по сравнению с 3,749 триллиона долларов в мае.

Однако при более внимательном рассмотрении компонентов обнаруживается что-то тревожное.

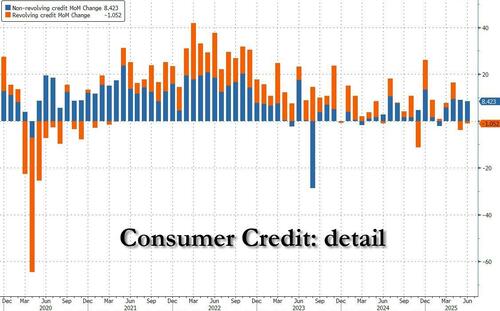

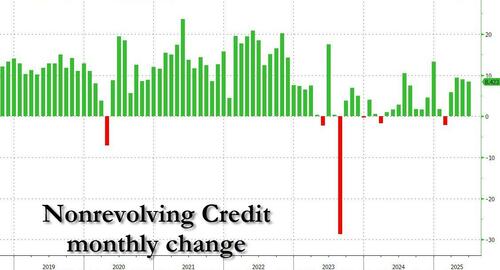

Скучный невозобновляемый кредит увеличился на 8,4 миллиарда долларов или более или менее в соответствии с тем, что он сделал в последние месяцы.

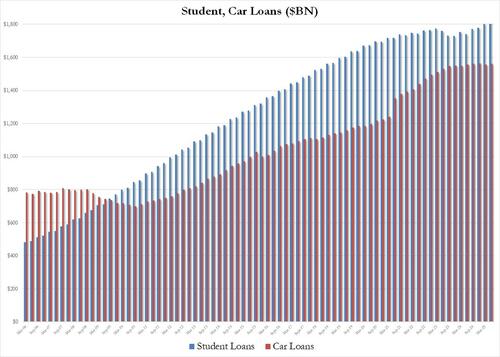

... Увеличение в 2-м квартале было обусловлено примерно равным вкладом в студенческие кредиты (+8,2 млрд) и автокредиты (+5,1).

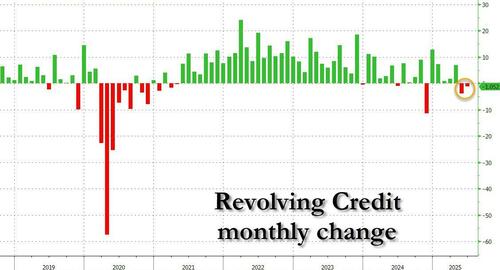

... Сюрприз заключался в размере оборотных кредитов, то есть задолженности по кредитным картам, которая в июне сократилась чуть более чем на 1 миллиард долларов, что стало вторым подряд ежемесячным падением в серии.

... Это очень важно, потому что это сделает его Впервые с момента экономического коллапса на пике кризиса.

Что вызывает вопрос: это причина — То есть экономика сейчас пострадает от резкого замедления, когда потребители явно свалятся вниз и перестанут это делать. заряжать - или эффект - экономика уже застопорилась, и это только следствие. Если это действительно так, то стоит ожидать драматического вниз Пересмотр всех недавних экономических данных, аналогичный тому, что мы видели на прошлой неделе с зарплатами, поскольку экономика США входит в свою новую планировку к рецессии.

Тайлер Дерден

Ту, 08/07/2025 - 16:40