Аукцион Stellar 20Y прервался из-за сильного внешнего спроса

После коллапса базовой торговли на прошлой неделе (который, как мы теперь знаем, уже претендовал на несколько мультистратных хедж-фондов с относительной стоимостью), многие опасались результатов сегодняшнего аукциона 20 лет, повторного открытия 19-летнего 10-месячного cusip UJ5. Оказалось, что им нечего бояться.

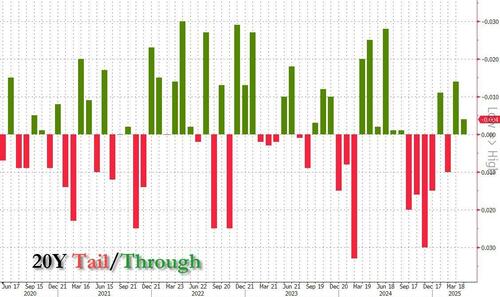

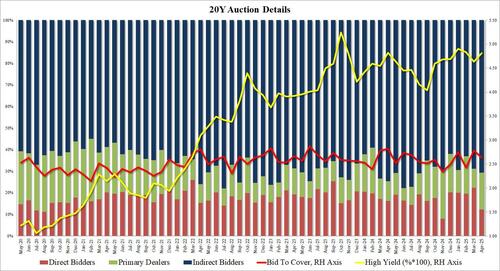

Аукцион стоимостью 13 миллиардов долларов по цене 1:01 вечера по восточному времени с высокой доходностью 4,810%, резко по сравнению с 4,632% в прошлом месяце и самым высоким с февраля; что более важно, он остановился на 4,814% на 0,4 фунта, второй подряд остановка (если частично слабее, чем в прошлом месяце) и 3-е место за последние 4 месяца.

Это был не только заголовок: ставка на обложку составила 2,63, что по сравнению с 2,78 в прошлом месяце было комфортно выше среднего показателя в 2,57.

Но, как и на прошлой неделе, за внутренними документами пристально следили, потому что в то время, когда практически не было прямого спроса на американскую бумагу (на фоне ослабления базовой торговли), состав сегодняшнего распределения изъятий, несомненно, был бы шумным. В конце концов, не было бы шума, потому что не было никаких сюрпризов: Косвенные продажи упали на приличные 70,7%, что является самым высоким показателем с августа и, естественно, выше среднего показателя по шести аукционам; Что касается Directs, в отличие от краха на прошлой неделе, сегодня они снизились на 12,3% - да, по-прежнему самый низкий показатель с ноября, но вряд ли однозначный показатель, как мы видели на прошлой неделе. Наконец, дилеры остались с 17,0%, что чуть выше среднего показателя в 15,3%, и в соответствии с недавними аукционами.

В целом, это был замечательный солидный аукцион 20 лет, который, безусловно, развеял опасения, что иностранцы бойкотируют аукционы Казначейства США. Что касается вторичного рынка, то это совсем другая история.

Тайлер Дерден

Свадьба, 04/16/2025 - 13:29

![Powrót tradycji w Rzeszowie. Oficjalne ślubowanie Straży Miejskiej [ZDJĘCIA]](https://storage.googleapis.com/bieszczady/rzeszow24/articles/image/57ce861d-7991-4c1e-b85e-ab83a2abaff4)