Трамп призвал страны присоединиться к торговой войне против Китая

Бенджамин Пиктон, старший рыночный стратег Rabobank

Центральные банки и государственные визиты

Предстоящая неделя становится своего рода водоразделом для рынков. FOMC, похоже, готов к первому снижению ставки второго президентства Трампа85 из 93 аналитиков, опрошенных Bloomberg, прогнозируют сокращение на 25 л.с. (включая RaboResearch), при этом 6 прогнозируют отсутствие изменений и 2 прогнозируют увеличение на 50 л.с.

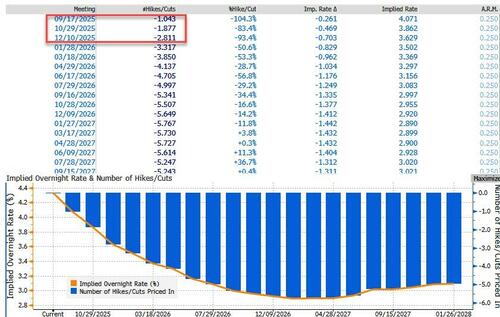

Фьючерсы OIS убеждены, что сокращение по крайней мере на 25 б/с является завершенной сделкой, несмотря на то, что основные показатели PCE и CPI значительно превышают целевой показатель ФРС в 2% на уровне 2,9% и 3,1% соответственно. Дельта в 26,1 б/с в настоящее время оценивается в подразумеваемую ставку ФРС после голубиного поворота от Джерома Пауэлла в Джексон-Хоуле, двух месяцев подряд ужасных цифр рабочих мест (которые FT сегодня закладывает у ног тарифов Трампа) и некоторых еще более ужасных изменений в ранее сообщенных доходах от занятости, которые, по-видимому, частично были вызваны моделью рождения-смерти BLS.

Постоянные читатели вспомнят, что Трамп, недовольный колебаниями уровня занятости, сенсационно уволил главу BLS Эрику Макинтарфер после того, как июльский отчет о заработной плате показал огромный пересмотр в сторону понижения на 258 000 человек.

Интрига встречи FOMC на этой неделе будет усилена Слушание в Сенате по утверждению помощника Трампа Стивена Мирана, которое запланировано на сегодня. Администрация настаивает на том, чтобы Миран была утверждена в качестве замены Адрианы Куглер, которая недавно покинула свою должность губернатора ФРС, до завтрашнего заседания FOMC. Нет никаких сомнений в том, что Миран присоединится к июльским диссидентам Боуману и Уоллеру в стремлении к снижению ставки.Может быть, даже 50-битный разрезЕсли его назначение будет подтверждено сегодня. Президент Трамп, безусловно, думает так, - сказал он журналистам в воскресенье. Он ожидает «большого сокращения» от FOMC на этой неделе..

Отдельно президент Трамп возобновил в воскресенье запрос на федеральный апелляционный суд, чтобы позволить ему уволить губернатора ФРС Лизу Кук до встречи FOMC на этой неделе. Bloomberg Economics перечисляет Кука среди самых голубиных управляющих ФРС на своем спектрометре, что, похоже, противоречит идее о том, что Трамп хочет сложить FOMC с голубями. Может ли быть так, что президент убежден, что решения управляющих ФРС о целесообразности денежно-кредитной политики не являются чисто технократическим процессом и на самом деле демонстрируют некоторые из них? Податливость зависит от того, кто оккупировал Белый дом? Смотрите здесь для нашего полного предварительного просмотра встречи FOMC на этой неделе.

На этой неделе ФРС не единственный центральный банк в действии. Банк Канады, Банк Англии, Norges Bank, Банк Японии и Центральный банк Бразилии соберутся для определения ставок. Ожидается, что BOC и Norges Bank сократят ставки на 25 млрд баррелей в сутки, в то время как BOJ, BOE и BCB сохранят ставки без изменений.

Банк Канады находится в аналогичном положении с ФРС, в результате чего курс его денежно-кредитной политики диктуется быстро ухудшающимся рынком труда, даже когда инфляционное давление остается неудобно повышенным. Как указывают здесь Молли Шварц и Кристиан Лоуренс, канадская экономика страдает от тарифных шоков через торговый канал, которым не помог экономический национализм, принятый бывшим премьер-министром Трюдо, когда он в начале этого года был на расстоянии одной ноги от двери. Все чаще Марк Карни, похоже, возвращается к подходу Трюдо с волосатой грудью в пользу стратегии «пойди, чтобы поладить» с южным соседом Канады.

Замедление Карни в борьбе с тарифами интересно в контексте предложений Дональда Трампа на прошлой неделе о том, что союзники по НАТО должны разместить тарифы 50-100% на Китай и Индию в качестве вторичных санкций. За продолжающиеся закупки российских энергоносителей. Неудобно, ЕС также продолжает закупать российские энергоносители, и ни один из лидеров стран НАТО не считает нужным поддержать план Трампа.

Однако, возможно, стоит помнить, что еще совсем недавно 5%-ный целевой показатель расходов, требуемый США от союзников по НАТО, считался нестартерным и невозможным при нынешних фискальных ограничениях.Пока этого не было. Также предполагалось, что ЕС не подпишет одностороннее торговое соглашение с США. Пока не сделалЮжная Корея не согласилась на 3,5% расходов на оборону. Пока не сделал. Мы видим здесь закономерность?

Трамп был прозрачным в своих усилиях загнать союзников в поддержку своей стратегии экономической и геополитической изоляции Китая. Хотя многие СМИ по-прежнему не обращают внимания на более широкую стратегию и продолжают видеть только хаос.

Канада досрочно ввела тарифы в размере 100% на китайские электромобили и 25% на китайскую сталь и алюминий, в то время как Мексика - в преддверии переговоров USMCA, запланированных на следующий год - объявила о тарифах до 50% на автомобили и другие продукты, произведенные в Китае и азиатских странах, подозреваемых в том, что они выступают в качестве посредников для перевалки Китая.. В октябре прошлого года ЕС ввел тарифы до 35% на китайские электромобили, а Южная Корея ввела пошлины в размере 38% на китайскую стальную плиту и 21% на нержавеющую сталь, а также взяла на себя обязательства предоставить свой опыт и капитал, чтобы помочь возродить судостроение США. Требования Трампа подталкивают союзников к дальнейшему протекционистскому пути, по которому они уже идут к общим тарифам против Китая.

Для дальнейших признаков того, что западные лидеры ходят по политическим требованиям США, посмотрите не дальше, чем на Австралию. Потратив месяцы на то, что Австралия будет вынуждена увеличить расходы на оборону в соответствии с требованиями США, ПМ Albanese недавно объявила об инвестициях в размере 1,7 млрд долларов в новый флот подводных летальных беспилотников, оснащенных ИИ, который будет построен американским производителем оружия Anduril. Вскоре после этого Альбанезе объявил о «невыплате» в размере 12 миллиардов долларов США за расширение судостроительных и ремонтных мощностей в Западной Австралии, где атомные подводные лодки класса «Вирджиния» и «Astute» будут базироваться на ротационной основе и проходить техническое обслуживание в соответствии с условиями соглашения AUKUS (даже если китайское исследование оборонной промышленности говорит, что ИИ может сделать «почти невозможным» для подводных лодок выжить в будущих морских боях), тем самым снижая давление на мощности собственных судостроительных и ремонтных объектов США. Опять же, мы ощущаем тенденцию?

Сам Трамп со вторника на этой неделе совершит государственный визит в Великобританию с Дженсеном Хуангом из NVIDIA и Сэмом Альтманом из OpenAI. FT сообщает, что премьер-министр Стармер сегодня объявит о новом соглашении между США и Великобританией по ядерной энергии, которое, по-видимому, включает соглашение между британской Centrica и американской X-Energy о строительстве передовых модульных реакторов в Хартлпуле, Англия. Другие сделки, касающиеся технологий, искусственного интеллекта и шотландского виски, также будут объявлены.

Конечно, энергия является вкладом во все производство, и огромное потребление электроэнергии центрами обработки данных, поддерживающими ИИ, требует наличия доступной энергии. Отчитываясь о партнерстве в ядерной энергетике, FT одновременно жалуется на то, что «Запад похоронен под бюрократией», поскольку застенчивые бюрократы лепят на регулировании и сложности, тем самым убивая конкуренцию, инновации и производительность, которые понадобятся для реализации «доступной» части «изобильной, доступной энергии». Торговые тарифы Трампа и различные национальные ответы на них указывают на то, что они являются еще одним источником сложности, с которым приходится сталкиваться западному бизнесу.

Возможно, общий внешний тариф упростит ситуацию?

Тайлер Дерден

Мон, 09/15/2025 - 13:45