Предыдущая статьяТысячи увольнений STMicro рядом с Gloom Outlook и Chip Slump

На следующий день после того, как STMicroelectronics, один из крупнейших производителей чипов в Европе, заявил, что 2024 год был одним из худших для отрасли и прогнозировал доход в первом квартале ниже оценок Bloomberg Consensus, компания, как сообщается, планирует сократить тысячи рабочих мест.

Bloomberg цитирует источники, близкие к франко-итальянскому производителю чипов, которые говорят, что около 6% рабочей силы могут быть сокращены из-за досрочного выхода на пенсию и истощения на фоне длительного спада в автомобильном и промышленном секторах.

Вот больше из отчета:

The Сокращение рабочих мест под обсуждениемкоторые могут быть объявлены уже в следующем месяце, находятся в диапазоне От 2 000 до 3 000 рабочих повлияют на работу компании в Италии и Франции.По словам людей, которые просили не называть их имена, потому что информация не является общедоступной. Решение не является окончательным, и масштабы сокращений все еще находятся на рассмотрении.

Итальянское правительство, которое вместе с Францией владеет 27,5% акций компании, Стремление ограничить воздействие «Реструктуризация итальянской рабочей силы», — сказал он.

Представитель STMicro подтвердил СМИ, что впереди реструктуризация рабочей силы:

""В ближайшие неделиМы начнем конструктивный диалог с представителями сотрудников вокруг. Окончание программ поддержки карьеры, построенные на добровольной основе, включая досрочный выход на пенсию. "

В четверг генеральный директор Жан-Марк Чери сказал аналитикам, что обеспечить основу для годового руководства будет сложно из-за плохой видимости и повышенной коррекции запасов среди клиентов. Мы считаем справедливым рассматривать Q1 как низкую точку 2025 года. "

Александр Дюваль из Goldman, Джеймс Сондерс и Анант Джахар сегодня утром предоставили клиентам ключевые выводы из отчета о доходах STMicro:

STM ожидает значимого субсезонного роста в 1Q25 с ограниченной видимостью сроков восстановления.

Доходы компании в автомобильной промышленности сталкиваются с несколькими препятствиями в 2025 году, включая специфические факторы компании / клиента, при этом продажи, вероятно, сократятся.

Спрос на рынке полуфабрикатов остается мягким, а избыточные запасы каналов по-прежнему являются препятствием для любого потенциального восстановления продаж.

Мы сохраняем осторожность в отношении краткосрочной валовой прибыли, учитывая высокие расходы на разгрузку и постоянный избыток запасов. Оставайтесь нейтральными.

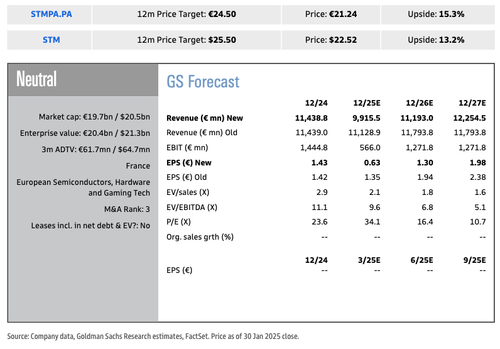

Аналитики были «нейтральными», оцененными на STMicro с их 12-месячными ценовыми ориентирами в 24,5 евро / ADR 25,5 долларов США (против 27 евро / ADR 28,5 долларов США ранее) на основе 6x CY26 (прокат вперед против 6x 2HCY25E + 1HCY26E ранее) EV / EBITDA.

Скользкий склон...

STMicro также сообщила аналитикам, что некоторые производственные мощности, сборочные и испытательные заводы будут простаивать в ближайшие дни.

"" У нас также есть план временного закрытия многих наших заводов в этом квартале. «Мы ожидаем, что во 2-м квартале у нас будет значительная сумма с точки зрения разгрузки», - сказал финансовый директор Лоренцо Гранди.

Конкуренты, такие как Texas Instruments, также предоставили инвесторам прогнозируемую прибыль в первом квартале ниже оценок Bloomberg Consensus, ссылаясь на вялый спрос и более высокие производственные затраты.

Между тем, компании по производству чипов для центров обработки данных были поддержаны инфраструктурным проектом Stargate AI и надежными прогнозами расходов Capex от компаний Mag7.

Однако новые модели ИИ DeepSeek, представленные в начале недели, ставят под сомнение все расходы Capex.

Тайлер Дерден

Фри, 01/31/2025 - 09:00