These Are The Best US Cities To Flip Houses In 2025

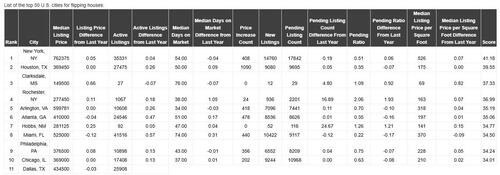

For those looking to flip houses in the upcoming year, a recent ViewHomes Team study analyzed U.S. cities based on prices, demand, market activity, and inventory to guide investors.

House flipping continues to be a profitable venture, but location remains the key to success. A recent study identified the top U.S. cities for investors looking to maximize returns in 2025, balancing affordability, demand, and market stability.

New York City takes the top spot despite its high median listing price of $762,375. The city’s relentless demand, with over 35,000 active listings and 408 price increases, ensures a steady stream of buyers eager for renovated homes.

Similarly, Houston, Texas, offers strong opportunities with over 27,000 active listings and a median price of $369,450. The city’s steady price trends and high pending listings indicate a consistent demand for flipped properties.

For those seeking a more affordable entry into house flipping, Clarksdale, Mississippi, presents a compelling option, the recent study by ViewHomes Team revealed. With a median listing price of just $149,500, it offers budget-conscious investors a chance to profit from a growing market.

Meanwhile, Rochester, New York, provides a stable and predictable environment for flippers, boasting a median price of $277,450, over 1,000 active listings, and slight but steady price growth.

Arlington, Virginia, stands out for its fast turnaround time, with homes spending a median of just 34 days on the market. With a median listing price of $599,781 and over 10,600 active listings, flippers can expect quick sales and solid returns. Atlanta, Georgia, continues to attract investors with its blend of affordability and strong buyer interest. Though the median listing price is $410,000, the city maintains steady demand, as reflected in its 8,626 pending listings.

Hobbs, New Mexico, is an emerging market with relatively low competition but strong demand. With only 92 active listings and a median price of $281,125, the city’s increasing price per square foot makes it a promising option for flippers looking for a less crowded market.

Meanwhile, Miami, Florida, remains a competitive but profitable market with over 41,500 active listings and one of the highest price-per-square-foot rates ($370). Despite a slight price decline, its median listing price of $525,000 and continued buyer demand make it a hotspot for investors.

The study revealed that Philadelphia, Pennsylvania, offers a balanced mix of affordability and opportunity, with a median listing price of $376,500 and over 10,800 active listings. The city’s steady growth and strong pending ratio (0.75%) indicate consistent buyer interest.

Lastly, Chicago, Illinois, rounds out the top markets with 17,400 active listings and a median price of $369,000. With a stable market and strong buyer engagement, Chicago presents opportunities for investors at all experience levels.

These cities provide a diverse range of flipping opportunities, from high-end urban markets to affordable, emerging areas. Whether seeking quick turnarounds or long-term stability, house flippers in 2025 have promising options to explore.

“These findings highlight the crucial role location plays in the success of house flipping. While renovating a property is important, the ultimate profitability hinges on finding the right market, one with strong demand, quick turnover, and a pool of eager buyers,” said Liam Cope, a real estate broker from ViewHomes Team.

„New York City, with its high demand and strong buyer interest, clearly stands out as a prime location for investors. However, what’s really exciting is the variety of cities that offer great opportunities. From affordable options like Clarksdale, Mississippi, to bustling markets like Miami and Chicago, house flippers now have a wide range of choices depending on their investment strategy and budget,” he continued.

„Whether you’re looking for a competitive, high-demand market or a smaller, more affordable one with growth potential, these cities provide ample opportunities to maximize your return on investment. It’s clear that the market is evolving, and for investors willing to do their research and think strategically, the rewards are there for the taking.”

Tyler Durden

Wed, 01/29/2025 – 23:00