Супертанкеры развернулись в Ормузе в качестве мировых брекетов для иранской реакции

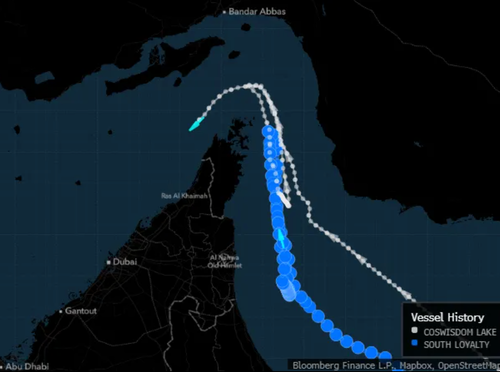

Два супертанкера — «Озеро мудрости» и «Южная лояльность» — каждый из них способен нести 2 миллиона баррелей сырой нефти, резко изменив курс в Ормузском проливе в минувшие выходные после того, как американский бомбардировщик-невидимка нанес удар по ядерным объектам Ирана.

Озеро Косвиздом и южная лояльность вошли в водный путь и резко изменили курс в воскресенье, согласно данным отслеживания судов, собранным Bloomberg. Первый из двух носителей затем сделал второй разворот и теперь возвращается через Ормуз. Другой остается за пределами Персидского залива, согласно его сигналам в понедельник. - Блумберг

В воскресенье иранское государственное издание Телеканал Press TV процитировал генерал-майора Коусари, старшего члена Комиссии по национальной безопасности парламента Ирана, который заявил:

Парламент пришел к выводу, что Ормузский пролив должен быть закрыт, но окончательное решение в этом отношении лежит на Высшем совете национальной безопасности."

Аналитики RBC Capital Markets во главе с Хелимой Крофт считают, что Ирану не нужно закрывать критическую морскую точку остановки, чтобы нарушить глобальный транспорт нефти. Вместо этого Тегеран может использовать целенаправленные удары по отдельным танкерам или ключевой инфраструктуре, такой как порт Фуджейра, для дестабилизации жизненно важного водного пути.

Крофт и ее команда отмечают:

Иран мог бы уже нанести серьезный ущерб, но не нанес, предполагая стратегическую сдержанность.

Даже ограниченные действия могут побудить грузоотправителей избегать этого региона, особенно в нынешних условиях высокого риска.

Если руководство Ирана почувствует угрозу своему выживанию, оно может мобилизовать союзные группировки в Ираке и Йемене, что еще больше усилит угрозы региональным энергетическим активам.

РБК предупреждает, что для оценки истинного ответа Тегерана могут потребоваться дни или недели, и предостерегает от предположения, что опасность миновала.

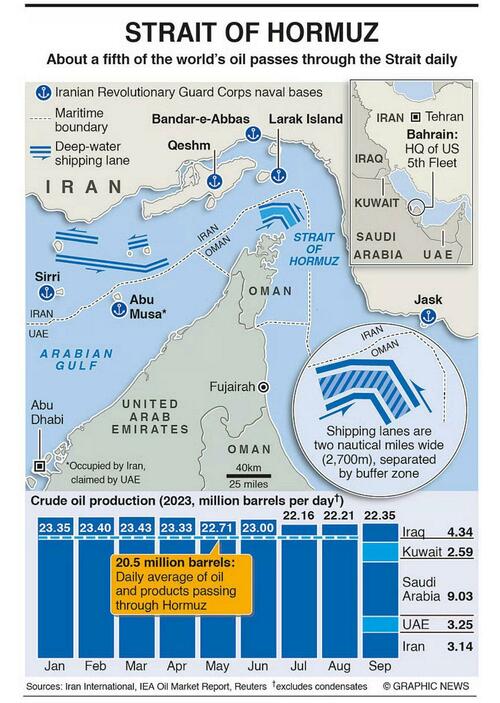

В одночасье фьючерсы на нефть марки Brent резко изменились — теперь они торгуются около закрытия пятницы и упали на 6% или около того от внутридневных максимумов. UBS Исследование предупредило, что реальный риск левохвоста остается закрытием Ормузского пролива, что вызовет срыв, превышающий шок от поставок в России в 2022 году, и может привести к росту цен выше 120 долларов.

Другие критические исследования по сценариям Ормуз:

Нефть может поразить $130 в худшем случае - JPMorgan

Что будет дальше с нефтью: банки считают, что нефть подскочила до 120 долларов, а худшие прогнозы выросли до 17%

150 долларов за нефть? Goldman Sachs рассказал, как рынки будут реагировать на эскалацию в Иране

Morgan Stanley: три сценария развития нефтяной отрасли

Асимметричный ответ Ирана возможен. «Ограниченный, но эффективный (частичный сбой в Ормузском/Красном море правдоподобен, хотя полное закрытие маловероятно)», — отметил аналитик Goldman Джулио Эспозито.

Имейте в виду, что любое частичное или полное закрытие Ормузского пролива повлияет на азиатских импортеров, таких как Китай, Индия, Япония, Южная Корея и Сингапур, а также на некоторые части Европы. США сравнительно менее подвержены риску из-за добычи сланца и стратегического нефтяного резерва. Реальный вопрос заключается в том, позволит ли Азия Тегерану закрыть водный путь?

Тайлер Дерден

Мон, 06/23/2025 - 06:55

![Kradzież portfela na dworcu PKP. Monitoring nagrał złodzieja, a zatrzymali go policjanci [WIDEO]](https://static2.kk24.pl/data/articles/xga-4x3-kradziez-portfela-na-dworcu-pkp-monitoring-nagral-zlodzieja-a-zatrzymali-go-policjanci-wideo-1758192946.jpg)