Спотовые биткойн-ETF видят сильный спрос; вершины крипторынка 4 триллиона долларов, когда генерал-майор отключает золото

Спотовые биржевые фонды Bitcoin (ETF) на этой неделе показали высокий спрос. Зафиксировать приток более 1,7 млрд долларов до закрытия торговой недели в пятницу.

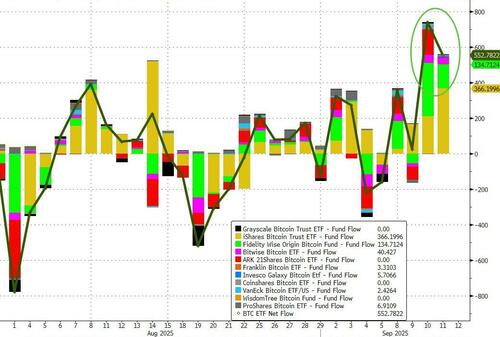

Данные SoSoValue показали, что у ETF была сильная неделя, а в среду приток составил почти 800 миллионов долларов. По состоянию на четверг трекер ETF показал, что на этой неделе чистый приток биткоин-ETF уже составил 1,7 миллиарда долларов.

Как сообщает Ezra Reguerra через CoinTelegraph.com, Высокая производительность знаменует собой самый большой еженедельный показатель ETF за почти два месяца, что свидетельствует о восстановлении доверия к классу активов.

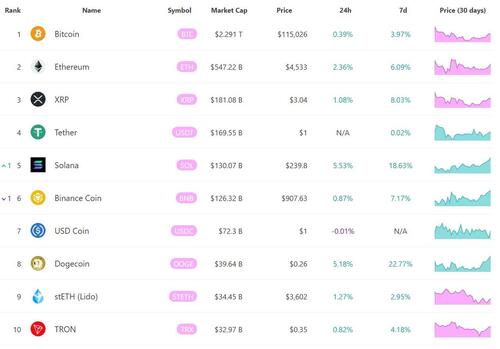

Сильный приток ETF произошел, когда биткойн поднялся до $115 000, что на 4,5% больше, чем его цена в $110 000 в прошлую пятницу.

Спот Bitcoin Ежедневные данные о чистом притоке ETF. Источник: SoSoValue

ETF Spot Ether оправились от почти 800 миллионов долларов оттока

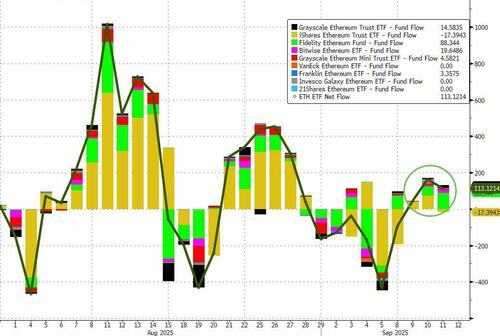

У ETF Spot Ether также была сильная неделя, с учетом чистого притока более 230 миллионов долларов по состоянию на четверг. Это резкое восстановление класса активов после почти 800 миллионов долларов оттока на прошлой неделе.

Пока ЭТО ETF восстановились, а держатель корпоративного казначейства BitMine продолжил наращивать покупки эфира на этой неделе. В понедельник BitMine приобрела 202 500 ETH, что привело к 2 миллионам ETH. Компания сделала следующую покупку в среду, купив у Bitgo 200 миллионов долларов в ETH.

Данные с сайта Strategic ETH Reserve показывают, что BitMine в настоящее время владеет более чем 2 миллионами ETH на сумму 9,3 миллиарда долларов на момент написания статьи.

Трекер данных ETH также показывает, что в общей сложности резервные компании ETH владеют почти 5 миллионами ETH на сумму около 22,1 миллиарда долларов.

Между тем, эмитенты ETF владеют 6,6 миллионами ETH на сумму около 30 миллиардов долларов для поддержки активов. Это означает, что почти 12 миллионов ETH, почти 10% циркулирующего предложения находятся в распоряжении учреждений.

CZ сравнил рыночную капитализацию криптовалют с Nvidia

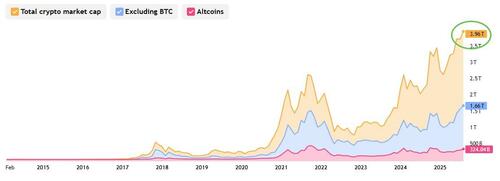

Более широкий крипторынок также перевалил за $4,1 трлн на этой неделе, уровень, ранее достигнутый в июле и августе.

Соучредитель Binance Чанпэн Чжао подчеркнул веху на X, сравнив совокупную стоимость всего криптопространства с Nvidia, которая составляет примерно 4,3 триллиона долларов, согласно 8marketcap.

«Объединенная рыночная капитализация всех будущих денег составляет менее одной рыночной капитализации чиповой компании. Ты делаешь математику, Чжао написал.

Действительно, как пишет Дариус Мухтарзаде, научный стратег в 21Shares, Поколение Альфа будет расти с Биткойном как культурным и финансовым родным, что делает его их хранилищем ценности по умолчанию по сравнению с традиционными инвестициями в золото.

Золото долгое время считалось основным средством сбережения — блестящим, дефицитным и проверенным временем.

Однако для поколения Альфа, первого поколения, действительно рожденного в цифровом мире, этот блеск уже начинает исчезать.

Вместо этого они вырастут с совершенно другим базовым уровнем ценности, как она движется и где живет. На самом деле, Биткойн будет не просто инвестиционным вариантом, он станет дефолтом для этого поколения.

Рожденный в цифровом мире

В отличие от предыдущих поколений, Gen Alpha не считает биткоин чем-то новым или революционным. Они унаследуют мир, в котором Биткойн всегда существовал, присутствует в финансовых приложениях, обсуждается в классах и встроен в цифровые платформы. Для них это не будет рискованным или радикальным. Это будет нормально.

С первого дня их ценный опыт будет цифровым. Физические деньги будут редкими, так как большинство платежей будут безналичными. Они узнают о дефиците через игровые токены и экономику в приложении, а не золотые монеты в ящике. В этом контексте Биткойн не будет казаться экзотическим, он будет частью повседневной жизни. Напротив, золото будет восприниматься как экзотика генералом Альфа как желтый камень с исторической ценностью.

Биткоин стал доступнее, чем золото когда-либо

Золото - это тяжело. Вы должны купить его у надежного дилера и хранить его физически, чтобы иметь полный контроль. Биткойн, с другой стороны, находится на расстоянии нескольких кранов. Благодаря уже существующим финтех-приложениям и образовательным инструментам для детей Gen Alpha может получить доступ к биткоину, прежде чем они поймут, как работает сберегательный счет.

Доступ будет бесшовным через игры с поддержкой криптографии, награды за лояльность или приложения. Барьеры, которые когда-то заставляли биткоин чувствовать себя техническим или недоступным, быстро исчезают.

Доверие будет заслужено, а не принято

Там, где старшие поколения постепенно теряли веру в институты, поколение Альфа начинало с глубокого скептицизма. Они растут в эпоху экономической неопределенности, институционального недоверия и алгоритмической информации. Для них «доверие» не будет предоставлено правительствам или банкам по умолчанию; оно должно быть заработано через прозрачность.

Биткойн, по дизайну, соответствует этому мировоззрению. Это открытый исходный код, проверяемый и децентрализованный. Он не требует доверия, он позволяет проверять. В мире, где мантра «не доверяй, проверяй», ген Альфа естественным образом тяготеет к системам, которые не требуют веры в посредников.

Биткоин станет культурно родным

Биткоин больше не просто актив, это часть поп-культуры. Для генерала Альфа это культурное знакомство только углубится. Они столкнутся с Биткойном через финансовые приложения, влиятельных лиц, создателей, игры и даже школьные программы.

Так же, как социальные сети были второй натурой для поколения Z, цифровые активы будут встроены в онлайн-идентификацию Gen Alpha. Постоянное воздействие мемов, брендов и основных платформ сделает биткоин более культурно значимым, чем золото, которому не хватает цифрового присутствия.

Bitcoin можно программировать

Золото физическое, тяжелое и инертное. Он сидит в хранилищах. Тяжело двигаться и труднее использовать. Биткойн — это противоположность. Она программируема, не имеет границ, делима и интегрирована в более широкий мир децентрализованных финансов.

По мере того, как поколение Альфа растет, ожидая, что цифровые системы будут гибкими и отзывчивыми, динамичная природа Биткойна будет функцией, а не бонусом. Это просто соответствует миру, в котором они будут строить и жить.

Поколение, которое не нуждается в убедительности

Каждое поколение меняет облик финансовой системы. Миллениалы флиртовали с биткоином. Поколение Z нормализовало это. Альфы не нужно убеждать.

Они не будут рассматривать биткоин как альтернативу старой системе. Они будут рассматривать его как часть системы. Не из-за идеологии, а из-за знакомства, удобства использования и культурной значимости.

У золота был свой момент. Биткоин только начинается. Генерал Альфа вырастет с ним в кошельках, а не в хранилище.

Тайлер Дерден

Фри, 09/12/2025 - 14:25