Нефть выросла после того, как США объявили о новых санкциях, цементируя энергетику как лучший сектор 2025 года

Как это часто бывает, так же, как Уолл-стрит отказалась от нефти, она растет.

WTI подскочила до 3-дневного максимума и была в темпе, чтобы достичь самой высокой цены с начала месяца, после того, как США объявили о санкциях против китайских частных и нефтяных танкеров, которые поддерживают экспорт нефти Ирана.

В частности, Управление по контролю за иностранными активами Казначейства (OFAC) назначило китайский нефтеперерабатывающий завод «чайпот» и его генерального директора для покупки и переработки иранской сырой нефти на сотни миллионов долларов, в том числе с судов, связанных с иностранной террористической организацией, «Ансараллой» (обычно известной как хуситы) и иранским министерством обороны логистики вооруженных сил (MODAFL).

«Закупки нефтеперерабатывающих заводов в Иране обеспечивают основной экономический спасательный круг для иранского режима, ведущего государственного спонсора терроризма в мире», - сказал министр финансов Скотт Бессент. Соединенные Штаты привержены прекращению потоков доходов, которые позволяют Тегерану продолжать финансирование терроризма и развивать свою ядерную программу. "

OFAC также ввел санкции в отношении 19 предприятий и судов, ответственных за доставку миллионов баррелей иранской нефти, включая часть иранского «теневого флота» танкеров, поставляющих нефтеперерабатывающие заводы, такие как Luqing Petrochemical.

Новость подняла WTI на 2% до самого высокого уровня за 2 дня и просто стесняется самого высокого ценового показателя в марте.

В качестве предостережения и как отметил собственный эксперт Bloomberg по энергетике Хавьер Блас, США в прошлом санкционировали крупных китайских нефтяных трейдеров, которые были в значительной степени вовлечены в ирано-китайский бизнес (например, Zhuhai Zhenrong Company). Возможно, на этот раз все будет по-другому.

Обратите внимание, что США Казначейство в прошлом санкционировало крупного китайского нефтяного трейдера, который активно участвовал в ирано-китайском бизнесе (Zhuhai Zhenrong Company Ltd.) с небольшим влиянием.

— Javier Blas (@JavierBlas) 20 марта 2025 г.

Сегодняшний скачок цен на нефть только сделает счастливых инвесторов в энергетику еще счастливее.

Как отмечает Bloomberg, трейдеры прикрывают производителей нефти и газа по мере роста инфляционных опасений, возвращая группу на вершину списка лидеров S&P 500 после того, как она сильно отставала в последние два года. Одна из причин: как мы неоднократно отмечали, энергетические запасы являются обычным коротким шагом к «длинной технологической» паре. Таким образом, в любое время технические имена скользят, энергия отскакивает и наоборот.

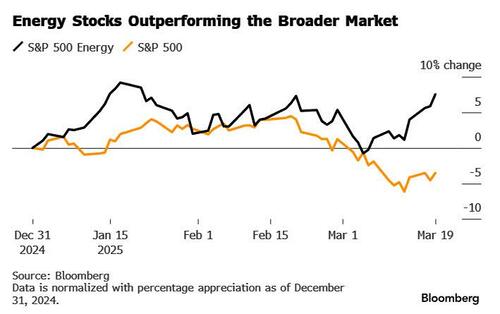

В этом году цена на нефть может снизиться примерно на 6%. Но энергетические акции в настоящее время являются наиболее эффективными из 11 секторов в бенчмарке акций.. Группа выросла почти на 8% в 2025 году на фоне широкого падения рынка почти на 4%.

Последний раз сектор возглавлял S&P 500 в течение всего года в 2022 году, когда вторжение России на Украину привело к резкому росту цен на нефть выше 100 долларов за баррель. В среду эта цена составляла около $67. В 2024 году сектор упал, набрав около 2%, поскольку общий рынок взлетел более чем на 20%, чему способствовали акции технологических компаний.

По данным Bloomberg, сохраняющееся беспокойство по поводу инфляции, поддерживающая администрация (Трамп встретился с руководителями нефтяных компаний в среду), а также усиление геополитической напряженности подпитывают силу акций. С ростом долгосрочных инфляционных ожиданий привлекательность сектора хеджирования является ключевой для инвесторов, стремящихся оградить свои портфели от риска роста ценового давления.

Саймону Лаку (Simon Lack), портфельному менеджеру Фонда энергетической инфраструктуры Catalyst, это только начало.

"Энергетика будет превосходитьОн добавил, что сектор остается недооцененным даже после недавнего подъема. Белый дом действительно любит энергию США и хочет, чтобы мы экспортировали больше. "

Несмотря на растущие опасения инфляции и, что еще хуже, стагфляции, инвесторы вкладывают деньги в энергетические акции, что имеет смысл: энергетика, как правило, является наиболее эффективным сектором в периоды экономической стагфляции.

Клиенты Bank of America вложили в энергетику больше, чем любой другой сектор, поскольку индекс S&P 500 на прошлой неделе пошел на поправку. Институты были крупными покупателями, поскольку когорта зафиксировала самый большой приток со времен кризиса в Кремниевой долине.

Безусловно, существует множество потенциальных проблем для ралли сектора, в том числе от Трампа. По словам Эрика Натталла, портфельного менеджера Ninepoint Partners, энергетика сталкивается с «барьером неопределенности», включая мантру администрации о поиске более низких цен на нефть и потенциале увеличения поставок российской нефти на рынок в случае прекращения огня на Украине.

С другой стороны, энергетика остается одним из самых дешевых секторов на рынке, и из-за неустойчивых показателей быстрорастущих технологических акций инвесторы ищут ценность. Вот почему после того, как Уолл-стрит обрушилась на сектор в течение большей части 2024 года, она снова стала более позитивной. По данным Barclays Plc, в прошлом году в секторе произошли отрицательные изменения доходов, но теперь он получает обновления в то время, когда другие сегменты S&P 500 подвергаются понижениям.

«Энергетика долгое время была нелюбимой», — говорит Лак из Catalyst Energy Infrastructure. Сектор также ожидает двузначный рост прибыли в третьем квартале и опережающий рост прибыли на 20% в течение следующих трех месяцев, согласно прогнозам аналитиков.

Тайлер Дерден

Thu, 03/20/2025 - 12:00