Lucid присоединяется к альянсу Robotaxi с Uber и Nuro

Американская гонка роботакси вступает в новую фазу, приближаясь все ближе к точке перегиба гипермасштабирования. С быстрым расширением Waymo в городах США и запуском парка роботов Tesla в Остине, штат Техас, в июне этого года, импульс набирает обороты. Теперь появляется новый альянс — Uber Technologies, производитель электромобилей Lucid Group и стартап Nuro — готовящийся выйти на рынок роботакси с «премиальной глобальной программой роботакси следующего поколения», которую планируется запустить в крупном городе США во второй половине 2026 года.

В пресс-релизе Lucid говорится, что Uber запустит программу роботакси в конце следующего года, развернув 20 000 автомобилей Lucid Gravity, оснащенных системой автономии Nuro Driver Level 4.

""Uber планирует за шесть лет развернуть более 20 000 автомобилей Lucid, оснащенных Nuro Driver. Автомобили будут принадлежать и эксплуатироваться Uber или его сторонними партнерами по автопарку и будут доступны для водителей исключительно через платформу Uber.«Беспокойный производитель электромобилей заявил».

Компания планирует инвестировать несколько сотен миллионов долларов как в Lucid, так и в Nuro. Обязательство в 300 миллионов долларов для Lucid. Часть этого финансирования будет направлена на модернизацию сборочной линии Lucid для интеграции автономного оборудования Nuro в внедорожники Gravity.

Люсид отметил:Первый прототип роботакси Lucid-Nuro уже работает автономно на закрытой трассе на полигоне Нуро в Лас-Вегасе."

На рынках акции Lucid Подскочил на 62% в премаркете в Нью-Йорке. По состоянию на конец среды акции упали на 24% по сравнению с годом. Акции по-прежнему сильно сокращены - около 32% акций, или примерно 395 миллионов акций, продаются короткими, с соотношением дней к покрытию около 2,9 - оставляя место для покупки. потенциальное сжатие во время кассовой сессии. С пика мании эпохи Ковида в 2021 году акции упали на 95% от своих максимумов.

В последние годы Lucid столкнулась с постоянными проблемами, отражая более широкую борьбу в отрасли электромобилей на фоне продолжительной ценовой войны и снижения спроса. Возможный отказ от федеральных налоговых льгот на электромобили при администрации президента Трампа может усилить давление, создав дополнительные препятствия для производителей, уже сталкивающихся с проблемами рентабельности.

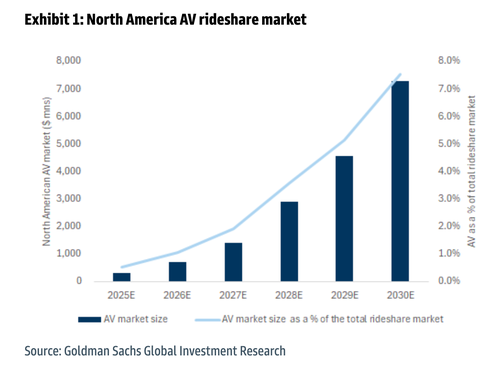

Недавняя записка Goldman предполагает, что рынок роботакси в США готов к значительному росту в течение следующего десятилетия. Доклад предлагает ценную информацию, обеспечивая основу для понимания того, куда отрасль движется до 2030 года. Читайте записку здесь...

И начинается гонка роботов. Далее следуют грузовики...

Тайлер Дерден

Thu, 07/17/2025 - 09:25

![W sklepach nowość. Ziemniaki o wymiarze 20-28 mm (jak orzech). Według rządu jadalne. Do tej pory odpad. Jak się obierze pestka czereśni. Zebrane przed osiągnięciem pełnej dojrzałości, o skórce łuszczącej się [projekt rozporządzenia]](https://g.infor.pl/p/_files/38870000/ziemniaki-38869625.png)

![Fałszywe inwestycje, podejrzane linki. Eksperci o cyberzagrożeniach [ZDJĘCIA]](https://radio.lublin.pl/wp-content/uploads/2025/10/EAttachments901854881425cd116a7e9dd047269be8046fac8_xl.jpg)