Как тарифы могут повлиять на цены на автомобили в США

Тарифы на импортируемые товары могут оказывать широкое влияние на цены, особенно в автомобильной промышленности, где цепочки поставок являются глобальными, сложными и очень чувствительными к изменениям стоимости.

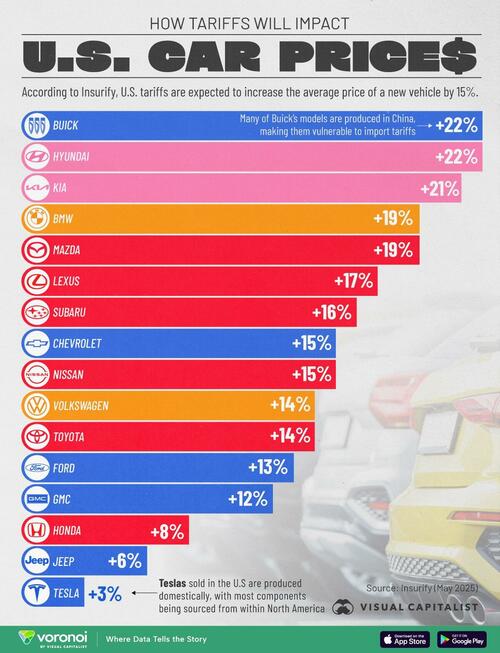

В этом видео Маркус из Visual Capitalist Лу показывает, как тарифы повлияют на цены на автомобили в США, при условии, что фиксированный 25-процентный тариф применяется к транспортным средствам, импортируемым из-за пределов Северной Америки.

Данные и обсуждение

Данные для этой визуализации получены от Insurify, которая прогнозирует рост цен для различных автомобильных брендов на основе их воздействия на зарубежное производство и запчасти.

Для моделей, собранных в Северной Америке, прогнозы представляют собой 25-процентный тариф на неамериканский контент модели и до 15-процентную тарифную скидку от общего MSRP. Посетите официальный информационный бюллетень Белого дома, чтобы узнать больше.

Анализ показывает, что Тесла, Джипи Honda На них меньше всего повлияют тарифы Трампа на автомобили. Бьюик, Hyundaiи Киа Они столкнутся с самыми высокими ценами.

Производство Buick Asia-Centric

Хотя Бьюик Это американский бренд, компания выпускает множество своих моделей в Китае и Южной Корее. В результате Бьюик возглавляет этот список с 22% Прогнозируемый рост цен — самый высокий среди всех опрошенных брендов.

Это подчеркивает, как глобализация изменила даже устаревшие американские таблички. На самом деле, Buick настолько велик в Китае, что у него есть собственный суббренд.

Hyundai и Kia столкнулись с высокими тарифными рисками

Другие уязвимые бренды Hyundai и КиаКаждый из них, по прогнозам, увидит 21-22% Повышение цен на автомобили. Хотя оба бренда имеют некоторое производственное присутствие в США, значительная часть их моделей и компонентов все еще импортируется из Южной Кореи.

В конце 2024 года, Компания Hyundai Motor Group Metaplant America Компания открылась в Грузии, где будет производить свои электромобили, продаваемые в США. Завод способен производить до 500 000 автомобилей в год.

Tesla меньше всего пострадала

Вертикально интегрированная цепочка поставок Tesla и внутреннее производство помогают защитить ее от тарифных рисков. С учетом того, что большая часть производства Tesla базируется в США, особенно на заводах в Фримонте и Остине, ожидается, что цены на автомобили Tesla вырастут всего на 3% в соответствии с новыми тарифными правилами.

Это минимальное влияние может дать Tesla конкурентное преимущество, если другие бренды будут вынуждены повышать цены. Fortune недавно сообщила, что Tesla по-прежнему является лидером электромобилей в Америке, хотя продажи упали в годовом исчислении в апреле на 16%.

Если вам понравился сегодняшний пост, ознакомьтесь с лучшим продаваемым автомобилем в каждом штате в 2024 году. ВоронойНовое приложение от Visual Capitalist.

Тайлер Дерден

Свадьба, 06/25/2025 - 05:45